The SECURE Act has officially passed, but what exactly does it mean? As the biggest retirement legislation in a decade, it can be tough to understand all of the ways this may actually impact your family. Watch now as our team of experts tell you what you need to know.

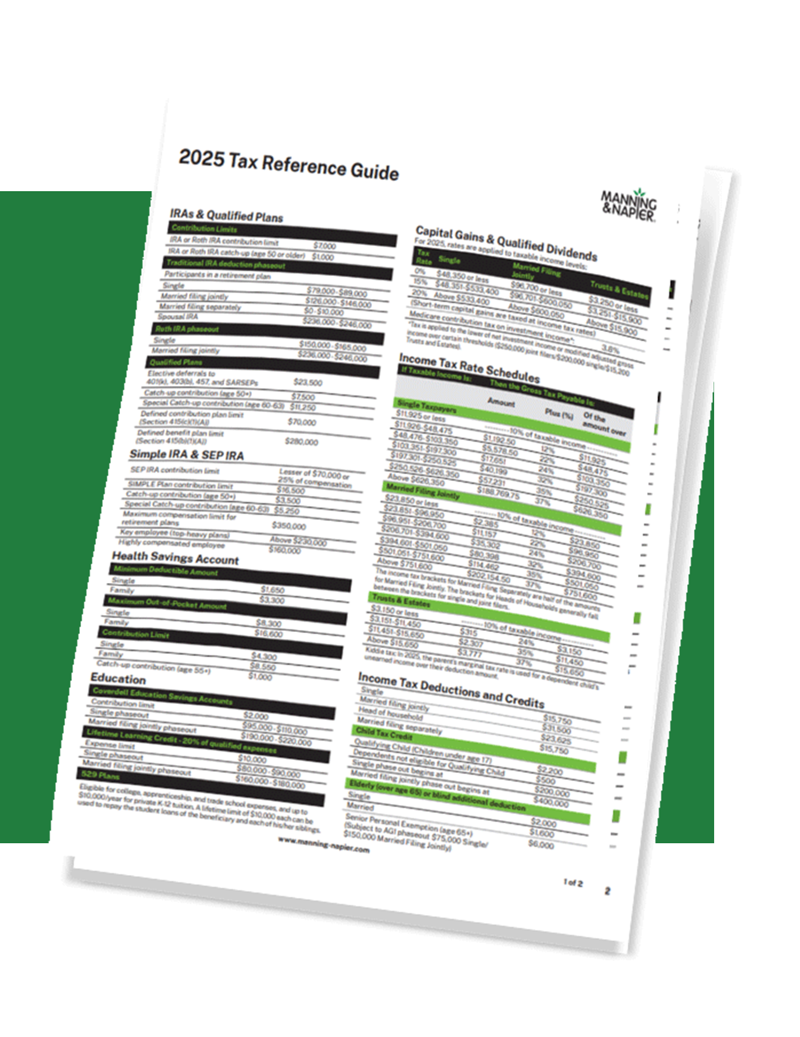

2025 Tax & Planning Guides

Download these quick reference guides for all you need to know about taxes, Social Security, and Medicare for the 2025 tax year in just one place.

Download your free copiesFull Transcript

Dana Vosburgh: Hello, everyone. Happy New Year. Thank you for joining us for today's webinar. It's an overview of the recently enacted SECURE Act.

I'm Dana Vosburgh, Managing Director of Advisory Services. I'm joined by two of my colleagues today, Veronica Van Nest and Margaret Jeffries. Both are wealth management consultants on our advisory services team.

Before we get started, if you have any questions throughout the webinar today please feel free to submit them at any time using the Q&A option on your screen.

When we conclude today's prepared materials we'll spend remaining time answering questions that have been submitted.

If we're unable to answer your question due to time constraints or maybe because, you know, we need to do a little additional research for you, we will personally follow up with you after the webinar; and for your convenience, a recording of this webinar will also be available.

So with the SECURE Act, thinking about end-of-year legislation, it's not uncommon for something to pass sort of at the last minute. But what we'll be discussing today is a little unique in that it was both sudden and not so sudden at the same time.

So, I think a little bit of background is helpful here as you can see on the screen. The Setting Every Community Up for Retirement Enhancement Act of 2019, try to say that 10 times really fast, better known as the SECURE Act, was originally passed by the House of Representatives last May.

The general goal of the bill was to address concerns in the US retirement system essentially to encourage more retirement planning and savings because right now there's a lack of it in the United States.

