Every new year brings about changes to certain tax laws, savings limits, Social Security benefits, and more. A newly passed bill, piggybacking off the SECURE Act – making additional changes to key retirement plan rules – has left many with questions.

In our recent webinar our planning experts highlight noteworthy tax changes, discuss last minute opportunities for the 2022 tax season, and outline important planning ideas for 2023 (and beyond) to help you and your family plan for a successful year.

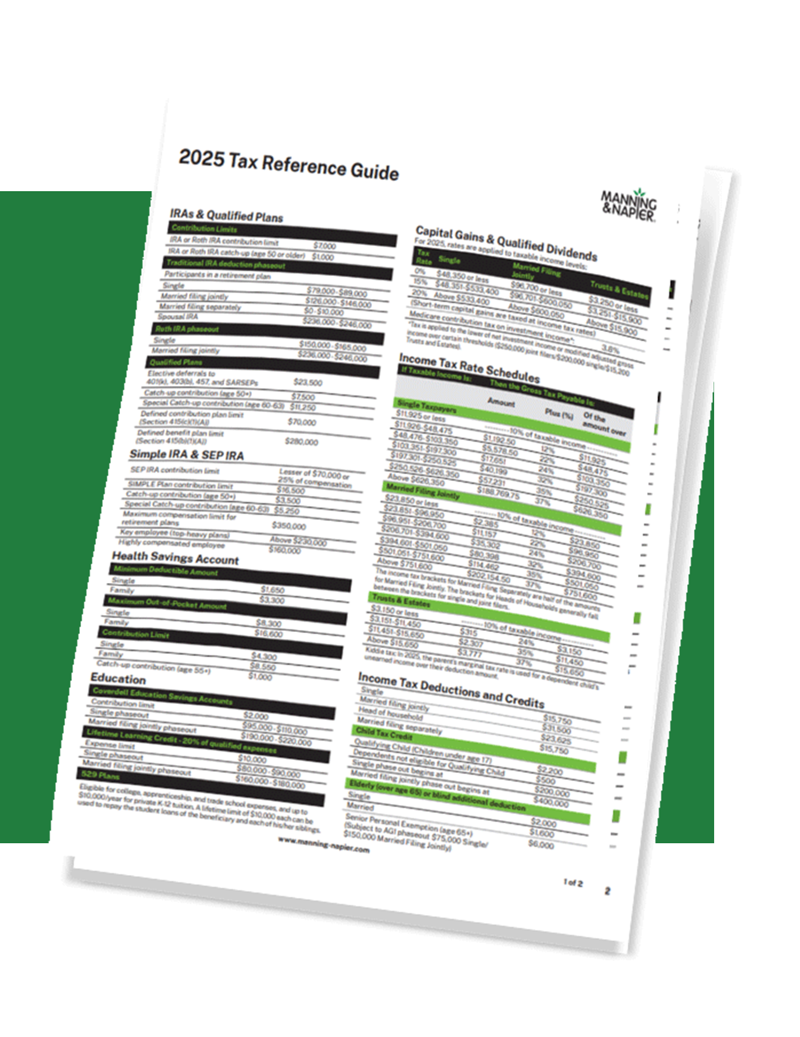

2025 Tax & Planning Guides

Download these quick reference guides for all you need to know about taxes, Social Security, and Medicare for the 2025 tax year in just one place.

Download your free copiesFull Transcript

Dana Vosburgh: Hello everyone, and thank you for joining us for today's webinar where we'll be providing our annual tax update and reviewing important tax planning considerations for the year ahead.

I'm Dana Vosburgh, Managing Director of Advisory Services at Manning & Napier, and I'm joined by my colleague Christina Poles, Tax Consultant on our Advisory Services team. Christina is actually sitting directly across from me here. So if you see me looking in that direction, that's why.

Also, as you settle in virtually here, we're interested in knowing where people are joining from today. So please take a second to type in your location in the chat feature. You'll see that at the bottom of the screen.

It's nice to know who we're reaching with these events that we put on. So if you can put that in the chat, that'd be interesting to see. Thank you.

All right. Well, if you have any questions throughout the webinar, please feel free to submit them at any time using the Q&A option located at the bottom of your screen. And when we conclude today's prepared material, we'll spend any remaining time answering questions that have been submitted.

And if we're unable to answer your question due to time constraints, or perhaps we just would like a little extra time to do some research for you, I will personally follow up with you after the webinar and I'll stress I mean, submit any and all questions you have.

Taxes, you know, taxes can be complex, tax situations can be unique and for everybody. So if we don't answer your question during the webinar, just know that we'll absolutely follow up with everyone after.

For your convenience a recording of this webinar will also be available on our website within the coming days. So if you have to jump off for any reason, you can, you know, catch up with the recording.

Finally, I'll point out that there is a closed captions option on the bar at the bottom of the screen for those who might find it to be helpful.

Okay well, what are we going to cover today? This kind of lists out the agenda. But really, every year, the IRS releases important information about tax brackets, retirement savings limits, deductions or credits, and other key tax rules that go into effect the following tax year.

In addition, we've had new legislation that was signed into law in 2022, such as the Inflation Reduction Act and SECURE Act 2.0. And those add, you know, a list of new details that we have to keep straight as we move into a new tax year and think about planning beyond that.

Some changes might be very small, you know, important changes, but impacting a small percentage of taxpayers and others may be more meaningful that impact everyone in some way.

So as an annual tradition, we're going to summarize some of the information that stood out to us and discuss some of the highlights so you can make informed planning decisions, whether it's staying up to speed on the amounts to save for retirement, or incorporating tax planning strategies to educate yourself in addition to that and build in some, you know, some strategies that can help when you're doing some planning in the years to come.

So I'll just move to the next screen here, just thinking about the tax environment. And if we reflect back on 2022 from a tax planning perspective, I think that for most people it was different than what they've experienced consistently over the last decade or so.

Since the financial crisis in the late 2000s, over a decade of bull market growth created meaningful gains in portfolios.

Interest rates, prior to what we've been experiencing over the last year or so, we're at historic lows. Things are becoming a bit different now and really challenging the mindset that some people may have had or developed over time about taxable income generated by an investment portfolio.

The industry itself has changed to a degree. Last year's challenges, with both stocks and bonds being meaningfully down have pared back gains or created some losses. So this has removed a barrier in some ways that developed for some to adjust the portfolio.

We're also in a window of time currently that can be beneficial to implement certain tax strategies. We'll go into that in a fair amount of detail, but tax laws are, historically speaking, very favorable right now, and it may not feel that way when you calculate your taxes.

