Manning & Napier’s Investment Policy Group discusses, analyzes, and dissects major macroeconomic variables including the economy, global financial markets, and asset allocation to ultimately determine the firm’s views.

From our viewpoint

Soft landing: (noun) - a rare economic phenomenon of a central bank able to bring inflation under control via higher interest rates without creating a recession.

Dictionary publisher, Merriam Webster, recently announced that “authentic” was selected as the word of the year for 2023. If they were to select an investment phrase of the year, it would almost certainly be “soft landing”.

The prospect of a soft landing went from a low probability scenario in the minds of many investors at the start of 2023, to an assumed given by year-end. The dynamic trio of inflation, the Federal Reserve, and interest rates all factored in the equation. Stocks and bonds cheered slowing inflation and language from the Fed that suggested that the rate hike campaign is over and lower rates could be on the horizon.

Positive stock and bond returns were certainly welcome on the heels of a difficult 2022 but we are skeptical of the market’s near complete embrace of the soft landing scenario. Our outlook remains cautious as the impact of the Fed’s rate hike campaign continues to work its way through the economy, at the same time valuations and sentiment leave room for relatively little to go wrong. While headline measures of economic activity such as GDP and unemployment look okay, these are lagging factors that only tell us where we have been. Many leading measures of economic activity suggest that more difficult times are ahead. This sort of divergence between leading and lagging indicators frequently occurs near the end of economic expansions.

We believe that risk management should take priority in times like these. By promoting safety today when risks are elevated, we can preserve capital to deploy into more attractive opportunities when conditions are more supportive. Those risk-taking conditions will eventually emerge again, and you can be sure we will be there to capitalize when the moment is right.

The coming year promises to be no less eventful than 2023. Odds are good that there will be more noise than ever for investors to sort through amidst a presidential election at home and, unfortunately, rising geopolitical risks abroad. Our team of investment professionals is focused on seeking out the signal amongst this noise, on the lookout for not only risks, but opportunities as well.

Learn more about our Outlook

Watch a replay of our Annual Outlook webinar to hear from our team, including Director of Investment Policy Group, Chris Petrosino, as we discuss wealth management trends and our expectations for the year ahead – and how a strategic investment approach can help you meet your goals.

Watch nowInflation may not be the only thing slowing

Lagging indicators suggest that all is well in the economy, however, more forward-looking factors present reasons for concern.

Thus far, inflation has been one of the few economic measures to fall in the face of the Fed’s aggressive rate hike campaign, which brought interest rates to a 22-year high with 11 consecutive increases. What was once an astonishing 9.1% rate of inflation in June 2022 has fallen to 3.1% as of December 2023.

With that dramatic drop, the Fed has signaled growing confidence in achieving victory in their battle against inflation while simultaneously avoiding a recession.

However, we believe that the full gravity of the rate hike cycle on the broader economy has likely yet to be observed. Our view is that a recession is the most likely outcome, and if nothing else, the economic backdrop remains a challenging one.

Our outlook may seem at odds with many of the most widely followed measures of economic activity including unemployment, GDP growth and consumer spending – all of which suggest a relatively healthy backdrop. However, these indicators are notoriously poor signals of future activity that will not sound the alarm until it is too late.

We prefer to focus on more forward-looking, or leading, signals that can provide a better sense of how the economic sands may be shifting beneath our feet. Many of these indicators are giving warning signs typically observed at the end of an economic expansion.

A cracking economy: a look into the indicators

Some indicators, such as the unemployment, were stronger than expected throughout 2023, but there are emerging pockets of weakness. We believe that many forward-looking indicators of economic growth are signaling weakness ahead—the labor market, for example, is a classic lagging indicator that will not look bad until it is too late.

Balancing risk and reward

It takes an active approach to stock selection to find investments that are well positioned for the road ahead.