And so that was the purpose of the bill. In addition, the bill adjusted a number of other rules pertaining to retirement plan options and tax deferred retirement withdrawals just to name a couple of things.

So, despite the bill's support and easy passage in the house, which was really overwhelming, it stalled in the Senate. And expectations were that it would probably stay there until later in 2020 when it could potentially be attached to a broader bill of some kind.

Then, in a final year end push to the SECURE Act was attached as it was drafted in the house to a spending bill that needed to be passed and signed into law in order to keep the government funded and running to the end of the year.

So, if this seems like a surprise to anyone on this webinar, particularly if you were winding down for the holidays, you're not alone. That's why we wanted to have this webinar fresh into the New Year to summarize the bill's key provisions and touch on possible planning considerations. In many ways, we're wrapping our heads around some of the rules and the provisions and what they mean for individuals, businesses and business owners.

The focus of this today is really to outline those key rules, and touch on certain planning considerations, but we expect to do a deeper dive into some of the specific planning strategies in the coming weeks.

So with that I think Veronica, you're going to start us off covering some of the provisions in the SECURE Act that would impact individuals.

Veronica Van Nest: Yes, thanks Dana. So as you can see on this slide, there are several significant changes to how the IRAs have been treated historically in the SECURE Act.

We'll delve more deeply into each of these on the slides that follow, but just to give you a roadmap for where we're heading, one of the changes was to repeal the IRA contribution age limit.

A second change was to increase the required minimum distribution age to 72 from 70 and a half. Third, is the elimination of the stretch IRA, which I personally believe is probably one of the most significant changes in this act.

They also expanded the 529 plan capabilities and the qualifying education cost to a couple of different, additional types of institutions you can pay those costs to, added penalty free withdrawals for births and adoptions, and the kiddie tax was reverted to the pre-Tax Cuts and Jobs Act tax rates.

So, I'm going to start with the first change here, which was the change to allow IRA contributions after age 70 and a half.

I was actually kind of surprised to realize that traditional IRAs were the only retirement accounts for which contributions weren't permitted for working individuals after a certain age. 401(k)s you can contribute to, you just couldn't contribute to an IRA.

Now, with this change in the law, you can contribute after age 70 and a half. Any age can contribute as long as you have W-2 income. You have to have some type of wage or self-employment income.

But you still have to, and one of the things Margaret will speak to, is the change in the required minimum distribution age of 72. Even if you are still contributing, you do have to withdraw at age 70 to start those required minimum distributions.

So, one of the planning opportunities that's available here is if somebody wants to keep contributing to their IRAs, they can get a part time job after they retire. Or, if your spouse is still working, you can consider taking advantage of the spousal IRA rules and that will allow you to contribute to this. As we said, you need some type of income to do that.

Margaret is going to cover the next two points.

Margaret Jefferies: As Veronica mentioned, the required minimum distribution age has been moved back, I think in an effort to eliminate some confusion around the previous 70 and a half birth date rule, trying to have to calculate when exactly did you turn 70 and one half. And also to reflect that people are now living longer and also working longer.

The change is not retroactive. It only goes into effect for people born on or after July 1st of 1949, which are people that had not yet turned 70 and one half as of 2019.

Those that had already turned 70 and one half as of 2019, or were born before July 1st 1949, still have to take a RMD for 2019 by the April 1st cutoff, including the extension, and then also have to take an RMD in 2020. So even if you're not yet 72 in 2020 but you turned 70 and one half before July 1, you still need to take the RMD for this year.

And I just wanted to point out that currently it's estimated that only about 20% of retirees can wait to take their required minimum distribution, about 80% of people are actually starting distributions from their retirement accounts prior to starting RMDs.

Dana: Because they actually need the money. So that’s interesting with some of these changes where there's a focus on.

That's a big tax on the people, it certainly is if you don't want to take on, delay as long as possible. But there's a large majority of people that have IRAs that really need those IRAs to meet their own spending needs. So that's interesting.

And I think that from a planning standpoint something that's nice here and you touched on it was eliminating the 1/2, which has been in our lives as planners for a very long time. It is a nice simplification and I think a welcome change at least as far as that goes.

Then, Veronica, something you mentioned before as far as with what we see with being able to contribute to the IRAs is, after 70 and a half, we see that a lot working with clients where they don't.

And I think it's the changing of the retirement lifestyle, where there’s this partial retirement, people continue to have some work and they would be interested in putting away some more money that maybe, at some point, they could convert to a Roth IRA for planning down the line.