But, you know, but they are favorable, historically speaking, and they're poised to be less so in just a few years. So those are some of the thoughts ahead as far as just to provide some context as we start this conversation, just in the world of tax planning and it can set the stage for what we'll talk about, some of the considerations that we'll be talking about today.

So, Christina, before we move into those considerations for 2023 and looking beyond that, let's first touch on a few highlights that you wanted to discuss in 2022.

Christina Poles: All right. It sounds great. And thanks, Dana. So, like Dana mentioned here, 2022 had some huge impacts on the tax code.

So this past year we had two major legislations that were passed, the first of which was the SECURE Act 2.0, and then also the Inflation Reduction Act that passed back in August.

So the SECURE Act has a lot to unpack as far as changes, and we'll be diving into some of those nuances later here in the webinar. But I did want to touch on the Inflation Reduction Act at a high level.

So there's three major areas that it targeted to kind of fight inflation in the long term. So the first area was to increase revenue and enforcement efforts. So they did accomplish this by the new IRS funding of $80 billion. Now, half of that has been promised to go directly into enforcement and revenue collection efforts.

The second plan of attack was to target major corporations in the form of some new corporate taxes. And the third attack was to increase domestic manufacturing and clean energy production in the US.

So to keep this discussion relevant and for time's sake, we're not going to go into every extensive detail on every change. But I do want to highlight just a few key changes from the Inflation Reduction Act that are relevant to individuals.

So one area that was massively expanded was the home energy credits. Previously, when those credits first came out, they had a lifetime cap of $500. So if you were somebody that took advantage of the first round of these credits, this is a perfect time for you to revisit the new rules.

So what was once a lifetime cap of $500 has now been changed to 1,200 annually. As far as the credit goes. This credit's equal to 30% of the cost of your home energy improvements and also any new power systems that you install. So these are actually two different systems, two different credits, and you can take advantage of both.

And you can also use it for a home energy audit. So if you don't know where you stand, this is a good time to kind of get that audit done and get a good sense of that.

And there are also some changes, an expansion to the electric vehicle credits. So now new EV that are purchased after January one of this year, they have the final manufacturing done in the US can qualify for the maximum credit, up to $7,500.

So this speaks again to that attack effort, number three, which is domestic manufacturing and clean energy. But to take this credit even further, beginning in 2024, you as a purchaser can actually push this credit back to the dealer and take it as a cash rebate or even a down payment.

So if you've been, you know, window shopping, the new Teslas like I have this might be a perfect time and a perfect excuse for you to pull the trigger on that purchase.

In addition to the new vehicle credits, they actually created a used vehicle credit. Those didn't exist before. And this credits up to $4,000 on used electric vehicles as well as the new one.

So it's subject to the same manufacturing standards as the new vehicles. But for both credits, there's going to be some phaseout and income limitations that you have to be aware of as well.

So the most important factor in qualifying for these EV credits is where the location took place for the final manufacturing. So if you don't know this intuitively, don't worry. They do have a tool online. It is called the VIN decoder, and it's on the National Highway Traffic Safety Administration.

So as you're looking for a car, you can before pulling the trigger on the purchase, go and type the VIN in and see where it was finalized and if the vehicle's available for this. I mean, I hope there's no used car dealers on this call, I'm going to pick on them a little bit.

But if there is a credit available, I'm sure your sales team is going to make sure that you're aware of it. Right but like I said, we're going to go into more details on the changes for SECURE Act 2.0 later in the webinar.

But before we dig into that, Dana, can you walk us through some of the tax changes for 2023?

Dana: Yes, we'll touch on and some of those changes. I think we'll go through them quickly. Inflation has been the topic over the last year to 18 months, as you've certainly heard. And although it's created challenges in the markets and perhaps your own budget. On a positive note, it's been reflected in some of the inflation adjusted numbers we see released every year.

This information is available in our reference guides that we release every year covering tax rates, tax brackets, contribution limits. We have information about Social Security and Medicare, and they've been updated for 2023. So you can download them by going to our website, but I'll move through these quickly.

We'll start with social security, start with a positive message that there was a meaningful cost of living adjustment this year, 8.7%, after also a sizable increase in 2022.

And you can see, you know, the various cost of living adjustments over the last 10 years+ there. This is good for people that may have more of a fixed budget to have. Obviously it's a cost of living adjustment that increases and tracks along with inflation.

Next thing that we'll cover here is some of the highlights for how retirement contributions have changed. So from 2022 to this year and pretty much everything with the exception of the IRA catch up amount received an increase for 2023.

So for instance, if you're over the age of 50 participating in a 401(k) plan, you can defer 3,000 more this year than you could last year.

And, you know, you can see obviously for a lot of people, if they have an IRA, you can contribute a bit, a bit more this year. Like I said, the catch up for the IRA is the only thing really on the screen that did not change.

Something just to keep in mind, if you have any kind of auto savings features set up for your retirement accounts or money, you know, that just automatically goes into eventually match up with that limit.

If that's increased you want to go in there and make sure that you update that. So that you're saving as much as possible, and not missing an opportunity to save a bit more.

Next one is deductions and credits and kind of the common deductions and credits that we think about. The standard deduction is higher, as you can see on the screen there.

And the standard deduction increased significantly several years ago as part of the Tax Cuts and Jobs Act. So many more people are using the standard deduction now versus itemizing.

Also for the child tax credit, which, if you can remember, received a lot of attention in 2021 due to the CARES Act and, you know, increased the flexibility and the amount that people receive for that. That has not changed for 2022, or from 2022. So the amount is the same this year. And so some people may be interested in knowing that just because it was something that, you know, I think some people really benefited from and had a little bit of a surprise increase in some cash flow for a couple of years ago. Christina, do you have anything to add there, I think you're going to mention something about the personal exemption.

Christina: Yes, Dana I really like this slide. So one of the reasons I chose this personal exemption at 0 for 2022 and 2023, if you're not somebody that follows the tax changes on a regular basis, you might think that this is typical.

I know everybody knows that the standard deductions getting ready to sunset, but personal exemptions not really out there as much. So if you still are of working age, you might remember your HR coming around maybe a few years ago and asking for a new w-4 form. So, if you are even retired, you could have remembered filling that form out and you'd have to list, you know, how many people are claiming one, two, three. This goes directly to that personal exemption.

So a few years back, there was a new form. It said, hey, what's your filing status? So now instead of asking how many you're claiming, it's, are you single? Are you married? That speaks exactly to this personal exemption.

