A tough start to 2022

After closing out 2021 on a high note, 2022 has brought challenge after challenge.

The post-pandemic recovery was remarkable for so many reasons. The market fell quickly, but it snapped back just as fast, and then continued on up and up, breaking to new highs seemingly every week.

Economically, the story was much the same. After re-opening, the US consumer began to spend, aggressively. The housing market caught fire, businesses began investing, the labor market healed rapidly, and previously stagnant wage growth finally started to rise.

Of course, that is not at all where we are today. How did everything change? To quote Hemingway, “Gradually, and then suddenly.”

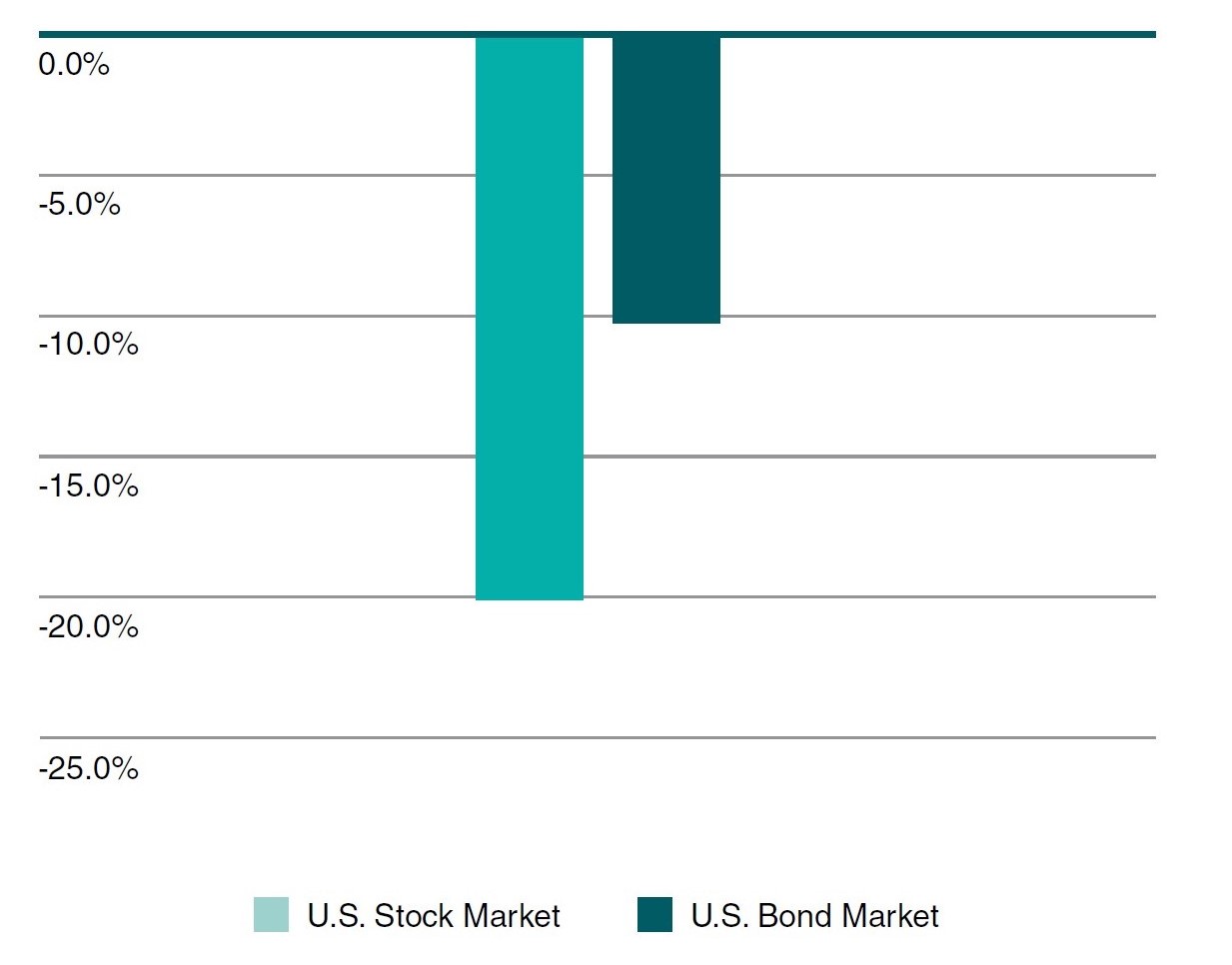

Surging inflation, rising interest rates, and fears of recession have all conspired to drive stocks into another bear market, as well as dragging down bond market performance in the process. But even beyond those forces, for us, the number one underlying cause of today’s market and economic concerns are a result of what has been a blazingly quick move through current economic cycle.

