Key takeaways

- Policymakers will do whatever it takes to bring down high inflation, as we have seen from the 15-month interest rate campaign.

- Today, central banks around the world are battling with the decision on whether to skip, pause or continue to hike rates, with some ahead of the Federal Reserve and extending rate skips already.

- As we have gotten to a period where there the economy is cracking, there may be greater reluctance from the Fed to keep hiking rates. A continued period of skips and/or rate cuts is driven by something in the economy “breaking.”

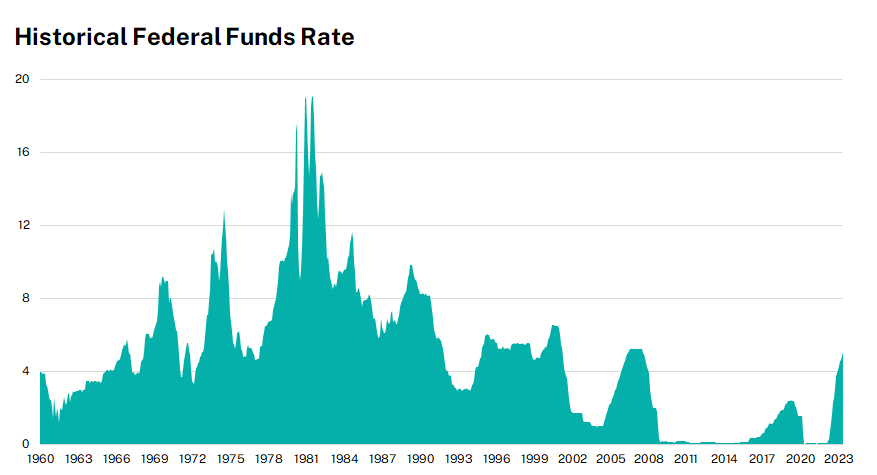

Month by month investors have been preparing themselves for a recession, while the Federal Reserve (Fed) has continued their aggressive interest rate hiking campaign. As we move through July, the fifth of eight scheduled Fed meetings for the year looms closer. In the June meeting, the Fed opted to skip rate hikes for the first time this cycle, holding the rate at 5.00%-5.25% for the month. Up until this point, rates have been hiked at each meeting since March 2022. This series was the greatest count of consecutive rate hikes since the 1980s.

What Have We Seen So Far?

Since the initial rate hike, Chairman Jerome Powell made the Fed’s intention of lowering inflation back to the target of 2% clear. Policymakers were – and are – willing to do whatever it takes to achieve this goal. In general, for inflation to get lower, the economy will need to slow and recover.

Signs of a slowing economy are:

- Demand for real estate slowing

- Consumer confidence slowing

- Rising unemployment

With headline inflation at 3.00% and core inflation at 4.8%, there is still work to be done, and now the question remains, what will happen with rate hikes going forward?

As Chairman Powell stated in the last meeting, two more rate hikes are scheduled through the end of 2023. However, if inflation does not retreat, there is a reality that we could see more moderate, consistent hikes, similar to what we have seen so far this year.

After a continued period of rate hikes, with no skips reinforcing the Fed tightening policy, what is the ultimate consequence of monetary tightening through a rate hike campaign? A recession, which has been the primary concern of rate hikes in general. While we are not in a recession today, the economic cycle we are seeing unfold is in fact reflective of the delayed effects of rapid rate increases and elevated interest rates.

For Example, Cracks in the Economy Caused by High Borrowing Costs Are:

- Banking Crisis: The banking crisis was caused by a combination of variables, but the most convincing being the rise of interest rates. With this rise, deposits got more costly, and at the same time, bond investments declined. In crisis prevention, banks were trying to effectively manage interest rate risk and create volatility-proof investment strategies. However, the banks that we have seen crash, did not properly protect themselves. As a result, these banks were faced with major liquidity problems, which forced a collapse and intervention.

