Date nights are the perfect excuse to get dressed to the nines and take your partner out for a night in the town. Lean into the spirit of date night by dedicating time to discuss finances - freely and confidently - so you and your partner can continue to be a team when it comes to achieving your financial goals.

It may not be the most romantic topic, however, there are elements that no spreadsheet, budgeting app, or financial plan can account for as you work together to build the life you want. That is why regular, honest conversations about what you want to achieve as a couple, and as individuals, will reduce headaches and stress going forward – making you a better, united team in the long run.

Financial priorities, established by the questions and conversations you’ll have, will change and evolve as you grow in your relationship. That’s why we’ve divided this guide divided up by relationship status to help you address key questions for each stage. Of course, feel to peek ahead to see how your answers today may impact your future, or look back and revisit questions to see if your answers from the past have changed and how they’ve influenced where you are now.

Financial planning at your fingertips

Our free financial planning app can help you – and your loved ones – navigate finances with ease. From budgeting tools to calculators to help with planning for life’s milestones like wedding planning, college finances, retirement, and more, we’ve got you covered! Get your free access to this powerful, interactive tool today.

Get startedFor everyone

Our finances fuel our lifestyles. Whether it’s your milestone birthday present to yourself, your next family vacation, your wedding, helping your child pay for college, or how you’ll spend retirement – we all need an actionable financial plan. These are questions everyone should reflect on and answer.

- What are our goals for the next five to 10 years?

- What kind of lifestyle do you want to live in retirement, and how are we currently saving for it?

- What non-financial goals do we want to accomplish?

- What is our risk tolerance, and therefore are we comfortable investing?

- What would we do if one of us were to be laid off?

For those dating

As your relationships become more serious, then your finances will follow suit. That doesn’t mean you should avoid learning about how your partner manages their finances until the day you move in together or get married. Financial incompatibility can influence a relationship more than you realize.

- Do you understand your debt, assets, and expenses?

- Are you currently saving for anything?

- How do you think couples should manage their finances?

- How has your financial upbringing impacted how you view your own finances and financial goals?

- If you received an inheritance of $30,000 tomorrow, how would you spend it?

For those engaged

First, congratulations on the engagement! While you’re busy wedding planning, dedicate time to thinking about post-nuptial life. Hopefully, you’ve had conversations around finances and are compatible and in agreement with how you’ll handle them as a couple. This is the time when words become actions and thoughts on paper become your plan.

- If one of us has debt and the other doesn’t, will it be “our debt” or “your/my” debt?

- Do you have any money saved right now?

- Will we combine our money, keep it separate, or blend the two approaches?

- How much could we spend without talking with each other?

- When will we sit down to discuss our finances? Who will be responsible for the big picture (savings rates, investment allocations, etc.)? And who will be responsible for managing our day-to-day finances (paying bills, tracking expenses, and managing the budget)?

For those married with, or planning to have, kids

It’s no secret that having kids means reworking your budget to afford diapers and daycare each month. On top of that, expanding your family could mean upsizing your home and vehicles – all of which should be discussed with your partner so you can start saving and budgeting appropriately.

- Will we need to upsize our home or cars?

- What is our plan for childcare?

- How will we handle our kid’s education? Do we prefer public or private schools? Will we help pay for college? Will we use a 529 plan or another savings vehicle to save for educational expenses?

- Do we have sufficient life insurance, and do we need to update our estate plan? Who should we choose as legal guardian of our children should something happen to us?

- Which health insurance plan will be best for our growing family? How might an additional member of the family affect our healthcare costs?

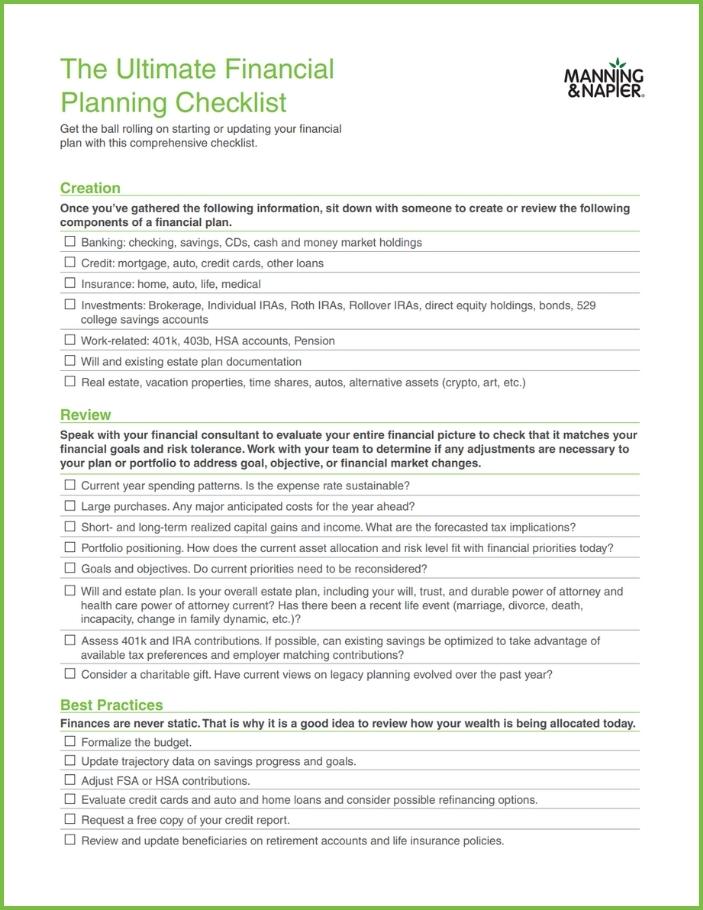

The Ultimate Financial Planning Checklist

Whether you’re creating a plan for the first time, or reviewing your existing one, ensure you’re not missing key details with the help of this free download, covering the components and factors needed in a financial plan that account for today and tomorrow.

Get your copyFor those married and are childfree

Being childfree means that you won’t have the added expenses of raising children, so you’ll have more to tuck away for retirement or to spend on the hobbies you enjoy. Whichever you prioritize, talk it through with your partner to confirm you both are on the same page when it comes to your finances.

- How important is it to leave an estate, or do we value enjoying as much of our wealth as we can?

- Can we retire earlier? Do we want to?

- What is our long-term care plan when we’re older?

- Should we consider working with an advisor to document our financial plan and tax strategies for our lifestyle?

- Who will inherit our estate?

For those married and in retirement

Although you’re in retirement and will have a good pulse on your finances during this fixed-income era of your life, that doesn't mean you shouldn’t still be thinking ahead and planning. Now that your retirement is figured out, take this time to confirm you’ll be taken care of as you age and that you have a plan for all your affairs.

- Should we have a trust as part of our estate plan?

- Where are important documents (both digital and hardcopies) and account information (login and passwords) stored?

- Are there causes we care deeply about, and is giving to them part of our plan?

- What is our healthcare and long-term care plan?

- Are our healthcare proxies up to date?

Whether you’re five days, months, years, or decades into your relationship, find a regular cadence that works for you and your partner to discuss your financial journey. Your financial journey may look different than your peers, but as long it works for you – and you’re achieving your goals – then it’s a successful one.

We can help

We can review your financial plan and ensure you’re employing the right strategies to reach your goals. Start the conversation today by scheduling a call with a member of our team. We’ll help create a personalized, well-rounded financial plan that includes elements like tax management, retirement planning, estate planning, charitable gifting strategies, and more.

Schedule a free consultation todayPlease consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.