What a week for a struggling video game retailer. GameStop, whose business has been under serious pressure for years now, saw its stock price experience startling levels of volatility last week as a short squeeze, options trading, social media, and raw speculation all coincided to send the stock soaring to completely unimaginable levels.

The price changes have been so extreme that a variety of major discount brokers placed trading freezes and restrictions on simply buying shares of the stock. This decision, largely sparked by spiking margin requirements and options trading, was immediately decried by market participants and politicians alike. Several other names such as Bed Bath & Beyond and AMC, and even major commodities such as silver, have also experienced notable price jumps, with some under trading restrictions as well.

What happened this past week is a combination of a several trends: a short squeeze, massive growth in retail options trading (and its outsized impact on underlying prices), and social media. To understand what all that means, it’s first important to understand what shorting means.

Playing the Short Game

A trader will ‘short’ a stock if he or she believes it will go down in the future. This is done by borrowing shares from a broker, and then selling those shares to someone else, something many modern trading platforms make easy to do. If the stock falls, say from $10 to $5, the trader can ‘cover the short’ by buying shares at $5, giving those shares back to the lender, and profiting $5 in the process.

But if the stock goes up in value, say to $15, the trader would be looking at a loss of $5 to ‘cover’ the position. Suppose the stock keeps rising even higher, the trader's loss would keep rising too, with no limit (i.e., if the stock rose to $150, the trader would be looking at $140 in losses, 14x bigger than the original value).

It is easy to see the risk here, and that is part of the reason why brokers have various margin requirements. If prices rise too much, short traders may be asked to reduce their leverage by covering a portion of their short positions, resulting in more demand for the stock and driving the price up even higher, in a self-reinforcing cycle known as a short squeeze.

Many of the stocks you have seen in the news over the past week are also some of the most heavily shorted shares in the stock market. What has happened with GameStop has many characteristics of a classic short squeeze, and they are not that uncommon.

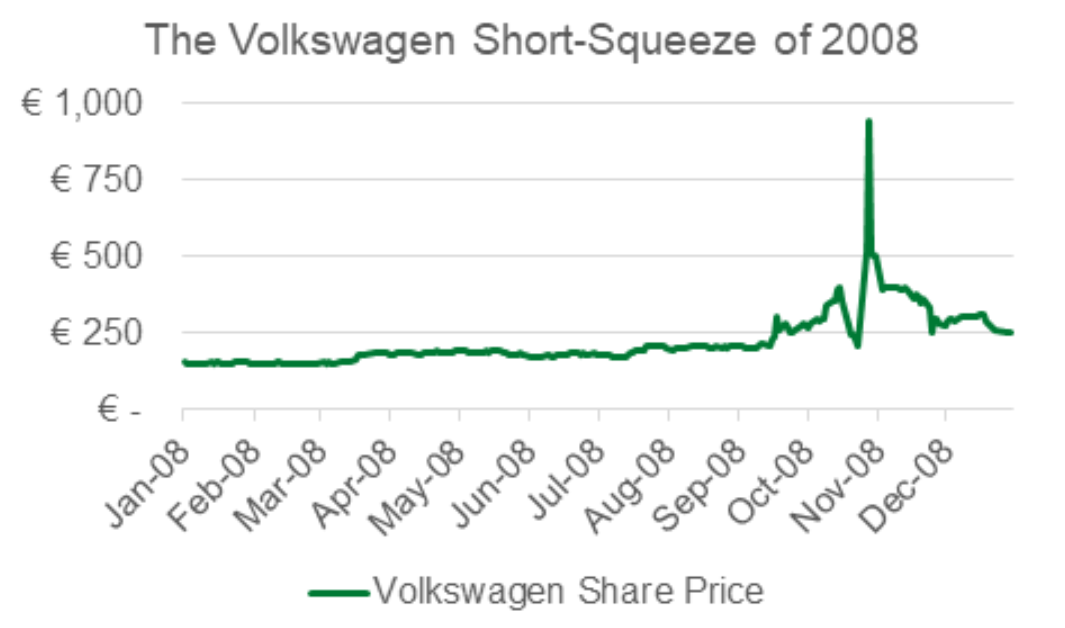

Memorably, this occurred in 2008 when Volkswagen shares underwent a short squeeze and the automaker briefly became the most valuable company on the planet. Ultimately, the technical factors that drove the short squeeze in Volkswagen dissipated, and the shares returned to trading in a reasonable range of fair value.

