There is no wrong time to start your financial wellness journey. You can decide to tackle it on a random Tuesday afternoon, the New Year, the start of a new job, or after a major life event. It doesn’t matter when you choose to, all that matters is that you’ve made a step to.

Overcoming where to start is the biggest hurdle because there are many factors influencing your financial journey. You not only need to get started, but you need a comprehensive approach too. That is why we’ve put together this guide to help you establish an encompassing foundation of your current financial situation.

As you go through this exercise, consider starting with these 12 Actionable Tips. They provide additional steps you can take today, as well as insight into what to be prepared to do in the future. And, as always, our team is ready to help you, schedule a call whenever you’re ready.

Your Financial Health Checkup

Before jumping right into your financial plan, and as the champion of your financial success, adopting the following good habits in your everyday life further helps you achieve your ultimate goal.

Your day-to-day: Finances are never static. That is why it is a good idea to review how your wealth is being allocated today.

- Make a budget and review your spending. Consider using a personal finance app to assist and review your ongoing spending.

- Review savings progress and set goals for the next year.

- Review FSA or HSA contributions. If possible, maximize contributions for tax savings and employer matches.

- Review all insurance policies - home, auto, and life - to determine if you have enough coverage, or if deductibles need to be adjusted.

- Evaluate credit cards and auto and home loans and consider possible refinancing options.

- Request and check a free copy of your credit report.

- Donate to the causes and charities you care about.

- Ensure your emergency account is fully funded for 3 to 6 months’ worth of expenses.

Your future: There is no time like the present to start preparing for your future, right? Whether it is retirement or your legacy, taking small steps now, can lead to improvements in financial stability and achieving your goals. Here are the items to check off your list.

- Update the beneficiaries on retirement accounts (and life insurance) to ensure they are correct and who you want them to be.

- Review your estate plan and trust. Ensure your overall estate plan, including your will, trust, and durable power of attorney and health care power of attorney are current.

- Assess 401k and IRA contributions. If possible, maximize the amount you can contribute and take advantage of available tax savings and employer matching contributions.

- Consider a charitable gift for the year to take advantage of the tax saving.

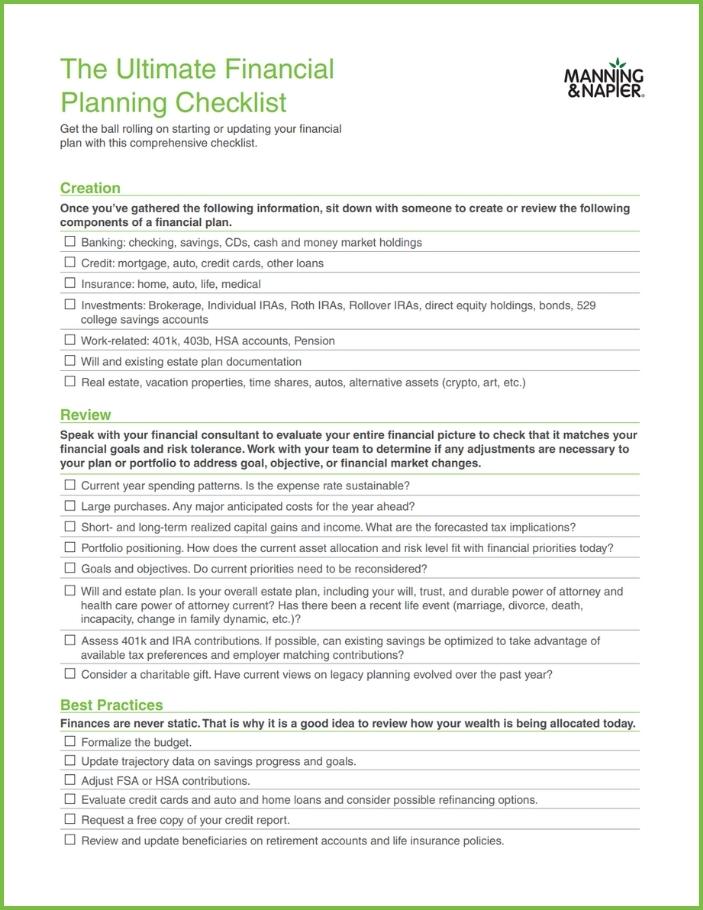

The Financial Planning Checklist

Once you feel confident about your financial health, you’re in a great place to either create or review your financial plan. A financial plan is a complete overview of your current wealth, your financial goals, and strategies on how to accomplish those goals.

The following checklist is a comprehensive outline of components and factors to consider when creating a financial plan. Whether you’re creating one for the first time, or reviewing your existing plan, ensure you’re not missing key details with the help of this list.

At the end of the day your financial wellness is an ever-evolving journey. This guide, checklist, and 12 Actionable Tips are here to support you at all phases of your journey.

Download your copy

Please consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.