The economy wasn’t the only surprising area last year. Between excitement around artificial intelligence and budding conviction that the Fed can achieve a soft landing, investors choose optimism over caution throughout 2023. Equity markets delivered stronger-than-expected performance last year, highlighted by the S&P 500’s double-digit returns. The Magnificent 7 stocks (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla) dominated performance helping the market-cap-weighted S&P 500 nearly double the performance of the average stock in the index (26.3% vs. 13.8%)

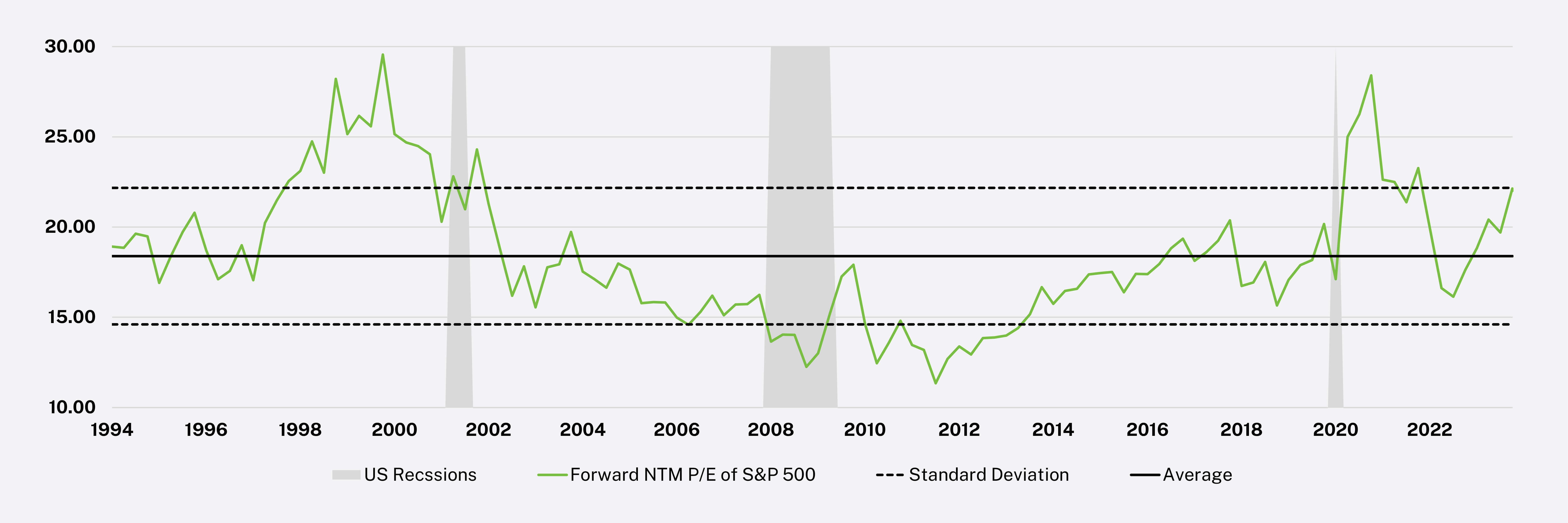

The overall market performance was not a result of stronger earnings but instead, it was driven by rapidly expanding valuations. In fact, the change in the price-to-earnings (PE) multiple explains virtually all of the S&P 500’s growth last year. This is to say that by the end of 2023, investors valued each dollar of earnings approximately 25% more than at the start of the year. A stock can still be attractive after such an increase in valuation, yet only to the extent that the value of expected future cash flows has increased as much or more, or the stock’s starting valuation was so depressed that it has yet to reach fair value. However, as our analysts search the globe for attractive investments, we are finding few names that meet our time-tested investment strategies and pricing disciplines.

Accordingly, we have positioned client portfolios for more challenging market conditions by focusing on companies in less economically sensitive areas such as consumer staples as well as companies that can benefit from long-term secular themes. These industries were quick to price in the risk of a downturn and experienced recession-like conditions last year despite benefiting from attractive tailwinds.

In the year ahead, more opportunities will emerge. Our teams are already preparing for that eventuality, conducting work on more cyclical, ‘recovery’ areas of the economy. Companies from these industries are likely to represent a larger portion of your portfolio when conditions and valuations become more compelling.

Valuations: Equity Markets are Pricing High Expectation for 2024.