So there's a lot of interesting little opportunities there that maybe weren't available before, that somebody could take advantage of now.

Margaret: I also have to point out that even if you had planned for the RMDs to come out starting at 70 and a half, you can still go to your custodian and request an even a smaller amount or as much as you need.

So, there's no changes to any sort of early penalties or anything like that.

Veronica: Yes, I think that's important, too for clients to think about that. If you have some standing instructions, whether you want to change those and contact your custodian to do that.

Dana: Right, with the thinking that you would have to take it... And now you have a little bit more flexibility, at least for a couple of years certainly.

Margaret: And so, also as Veronica mentioned one of the bigger changes that came with the SECURE Act is the elimination of the stretch IRA rules. This impacts beneficiaries of original IRA owners that have passed away.

Under previous rules the beneficiaries and certain trusts, so individuals and income beneficiaries of certain trusts can take required minimum distributions over their own age life expectancy.

Under this new rule there is now a 10 year limit on the beneficiary withdrawing both traditional and Roth IRA balances. So there's no annual required minimum distribution that must come out, but by the end of the 10th year following the original IRA owner’s death, the balance has to be withdrawn.

There are some exceptions that called eligible designated beneficiaries who can still elect to take required minimum distributions over their own age under the previous stretch IRA provisions, so using their own life expectancy factor.

This includes spousal beneficiaries who actually can still take an IRA into their own name and it's not even considered an inherited IRA at that point or they can take it as an inherited IRA as well.

Also exempt are disabled and chronically ill beneficiaries, individuals who are not more than 10 years younger than the decedent. So for example, maybe an unmarried partner, a sibling of the IRA owner, or someone close in age. I think is who they're targeting with that rule.

And then a certain minor children are also exempt, which means a direct daughter or son of the original IRA owner. It does not include grandchildren. For the minor children exemption, it actually only delays the 10 year rule until the minor reaches the age of majority in their state.

When they do reach the age of majority that 10 year window then opens. This elimination of the stretch provision applies to new inherited IRAs where the IRA owner passed away in 2020 or later.

So if the owner had passed away on or before December, 31st 2019 then the old stretch IRA provisions still apply. If you have an inherited IRA already then continue taking RMDs as you have using your own life expectancy.

So, I just wanted to give an example, we had some questions ahead of the webinar on what this kind of meant for different types of beneficiaries. So this example kind of shows that you have some flexibility in how to take required minimum distribution, or excuse me the IRA balance, within this 10 year rule.

If someone passes away this year, in 2020, and they gave it to their two nephews, so not to their direct children, not to their spouse and nephews and are usually more than 10 years younger than you, but not always.

So, to avoid being penalized by the end of the 10th year following the death, which would actually be December, 31st 2030, the two nephews must each withdraw whatever they inherited. In this case, I showed a $1 million IRA being split, $500,000 to each nephew. They must withdraw it by December, 31st 2030.

So what this does allow, in this example, Jack has limited income and decides to take small withdrawals over the 10 year period rather than drawing it all up front or waiting. Whereas Frank doesn't need the income prior to then, so he lets it grow tax deferred as long as possible until that very last deadline where he withdraws the entire balance.

So you can just withdraw it however you want. It is taxable to the beneficiary in the year withdrawn just like it is now. There's a lot of good information here. We are going to share these slides with people in the webinar because you could use it as a resource or reference.

You know, the interesting thing here, or the example is certainly waiting can delay any income received for 10 years, but then whatever was inherited is invested for 10 years, with reasonable returns that money could double.

So you could then have a much larger IRA that then has to come out. So thinking about the growth there is important to build into that equation. So these are sort of that unique, very specific, planning strategies that are going to be different for different people.

And I think we'll dig into some of these ideas a little bit more, as there is a chance, to think through some of these scenarios. That's good information... now Veronica is going to touch on 529 plan changes.

Veronica: Yes.

So there were a couple of different changes made to the 529 plan provisions that had previously existed. They added the registered apprenticeship programs and trade schools and then the costs associated with them.

Registration fees, books, supplies. So those are included as allowable expenses that can be paid from the 529, federal income tax and penalty free. You also, this is a nice addition for those individuals who might have some student loan debt.

The second point here is that you can withdraw $10,000 lifetime amount per beneficiary. But also for the beneficiary sibling. So if there was any debt that was there that can help with the payment of that.

