The Federal Open Market Committee (FOMC) delivered a widely expected 25-basis-point rate cut at its October meeting, marking the second consecutive reduction and bringing the target range to 3.75 - 4.00%.

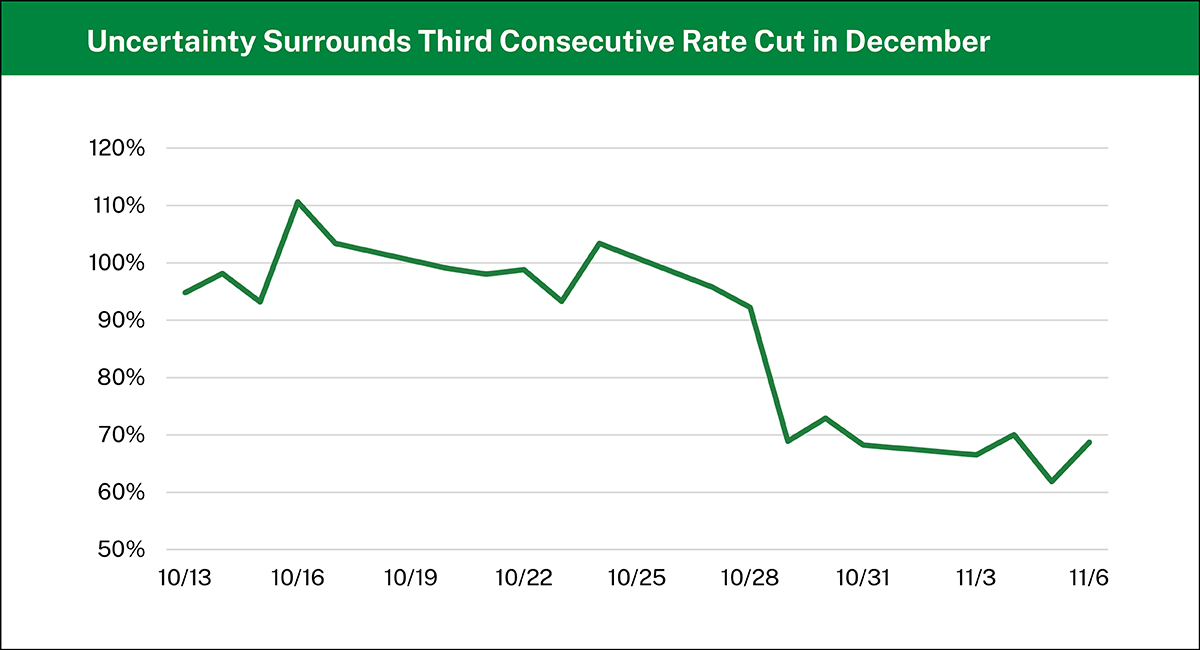

However, expectations for further easing quickly faded after Chairman Jerome Powell cautioned that a December rate cut was “not a foregone conclusion – far from it.” Before the meeting, markets had effectively priced another cut in December as inevitable, but odds have since dropped to near even, injecting fresh uncertainty into the final FOMC meeting of 2025.

For investors, this shifting outlook reinforces the importance of maintaining flexibility in fixed income positioning. Duration exposure has become more sensitive to data releases and Fed communications, making active management essential in the weeks ahead.

Analysis: Manning & Napier. Source: Bloomberg (10/13/2025 – 11/6/2025).

The Fed continues to navigate a challenging backdrop: a steadily cooling labor market alongside inflation that remains stubbornly above its long-run target. Progress on price stability has stalled in recent quarters as core goods inflation rises, influenced by new trade tariffs, a weaker US dollar, and improving global growth. Still, most FOMC members appear increasingly concerned about labor market softness. Job openings have declined steadily, unemployment hovers near 4.3%, and private sector hiring outside of healthcare and education has been negative for two straight quarters. Moderating wage growth may help restrain services inflation and support the case for further policy easing.

For investors, this mixed data underscores the value of diversifying sources of income which could include short-duration bonds, multi-sector credit, and selective alternatives that can perform across varying rate environments.