State of Financial Markets

Source: FactSet (01/01/2022 –06/30/2022). US Stock and Bond Market performance reflects the S&P 500 Total Return and Bloomberg Barclays US Aggregate benchmarks, respectively.

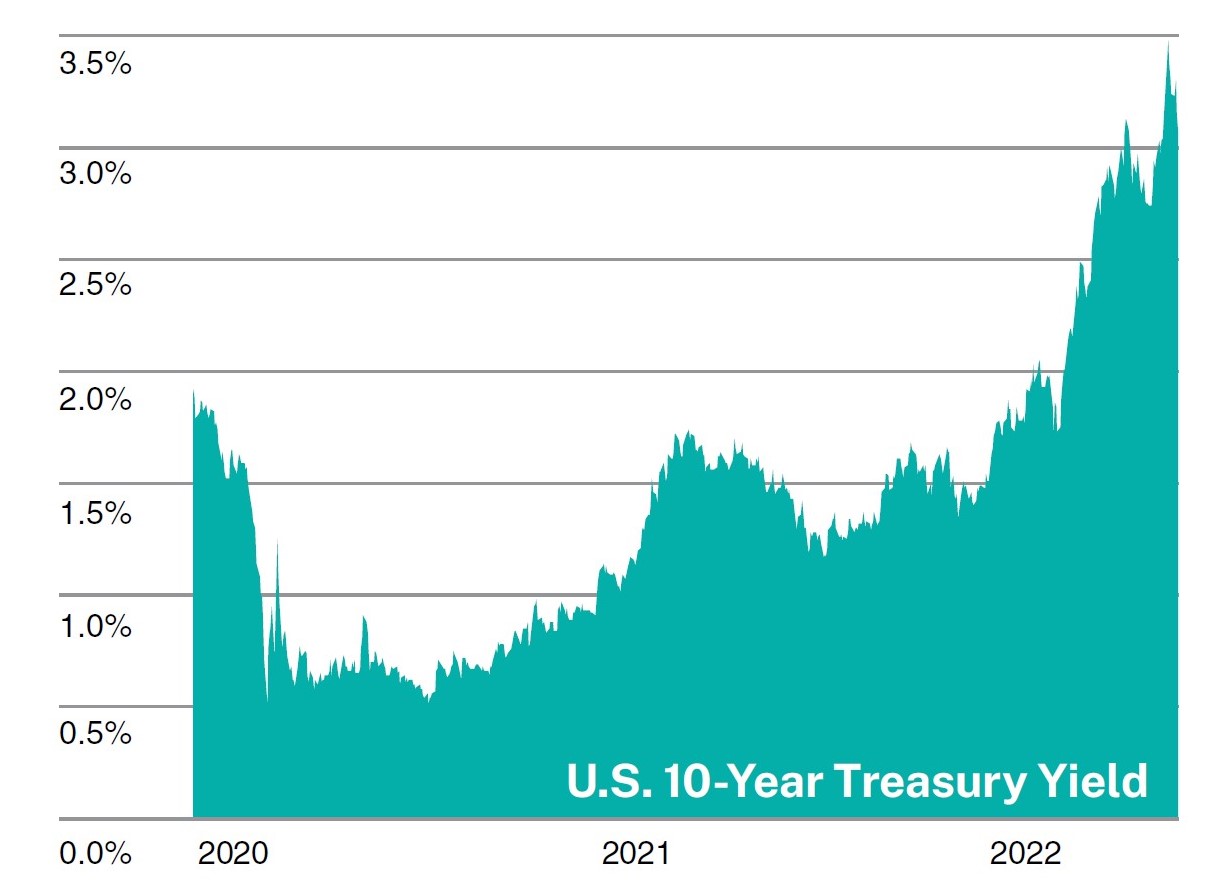

Interest Rates are Rising

Source: FactSet. Data is from 01/01/2020 - 06/30/2022.

Understanding the Bond Market Airplane

When interest rates rise, it makes existing bonds less attractive, causing prices to fall. For example, if you own a bond yielding 2%, and rates go ahead and rise to 3%, your bond is less valuable, causing its price to fall. We like to call this inverse relationship the bond market airplane: when one end goes up, the other goes down.

An accelerated economic cycle

The pandemic and all the stimulus that followed is quickly becoming yesterday’s news, but it’s impact is still being felt today.