These are effective for distributions made after December, 31st 2018. So anything made in the 2019 tax year and beyond are affected by this.

The one thing to note that similar to one other changes have historically been made in the 529 space. The states have to decide whether they're going to follow that or not. And so people have to stay tuned in their particular state to see if they're going to adhere to those changes or how those changes will be affected.

And then the other nice addition here was there was a penalty free withdrawals for births and adoptions. One thing to keep in mind that these withdrawals are subject still subject to income tax, but there's no penalties for those withdrawals.

They can actually be also put back into the IRA if the person so chooses, if they're going to get some funds after the fact. Those were allowed $5,000 per retirement account owner.

So if your spouse or another partner you could each withdraw the $5,000 for the new birth or adoption. So that's a nice little addition to that. And I think Margaret's going to talk about a few last changes and not changes.

Margaret: So one of the other things that the SECURE Act did was extend some deadlines or even, repeal some provisions of the Tax Cuts and Jobs Act of 2017. One of the major changes, I think, was to the kiddie tax or how unearned income of dependent children are taxed.

So prior to 2018, before the Tax Cuts and Jobs Act, the unearned income of dependents was taxed that the parent's marginal tax rate. But in 2018 and going until 2025, it was scheduled to be taxed at the highest income and capital gains tax rates for estates and trusts.

This is unearned income over $2,200 in 2019. So the SECURE Act, it actually repeals the change to the kiddie tax, and effective as of tax year 2020, the parent's marginal tax rate will be used again.

There's some language that allows for the application to have this apply retroactively back to 2018 and 2019. But we're expecting further clarification on the process for that. And whether or not it would be beneficial for certain people, worth the time, I guess, and CPA fees.

Dana: It is really interesting to us. It seems like they regretted making this change in the first place. So this is almost a complete do over where they're just reverting back to something and actually eliminating the tax years that it was meant to impact retroactively.

So an interesting change and beneficial for most just because parents' rates are likely to be, for most, lower than they would be for the highest possible Trust and Estates brackets, which are very condensed. So it's hasn't changed.

Margaret: Yes. So we did get a lot of questions on RMD age changes and everything, does that end up changing some other things. So the SECURE Act did not change when Social Security benefits will be taken. So it's the same. You can start taking it as early as 62 with some exceptions. Full retirement age, where you just get your normal benefit is still age 66 or 67 and you can still only delay benefits as late as age 70 to still get the 8% per year increase on that.

So it did not get pushed back to age 72 like the RMD age did. The other thing that still remains the same age are qualified charitable distributions from IRAs.

It was thought that this was kind of tied to RMD age in the past, but they ruled that that's not really the case. So once you reach age 70 and 1/2, you can donate $100,000, up to $100,000, directly from an IRA to a charitable organization as you have in past years.

The other thing that has not changed but is actually proposed, in the proposal stages currently, is that the IRS life expectancy tables to calculate required minimum distributions are being reviewed and are expected to be updated to reflect that people are living longer.

So, for example, as of right now when you begin RMDs at 72, again, if you hadn't got started them as of 2019, it's about 3.91% of the IRA balance, but what we're expecting that to go down slightly.

So, some planning opportunities for this is that qualified charitable distributions can still come out at age 70 and a half. If you don't think that you'll need your entire required minimum distribution, you'll have a 1 and 1/2 year window now to reduce your IRA balance and also fulfill some charitable giving desires. Obviously, you know, this is going to be a look at it on an individual basis and how it all fits in.

Dana: All right, great. Thanks, Margaret. So looking also at some of the provisions that were impacting individuals. I think a lot of people that have IRAs, since it was very IRA heavy, as far as changes go, bill this is an opportunity to touch on some of the provisions that impact business owners, businesses.

I mean that the whole point of the bill or one of the main points of the bill was that it is named “setting every community up for retirement enhancement” and that the idea would be to have more participation in retirement savings.

And so, the viewpoint that there's not enough of that, obviously, that people need to take advantage of that when you have tax deferred savings opportunities.

So here's a quick list of some of the key provisions that are impacting business owners, and businesses - easing rules for annuities and 401(k)s. I'll touch on that in a minute. But that's something where you can have income annuities as an option in 401(k) plans, which might appeal to certain people, in the past it was a bit less appealing for the fiduciary and the people offering those plans, there's a higher cap on the auto enrollment and escalation in 401(k) plans to exceed 10% up to 15% of compensation.

