How are you tracking toward retirement? Your savings are dependent on several variables, from income and earnings potential to life expectancy and societal expectations – all of which differ based on gender.

We can, and should, always celebrate the incredible progress that has been made toward equality, but also recognize the challenges that persist. While many areas deserve our attention, as wealth managers, we are acutely aware of the perfect storm women face in saving for a secure retirement. Not by their own doing, women are finding themselves on a lower rung of the wealth ladder, so let’s take a look at the hurdles women are facing and explore opportunities to overcome them.

Watch on-demand: Yes She Can: How to Build Financial Confidence

Did you know that 94% of women believe they will be personally responsible for their finances at some point in their lives, but only 48% of women are confident in their finances?

Take steps toward financial confidence by watching this on-demand event. We break down common hurdles and misconceptions, and share steps you can take to feel empowered to take control of your financial well-being.

Watch nowHurdle 1: The earnings gap

It’s a well-established fact that, on average, a woman is paid less than a man for doing the same job. The U.S. Census Bureau has tracked data on the earnings gap for over 40 years and, according to Pew Research Center analysis, while this gap has been closing over that time period, beginning at $0.65 for every dollar a man made, it has stagnated over the last 20 years, hovering in the low $0.80s.

Even when controlling for all variables, including the additional hurdles we’ll get to below, women still make only $0.95 for every dollar a man earns.