This was done away with during under the TCJA, and it is slated to come back. So we are going to see a standard deduction cut, but that personal exemptions are already going to come back as well. And that's about $4,000 per person. That's all I want to really touch on this one.

Dana: Good, the next one will highlight is Medicare. And in contrast to some of the increases we've just highlighted, Medicare premiums are actually lower in 2023 by 3.1% and this is due to lower than anticipated spending on certain drug costs and other part B services.

I'm sure that's a surprise to some people. People think about, you know, health care just sort of continuously increasing even, you know, faster than the rate of general inflation. But that's good, to have a scenario here where we have a premium decrease for Medicare and actually a large cost of living adjustment for Social Security.

Just a reminder I think there was a pre submitted question about the way income is used for Medicare premiums. It's not a typo on the screen. 2021 is listed because Medicare uses prior year income. So the prior year tax return.

So 2022 tax return, or tax year and that uses 2021 income. So it's two years prior just to answer that question. And this slide here, it just shows a timeline for important dates for 2023 as we're moving into tax season here. And obviously people are thinking about that. So April 18 being the big one right in the middle of the screen, that's tax tax day for 2023.

It's the day that you would have, the last day you would be able to make 2022 contributions for IRAs and certain retirement accounts. And it's the first quarter of 2023 estimated payment date. So that's a big day.

One thing I'll mention is that if you have a number of investment accounts with a range of different investments, a number of holdings, you may be better off waiting a little while before filing and let those 1099 come in and any maybe corrected 1099 has come out because that does happen on occasion.

And so rather than filing early and then being forced to file an amended return, you know, a lot of people like to do their taxes as soon as possible, and that's understandable. But it's just a suggestion in order to maybe avoid some potential frustration by having to file an amended return and just wait a little bit longer.

Okay so, you know, I think one of the big news stories last year or at the very end of last year was certainly the sequel to the historic SECURE Act.

The sequel is SECURE Act 2.0. And it's something that, you know, the SECURE Act in and of itself was something that I think maybe people forgot about because it happened right before COVID hit. But here we are now. There's been a sequel. Christina is going to cover some of the highlights for that.

Christina: So if you remember, the original act, the original SECURE Act was passed back in 2019 and it aimed to overhaul the retirement code and ensure retirees weren't running out of their assets or outliving their assets.

So if you can remember back then, the original passing came through right at the end of the year as officials were facing a government lockdown. So it was pushed through rather quickly. And because of that, there has been talks of the SECURE Act 2.0 furthering the agenda almost immediately.

This is a highly anticipated SECURE Act 2.0, and it was finally signed into the law at the end of December, 2022 and has delivered some major changes.

So the first that we want to highlight are some key changes to RMDs. If you're not at retirement age, RMD is required minimum distributions. So basically the IRS says, hey, if you have some pre-tax assets you've been saving for retirement, you can't just save them forever. At a certain point, you're going to have to start depleting those assets.

So the original SECURE Act pushed the distribution age back from 70 and 1/2 to 72, and a SECURE Act has pushed that back even further. So it's now 73. And I do want to clarify this rule. I know we've had a few pre submitted questions on this. And it has caused a lot of confusion for our clients as well, especially for those that turned 72 this past year.

So this particular provision doesn't take effect until January 1st of 2023. So that means if you turn 72 in 2022, you are required to have taken a distribution that year. But if this is your situation that you fall in, you know, don't panic. You do have until April to make the first withdraw when you start your RMDs.

And you don't have to worry about a penalty as long as you do it by tax filing date. So if you have a financial advisor, reach out, they can definitely help you determine, you know, what your RMD amount is and when you have to take your distributions, help you take those distributions. And another area an advisor might be able to help with is penalty reductions if you did miss an RMD distribution.

So prior to the SECURE Act 2.0, missed RMD would actually result in a 50% penalty from the IRS on that payment. So, you know, luckily and thankfully, the IRS recognized that this penalty was a little bit steep and that has been reduced under this bill to 25% This can actually get reduced further to 10% if the error is corrected within a timely manner.

So if you are in this situation, time does matter. So I would reach out to your advisor as soon as possible and help get that payment corrected and get that penalty further reduced.

So as Dana mentioned earlier, the catch ups were really the only area where you didn't see the IRS index the number for inflation. You know, luckily, this area was covered under the SECURE Act 2.0.

So while you didn't see the indexing, you won't see it take effect this year. It is set to start in 2024 for those that are 50 and older. And in addition to some of these RMD distribution changes, there are also some favorable changes for individuals who are more charitably inclined.

So donating to charity has been made easier with some of the changes to QLAC (Qualified Longevity Annuity Contracts) and QCDs (Qualified Charitable Distributions) prior to the changes QLACs were limited to 125,000. That has now been increased to 200,000. And qualifying charitable distributions are another great way to lower your taxable income by donating any unneeded RMDs.

So one big change for QCDs is this one time election for a QCD to a split interest entity. And this means the beneficiaries of the donation are not only the charity, but can also be an individual. So this could be in the form of an income trust. This could also be your spouse or child. This change allows a QCD payment to be made directly into a charitable remainder trust or charitable gift annuity. But there is one caveat to this, and that there is a lifetime cap of $50,000 for this.

So I know me and Dana, we've been talking about this a lot. So we think it's a great step in the right direction. But we do have a little bit of concern. Dana, do you want to talk about that a little bit?

Dana: Yes, I think just the question of whether or not people would take advantage of an option like this, it's nice to have the option. But, you know, as far as setting up a trust, administering a trust and the work that goes into, say, a charitable remainder trust or a charitable lead trust, any of those split interest vehicles, you know, a $50,000 limit is pretty small.

So, you know, I think it'll be interesting to see if people do really take advantage of it. Like I said, it's nice to have the options and to have that flexibility, but we'll see if it's really embraced.

Christina:Thanks for covering that. I actually agree with that, too. You know, the cost of setting the trust up versus how much benefit you're really getting from it.

It actually sparked my own curiosity. So I have a poll here for you guys I want to see, you know, do you have a trust set up currently or if not, you know, what are some of the reasons why you don't.

While you guys are voting on that I'm going to touch on the next topic really quickly. So aside from the new proactive deductions, the IRS also did some reactive rule clarification on charitable conservation easements.

So for those of you that don't know what these are, this is a voluntary agreement between an owner of a raw piece of land and a land trust or a government agency that basically limits the future development on that piece of land.

