It’s often said that Fed will “hike until they break something,” but what does that really mean? In March of this year, we saw firsthand what it can look like when the Federal Reserve hikes aggressively enough that something in the financial system ceases to function the way it did before. The implications can be far reaching, from the capital markets to the real economy. The current hiking cycle has seen this dynamic play out in the US banking system, where we are seeing signs of stress.

Banking basics

To better understand the economic impact of stress in the banking sector, we first need to understand both how a bank functions and the essential role that banks play in the economy. At their core, banks borrow in short-term markets (thus creating liabilities on their balance sheet) and lend into long-term markets at a spread (thus creating assets on their balance sheet). Because it is incredibly rare that all of a bank’s liabilities would be called at once, they’re also able to do so on leverage. Thus, they can earn a small spread on leverage, generating net interest income for themselves. Today, banks are also able to generate fee income in other ways, but the above is the core income-generating mechanism for a bank.

Lending on leverage also allows banks to multiply the money, or liabilities, that they have access to in order to create credit in the real economy. This allows money – in the form of credit – to flow from a depositor to, say, a small business or family that may need capital to purchase equipment or buy a new a home. Deposits are not the only source of funding for banks, but they are typically amongst the cheapest options and the most relevant for this discussion.

What’s happening in the banking sector today?

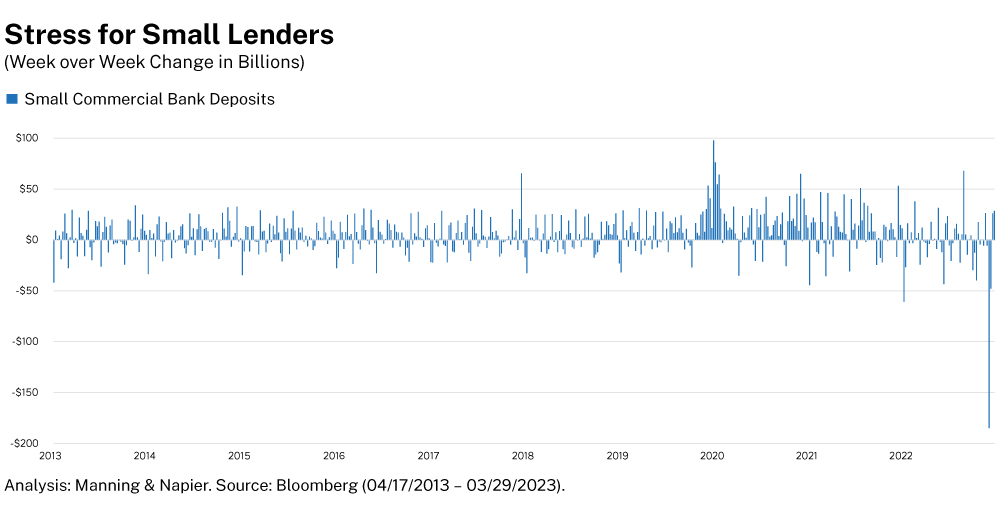

Today, we are seeing deposits leave the banking sector (particularly small banks) rapidly. There two key reasons for this. First, there are simply much better alternatives from a yield-perspective for the first time in a long time. With bond yields having backed up markedly in the last couple of years, savers can now earn a meaningful return on their cash in what they perceive as risk-free assets. This dynamic is best captured by looking at the flows data pertaining to banking sector deposits and money market funds.

Second, we have seen an outflow in deposits that is stark for small commercial banks. Following the collapse of Silicon Valley Bank and Signature Bank, we saw the federal government and its regulatory bodies step in to backstop the banking system. However, there has been some degree of ambiguity about exactly which banks the regulators would stand behind. This has contributed to the outflow at smaller banks, as some depositors have shown a preference for the safety and stability of larger commercial banks.

As we learned, banks require deposits in order to fund their lending activities. If deposits are leaving a bank, they are likely to curtail lending for two reasons. Functionally, fewer deposits mean that a bank has a smaller funding base that it can lever up against in order to create credit. From a sentiment perspective, the uncertainty surrounding the potential for deposits to leave also means banks could be less willing to lend. This could exacerbate an issue that is typical of a late-cycle economy—as banks start to see stresses in the economy, they tighten lending standards. Thus, uncertainty around their deposit base only worsens this situation and makes banks less willing to lend.

Tighter lending standards typically lead to a contraction in the credit available in the real economy, and thus can be self-fulfilling in pushing us toward an economic contraction. Historically, tighter lending standards have preceded periods of rising unemployment. Stresses in the banking sector that lead to such a tightening can, therefore, have a real impact on economic activity.

Enjoying this information? Sign up to have new insights delivered directly to your inbox.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product.