Source: Bloomberg (01/02/2008 – 12/30/2008).

Options Over Stocks

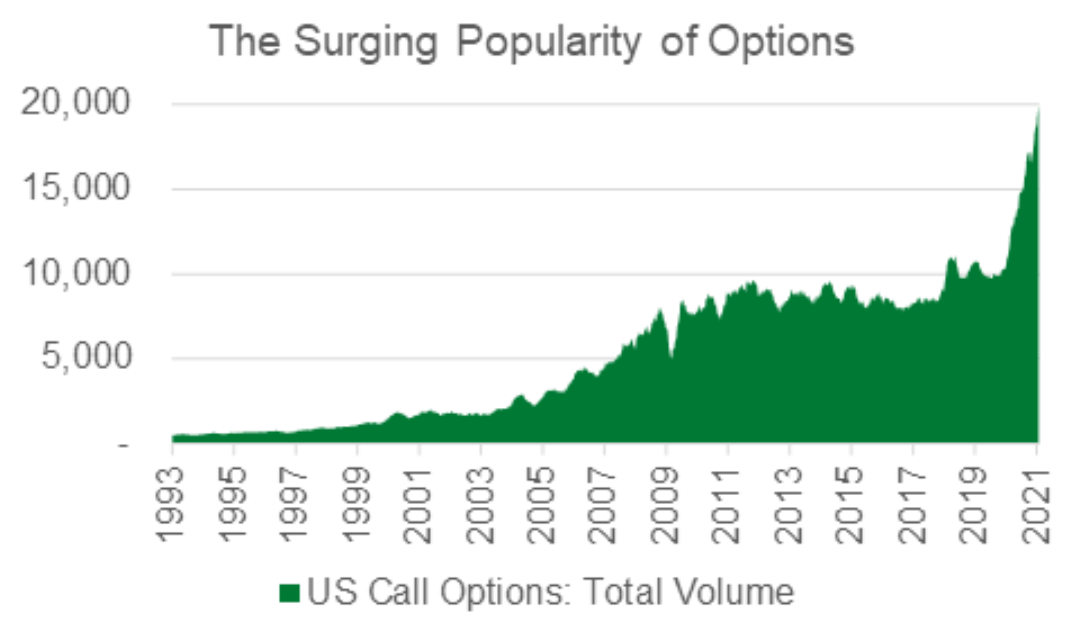

All of this share price volatility has been exacerbated by explosive growth in options trading. Options are instruments that allow traders to speculate on the price movements of various stocks and other securities for defined periods of time, usually for the near-term.

Options have become popular due to their leveraged nature. For example, traders can buy options on underlying stocks at a 100:1 ratio for a tiny fraction of the cost of buying a full 100 shares. For smaller investors, it is easy to see why this would be appealing, and market volatility is starting to show the impact of all the options activity.

Each time a trader buys an option on a stock, there is a market maker selling you that option who then holds the risk for length of the trade. To reduce that risk, market makers will do what is known as hedging. For example, if it is a single call option—the buyer is hoping the price goes up and the seller is hoping it goes down—the market maker will also buy underlying shares to hedge (i.e., offset) their risk to try to maintain a neutral exposure.

That is why hedging can often lead to increased buying activity on the underlying stock, driving the share price up even higher, and further highlighting the outsized impact options can have. Big picture, the growth in options activity means investors should expect more market volatility.

Data smoothed with 90-day rolling average. Source: Bloomberg (01/04/1993 - 01/28/2021).

Social Media and Internet Trends

For a long time, short squeezes and leveraged investing were the exclusive domain of professionals. Clearly, that has changed, and many people are now wondering how a group of retail investors could band together so quickly, efficiently, and effectively.