So this agreement allows for the land owner to take a charitable deduction on the loss of use value of the land. So this loss of use, here's a quick example. Let's say I have a $100,000 piece of land that I think could have been a shopping mall and that mall would have been worth $2 million.

Well, I would enter into one of these agreements, never build the mall, but I'm going to take the deduction for the $2 million. So if you're like me and you like to read the tax code, you would notice. What really stood out about these charitable easements is that the deduction can carryover for 15 years, so all the other charitable deductions are limited to five years.

So we're talking about a potentially huge deduction. We're talking about something that's really speculative in nature. And because of this, obviously there is an increased risk for abuse and abuse happened. So now these deductions, the IRS has clarified, it's going to be limited to 2 and 1/2 times the cost basis.

So in that example, instead of me writing off 2 million, I would only be allowed to write off 250,000. And if I try to do anything above that, that's going to be disallowed. So we have a lot of clients who are charitably inclined and want to give, but there's also a huge issue in the US with the opposite end of the spectrum.

So not even having an emergency savings. And it was really nice to see that the IRS recognized this and this issue and created a few new ways to access emergency funds.

So the CARES Act allowed for individuals who qualified for stimulus payments to withdraw funds from their retirement account penalty free. So these are referred to as hardship loans. And it was really great for those without emergency savings that were maybe out of work when they, you know, the government shut down during COVID. But if you want people to save for retirement, this is kind of a step in the wrong direction.

So the IRS recognized this and now these loans are limited to $1,000 and it's only available once every three tax years unless you repay the loan in full. And then, you know, you can take another 1,000 out, but it kind of forces people to keep their retirement funds in their retirement accounts.

But on the other side of the coin, you know, there's a lot of families that don't even have an emergency savings account established. So if you're living paycheck to paycheck, saving a few dollars can really feel like undoable and overbearing. And because of this, the new sidecar Roth accounts were created.

So this is one that I really like that was included in SECURE 2.0. And they sit alongside your employer retirement plan. So it's not actually part of your 401(k), it's a separate account. And they allow employees to save $2,500 a year on a Roth basis. So these are after tax dollars.

And because they're Roth contributions, they're available to withdraw penalty free. And they also come out of each pay period in the same way your retirement contributions do. So like I said, if you're struggling to save because it feels like a big dollar amount to save and you're living paycheck to paycheck. This way, you're not feeling like you're losing a huge chunk of money.

But it does let people create a savings account where a lot of people don't even have that. And sidebar Roth accounts are just one of the changes of the SECURE Act that involve Roth. So we want to touch on a few of those.

Roths are still as attractive as ever. Later, Dana is going to cover some Roth opportunities and planning. But I did want to cover a few changes, one of which was to the 529 plans.

So under prior law, there was no way to recover overfunded 529 money without incurring a 10% penalty. So the SECURE Act 2.0 changed this and now access 529 have the ability to be rolled over into a Roth IRA account.

This account is in the beneficiaries name and there is a lifetime limit of 35,000. But one of the key requirements to rolling these funds is that the 529 has to have been maintained by the same beneficiary for 15 years.

So this is a great incentive for college saving, but it's also an incentive that's telling you, let's get started a little bit sooner than later. And another great thing, another thing that's great with these is that there is no income limitations to consider when you're looking at this as well.

Roth 401(k)s for those that don't know historically used to require RMDs the same way some of the pretax assets would, what your regular 401(k), and it would require to start at a certain age. So now any portion you contribute to your 401(k) that's on a Roth basis or after tax basis, it's now going to match the Roth IRA distribution rules, which are a lot more lenient.

You don't have to, you're not forced to take a certain dollar amount each year. You can wait for a later age if you wanted to. So that was a nice feature that we saw with that.

And then if you're working still and your employer offers retirement matching, you're soon also going to have the option to have those matches treated as Roth contributions. So while you will pay tax on the match today, you do not pay taxes on any of the future gains.

If it gets, you know, if you pass away and it goes to a beneficiary. They never pay any taxes on that. So that's a really nice feature that came with SECURE Act 2.0. So a lot of these changes we've touched on took place in 2023, but there are a lot of changes coming on the horizon as well. So we wanted to cover a few of those at a high level.

One of the big changes that I want to point out is to the automatic enrollment. You know, currently, if you wish to save for retirement, you have to join your employer's retirement plan. So we have an issue of inactivity here and the IRS recognizes this.

So one of the changes they made is creating an automatic enrollment, and it's kind of streamlining this process and automatically adding you to your employer's retirement plan when you start. So they will actually put you in the plan automatically at 3% at least, and it increases annually up to 10%.

So if you don't want to contribute to your 401(k) at work, you know, that's perfectly fine. Not in our world because we're always going to tell you to save for retirement. So it's not really fine. But if you don't want to contribute, if you need more capital that year, it's okay. But it actually is now going to require you to go through the extra step to opt out. So that's a nice change. They're trying to get those people that just don't do anything to automatically be saving for retirement.

So another big change that's noteworthy on the horizon is the savers credit. So currently we have a $2,000 refundable credit, they claim every year on your tax return. So it either comes back as a refund or it is lowering your tax liability.

Starting in 2025, this credit is going to instead be directly added to your retirement plan. So instead of it being a tax credit, the Treasury is going to figure out some way to add it directly to the plan. We don't know how that's going to look yet. Obviously, 2025 is a good target, but this is a new system. There could be some caveats. We have no idea how that's going to play out, but that is slated to come down on the horizon.

So we did touch on a lot so far. And the next slide here, we do have a great timeline that shows, you know, when some of these changes are coming into effect.

Dana: A lot of really good information. A lot of good information there, Christina. And apologies if you have any random slide changes in trying to drive here as best I can. Sometimes it's a little much, but so anything else here, I guess, you know, as you see it laid out over 2024 and 2025 as well, a lot to keep track of. Is there anything else that you think is just looking out to next year and the year after that's on this slide that's worth touching on?

Christina: Yes, as I'm looking at this slide, I know we covered a lot of these there are a few that I want to point out, the first of which is the pension start up credit for small businesses.

So we haven't talked about business credits. There were some changes in 2022 for businesses, but they just are not as impactful as the individual ones. This is one that they added, which starts this year. And it's really exciting.

So a lot of small business owners, they don't save for retirement because the costs of initiating this plan, this credit is something that can help small business owners, maybe, you know, single owner LLC or a small business that has a few employees and it covers the administrative costs to starting that pension plan. And it's up to $5,000 and it's used over three years.