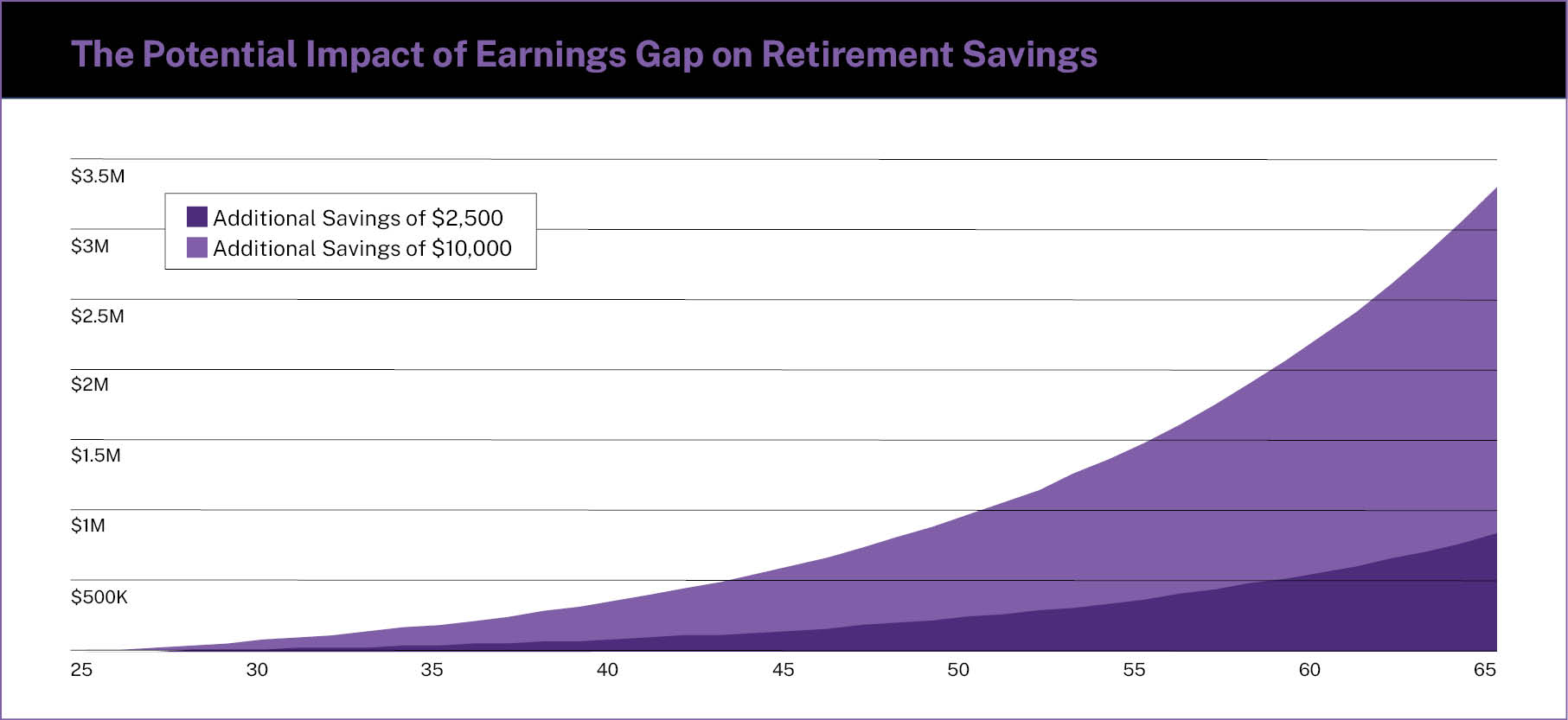

Not only is that a problem in and of itself, but it can have a noticeable impact on retirement savings. The 5% difference in wages alone, based on a job with an average starting salary of $50,000 at age 25 and assuming the difference – $2,500/year – is contributed to a retirement account growing at 7% a year, would result in over $780,000 in additional savings at age 65.

Going one step further and assuming a 20% difference in wages, or $10,000/year, now you are talking over $3,150,000 of additional retirement savings lost out on. Not to mention, these numbers don’t account for the lost potential from company matches and Social Security benefits, which are directly tied to income.

For illustrative purposes only. Calculations assume an inflation rate of 2.5% and after-tax return of 7%.

