When times are good, investors tend to think the good times will go on forever; and when times are bad, it can feel like the pain will never end. Heading into the end of last year, investors were enjoying one of the longest bull markets on record. US stocks reached levels up over 400% from their 2009 low, scraping new all-time highs seemingly every day.

As the market gained steam, some investors may have been tempted to think ‘this time is different,’ and that the market was poised for ever higher gains. At the end of last year, those fanciful hopes came crashing down in one of the stock market’s worst fourth quarters in recent memory.

The enthusiasm that preceded the market selloff quickly turned despondent. By mid-December, the stock market was falling seemingly every day, culminating in a brutal selloff on December 24th in what was the worst Christmas Eve trading day ever. Amid all the volatility, fundamental analysis was overlooked. Investors traded on emotion as selling beget more selling.

As we now know, neither the optimistic views of early 2018, nor the pessimistic views during the fourth quarter were appropriate based on the underlying economy. They do, however, highlight how financial markets can quickly become sentiment-driven as proper analysis takes a backseat.

Market Downturns Do Happen

No matter how hard policymakers try to stabilize the financial system, market panics still happen. They are inherent in our economic system and are rooted in basic human nature. The longer times are good, the more likely people are to forget about what caused the bad times, building more risk in the system. This cycle has played out time and again.

Before the Global Financial Crisis, for example, few thought real estate prices would ever go down. Real estate enthusiasm became so great that even the burst of dot com bubble failed to slow the exorbitant rise in home prices. When the housing market finally rolled over, the risks built into the system blew up with tremendous force, bringing the entire global economy to its knees. Only with a massive spending package—the Troubled Asset Relief Program (TARP)—were home prices able to be stabilized.

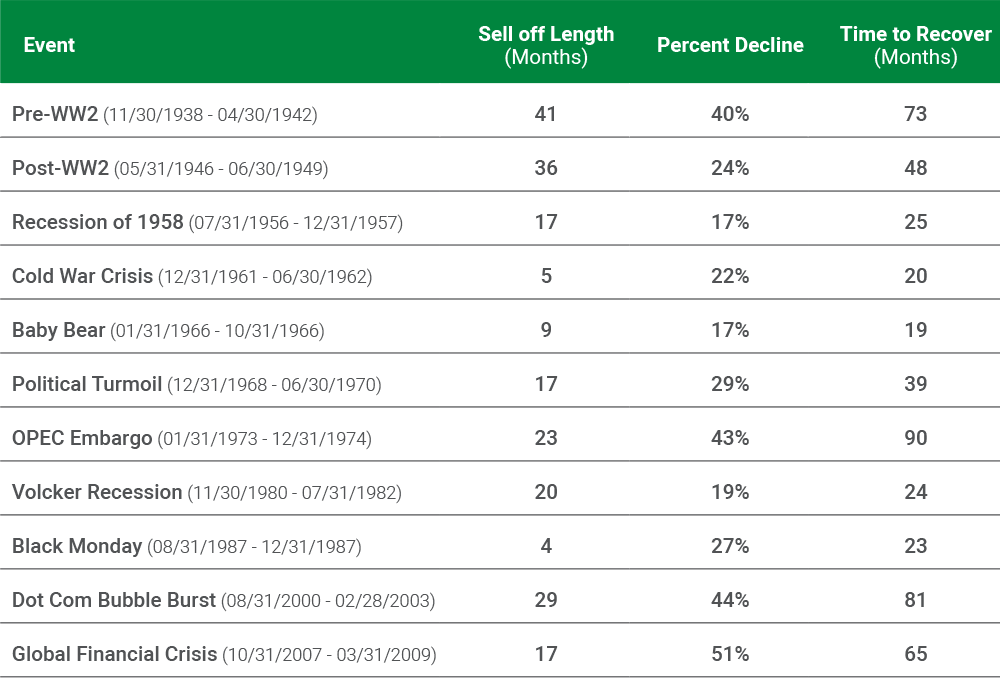

Over modern financial history, the US stock market has experienced a number of these moments when instability struck and financial markets paid a price. In an analysis of the past 80 years, we found 11 major stock market drawdowns, defined as selloffs of 15% or more, a rate of at least one per decade.

These selloffs were no small matter (see table below). Across the 11 market pullbacks, the median drawdown was a loss of 27% and lasted 1.5 years. Investors should also note that the more recent market selloffs have worsened in both size and duration.

Eleven Drawdowns Over The Past 80 Years

Source: Robert J. Shiller. The eleven drawdown time periods shown above are defined as having distinct drawdowns (15% or more) based on monthly S&P 500 Price returns since 12/01/1937.

Drawdowns of this scale can put pressure on personal finances. In a worst case scenario, major market selloffs can push desperate investors into forced selling at rock-bottom prices.

We also suspect that the typical market selloff might be worse than many remember. It is easy to see the market cycles in hindsight, but in real time, it is extraordinarily difficult to predict the exact moment when markets hit highs and lows.