So it's not you maxed out at $5,000 one year and then you get no credit for the next two. It's you get the same credit for three years. That's a new one. That's cool to point out.

And the other one we did talk about RMD age increasing to 73. That's actually going to be pushed back even further. So that's also on the horizon for that slated to increase to 75, that starts in 2033. So those are two that I want to point out from this.

Dana: So I mean, really what we're facing, in addition to some of those things on the horizon for SECURE Act 2.0. It's actually the Tax Cuts and Jobs Act that we're in the middle of right now and is our tax law but is set to sunset.

Many of the provisions are set to sunset at the end of 2025. So 2026 we'd be reverting back to, you know, the prior laws. So Christina, can you go into some, I think highlights there and things from a planning perspective that people should be aware of.

Christina: So one of the things I want to touch on are more business opportunities. Business credits. We haven't talked about those a lot. Bonus depreciation is a big one. It's actually slated to start sunsetting before 2025.

So when you hear sunset everybody thinks 2025, this is one that's actually going to start this year in 2023. So if you are a small business owner and you are purchasing equipment and machinery, it has to have a useful life of less than 20 years. You were able to take advantage of this bonus depreciation and basically, you know, certain vehicles even qualify for this. And I not every vehicle does, but some at a weight limit.

So if you were to purchase a vehicle last year, instead of depreciating that over the life of the vehicle, you're actually allowed to expense off and do a bonus depreciation of the cost.

So that can really impact your tax liability in that first year that you did the purchase. And this is something if you have a business and you're looking to replace equipment, we want you to be aware of because there's a lot of advantage here to doing that a little bit sooner than later. That's going to decrease by 20% annually until it gets fully phased out.

Like I said, 2022 is at 100%, this year we're looking at 80 and so on and so forth until that disappears in 27. So that's a good one that I'd like to point out. The other one is section 199A deductions.

So if any of you guys have a C corp or if you follow business law, you'll understand that the C corp tax rate got lowered under the TCJA they dropped it down to 21% And that's actually slated to be a permanent, you know, barring any legislation changes, which can also happen, that's set to be a permanent change.

So to make it kind of fair for other business entity types, we had this 199 deduction that you were allowed to take on 20% of your qualifying income. So these are for S corporations, partnerships, sole proprietorships, any kind of passthroughs.

And this kind of brings those entities to the same tax place/playground as the C corp. So this is actually slated to sunset in 2025. So if you see a lot of news about what's going to happen to the C corp rate or maybe are they going to extend this that's where that conversation's stemming because one's slated to be permanent. One slated to sunset. Go over to the next slide.

Thanks, to the tax brackets. I really love this visual, though, as you take a look at this slide. You're going to start to realize that almost every single person on this call is looking at a tax rate increase in 2026.

So the one bracket that we see no change is that 10% bracket. So up to $10,000 or so. You know, if you're making $10,000 a year or less, you have no tax changes for everybody else, which is probably everybody on this call. You are going to have these rates affecting your liability and your liability is slated to increase.

So when you're looking at this chart, I just want to point something out quickly. You know, let's say, for example, you make $400,000 a year. So I don't want you to look across and say, oh, I'm paying 32% taxes on all my money. And that's only going up to 33% 1% increase. Not a big deal.

That would be awesome if that's how our tax liability worked. Unfortunately, we get taxed at marginal tax brackets, so you have to start at the bottom and you have to move up the chart so that first 10,000 your tax liability is going to be the same, the next 70 or 80,000 or so, as you can see, you go from 12% to 15%. So you're paying 3% more taxes.

They're 3% more taxes than the next bracket and so on and so forth up to your bracket. So I just wanted to point that out. As you're looking at this, so when we start talking about some of the planning opportunities for these brackets, this is why we're pointing it out. It's not a 1% increase. It could be pretty substantial.

So I want to go on to some of the sunsetting on a timeline. So you can see, you know, what the changes are. There you go. And 2026 is going to be a massive year of change. So I want to draw your attention to the center column. And we did just take a look at the tax rates and the brackets.

But I do want to point out that there's two major sunsetting deductions, the first of which is charitable exemption. You know, currently that's just under 13 million that is scheduled to revert back to the pre TCJA levels which are between 5 and 6 million.

The second major one is the standard deduction, which we're also going to expect that to cut in half to around 6,000. This change is going to increase the likelihood of individuals choosing to itemize. So there's a lot of people that are taking the standard deduction now that have historically itemized.

We can see that going back to how it was before. So there are some changes to be aware of if you are and itemize are under the TCJA state and local taxes, which are commonly referred to as salt taxes, had a ceiling of $10,000, which means they capped what you could take after $10,000.

So these are property taxes, income, you know, sales tax. And, you know, depending on what state you live in, California, this could be massive. And I like to pick out our West Coast Hollywood state, but I'm here in New York and we're notoriously not a great save for taxes as well.

So this could be a big deal, the fact that the ceiling is going away. But while this is going away, the p limitation is also going to be reinstated. So if you don't know what that is, that limits the itemized deductions that you can take for certain income levels.

And another noteworthy change with that is personal and theft losses which were disallowed are now going to be allowed again. And for families, I know we talked about personal exemptions and dependent exemptions that's going to be reinstated, but the child tax credit is going to remain lower and right now, qualifying relative. So if you're a grandparent that's claiming a grandchild like you're qualifying for this tax credit for child, that's going to go away for qualifying relatives.

So I know we covered a lot of details so far, but we do want to also cover some proactive planning strategies where you can implement and take advantage of these changes. So Dana, do you want to go into some planning strategies?

Dana Vosburgh:Yeah, Thanks. So based on all of the areas we just covered, I think it's important to think about the key strategies that people may want to consider now and just sort of have in the list of potential planning ideas. Keep in mind, all strategies are not appropriate for every person.

Everyone's tax situation is going to be different and it can change from year to year as well. So it's important to be aware of these and then work with your team at Manning & Napier along with your accountant or other advisors to determine the right action items.

So the first one, which we've hit on a little bit already is Roth IRAs. And it seems that with every passing year with new legislation and other updates that come along the Roth IRA really gains more appeal. And Christina covered the new 529 plan rollover and the retirement plan enhancements. But I'll build on just some of the general appeal and some of the things that we do talk to our clients about pretty regularly.

A very good strategy for people in low income years. Perhaps if you're recently retired and you may only have Social Security along with maybe some investment income from non retirement accounts, is to do some annual conversions, Roth IRA conversions in the years before RMDs begin.