The recent government shutdown – the longest on record – has complicated the Fed’s assessment by limiting access to official data. Private indicators show a continued but gradual slowdown in employment, with notable headlines on layoffs at major companies. Given still loose financial conditions, the case for additional easing remains ambiguous. There is a meaningful chance the Fed pauses and leaves rates unchanged in December.

2026 Thoughts

Looking beyond year-end, markets anticipate the policy rate could move toward 3.0% by the end of 2026, while the Fed’s own projections remain slightly more cautious, with a median forecast around 3.4%. A terminal rate in the low 3% range appears achievable if labor markets continue to weaken. One emerging source of uncertainty is the leadership transition expected when Chair Powell’s term expires in mid-2026, as political pressure builds for a more dovish successor.

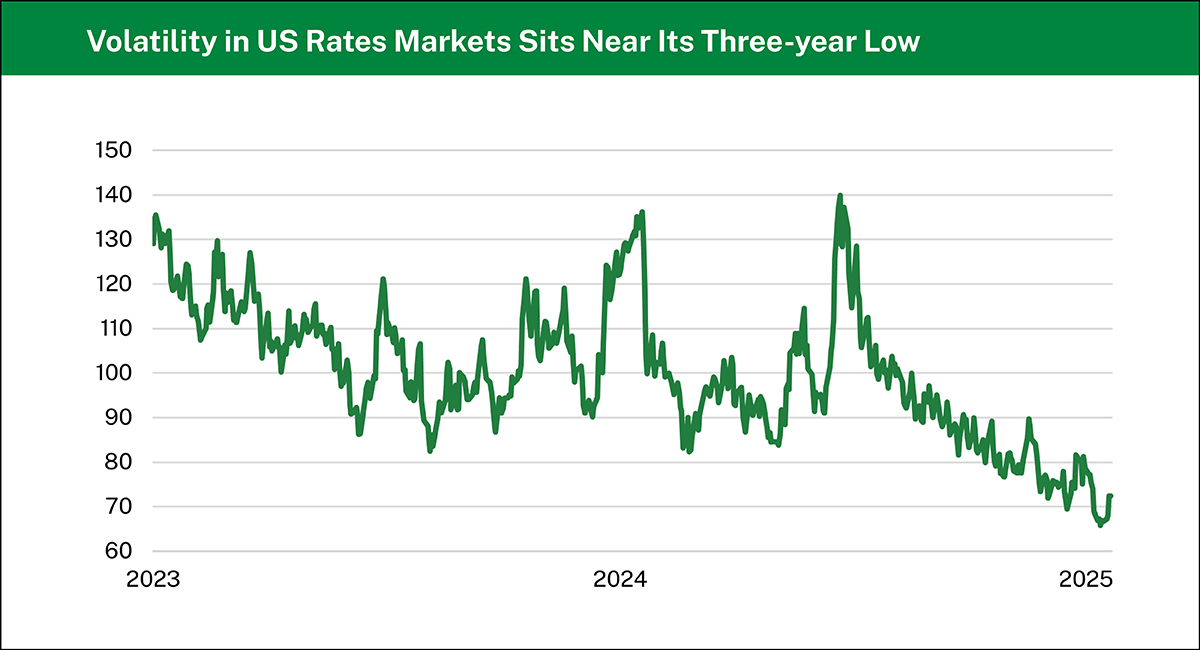

The MOVE Index, which tracks implied volatility in US rates markets, now sits near its three-year low. Investors should consider maintaining exposure to the tails of the distribution, as complacency may prove costly in a year shaped by policy uncertainty and shifting macro dynamics.

Analysis: Manning & Napier. Source: Bloomberg (10/18/2023 – 11/6/2025).

We can say with conviction entering 2026 that volatility – not just in interest rates but across all asset classes – will define the year ahead. Despite historically low implied volatility across rates, FX, credit, and equities, the potential for sharp dislocations is rising.

Income-Oriented Solutions for Your Clients

Our time-tested investment strategies and disciplined valuation approach provide a strong foundation to help navigate uncertainty with confidence. Backed by a comprehensive suite of income solutions tailored to every investor profile, we can help you meet your clients’ objectives across all market environments.

Explore our income-oriented solutionsThis material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.