Analysis: Manning & Napier. Source: Bloomberg (3/31/1994 – 1/3/2024).

Finding Opportunities in Cyclical Areas of the Economy

These three industries were quick to price in the risk of a downturn and experienced recession-like conditions last year despite benefiting from attractive tailwinds.

A new era for fixed income

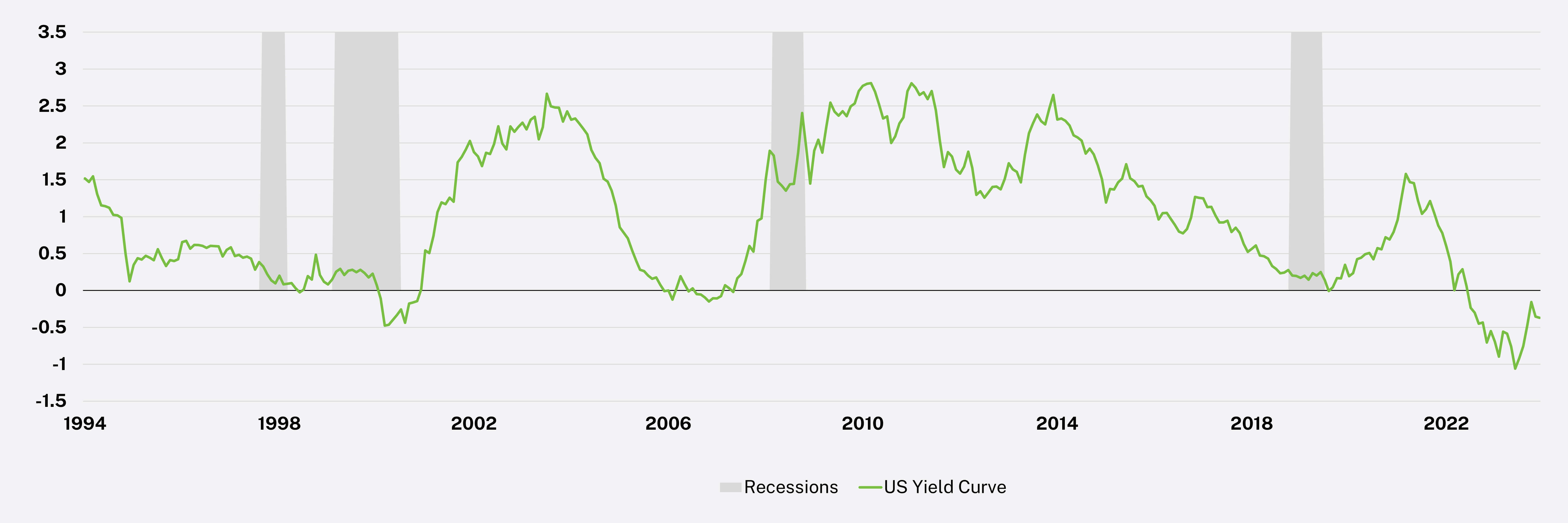

Whether a hard or soft landing occurs, we believe the stage is set for a normal credit cycle to play out as financial conditions (e.g., real yields, lending terms, and monetary policy) have tightened dramatically over the past two years or so.

All eyes were on the Fed this past year as investors looked for signs on the direction of monetary policy going forward. At this point, it appears that the Fed’s rate hiking campaign has come to an end and committee members are projecting cuts soon. As usual, the market seems to be getting a little ahead of itself, projecting more cuts than what was implied.

While markets appear to be increasingly embracing the soft landing narrative and the Fed has struck a more dovish tone, we still believe that the economy is in the later stages. To us, that is evident in the corporate credit segment of the market, both investment grade and high yield, where credit spreads remain extremely tight on a historical basis. With borrowing conditions having changed dramatically over the past two years, we do not feel those risks are being fully priced in.

When looking back over the past decade, companies had essentially been receiving “free” money and are now facing borrowing costs ranging anywhere from six to 10+ percent depending on the creditworthiness of the company. Although some of the larger businesses may be able to avoid issuing new debt, small businesses in particular face much different prospects as they do not have that luxury and likely need the capital to operate, setting the stage for what we’d consider to be a normal credit cycle. As such, we are generally underweight corporate credit heading into 2024.

