September has historically been the worst month for equities, and this year has proved no different. What was a calm start to the year has turned a bit choppy of late, with a whole host of risks now weighing on financial markets.

While some issues such as the debt ceiling seem to be resolving themselves, others including the trajectory of fiscal and monetary policy, big tech regulation, China, elevated valuations, and more, are all risks that must be reckoned with.

More than anything, we think a subtle, impactful shift is occurring under the surface of financial markets: The US economy is in the middle of its economic cycle. In today’s blog post, we look at what a mid-cycle economy means, why we think it is happening, and discuss the big picture implications for financial markets near and far.

An Unprecedented Rebound

The huge government responses to the pandemic no doubt prevented the worst-case scenarios of economic damage from occurring. But today, more than 18 months removed from the market bottom, those extreme fiscal and monetary policy measures are far less necessary.

Leaving those measures in place for as long as US policymakers did has accelerated us through the economic cycle to an unusually quick degree. Most economic cycles tend to evolve at a more gradual pace. The last cycle, having reset in 2008-09, went on to last about twelve years, and the mid-cycle phase did not commence until we were already several years into the recovery. In fact, the US equity market did not return to its pre-financial crisis peak for over 3 full calendar years. This time around, the market recovered in just four months.

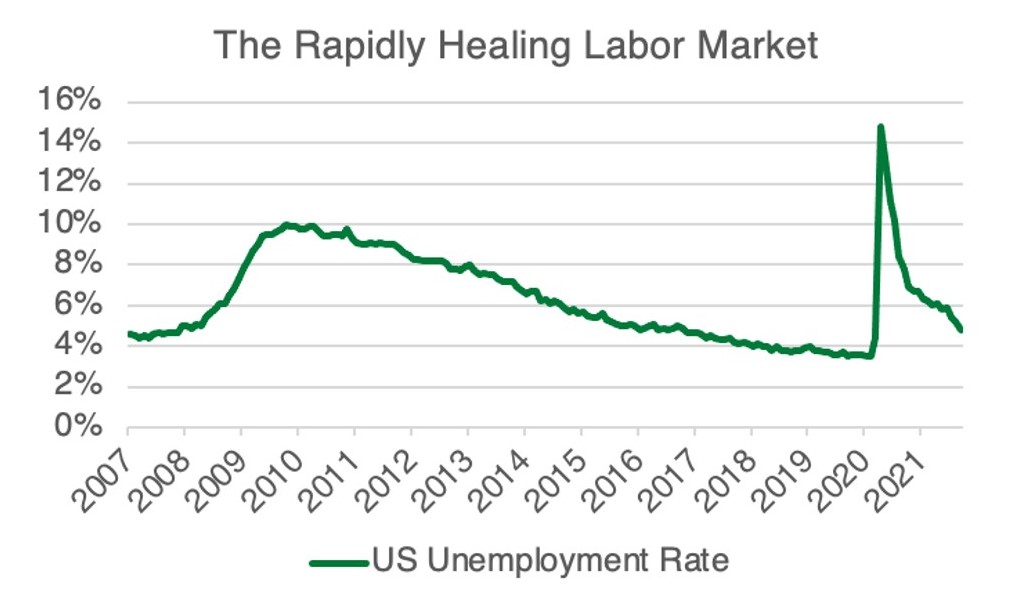

Of course, the economy moves more slowly than financial markets most of the time, but the broader point remains. Within the US, for example, the unemployment rate has now fallen back below 5% (as of last Friday’s jobs report), something that did not happen until 2016(!) during the last cycle. These types of mid-cycle characteristics are becoming prevalent throughout the economic system. Monetary policy is just starting to normalize. Consumer demand has rebounded rapidly, and supply chain tightness remains all over the place. Commodity prices are rising, wages are rising, and even broad inflation measures are showing pricing pressures.

Source: Federal Reserve (01/2007 - 09/2021). Unemployment rate (U3), seasonally-adjusted.

