With the next meeting of US Federal Reserve officials just a day away, it seems all but certain that monetary policy is set to become less restrictive as the Federal Open Market Committee (FOMC) responds to a weaker labor market. As short-term rates (i.e., savings account rates, money markets, certificates of deposits, shorter-dated bonds) are likely to decline, one of the most underappreciated and often misunderstood risks may begin to creep into the forefront: reinvestment rate risk.

Simply put, reinvestment rate risk is the uncertainty around the future level of interest rates, which, in turn, can make it more difficult for investors to meet their goals over the long-term. Generally, investors want to maximize their reinvestment rate risk when they believe interest rates will increase in the future, and minimize reinvestment rate risk when they believe interest rates are set to decline.

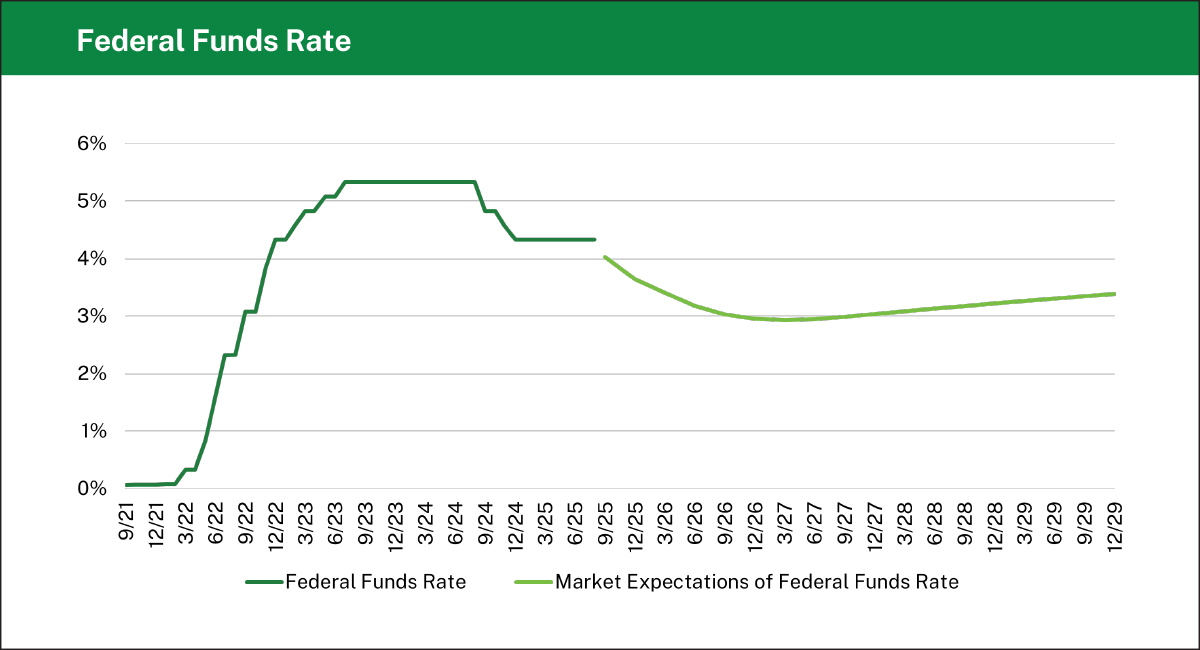

As the Federal Reserve drastically increased their policy rate in reaction to high inflation in 2022-2023, investors who increased reinvestment rate risk – by holding more shorter-dated securities, for example – were able to sidestep a historic bear market in bonds. Yields in money markets started close to zero before peaking in 2023 above 5%. As labor market conditions and economic growth appeared to weaken, the Federal Reserve reduced their policy rate to 4.25-4.50% at the end of last year. The market now expects the Fed to cut another 150 bps through the end of 2026, significantly lowering income and principal reinvestment rates.

Analysis: Manning & Napier. Source: Bloomberg (9/30/2021 – 12/31/2029).