- Worsening Consumer Spending: Throughout times of economic downturn, the consumer tends to spend less, and in return adheres to a stricter budget. As we have started to see, retail sales have gone negative, and credit card transactions are beginning to slow.

- The Housing Market: Although housing prices have held up, volumes are declining. When the housing market slows, it can indicate that job cuts are increasing, job openings are decreasing, and overall, there is less disposable household income for the consumer.

What Is Coming?

Although we’ve seen one month of no rate increase, that does not mean the Fed’s campaign is over quite yet. We know that inflation remains above the target range, indicating that the Fed has more work to do. While Chairman Powell reinforced to Senate lawmakers that the Fed will likely be raising interest rates at the July meeting with continuing hikes in the coming months, he did not rule out another skip at the September meeting. There have not been remarks around the plan for the final meetings in October/November and December.

Why skip at all? The Fed skips rate hikes to get a better pulse on the strength of the economy to avoid unnecessary hikes and overtightening.

Central banks around the world are also combatting inflation with rate hikes, with countries executing different strategies. Over the past few weeks, the Canadian and Australian central banks started raising their rates after a long-standing skip cycle because inflation is still above their target. The European central bank also increased their rates – and indicated that it would continue to raise them throughout the summer – despite reports that Europe has declared a recession after two consecutive quarters of GDP decline.

On its own path with the Fed only recently dipping their toe into pausing rate hikes, it’s an intricate landscape to navigate to achieve a 2% inflation rate. For this target to be reached by incorporating more frequent skips into their campaign, we believe the Fed would need to see the underlying drivers of inflation cool with hopes for a soft landing.

Underlying Drivers of Inflation

- Labor Market: Increased wages and rising prices put pressure on the economy and push the inflation rate higher.

- Lending Standards: When bank lending rates are held at low levels, demand for borrowing rises and leads to increased spending causing inflation to increase. In hopes to get a handle on inflation, banks tighten their lending policies, which forces some businesses into bankruptcy.

On the other side of the coin, why do investors like rate hike skips? When the Fed holds rates steady, investors can gain confidence in their return rates. Keeping the rates stagnant also helps monitor the improvements and growth within the economy. However, this is not a signal for investors to buy, but for them to stay on the course, stick to their long-term plan, and focus on finding companies that will be able to weather the market volatility. The June skip is a good example as the markets responded positively highlighted by the S&P 500 charting its fifth consecutive weekly gain. This five-week span is the longest gain stretch since the fall of 2021, before the aggressive rate hike strategy began in 2022.

What is the Fed’s End Game?

What does the Fed need to do to stop hiking rates, complete their campaign, and ultimately lower rates? Normal inflation levels would be the start. With that still just out of reach today, we know that a rate hike skip allows for officials to have time to make decisions and adjust to an economic environment. But to end the rate hike campaign altogether the Fed would need to see significant economic stress and be reluctant to continue going further. Historically, the Fed has paused or cut rates when something “breaks.”

Analysis: Manning & Napier. Source: FRED (01/01/1960 – 05/01/2023).

Our Thoughts

Overall, it’s not a straight path forward. The Fed and investors both must tread carefully to accomplish what they want, without overtightening. While we can’t say for certain what is to come, we do know that for the economy, a rate hike skip could make borrowing cheaper, encourage consumer spending, boost the housing market, and decrease unemployment. However, it can also increase inflationary environments. It is crucial for the Fed to time their decisions correctly to not cause further market disruption.

What does this all mean for a recession? The Fed will continue to raise interest rates to a point where they feel the economy has slowed, cooled and is ready to begin the recovery process. When rates are held constant, inflation and prices will begin to lower again to stimulate growth and resurgence in the economy. As this cycle unfolds and we move further through 2023, our base case remains to be that a recession will be difficult to avoid with the degree of tightening that has occurred and the work that remains to be done on the inflation front.

Enjoying this information? Sign up to have new insights delivered directly to your inbox.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.