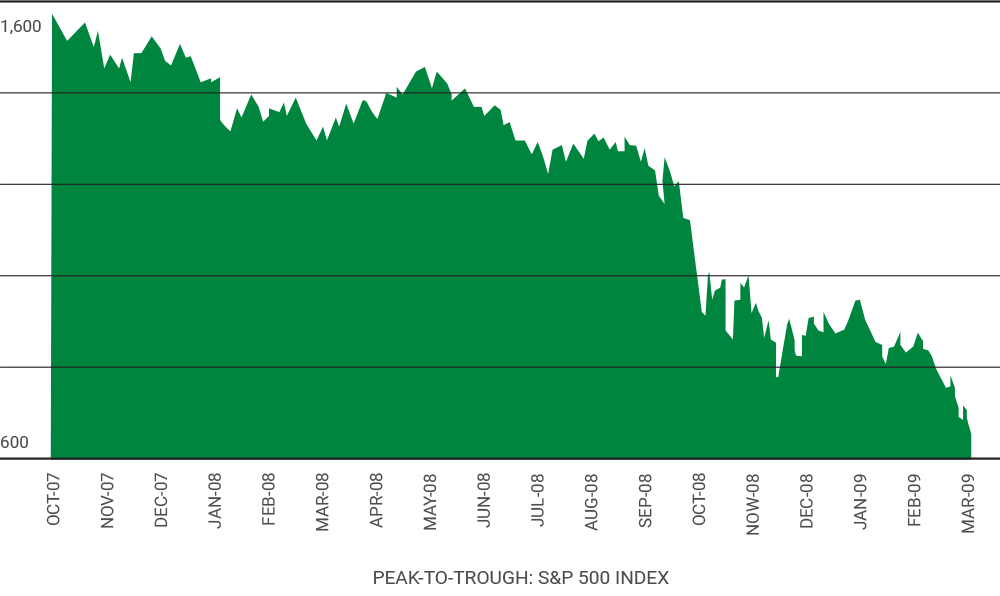

Referring back to the Global Financial Crisis example (see chart below), the market selloff actually included several periods of temporary strength on its way from peak to trough. False rallies in the spring and summer of 2008 may have led some investors to buy into the market too early. Those investors caught a so-called ‘falling knife’ and paid dearly in their attempt to time the recovery. The history of stock market panics are littered with these examples, and it highlights the difficulty in timing exact market tops and bottoms.

Markets Do Not Fall In Straight Lines

(Daily Increments)

Source: Bloomberg.

In the end, it would take the S&P 500 four years to eventually recoup its losses. By comparison, the recovery from the dot com bust was actually even worse, having lasted three months longer. Over the 11 market selloffs we studied, the median time in drawdown (from peak to trough, and then back to original peak) was an extensive three years.

A sustained three year bear market can seriously challenge an investor’s financial objectives. Forced selling, required or otherwise, at below fair value prices can cause permanent capital loss and significantly damage long-term financial progress.

What You Can Do

The best time to prepare your finances for future volatility is when times are good. It is easier to make significant adjustments when liquidity is flowing and prices are fair, of which, disciplined asset allocation plays a leading role. That’s why it’s critical for investors to have appropriate risk controls and avoid chasing returns at the wrong time.

To remain disciplined and avoid unnecessary risk, investors should periodically evaluate their own financial situations. This includes establishing a plan for an investment portfolio, if one doesn’t yet exist, or revising the plan as time passes or as life events unfold.

When constructing a financial plan, it’s vital to have clearly defined goals and objectives. The plan should outline appropriate investment strategies for meeting the objectives for different pools of investments (e.g., taxable investments or retirement investments). It should also include specific information on asset allocation and risk tolerance. These details define appropriate risk thresholds, which form the basis of risk management. A solid understanding of why these limits exist can help investors avoid chasing market returns in the heat of a bull run.

To learn more about this topic, you may be interested in watching a recording of our recent webinar, How Near-Sighted Investment Decisions Can Impact Your Future.

The Best Time to Buy

Within predefined limits, investors should look to add risk when others are most fearful. These moments are often defined by panicked selling. Frantic selling during the Global Financial Crisis led to collapsing home prices, something few ever saw as possible. With many homeowners underwater, the selloff was a once-in-a-generation opportunity for prospective buyers.

These lessons illustrate how chasing returns in a bull market can lead to painful losses. Instead of trying to time market downturns, investors should focus on what they can control such as adjusting expenses and regular financial monitoring. In managing these variables, investors can ensure that they aren’t completely dependent on the whims of the market.

Our Complimentary Financial Planning Magazine

It can be easy to feel overwhelmed by the ever-changing world of wealth management. But that’s where Prosper comes in. This free financial planning magazine is designed to give you the knowledge you need to keep your financial plan on track.

Get your copyAll investments involve risk, including possible loss of principal. The S&P 500 Price Return Index is an unmanaged, capitalization-weighted measure comprised of 500 leading U.S. companies to gauge U.S. large cap equities. The Index returns do not reflect any fees, expenses, or adjust for cash dividends. S&P Dow Jones Indices LLC, a division of S&P Global Inc., is the publisher of various index based data products and services, certain of which have been licensed for use to Manning & Napier. All such content Copyright © 2019 by S&P Dow Jones Indices LLC and/or its affiliates. All rights reserved. Data provided is not a representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none of these parties shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.