So this is where you can convert up to a certain bracket level and then evaluate again, you know, the next year. Does it make sense to do that again? This can help to smooth out taxes over time. And that's something that maybe some people don't think about as much. But, you know, really maybe paying some taxes now in order to lower taxes in the future.

And because of what often happens is people will have a few years of very low income and the corresponding low taxes that go along with that. And then when RMDs begin, you know, in the your seventies, they face annual income that is very high. So as you convert you're reducing future RMDs as well, because Roth IRA owners do not have to take RMDs.

So now remember, beneficiaries, if you do inherit a Roth IRA, you do have to take required minimum distributions. You're not paying tax on it, but you are required to take it by at least a difference and the key benefit, the key appeal, is with Roth IRA owners you do not have to take required minimum distributions.

So just remember that you should also have non IRA money available to pay the tax on a conversion. So you know, sort of having that bucket of money available to, you know, pay the additional tax that you're compiling, or you're generating based on the conversion.

Regarding backdoor Roth IRA contributions, which we have up up there on the list as well. Remember that there are income limits on the ability to contribute to a Roth IRA, but there is no income limit on Roth IRA conversions. So this creates opportunities, so if you don't have an IRA and your income is too high to contribute, you can take advantage of what's known as the backdoor Roth IRA contribution.

This is where you can contribute to a traditional IRA, so you still need to have earned income. So people that are still working, or at least have a part time job, and then shortly thereafter you convert the amount to a Roth IRA. The IRS has not closed the door on the strategy. So that pun is intended there.

So it's a nice way to build up a different bucket of retirement savings where you can still take advantage of having a Roth IRA and then maybe incrementally still being able to contribute to an IRA and then and then convert it over.

Also Roth IRAs are tax beneficial for heirs. So that's something here that's good to think about when you think about multigenerational planning. Being strategic now, with some of the things we just mentioned, with Roth IRAs can provide a nice tax free asset to beneficiaries.

Right, so if you have, your children are your beneficiaries, maybe they're in a very high tax bracket or you anticipate them being in a high tax bracket in the future, having a tax free IRA that you pass to them is a nice benefit and good from an estate tax planning, it's not exactly estate tax, but tax planning perspective for your multigenerational planning. So really, there's no significant downside.

There's timing questions that people may have about Roth IRAs, but when does it really make sense to do it, so, you know, we can certainly go into that a little bit in our Q&A, but I'll move on to some additional planning tips that we wanted to think about. And this is just areas of just good general strategies that are good to keep in mind as you review your plan each year.

Many people listening to this either heard a fair amount of tax loss selling last year or took advantage of tax loss selling. Really, a silver lining to markets being down is for people with taxable investments is that you can sell securities at a loss to offset capital gains.

So we're in a new tax year now, but you can still do strategic tax loss selling, you know, each year really as you have, as you perhaps have some losses to take advantage of.

So for those with less, who are less familiar with this when calculating capital gains tax, you add up all of your realized gains and you and you also add up all of your realized losses and then you net those together. So losses will offset gains. So there may be good candidates to sell in your portfolio. And then buyback after you know, after a period of time, you have to wait the wash sale period and you can buy back into those securities and continue on.

So just something to think about there as you're kind of reviewing tax planning, tax planning options. Think about also sources of withdrawals. So for, you know, each year from a tax planning perspective, you can review your portfolio and determine how to tax efficiently excess money.

So it may make sense to even just, for instance, access an IRA before RMD years, similar to the Roth IRA concept. You would fill up, you know, you would take a distribution, fill up maybe up to a particular bracket tax bracket if you're in very low income years and then that reduces your RMDs and future withdrawals that you'll have to take from your IRA.

But just also just, you know, understanding where you have assets and each year maybe reviewing those accounts and making, you know, a tax planning decision about where some of those assets may be coming from.

Similarly, think about the types of securities in your portfolio. You know, this is kind of a more basic concept, I guess, from a tax planning standpoint, but it's really just, you know, thinking about for a taxable portfolio and you and your tax sensitive, are you trying to limit the taxes that you're paying, incorporating municipal bonds, maybe ETFs that tend to be more tax efficient by nature. So those are know, those are things to do, to keep in mind when you're, again, reviewing your plan at the beginning of the year or just throughout the year when you have your annual review.

As a business owner, also, establishing or reviewing a retirement plan can be a really powerful tax planning tool. So both if you're a small business owner, you know, for your business, you have the ability to make tax deductible contributions to the retirement plan. And then for yourself, you have the opportunity to put away significant tax savings for retirement. And you can structure a plan in a way to where it's really appealing, it's an appealing benefit to your participants and your employees.

But it would also be structured in a way to where you can really maximize that savings for yourself. So on this, at least on this topic, one final comment I'll make is to take a balanced approach when it comes to tax planning. We talk about this a fair amount when we meet with our clients.

But there are smart tax strategies and then there are strategies that can really overpower the rest of your planning. Try to think about tax planning, serving a role in wealth maximization over time, over, you know, a time horizon and not simply, you know, trying to minimize taxes every single year because they can be kind of conflicting in the way they operate.

On to the next topic, we have some, we touched on charitable giving a bit already. So there we go. So QCDs, qualified charitable distributions. If you are charitably inclined and over 70 and half, it's worthwhile to consider how a QCD you can fit in your planning.

These are tax free direct transfers from your IRA to a qualifying charity. They can fulfill RMDs for that year up to the QCD limit, which is still 100,000 this year, but is going to be increasing with inflation in the next following years. So that's a change where it had been set at $100,000 for quite a while.

Also, donating highly appreciated stock can be beneficial as an option to avoid capital gains and receive a deduction. This can also, so donate to charity, but it can also make sense when making a gift of securities to individuals who are perhaps in a lower tax bracket. So, you know, many people attending this webinar may have taken advantage of that over the years.

You know, as far as just thinking about, OK, you know, I'll use this highly appreciated security. And I'll give that away. But an alternative strategy for portfolios with losses, which people, you know, may have that more from last year can be to sell securities at a loss, reduce the capital gains that you have because you can offset thereby realizing the loss, offset any gains and then gift cash to a charity which can allow for a larger deduction up to 60% of AGI.

So, you know, it's kind of an alternative way of doing it, taking advantage of a loss, also having an opportunity to have a large deduction. So that's something for people to keep in mind as you're kind of reviewing your charitable giving.

And I'll just also mention donor advised funds at the bottom there you can see they continue to gain popularity. It can be a good option for larger donations or people have talked about, you know, kind of taking several years worth of donations and then and then, you know, making that the donation to the donor advised funds they so it's a good way for those large donations, you have a large tax deduction for that.