So that's an increase there, trying to, again, almost automatically force people to at least try to save a little bit more, an increase in tax credits for small businesses that adopt retirement plans and there's more relaxed rules for multiple employer plans that could be an opportunity for smaller businesses to group together and then be able to offer a plan to participants, and then more flexibility for part time workers to participate.

That's going to be a nice, I think it at least creates a little bit more of an opportunity for people that might have multiple part time jobs and they want to take advantage of some tax-deferred savings.

So I think, just kind of working through these quickly, this one with lifetime income and with annuity contracts, that's something that the bill is very good for insurance companies because this gives them an opportunity to then really be I think larger participants in the 401(k) world and being able to offer those income annuities. It could appeal to people.

So on this slide here you can see it creates a safe harbor for administrators (fiduciaries) to include annuities. Annuities have been allowed in 401(k) plans for quite a while but employers didn't offer them as an option, I think more out of fear for being held liable if the annuity company would go under and not meet the obligations because, the risk there is that, the insurance company has to be able to pay the annuity out to participants.

So that was unappealing. The act makes it easier for fiduciaries to meet the prudent man requirements when selecting and monitoring annuity providers by allowing them to rely on the annuity company's representations of their capabilities.

So they're basically saying that if they have the financial ability to do it that it is a way to, I guess qualify or meet that requirement for the fiduciary.

Fiduciaries are also not required to select the lowest cost contract, which is something else that from some of the insurance, the annuity options, maybe was a hurdle. So if that's not a requirement that makes it a little bit easier.

Requires retirement plan statements to include lifetime income disclosures at least once a year, once in a 12 month period. The act also creates a new distributable event for current or former employees that just applies to the annuities. So the concern being that if you change jobs, or you leave, you're locked into this annuity. What does that mean?

So with these provisions the plan can be transferred in kind directly to another plan or an IRA if it's done so in 90 days leading up to the removal or leaving the plan. So you can avoid or avoid surrender fees and forfeit some of the rider, and avoid forfeiting the rider or benefits.

So those are things that are kind of a big change, where you might see some more annuity contracts in plans that could be at least less unappealing to the fiduciaries.

There's an increase in the small business tax credits as you can see here. That's another opportunity to allow, or to entice business owners, small business owners, to adopt plans. You can see it's applicable for employers with 100 or fewer employees.

It increases the startup costs credit. So, there is a bit of a complex formula there, but increases the current $500 tax credit cap to the greater of $500 or the lesser of $5,000 or $250 multiplied by the number of compensated employees.

Something that is a little bit more enticing, this also provides an automatic enrollment credit. So small employers can also have additional $500 credit for three years for including an automatic enrollment option.

So these are available starting in the 2020 tax year. There is at least more flexibility now for multiple employer plans. So they've also created something called pooled employer plans, which opens the door for other people in the industry, individuals to offer and be administrators for multiple employer plans.

So it could be an opportunity for RIAs out there. The act relaxes rules for unrelated small businesses and employers to work together to create multiple employer plans. So in the past, there had to be some sort of related business.

Employers are no longer required to have a common business or reside in the same location to have a plan together, it's more flexible in that way. And it also eliminates the one bad apple rule with these plans that was unappealing, because now if there is one whereby you would have a disqualifying act it would disqualify the entire plan before. Now that's not necessarily the case, that one bad apple, so to speak, would not disqualify the entire plan.

Moving on to the last one here, expanding the participation for part time workers. As I mentioned before, part time workers who work at least 1,000 hours in one year are allowed to participate. That's still the case. But now and beginning in 2021 it expands that to workers with at least 500 hours of work in three consecutive years.

So there is no mechanism to force anything to start before 2021, so that means that most likely employees will not be really eligible for this 500 hour threshold until 2024 most likely. So that's just something to keep in mind.

So that is I think the main provisions that we wanted to highlight. Thank you all for attending today's webinar. If we didn't have a chance to answer any of your questions we will be following up personally to answer that question for you.

And please, as you see on the screen there, subscribe to the content that Manning & Napier creates. We cover a broad range of planning and investment related topics, and be on the lookout for our 2020 reference guide that will outline current tax facts and retirement plan contribution limits among other helpful tax and savings details.

Some of the information that we went over in this webinar will also be on that reference guide as sort of this fresh legislation, and I think key bullets and things to consider. Likewise, we'll be providing new versions of the Social Security, Medicare and Long Term Care guides, so be on the lookout for those as well.

On behalf of my colleagues, Veronica and Margaret and Manning & Napier, thank you again, and have a great start to the year.