Even if you love work, colleagues, customers, and your regular routine, you have dreamt about the ‘perfect’ retirement. But have you really thought about what retirement means to you – and are you prepared to make the transition?

“Pre-retirement planning?” you say incredulously. “I have saved my money and invested. The whole point is to do what I want on things I enjoy like traveling, relaxing, golfing, and having fun with the grandchildren.” A word of caution: It may not be as easy as it sounds.

The reality is that the retirement transition may present one of the most significant changes in your life—emotionally, psychologically, socially, and financially. For example, many clients in early retirement express some concern and anxiety over the transition from earner and saver to spender. Even if you continue to consult or work part-time, having to start spending your savings in retirement is inevitable. This can be disconcerting. Especially if you spent the last 30 years saving that money.

Sometimes, clients look at their investment accounts as principal and grow concerned about generating income to spend without dipping into the principal. This may limit them to overly conservative asset allocations or reduced spending which makes for a stressful early retirement period. It is critically important to understand your spending needs so that you develop a comprehensive financial plan with appropriate investment objectives to support spending throughout retirement. Part of our planning mission is to help you connect your assets and spending needs to your current and long-term retirement planning goals.

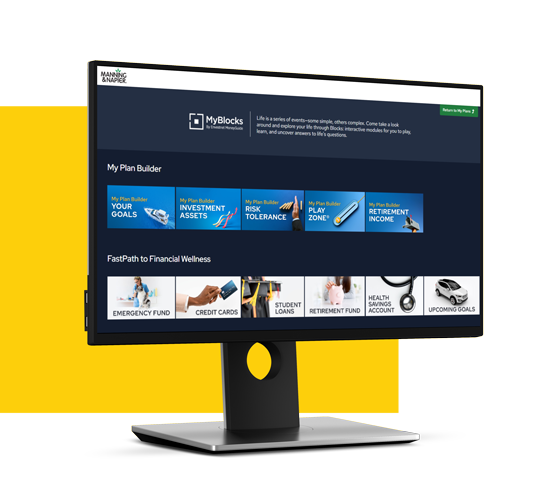

Financial planning at your fingertips

Our free financial planning app can help you – and your loved ones – navigate finances with ease. From budgeting tools to calculators to help with planning for life’s milestones like wedding planning, college finances, retirement, and more, we’ve got you covered! Get your free access to this powerful, interactive tool today.

Get startedAnother tip to help the transition into retirement is to develop a plan for that spending so you get real value out of lifestyle choices, social and family connections, and other early retirement activities. This helps reduce spending anxiety and hopefully makes the retirement transition enjoyable.

Ideally, you should start to focus on these areas in the 3-5 years before retirement. Then once you feel confident in your retirement plan, focus on how your financial and tax; life insurance; and estate plans are going to help you achieve your retirement goals. Remember that retirement marks a significant transition in life, which is more than changing your income streams and updating your financial plan. It's one part of a multi-faceted approach to the emotional, psychological, and social aspects of retirement. Preparing early will ease the transition leaving you with a solid framework for making decisions as you enter this new phase of life.

Pre-retirement planning considerations

1. Lifestyle

Do you know what you want to do in retirement? For example, travel, work/consult part time, volunteer, learn something new, hobbies, etc.? If you are not exactly sure what you want to do, start a list and investigate your interests.

2. Social & Family Considerations

Think of the people you want to remain connected with after retirement, or want to see more often, and plan to see them. Strengthening these social networks is crucial in early retirement.

3. Health & Health Care

Are you maintaining good health? Does retirement present an opportunity to make improvements? Have you investigated your health care insurance options and coverages?

4. Financial & Tax Planning

Now is the time to consider consolidating assets, developing a spending and tax plan, reviewing social security, pensions and other non-investment income, reviewing asset allocation, and investment objectives.

5. Life Insurance

If you are no longer working, you may lose certain employer insurance benefits. Now is the time to determine if you need the coverage.

6. Estate Planning

Review your estate plan (wills & trusts, power of attorney & health care proxies) and beneficiary designations to confirm they are up-to-date and meet your goals.

We can help

Planning for retirement should be fun! We can help guide you through the financial and emotional decisions that go hand-in-hand with retirement and create a personalized, comprehensive financial plan to help you get to your ideal retirement and includes elements like tax management, estate planning, charitable gifting strategies, investments, and more.

Get started with a free consultationPlease consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.