Hurdle 2: Risk tolerance

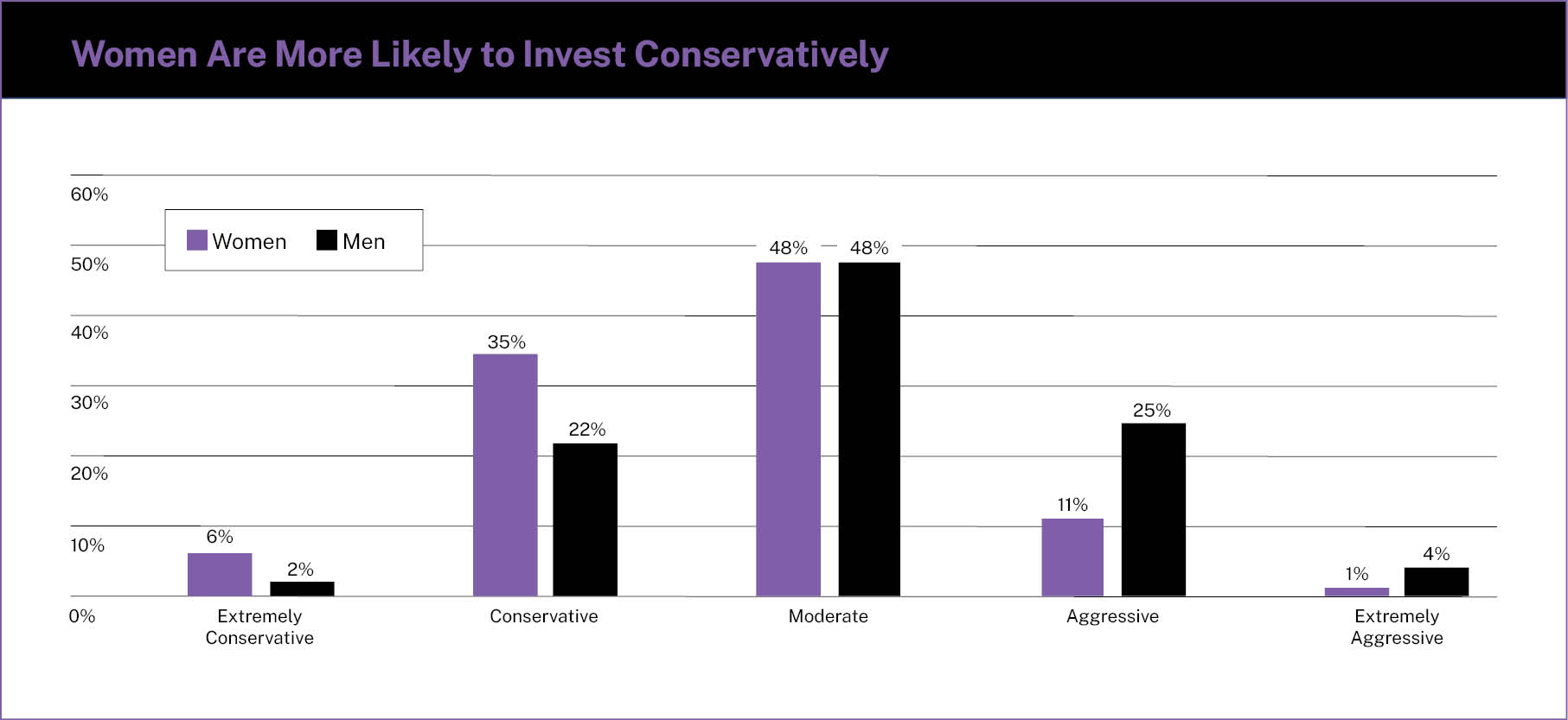

In general, women tend to be more risk-averse. This has been observed in investment portfolios, medical statistics, and even salary negotiations. New research has found that men and women are not inherently much different when it comes to initial risk-taking, but women experience greater negative consequences over their lifetime for engaging in “risky” behavior, like asking for a raise or promotion, so it conditions them to take on less risk over time.

While taking on more investment risk isn’t always the end goal, it’s important to ensure you are taking the appropriate amount of risk that aligns with your goals and when you plan to spend your savings. This “investing gap,” combined with the earnings gap, further compounds the retirement savings issue.

Source: Regions.com

Hurdle 3: Caregiver expectations

It’s also no secret that, when it comes to having and raising children or caring for other family members, women are typically the default caregiver. It can mean taking more time off from work, or even sitting out of the workforce altogether for an extended period of time, potentially resulting in lost wages or promotions, and permanently impacting long-term earnings potential and retirement savings.

Consider, for example, how important time and starting early is in the retirement savings formula, and the resulting long-term damage due to sacrificing a few years of saving while young can be amplified. It’s no wonder compounding has been called the most powerful force in the universe.

For example, $1 saved at age 25 could potentially grow to $16 by age 65, while $1 saved at age 35 might only grow to around $8.

Hurdle 4: Life expectancy

Along the same lines as risk tolerance, women generally eat healthier and engage in less risky behavior, so tend to live longer than men. According to the most recent estimates from the Social Security Administration (who have a large financial interest in getting this right), women born today are projected to live until 80 and men only until 74, a six-year difference!

Not only does this mean their retirement savings will have to last longer and with no one to share expenses with, but they may experience greater health care costs and longer stays in long-term care facilities at the end of their life, putting additional demands on their savings.

Feel Empowered

Taken together, these factors can have a noticeable impact on retirement savings. As women navigate the journey from early career to retirement, here are some tips to consider along the way.

- Any time is a good time to create a financial plan – take control and gain confidence by putting one together. Whether you do it alone or choose to work with a professional, simply knowing where you stand and what has to be done gives many people the needed confidence to stay the course or bring about change. Everyone’s finances are different and for those who are less than five years from retirement, this is a critical step in visualizing what retirement looks like for you.

- For those with partners, be involved in the planning conversations from the start. If you are working with a financial professional, consider asking for your own one-on-one session to provide an opportunity to ask questions or speak your mind, without fear of creating an uncomfortable situation. Be sure to ask questions about and understand what your financial situation would look like if you no longer had your partner to rely upon, whether that’s today or in the future.

- Appreciate how important time and compounding is to retirement savings and ensure you are using it to your advantage. For those who choose to stay home or forgo full-time work as a caregiver, understand the unseen value and economic benefit contributed to the household’s long-term wealth. While there will be lost wages as a result of staying home, continued retirement savings doesn’t have to be sacrificed, as well. If one spouse isn’t earning income, a spousal IRA can still be opened and funded up to the annual contribution limit.

- Plan for longevity and higher health care expenses, especially for those in good health with a strong family history. Ensure your retirement savings can handle an additional five to 10 years, along with potentially higher expenses at the end of life due to long-term care.

- Understand how your spouse’s retirement income benefits might impact you. Social Security and some pensions include a spousal benefit or a joint and survivor feature. If you are potentially entitled to part of the benefit, ensure you understand all the options available and how filing at different times may impact the ultimate payout.

- Finally, always be your own advocate. Whether it’s about compensation from your employer or ensuring your needs are fairly met within a financial plan, it’s important to speak up. For example, many states are now requiring pay transparency for certain employers and the internet is full of resources that will provide a decent estimate or range of pay for your role. If you have a strong case and can demonstrate your value, don’t hesitate to speak up and require equal pay for equal work.

As we use this month to celebrate the accomplishments of women both past and present, it’s imperative we acknowledge the ongoing challenges that persist, particularly in securing their financial future. Together, let us raise awareness and implement proactive strategies as we work towards a brighter future for women.

Sources: Census.gov, Pew Research Center, Psychology of Women Quarterly, Regions.com, SSA.gov, Bank of America

Please consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.