We have never seen the kind of government fiscal spending and unprecedented monetary policy like we saw during that stretch. While it was undoubtedly effective in keeping the economy afloat, it also sped up the recovery process, so much so, that we believe we are going through a dramatically accelerated economic cycle. In fact, a variety of our key indicators and metrics are flashing yellow, suggesting that the economy is already late-cycle. This is remarkable, and it is also the riskiest time for investors.

A late-cycle economy is most problematic because markets are forward looking. Markets will selloff first, anticipating the economy turning down, rather than waiting for it to actually happen. During this phase, the economy is often in good shape, if not running hot, but market and economic risks are starting to build. This is certainly the case today, with economic growth high and the most prevalent building risk being inflation.

It’s natural to want to look to the past when trying to determine what we think will happen going forward. And there are definitely lessons to be learned from the most recent downturns: the pandemic and how quickly the world can change; the Global Financial Crisis and the concept of systemic risk; the Dot Com bust and how even smart investors can lose their bearings on reality (e.g., see currencies: crypto).

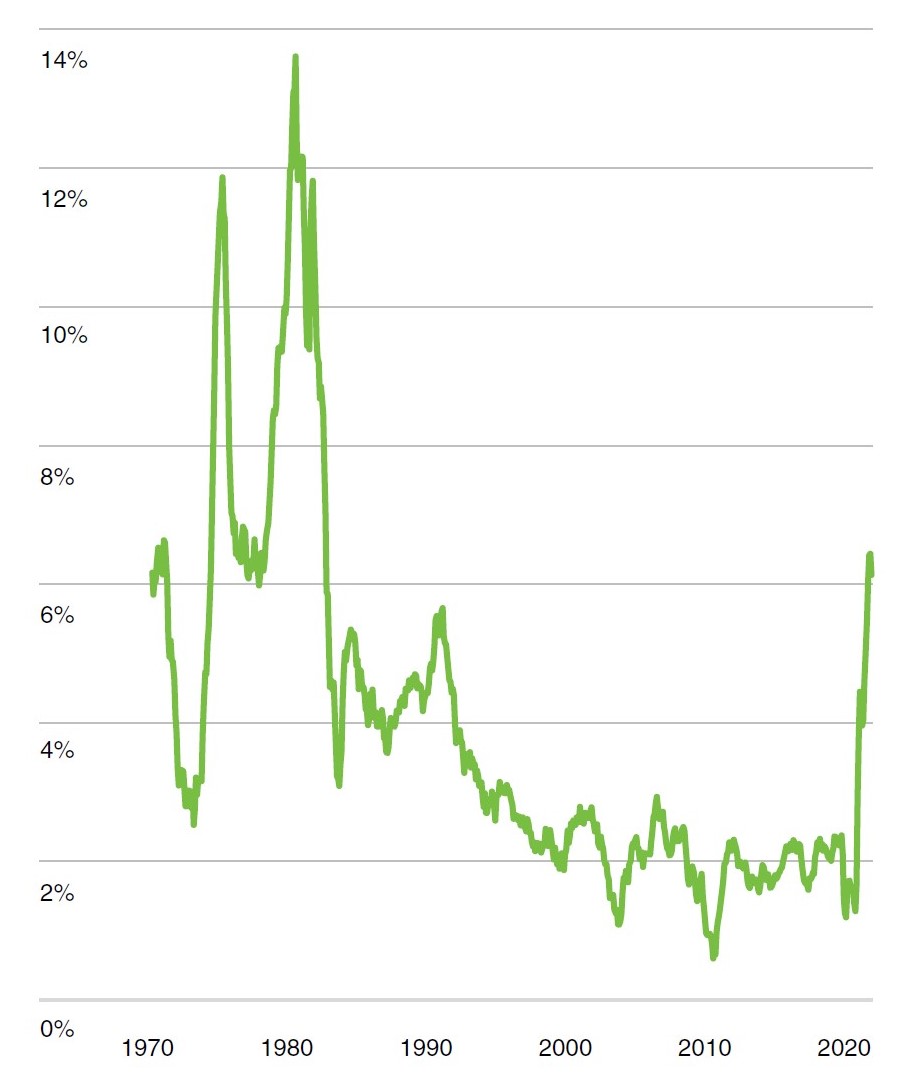

What makes this time around unique from all those prior moments is inflation, for a few reasons. First, we are going through the most significant bout of inflation we have seen in decades. So significant, that it is causing the Federal Reserve to raise interest rates at a pace that is sure to begin to cause trouble for borrowers, soon enough. We think it is certainly plausible that, in their bout to slow inflation, policymakers choke off the economic expansion in the process.