Areas where we are continuing to find value are in the securitized segment of the market, particularly asset-backed securities – most often in more niche areas of the market such as litigation, finance, cell towers, and data centers as opposed to standard credit cards and autos – that are backed by asset classes with high quality fundamentals and low credit risk. We see another opportunity with mortgages, which we view as a high-quality asset with an attractive spread in comparison to corporate bonds.

As we’ve noted throughout this outlook, we think we are in for a difficult environment in 2024, but we believe that our select, disciplined approach focused on current valuations and economic conditions will be key to navigating this uncertain environment, helping us avoid areas of risk and uncover pockets of opportunities.

10-Year Minus 2-Year Yield Curve: Recession Risks Remain Elevated.

Analysis: Manning & Napier. Source: Bloomberg (1/31/1994 – 12/29/2023).

Keys to wealth management in 2024

Controlling your controllables is the name of the game of wealth management. Regardless of what happens in the markets and economy, there are steps you can take to secure your financial future.

While markets and the economy influence your financial plan, they are simply two components on top of always changing rules, regulations, your goals, and life moments. They all impact your finances. As we’re taking care of your investments, here are reminders of actions to stay in control and confident of your finances.

Tax Management

Save money by implementing a tax-efficient strategy. 2024 is bringing changes to tax brackets and more. Evaluate your options before writing the IRS a check.

Estate Planning

Federal estate and gift tax exemption is set to revert, when adjusted for inflation, to somewhere around $6.5 million per person beginning in 2026.

Those with sizable estates (greater than $40 million) should consider making substantial gifts before the deadline. Smaller estates should explore estate planning techniques such as annual gifting.

Stress Testing Your Plan

What is your plan's success rate? 40%? 70%? 95%? Gain confidence in your long-term plan amidst the day-to-day noise and volatility with state-of-the-art planning tools. Input your information and easily manipulate your plan and run a series of tests to help you visualize if you’re on track to achieve your financial goals - all in real time.

Schedule a free consultation today!

Dates to Add to Your Calendar

January 16th

Fourth Quarter 2023 Estimated Tax Payment Due

April 15th

Tax Day, First Quarter 2024 Estimated Tax Payment Due, Last Day to Make a 2023 IRA Contribution, Last Day to Make

a 2023 HSA Contribution

June 17th

Second Quarter 2024 Estimated Tax Payment Due

September 15th

Third Quarter 2024 Estimated Tax Payment Due

December 7th

Medicare Open Enrollment Due Date

December 31st

Last Day for 401(k) Contributions

Learn more about our Outlook

Watch a replay of our Annual Outlook webinar to hear from our team, including Director of Investment Policy Group, Chris Petrosino, as we discuss wealth management trends and our expectations for the year ahead – and how a strategic investment approach can help you meet your goals.

Watch nowAnalysis: Manning & Napier.

The data presented is for informational purposes only. It is not to be considered a specific stock recommendation.

Past performance does not guarantee future results. Performance for periods greater than one year is annualized. Please note that diversification does not assure a profit or protect against loss in a declining market.

All investments contain risk and may lose value. This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The S&P 500 Total Return Index is an unmanaged, capitalization-weighted measure comprised of 500 leading U.S. companies to gauge U.S. large cap equities. The Index returns do not reflect any fees or expenses. The index accounts for the reinvestment of regular cash dividends, but not for the withholding of taxes. Index returns provided by Bloomberg.

The S&P 500 Index is an unmanaged, capitalization-weighted measure comprised of 500 leading U.S. companies to gauge U.S. large cap equities. Index data provided by Bloomberg. Index data referenced herein is the property of S&P Dow Jones Indices LLC, a division of S&P Global Inc., its affiliates (“S&P”) and/or its third party suppliers and has been licensed for use by Manning & Napier. S&P and its third party suppliers accept no liability in connection with its use. Data provided is not a representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none of these parties shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.