Key Takeaways

- Be on the lookout for red flags of lifestyle creep: a declining savings rate, increased debt, or higher monthly spending

- It is much easier to control your spending than it is to control your income

- Combat lifestyle creep by creating a budget, saving a fixed percent of your income and choosing thriftier alternatives

What is Lifestyle Creep?

Lifestyle creep can be defined as the gradual and steady increase in our spending as our salary increases. Putting it another way, lifestyle creep is living up to or beyond our means – it is a disease that can slowly and silently destroy your finances. And like a disease, it can go undetected and cause lasting damage.

Society has conditioned us to spend what we make and to keep up with the Joneses. There are endless amounts of more expensive, exclusive, and elusive products to spend money on to achieve a desired social status or fill a hedonic need. Due to this behavior, people with vastly different incomes can both still live paycheck to paycheck, a damaging effect of lifestyle creep.

Signs of Lifestyle Creep

Just as there are symptoms of a disease, one can check themself for any of the signs that lifestyle creep may be affecting their purchases and overall finances. First, look for a declining savings rate in proportion to your income. Say over 10 years your income has increased 25%, but your annual savings have remained fixed at $5,000, that suggests that there are unsustainable spending habits. Another red flag is increasing debt – with more income comes larger purchases with larger payments. A third sign of lifestyle creep is the general acceptance of higher prices. Perhaps regular coffee run or splurging on a bottle of wine has become so normalized that a less expensive option seems inferior. Seeing purchases that were once a treat become staples in your life is a sign your lifestyle is becoming more expensive.

It is easy to lose your financial grounding and succumb to impulse purchases but spotting the signs can also be easy if you monitor your spending habits over time.

How to Prevent Lifestyle Creep

If you recognize these signs in your life, or want to prevent it, there are steps you can take to combat your spending. These include creating and sticking to a budget, keeping to a fixed savings rate as a percentage of income, choosing thriftier alternatives, and tracking your spending and debts.

1. Set to a budget.

If you enjoy luxury items, make a mental note every time you use one you purchased to see if its added cost is providing you additional happiness or utility. Is the Starbucks coffee worth the added expense compared to the coffee that can be made at home? By recognizing the value certain objects have to you and your life, you can develop a better understanding of where your money should be going and where you have been wasting money in the past.

2. Establish a fixed percentage savings rate.

It is an essential part of controlling lifestyle creep if you follow the rule of thumb of saving 15%-20% of pre-tax income. This way, as you earn more, you also save more. Today, many employers can divide your paycheck to be deposited into different accounts. This eliminates any temptation to spend what should be saved.

3. Prioritize smarter lifestyle choices.

Simple things like shopping for non-luxury dupes and generic brands, dining at home (eating out generally costs five times as much as cooking at home) or reducing the number of streaming services you have are all little changes you can make that will add up in savings over the long term.

4. Lastly, it may seem obvious, a budget is your best friend.

Track your spending by creating a simple excel spreadsheet or utilizing a budget app – an always keep an eye on it. Things to include are rent/mortgage, debt payments, fixed and variable expenses, and credit card payments to gain a complete picture. Make the most out of your budget by monitoring how spending varies month to month, the categories you’re spending in, and try to control upward trends by being more conservative the next few months.

Life is a constant battle of exerting willpower over your impulses, so channel impulses into savings and long-term strategies – and the places that matter most, like your retirement plan, a college savings plan, or a new car fund for when you’re ready to upgrade. For your day-to-day, be able to recognize the signs of lifestyle creep and react early on. If left unattended, it will grow and destroy your financial future without you even knowing until it is too late. If you need help getting back on track with your goals, our team of consultants and advisors are here, ready to help.

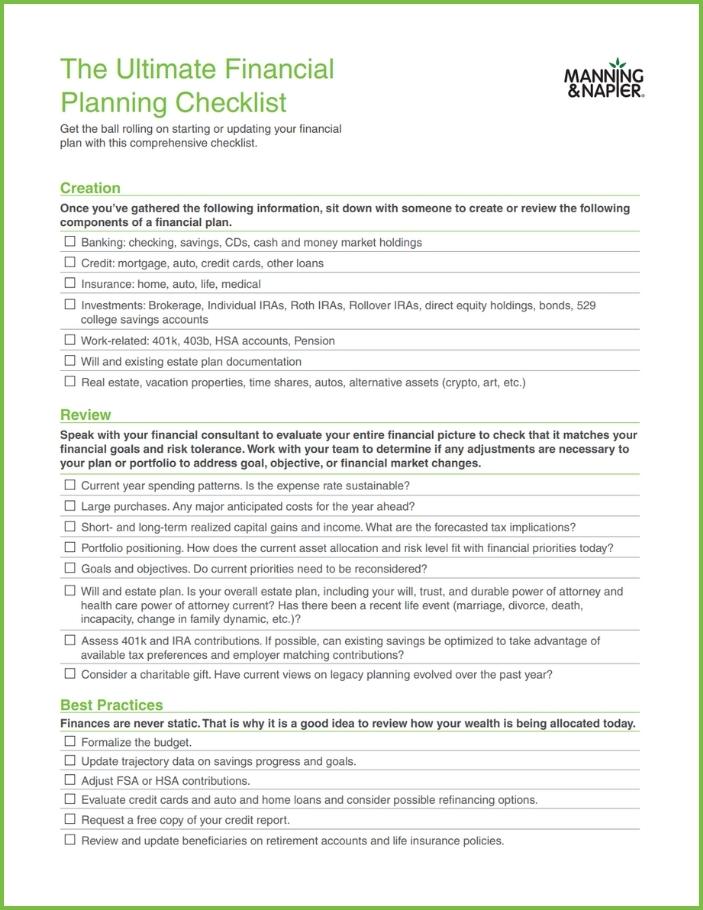

The Ultimate Financial Planning Checklist

Whether you’re creating a plan for the first time, or reviewing your existing one, ensure you’re not missing key details with the help of this free download, covering the components and factors needed in a financial plan that account for today and tomorrow.

Get your copyEnjoying this information? Sign up to have new insights delivered directly to your inbox.

Please consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.