Recessions are no fun, and bear markets aren’t pleasant to go through either. The economy slows, markets go down, and even well-diversified portfolios can take a beating along the way. In the same way that rising tides lift all boats (i.e., lift up portfolios), falling tides drag them down and there is little most investors can do to avoid it.

But there’s a big difference between controlling what you can control, versus sticking your head in the sand, doing nothing, and hoping for the best. Navigating downturns should absolutely be discussed, thought about, contemplated, and planned for. And while the best time to prepare your plan for rocky markets is before they get choppy, preparing today is better than not preparing at all.

For most clients, the first step is being open to having these difficult conversations. What is your plan B if you retire and markets immediately take a turn? Hope isn’t a strategy, but there are tools that can help. What we’re talking about today is called stress testing.

Delivering More Than a Guess

Stress testing tries to answer the difficult questions: If markets go awry, will I still be okay? Will my plan still be on track? While there’s no way to know exactly what the future will hold, you should still demand more than guesswork.

Using historical data from over 100 years of market movements, both at home and abroad, your future portfolio can be simulated against a range of potential market environments and outcomes. You can ask, “How would I do if we went through another Global Financial Crisis?” and see results quantifying the kind of draw-down you might expect, providing a degree of peace of mind.

Yet no two market environments are ever the same. What brought about a market selloff in 2000 was very different than in 2008, in 2020, and today. By running statistical analysis, today’s technology can hypothesize new, possible market selloffs beyond only historical examples. And this analysis can go one step further, taking in data for where markets and economies stand today and inputting forecasts for where they are likely to go. This can give the simulations can take on a real relevance for the here and now.

Bad, Bad Luck

‘Bad Timing’ and ‘Monte Carlo’ are about more than a trip to Vegas. For financial professionals, they are extremely sophisticated quantitative tools, helping us glean critical insights on your financial plan.

Bad Timing does just what it sounds like: It projects how your plan will do if your market timing is poor. This day could be today, the day you retire, or some other key event in the future. The upshot is that you’ll be able to see, with real data, how resilient your portfolio and overall financial plan is to a possible market selloff at the worst possible time. If the impact is too severe, adjustments can be made to de-risk—or increase risk—as appropriate.

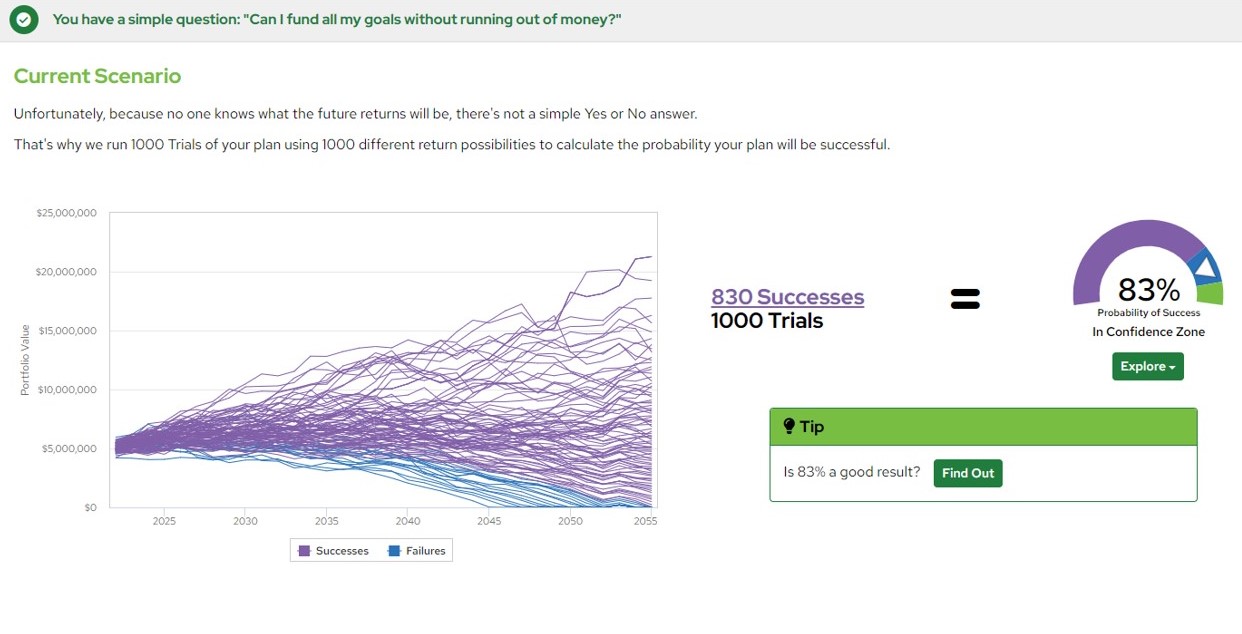

Monte Carlo, on the other hand, is related to the Bad Timing analysis, but looks at both the upside and downside. By running 1,000 simulations of possible outcomes, based on return forecasts, risk expectations (i.e., standard deviations), and correlations, your portfolio is run up against an extremely wide range of different outcomes. At the end of the trials, you will receive a probability of success that can help identify what changes can be made to improve the portfolio for the unexpected.

To see what this looks like in practice, the below sample visualizes a plan and 1,000 potential outcomes, highlighting positive outcomes in purple and negative outcomes in blue. This all comes together by inputting your financial plan and our Investment Research department’s financial market forecasts. Our Financial Consultant teams can then run a variety of Monte Carlo scenario analyses to determine whether you are on the right track and calculate your probability of success.

More than Markets

Market volatility is one of the greatest ‘known unknowns’ that is outside the control of all of us with a huge potential impact on financial planning. But there are other considerations beyond returns.

Our tool has the flexibility to adjust for changes to social security payments, premature death or unexpectedly long life, changes to healthcare costs, long-term care costs, and much more. You can tell us, what are you afraid of, and we’ll make you see real analysis on what that means for you, your plan, and your peace of mind.

We work closely with our clients to actively stress test their financial plans and optimize their outcomes. If it’s been a while since you’ve tested your portfolios or if you’re interested in learning how financial planning tools and analysis can make a difference for you, please don’t hesitate to reach out and we’ll connect you with a Financial Consultant.

Are you on track? Take control today.

Transform the way you approach your finances with our free financial planning app. Filled with a variety of tools, calculators, and educational modules, MyBlocks puts you in control of your financial future. Get your free access to this powerful, interactive tool today.

The information in this paper is not intended as legal or tax advice. Consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation.