Are you on track to retire and stay retired? The steps are laid out for us. Contribute to—or more preferably, max out—your 401(k), diversify your investments, build a nest egg, and retire at 65.

But as retirement approaches, it’s natural to wonder:

- Can I really afford to stop working in 5 to 10 years?

- Can I switch to a part-time role to reduce my stress and feel less burned out?

- Will I outlive my savings?

- Will my lifestyle look the same in retirement?

- Am I emotionally ready for this transition?

It’s common to feel uneasy ahead of this transition, but there are ways you can feel more confident about your retirement and financial plan. Let’s start by examining some of the challenges that may be impacting your retirement outlook and explore how you can adapt your strategy to stay on track.

4 Reasons Your Retirement Plan Might Need a Closer Look

1. The Magic Number Keeps Moving

In 2025, the average American believes they need $1.26 million to retire comfortably. That number has bounced around over the years, and while some may need more than that, the figure underscores a deeper truth: retirement isn't what you've saved, it's about how you want to spend your future.

When you hear that the average retirement balance is $970,570 for those in their 50s, it’s tempting to feel like you have a goalpost to target. Until you remember that your lifestyle can change, which could result in spending more sooner than you planned due to rising health care costs, inflation, providing for children or grandchildren, or other factors.

2. The Market’s Influence

In the first three months of 2025, the number of Americans with over $1 million in their 401(k) dropped by 25,000 due to market volatility. It’s a stark reminder: paper wealth is still vulnerable to the ups and downs of the market.

You may have made the right moves: maxed your catch-up contributions (now up to $11,250 for those 60–63 years old), rebalanced regularly, stayed diversified – but timing does matter. A 20% market correction early in retirement can disrupt the plan you have in place.

3. The Longevity Problem… Living Longer Costs More

If you're retiring at 60 or 65, you're not planning for just 20 years of retirement. You’re planning for 30 or even 40. Current longevity data shows a 50% chance one partner in a couple will live into their mid-to-late 80s, and a 25% chance that they’ll reach 90 or beyond.

That reality makes the traditional 4% withdrawal rule feel more like a starting point than a fixed formula. The key? Flexibility. A retirement plan that can adapt to changing needs and longer lifespans is essential for lasting confidence.

4. Inflation Isn't Done with You

While inflation has cooled since its 2022–2023 8% peak, even a steady 2.5 to 3% annual inflation rate can quietly erode purchasing power. If you plan to travel, help your children, or cover long-term care out of pocket, your savings may need to stretch further than you initially expected.

4 Steps to Revisiting Your Plan

1. Focus on Your Lifestyle, Not Your Savings Number

There is no single “magic number.” Instead, run multiple scenarios based on lifestyle, spending, and risk tolerance. Don’t just ask, “Can I retire?” Ask, “What are my needs, wants, and wishes in retirement?”, “Can my plan withstand or adapt when needed?”

Exploring different scenarios can help you understand how your savings translate into real-life choices. The right planning tools can show the impact of retiring now versus waiting a year or two, or help determine the best time to claim Social Security based on your unique situation.

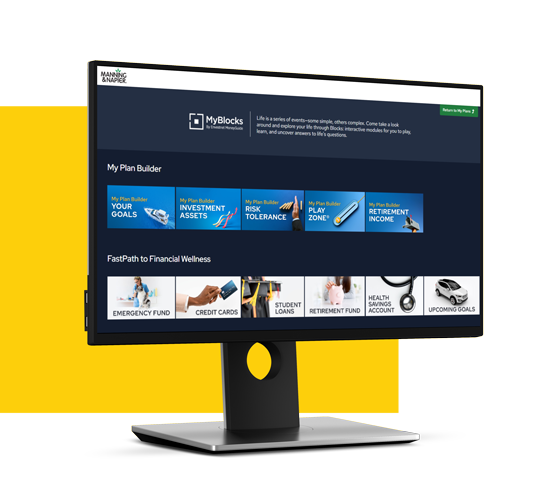

Financial planning at your fingertips

Our free financial planning app can help you – and your loved ones – navigate finances with ease. From budgeting tools to calculators to help with planning for life’s milestones like wedding planning, college finances, retirement, and more, we’ve got you covered! Get your free access to this powerful, interactive tool today.

Get started2. Build in Buffers

Plan as if you’ll live to 100, face two major market downturns, and spend more than expected on health care. If the plan survives that? You’re bulletproof.

Stress testing your plan can provide you with peace of mind. By using historical data from over 100 years of market movements, both at home and abroad, we can see how your future portfolio stands against a range of potential market environments and outcomes. It’s a powerful way to ensure your plan is resilient, not just optimistic.

→ Learn more about stress testing your financial plan.

3. Focus on Flexibility

No financial plan or portfolio is ‘set it and forget it’. Regular check-ins with your financial advisor allow for opportunities to explore new strategies, advice on how to navigate new priorities or life changes, and reassurance that you’re on track.

A review with your financial advisor can help you see how your financial plan aligns with your retirement and ease your nerves. It’s best practice to meet with them once a year, but don’t hesitate to reach out with concerns or questions as you get closer to retirement.

4. Prepare Emotionally

Your plan may say you can retire today, but retirement readiness isn't just about wealth. It's a major life transition that you have to be ready for emotionally as well. After decades of routine, transitioning to open days and a new identity outside of work can be more complex than expected.

So don’t just aim for a number. Aim for a life you’re excited to live, supported by a financial plan that gives you confidence and flexibility.

→ Learn more about the emotional considerations when planning for retirement.

We can help

Is retirement on your horizon? A financial advisor can help ensure you're able to retire when you want, and maintain financial freedom. Schedule a call today to determine how much you need to retire comfortably and stay retired, plan ahead for taxes, create an estate plan, and more.

Connect with usSources: Northwestern Mutual, Empower, Nasdaq, Stanford, and FRED.

Please consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.