If saving and investing are the building blocks of wealth planning, then proper tax management is the roof protecting the building. Great investment results, or your house, can be bogged down by poor tax decisions, or a leak in the roof, hampering your ability to meet long-term goals.

Wealth planning helps you match your investment strategies with tax management tools to minimize your tax burden and maximize your chances of success. Without a solution that considers both, you’re vulnerable to a less than optimal outcome.

Tax-Advantaged vs. Taxable Accounts

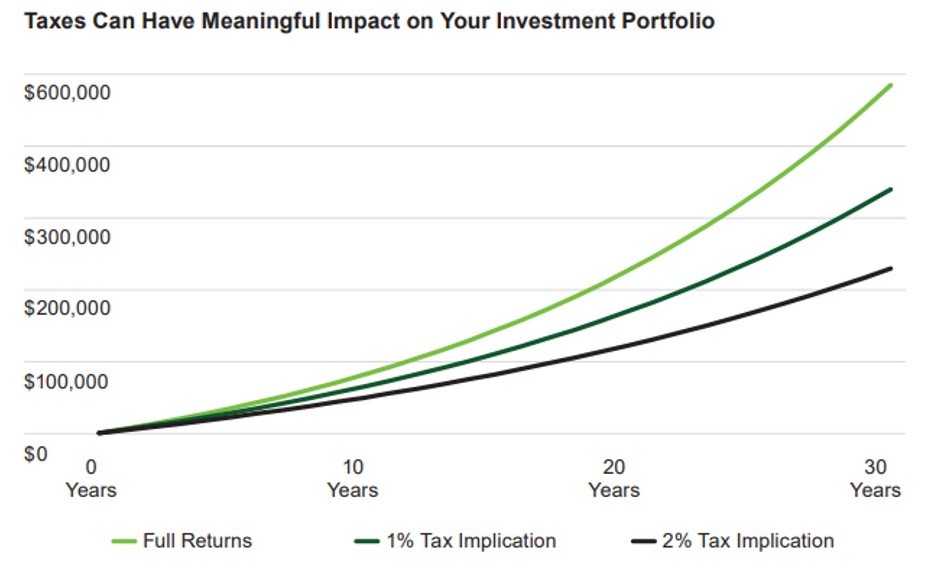

An investor can experience a substantial drag on performance, sometimes in a full percent or more, because of taxation. This concept is also known as a tax drag. Without proper strategy, you can end up realizing that tax implications can result in very materially less net worth that you otherwise could have.

As highlighted in the chart below, tax optimization strategies that can minimize the tax drag over the long-term can reap the most benefit. The sooner you plan and goal set, the longer your savings and investments have to compound. How to implement tax management strategies is something to discuss with your financial consultant who will provide the advice you need to understand and deploy the right set of tools that benefit your goals.

For illustrative purposes only.

Ways to Minimize Tax Drag

Minimize your possible tax drag by using and optimizing around available tax-preferred vehicles. Retirement accounts, such as 401(k)s or IRAs, and education savings plans like 529s are applicable tax-advantaged options. Strategically utilizing these account types allows you to see additional tax and growth benefits, maximize your savings, and potentially minimize tax drags.

Explore these strategies in our comprehensive Tax Guide and learn how these best practices can help you strategically and proactively achieve your financial goals.

2026 Tax & Planning Guides

Download these quick reference guides for all you need to know about taxes, Social Security, and Medicare for the 2026 tax year in just one place.

Download your free copies