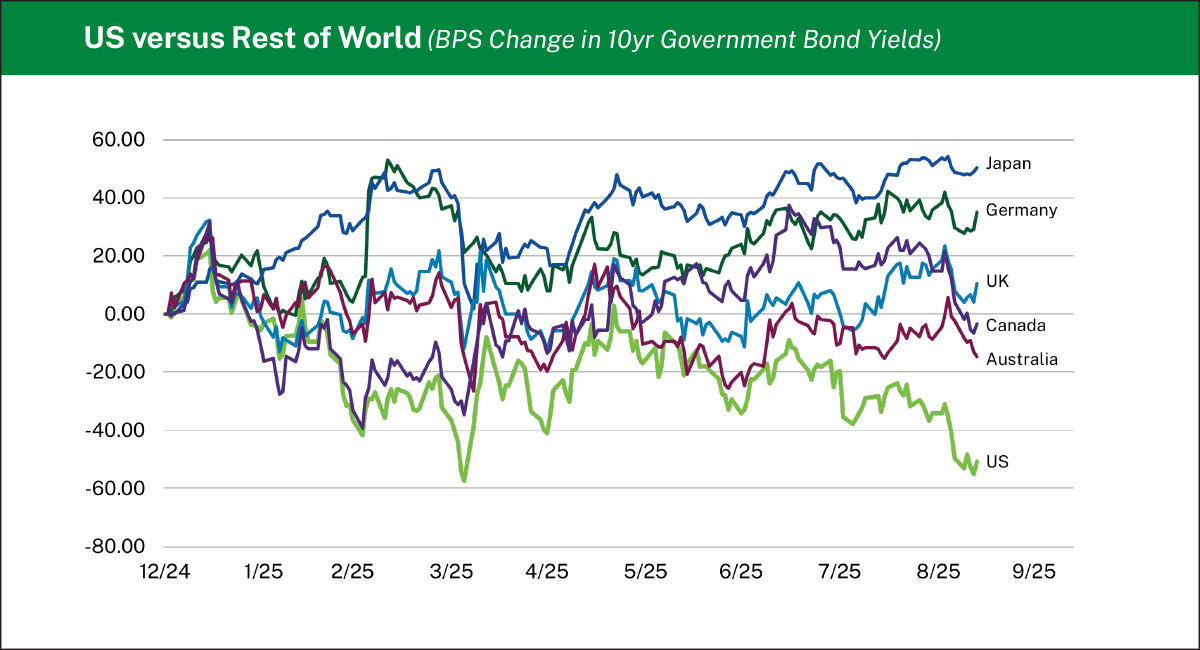

Investors who overlooked the vast majority of the fixed income opportunity set have neglected locking in rates and capitalizing on capital gains in broad fixed income markets. Despite continued rhetoric over the US fiscal situation, the benchmark 10-year US Treasury rate has declined meaningfully through the first three quarters of 2025 while many developed countries outside the US have seen their yields rise. This has allowed domestic fixed income markets to perform markedly better than money market fund alternatives so far in 2025.

Analysis: Manning & Napier. Source: Bloomberg (12/31/2024 – 9/12/2025).

Money market investors are also neglecting parts of the fixed income market that help provide additional yield enhancement within credit and securitized markets. While we have a generally cautious view on the overall credit market given extremely rich valuations, we continue to find idiosyncratic opportunities to help provide attractive yields in our fixed income portfolios. Our bottom-up approach to credit selection has allowed us to find securities that offer attractive risk/reward trade-offs without sacrificing credit quality. In particular, we are finding opportunity in parts of the securitized credit market that are more esoteric in nature, high in the capital structure, and secured by assets we find favorable.

In addition to traditional public fixed income markets, investors may wish to consider allocations to alternative sources of income such as private credit, real assets, or equity income strategies to help diversify portfolios, protect against reinvestment rate risk, and potentially enhance risk-adjusted returns. As investors may assume greater liquidity risk in these types of strategies, risk tolerance, liquidity needs, time horizon, and investment goals should be carefully considered when determining appropriate position sizing.

In summary, investors with significant allocations in money market funds, savings accounts, CDs, etc., are taking on a lot of reinvestment rate risk at a time when the Federal Reserve is set to resume their rate cutting cycle into 2026. We think that by neglecting interest rate risk, credit risk, illiquidity premiums, and convexity in fixed income markets, investors could be bypassing alternative sources of returns while inheriting unknown risks in their overall portfolio construction.

Income-Oriented Solutions for Your Clients

Our time-tested investment strategies and disciplined valuation approach provide a strong foundation to help navigate uncertainty with confidence. Backed by a comprehensive suite of income solutions tailored to every investor profile, we can help you meet your clients’ objectives across all market environments.

Explore our income-oriented solutionsThis material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.