And then you can control those investments and deploy those assets when it's right for you, when you feel like you want to do that. The one thing that I think is just far as it relates to the qualified charitable distribution and something that sometimes people are confused about is that donor base funds aren't qualifying charities for QCDs.

So you can't you can't direct assets from your IRA directly to a donor advised fund as part of that QCD. It has to come from a different source. It's just something right now that's not allowed and and tends to be a question for people because as donor advised funds become more popular.

And the less area I'll cover here is estate planning. Christina covered the sunsetting of certain tax cuts and Jobs Act provisions. One of the more noteworthy provisions is, is the estate tax exclusion being cut in half after 2025. So for those with large estates, the federal exclusion amount will be moving from just under the current 13 million per person to roughly 6 and 1/2 million. Adjusted for inflation in 2026.

So granted, we're still talking about very large estates, but the reduction will expose many more people to potential estate tax are cutting it in half. So obviously that's going to bring a lot more people into that potential estate tax realm. But remember that your estate, so I mean, you think about the calculation, remember that your estate includes the value of all of your assets.

So investments, real estate, businesses, personal property, life insurance is another one that people may not realize life insurance, death benefits, if they're not in a revocable trust. So that can add up over time. And if you see that amount, there is a quantifiable value associated with doing planning now, before estate tax laws revert, any amount above the reduced exclusion amount will be exposed to a 40% tax. So if you just do the math, easy math, if your estate is 1 million over the future exclusion, your estate would face a tax of 400,000.

So this can be avoided by doing some wealth transferring now under more favorable laws. And with some of the things we talked about with the sun setting and just trying to take advantage of that. And thankfully, the IRS has made clear that there will be no clawback on transfers made under current estate tax law. So, you know, if it was done during current law, then it will continue to hold and there will be no clawback.

So this is a real opportunity to get ahead of this issue for people with very large estates. I mentioned the annual gift tax exclusion as well. That's gone up to 17,000. I was 16,000 last year. So that's been an increase.

For those looking to transfer wealth, the annual gift tax exclusion is an amount that you can transfer to another individual gift tax free. So you don't have to file a gift tax return to do it. It doesn't eat away at your lifetime gifting limit if you stay under that level.

So, for instance, if you have and your spouse have four children, you can gift 136,000 to your children gift tax free. So the 17,000 to each from both spouses. So that's a good strategy if you really want to try to chip away at a large estate.

So, we've covered a lot and and we went over what we consider to be some of the key highlights. But, you know, everyone's situation is going to be different. And that's why we encourage you to work with an advisor who can incorporate these areas in a, in a comprehensive plan that's really designed to meet your goals and, and assist you with staying on track to achieving the purpose that you have for your money.

So with, with the time remaining, when we had some questions that came in, we can take some time to answer those questions. So I think we had a question on, is is the RMD table for filing when spouse is 10 years younger changed for 2023?

That has not changed for 2023. So I guess it's the table that is the joint last survivor table where you are calculating based on the difference in age. So that has not changed. But we can if I'm interpreting, I guess, the specifics in your question, Christina, if you had anything that you saw that came in while I was going through my last section there.

Christina: Yeah, I see one, if you realized tax losses and they exceeded your gains on any given year, can the excess losses be used to offset gains in future tax years? Luckily, the answer to that is Yes. It can actually offset $3,000 worth of ordinary income in that year as well. And for future years.

So let's say you didn't have any gains for the next three or four years. You can use 3,000 every single year, but you carry forward that indefinitely.

Dana: Okay so something came into the chat just now, please clarify the annual gift tax. Does the recipient pay tax? Does the gift have to be given in a lump sum?

So with the gift tax, you would not pay. So you have a lifetime gift tax exclusion. And that right now is matched up with a federal estate tax.

So if you are taking advantage of those annual gifts and you stay below that 17,000, you are not, nobody's paying any gift tax, and if you exceed that, so if you exceed that annual exclusion amount where you're well, what you technically have to do is file a gift tax return by making a gift that exceeds the 17,000.

And if you do that, what you're doing is you have to basically have an accounting of the amounts that you've exceeded the annual gift exclusion, and then you are eating away at your lifetime gift exclusion. And the way it works is then when you pass away, you have less for the estate tax exclusion to use because you've eaten away at some of that by making gifts.

So think about it as sort of they work together in that sense where if you do make large gifts during your lifetime exceeding the annual gift tax exclusion, maybe significantly what some people, what they'll do is a fund, a trust with a few million to get ahead of this current estate tax sunsetting. Funding a trust.

What you're doing is you're. You're taking advantage of the higher exclusion right now. You're utilizing some of that. And then when you pass away, you'll have the balance of what is left. After you've made that gift as far as the exclusion goes. So hopefully that answers that question. It can be a little bit it can be technical when you think about how that works. The gifting works with the estate tax.

But, you know, if you make a gift. And it goes over the exclusion amount. And nobody's really paying the tax yet, it's just accounting for the fact that you've utilized some of your lifetime gift exclusion.

Christina: I see another one here too, while we're talking about gift tax. This was typed into the chat about the 35k. Oh, sorry. That's the wrong one. It was. Yeah a 35k rollover possibility for overfunded 529s. They wanted to know if there is a limit of how much you can put into each account when you stack it with the five year.

So there's five years bunching of the 529 donations that actually follows the gift tax law. So it's five years of what you can gift somebody gift tax free that doesn't trigger a gift tax and that's for the recipient that the gift tax is triggered. So that's 85,000 and it's based on who is receiving it.

So you could technically, I think Dana gave an example like if you're married and you have multiple children, you can give a massive dollar amount away every year because it's based on who's receiving the funds. And it's the same thing with the 529 plan.

So if you have two grandchildren, you can set up two different accounts. You could fund them both for five years and it is $85,000 now that you do. And that's just the $17,000 gift exclusion times 5 years. So that's how they come up with that dollar amount.

And to follow up on that, because we just got another gift one, if you give less than 17,000, no one pays gift tax on that amount. It doesn't hit their exclusion. It's when you go over 17,000. So if you give them 18,000, then 1,000 of it would have been, you know, trigger a gift tax.

But then you start looking at the exclusion. So that's how that works. It doesn't have to be a lump sum. It's based on what you give them throughout the year. So if you get them the same every single month, you can tell you that that's the dollar amount you give them.