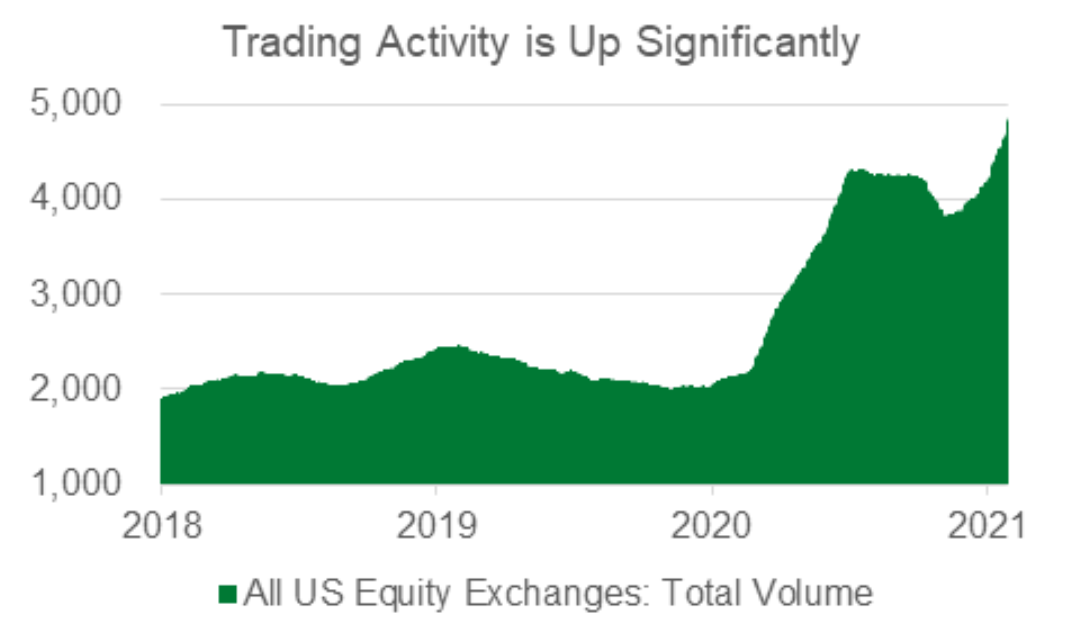

The answer lies in the internet, social media, and the ease with which investors can make speculative decisions independently and immediately. No longer do retail investors have to call their broker and wait days for a purchase to go through. No longer are individual transaction fees in the hundreds of dollars. Now, anyone can attempt to time the market and buy into trending names from news feeds and message boards. The fees are lower, the access is faster, and you don’t need years of experience to try your hand at it.

Thanks to this, thousands of smaller investors were able to collaborate online, pooling their resources and dramatically increasing their impact. As the speculative trade became more popular among certain circles on the internet, buying increased, pushing prices up even further.

These long-term trends have undoubtably been exacerbated in the pandemic. As we spoke about last year, the lack of live sports and people being stuck in their homes led to a ‘gamification’ of investing. Increased free time allowed more people to become acclimated with market speculation. Once those habits are formed, they can take time to break, especially considering that the market has more or less moved up in a straight line from last year’s market bottom. With just a couple dollars and an app, anyone can be a day trader now.

Data smoothed with 90-day rolling average. Data in millions. Source: Bloomberg (01/02/2018 - 01/28/2021).

What Hasn’t Changed

The impact on Manning & Napier and the broader financial system appears to be mostly negligible. We, however, are always monitoring markets for systemic and contagion risk, both from a fundamental basis and from a market technicals standpoint. While we are fundamental investors at heart, we have a Chartered Market Technician on staff regularly providing insight and perspective on how specific market nuances can impact your portfolio.

We will continue to closely follow the story, but our investment approach remains unwavering and lasting. For us, successful investing remains about fundamentals. Doing in-depth, security-by-security research requires time, energy, and expertise, and we believe the long-term results of our disciplined, time-tested processes speak for themselves.

Enjoying this information? Sign up to have new insights delivered directly to your inbox.This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. The reader should not assume that investments in the securities identified and discussed were or will be profitable.