Second, and should the economy turn down into recession, we would expect there to be significantly less enthusiasm for the kind of enormous stimulus and economic bailouts that we saw during the pandemic. This could perhaps slow the recovery process, and prolong the economic difficulties.

In either scenario, our outlook over the intermediate-term is cloudy, to say the least, and we know it can spark fear. While those fears wouldn’t be unjustified, it also remains essential for every long-term investor to stay focused on their goals and objectives, their strategic asset allocation, and their overall financial plan.

We believe most clients will be well served to stick to their pre-established financial plan, and allow their Financial Consultant and our investment teams to make tactical adjustments as needed.

Prices are on the Rise

Source: FactSet (12/1967 - 04/2022). Core Consumer Price Index (CPI), meaning standard CPI less food & energy.

Playing the long game

These volatile stretches are hard to get through, but to the extent possible, we encourage investors to think in terms of the long-term opportunities they create.

Our advice is to stay patient. Your financial plan was made for a reason, and that reason is for achieving your long-term goals, not gaining short-term profits.

For you and in most of our multi-asset class investment strategies, we have been following our time-tested investment disciplines and taking a more defensive stance across portfolios. This is a process that began late last year as our outlook first became more cautious, and it continues today.

We are executing on these views through the variety of tools at our disposal, including high level asset allocation, more granular style and sector positioning, and through individual security selection, all working together to manage risk while capturing select opportunities as we see them.

It is also worth highlighting some of those adjustments and areas of opportunity. Larger positions and additions include to certain growthoriented industries (i.e., payments, cloud computing, and biopharma). These companies remain attractive as they have the capability to deliver growth regardless of broader economic conditions.

At the same time, we have been reducing exposure to economically-sensitive cyclical areas, including in the energy sector, as we believe these business would be particularly hard hit in a downturn.

Additionally, we have been holding onto and/or adding to positions in more defensive areas such as in consumer staples and health care, as these companies tend to be resilient during tough times