Dana: My next question, can you use part of the RMD to support giving through the annual gift exclusion? So I guess it's kind of a tricky question in the sense that if I'm interpreting it correctly, so if you're withdrawing money, if you take your RMD, you have to pay tax on that. So that's out of the IRA, you have that money now, it's in wherever it may have landed. It's in your checking accounts, or in your savings account. Then you give that money to somebody else. That is, you know, that could still work under the annual gift exclusion for that year.

So it's just I think if I'm understanding correctly, you would withdraw the money. You have to withdraw it because it's in RMD for the year, comes out of your IRA, it's in your savings account. Then you give it away to somebody. As long as you stay under that 17,000, it's gift tax free. There's no there's no issue. There's no tracking of it. You've stayed under that level. So it's a pretty simple process. And a lot of people may do that because, a lot of people in retirement, their income is basically what's coming out of the IRA, their IRAs, and due to the RMD requirements and then that's what they used to fund various expenses and gifts throughout the year.

Another question, how do nondeductible contributions to conventional IRA, I'm guessing traditional IRA, affect a backdoor contribution? That's a good question.

So, I'm just thinking through the details here. So if you make a contribution to an IRA, I guess I'd want to double check on the specifics there.Typically what happens, and I think you understand this problem because the way you're asking the question, but you would have, you'd make the contributions to the traditional IRA and you knew immediately or closely thereafter, you do the conversion because there has been limited growth. There's no tax there. Do you get it? Do you get a deduction then? So I'd like to double check. I don't know, Christina.

Christina: I don't think you get a deduction, but this is where the pro-rata rule really comes into play. So there is something called a pro rata rule.

If you're going to do a backdoor like that, where you're not trying to trigger a huge tax liability. So you would take after tax dollars, put it in a traditional, like Dana says, roll it immediately. And then, I mean, if there's a little bit of gains, maybe you pay taxes on that.

You just want to understand that the IRS will treat all of your IRAs as one big aggregate IRA. So if you have traditional IRAs or like simple plans, anything that has pre-tax dollars in it, you do not want to do this backdoor IRA method without cleaning that up first.

So this is where an advisor like, I don't want you to go out and just do this on your own because you, what pro-rata does is it takes a ratio of how much you have in pre-tax assets versus how much you have in after tax assets. So it'd be great just to roll the after assets. But they say, no, you can't do that. You know, if 80% of your stuff is pre-tax, then 80% of every dollar you roll. You're going to pay taxes on.

So there are some things that we can do, which is reverse rollovers, where we'll take your traditional IRA and maybe put it in a 401(k) something like that where we'll get that off of the balance sheet. Pro-rata is only concerned with one day, which is 12/31. You guys celebrate New Year's Eve. We're celebrating pro-rata day.

So we want to make sure that you don't have any pre-tax dollars in there on that day and then this method would work.

Dana: Right, yeah because you want to be contributing after tax dollars in order to do the tax free conversion. So you can't really do it. You can't have it both ways there. So, a good point.

Christina: I have one here that I want to take. Were there any changes to the 401(k) withdraw age of 55 and what are the possible penalties? There actually were a lot of changes. We didn't cover that in here. So I want to touch on it quickly.

If you have been under a plan for 25 years, the IRS is now saying, okay, you've been under this plan for a long time, there are no penalties, even if you're not at 59 and a half, it's the same thing and that will stop at 55. So that's where that 55 comes from.

If you work at a government job and these are government pension dollars, that age actually drops down to 50 where you can't get that money penalty free. The IRS also did do an update on what they call a substantial and equal payment. So I'm trying not to butcher this and try to remember all little nuance rules while we're live here on this webinar.

But essentially, you can take withdraws and you have to set this up with the holder of the account where you could take the same exact dollar amount on an annual basis or really monthly. And this is where, you know, it'd be good to have the rules in front of us.

And just so you guys know, there's a lot of questions firing. And if we don't get to any of them, we are going to be following up. I'll personally be following up too. So if I butcher any of this trying to do it, I will follow up and say, Oh no, this is what I really meant to say. But essentially, you can take equal payments and once you get this set up, the payments come to you.

They're penalty free, but you cannot make any changes to the payments and you also cannot put any funds into that account. So like if you set it up. And I think you can determine what dollar amount you want to come out of this account, you know, annually or monthly that has to stay in place for five years or until you hit the age of 59 and 1/2 to modify it.

Because if you do, if you stop the payments before then or you try to modify it or you're, you know, any of those things, not only are you subjecting yourself to the 10% penalty, but you're also going to get penalized for messing up like an extra 10% for change, a substantially equal payment. So I just want to touch on that one quickly.

Dana: And I think maybe we can take one more here. And then to Christina's point, we'll absolutely follow up on any others, the one that I think is good to hit on because we touched on five times. But does contributing to a child 529 plan count is a gift under these rules.

So, you know, as far as a contribution to a 529 yes, I mean it is a gift to the 529 plan. There's no contribution limit necessarily. That's uniform across all 529 plans across, you know, each state's 529 plan. But if you exceed that annual gift tax exclusion and you are making a gift above and beyond, that gift exclusion for the year.

So, people do tend to limit contributions to that in order to account for the fact that they don't want to go over the annual gift tax exclusion. The nice thing is that for five times. And there's a five year contribution option that you can make a gift worth of five years of a contribution to 529 plans worth five years worth of the annual gift tax exclusion.

So right now in 2023, I think doing the math ready to be about 80,000 that you can contribute to a 529 plan. So you know, I think the thinking is frontload that because college is expensive. And so you can, you know, help really kind of fund that with a good sum of money and allow that to to, you know, grow over time and with the investments in the 529 plan. So hopefully that answers that question.

Great questions. I think there's a few others that will absolutely follow up on, but that will be the last question for today. So we went over an hour here, which is good and it's good to have the interest. Thank you all for attending today's webinar.

And as a reminder, we mentioned a recording will be available on our website very soon, I would think in the next couple of days. And if we didn't answer your submitted question, like I just said, well, we'll follow up afterwards.

If you're interested in learning more about Manning & Napier's wealth management services, please visit the link that you see on the screen there where you can schedule a call or you can contact your Manning & Napier financial consultant if you currently work with one.

Also, please register for the content Manning & Napier creates, covering a broad range of planning and investment related topics, including our annual reference guides, which we talked about, our tax and wealth planning guide, which you can see there as is highlighted on the screen here. We produce a significant amount of material that addresses planning related topics. And I think you can you'll find that to be interesting and helpful.

On behalf of my colleague Christina, Manning & Napier, thank you again and have a great day.