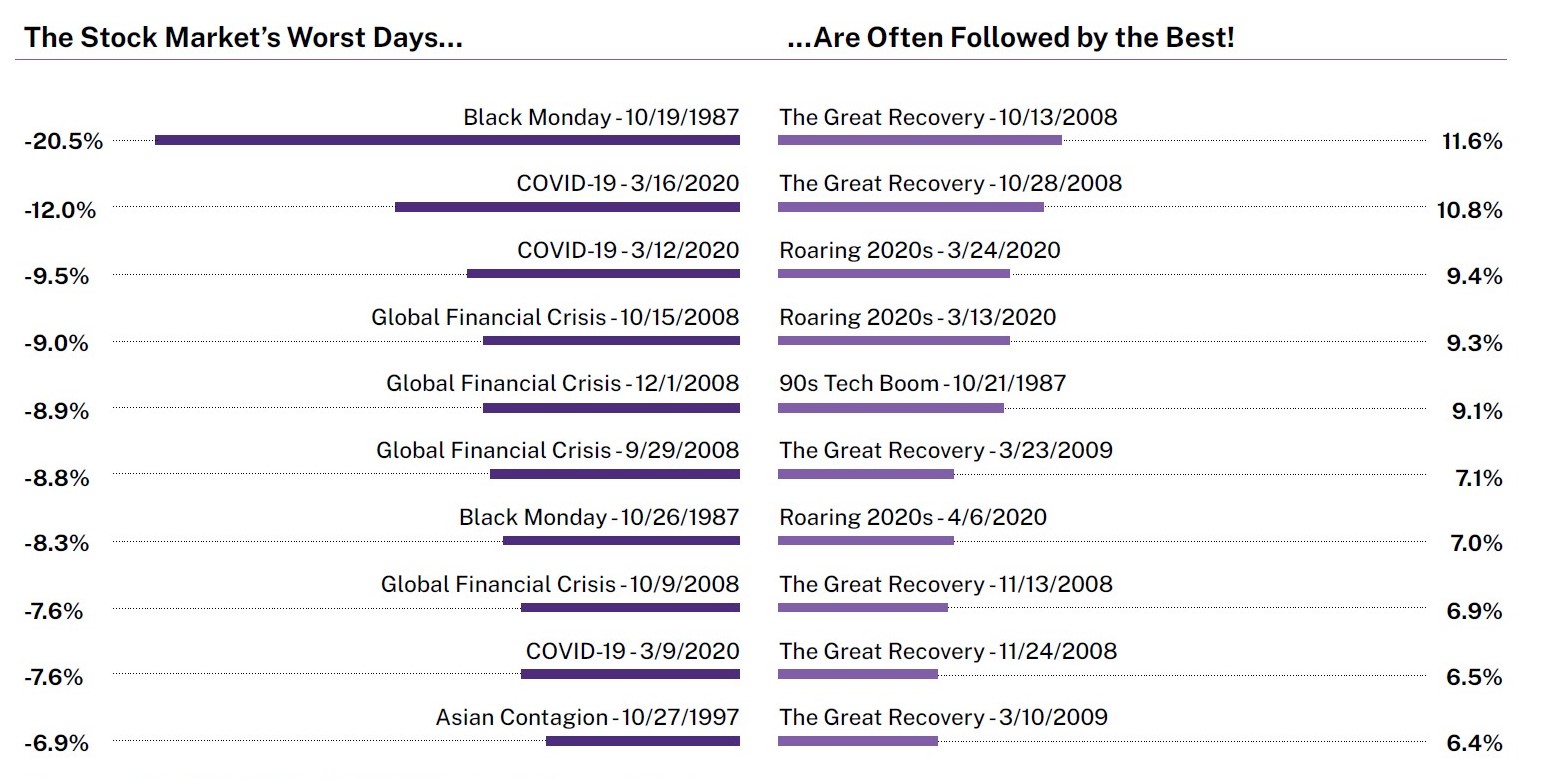

Taking a Big Picture Perspective

Discipline is about more than just defensiveness. Yes, during difficult times, it means positioning portfolios to provide a degree of downside protection, but it also means being opportunistic too. For example, when the stock market goes through a bottoming process, it tends to snap back in a hurry. Being flexible and staying nimble in our portfolios allows us to capitalize on these rebounds. We monitor both the down and the up!

Source: FactSet (12/30/1949 - 03/31/2022). Analysis: Manning & Napier.

Stay Patient, We're Here to Help

We know many of our long-time clients are wondering whether we believe now is the time to ‘lean-into’ the bear market and buy. In short: No, not yet. Our disciplines will, eventually, tell us that conditions are finally right for more aggressive buying, and when that time comes, we will move swiftly and decisively.

Until then, clients can expect us to continue to tactically adjust portfolios as market conditions evolve. We will stay true to our investment disciplines, waiting for a better moment to occur. If you have any questions on this outlook or what it means for your plan, we would be happy to connect you to one of our Financial Consultants.

Watch a replay of our Market Update Webinar to learn more

In our latest Quarterly Market Update webinar, we shared more on our outlook, discussed the current challenges facing investors, including inflation, rising interest rates, and the prospects of a recession, and shared planning advice and what we're doing for clients.

Download a PDF version of our Mid-Year Outlook.

Past performance does not guarantee future results. Analysis: Manning & Napier.

The S&P 500 Index is an unmanaged, capitalization-weighted measure comprised of 500 leading U.S. companies to gauge U.S. large cap equities. The Index returns do not reflect any fees or expenses. Dividends are accounted for on a monthly basis. Index returns provided by FactSet. Index data referenced herein is the property of S&P Dow Jones Indices LLC, a division of S&P Global Inc., its affiliates (“S&P”) and/or its third party suppliers and has been licensed for use by Manning & Napier. S&P and its third party suppliers accept no liability in connection with its use. Data provided is not a representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none of these parties shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged, market-value weighted index of U.S. domestic investment-grade debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more. Index returns do not reflect any fees or expenses. Index returns provided by Intercontinental Exchange (ICE). Index data referenced herein is the property of Bloomberg Finance L.P. and its affiliates (“Bloomberg”), and/or its third party suppliers and has been licensed for use by Manning & Napier. Bloomberg and its third party suppliers accept no liability in connection with its use. Data provided is not a representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none of these parties shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Returns for the Consumer Price Index represent an estimate of the average price of consumer goods and services purchased by households, given the market price change for a constant basket of goods and services from one period to the next. Index returns provided by FactSet.

For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.

All investments contain risk and may lose value. This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

This publication may contain factual business information concerning Manning & Napier, Inc. and is not intended for the use of investors or potential investors in Manning & Napier, Inc. It is not an offer to sell securities and it is not soliciting an offer to buy any securities of Manning & Napier, Inc.