Broadening the perspective to look at the rest of the world—we are an interconnected global economy after all—and we see mid-cycle characteristics in a variety of places as well. The Chinese government, confident in its economic stability, has begun prioritizing a variety of control-led, anti-growth initiatives deemed in-line with party goals. The merits of those goals notwithstanding, the government is clearly willing to withstand some amount of policy-driven economic tightening and associated market fallout. Europe, while a bit behind the US and China in its recovery, is for its part, beginning to have its own conversation around fiscal and monetary policy tightening. And in a number of emerging markets, such as Brazil and Russia for example, measures are already being taken to aggressively tighten monetary policy, in-part to combat rising prices.

In our view, the weight of the evidence suggests that the time for thinking about this economic recovery as nascent or fragile has come to an end. We believe that the fiscal and monetary tailwinds that have been in place for the past eighteen months are starting to fade, and that the ‘rate of change’ for this recovery is slower, not faster.

Standing on Its Own Two Feet

The question facing the economy is soon going to become: Can it sustain itself as government support is removed, and as the wave of pent-up economic demand returns to normal? We think yes, but we also believe growth is likely to slow from here.

Starting with the good news, the economy remains in growth mode. The pandemic, while still a health issue, is having less and less of an impact on economic activity. Household balances sheets are still in good shape, and consumer confidence is strong. Even as government support is removed, the economy should remain in a slower, yet positive growth environment.

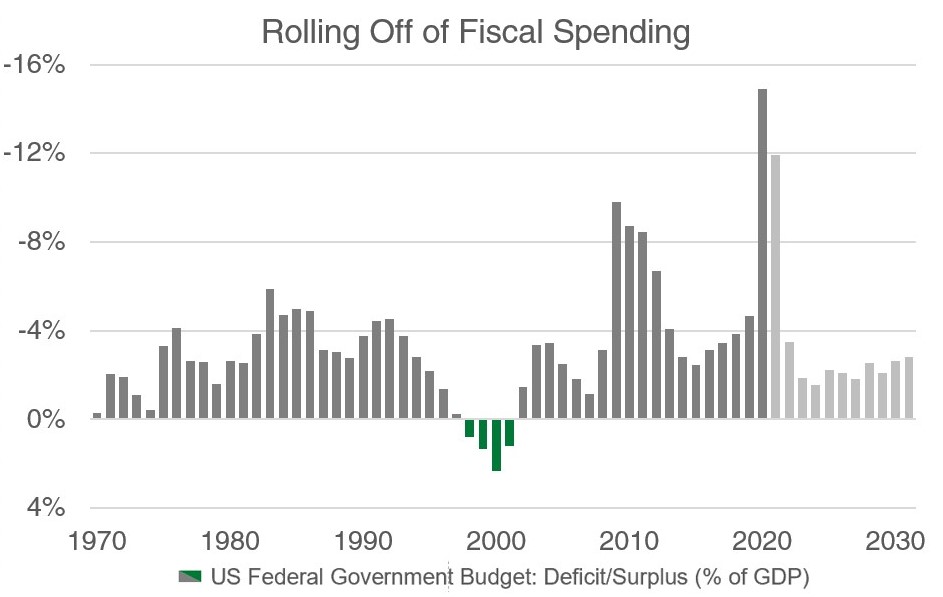

With that said, the same structural growth headwinds that have been in place for decades now are going to remain a drag. The demographic outlook for most developed markets is between poor and not great, with the US’s relatively mixed outlook being one of the better ones. Corporate and sovereign debt levels are elevated, and while some in Washington DC are clearly looking to inject more stimulus into the economy, the chorus of those questioning whether more spending right now is wise is growing louder.

Source: CBO (1970 - 2030). 2021-2030 are CBO projections.

Inflation has picked up steam. Supply chain issues persist, yet the pricing pressure goes beyond only logistical challenges. Real estate prices are increasing, home values are up, commodity prices are rising, automobiles are hard to find, and wage pressures are increasing. Inflation is a crucial risk to monitor.

Should inflation pressures sustain, it may hamstring central bankers, potentially forcing them to act sooner than they would like. Higher interest rates, the elimination and/or reversing of quantitative easing programs, and the unwinding of other monetary policy programs would all be on the table should policymakers feel the need to act to snuff out inflation. These outcomes would clearly be a negative for liquidity, the credit cycle, and ultimately, economic growth.

To be clear, we are not saying that the economy is too hot or that inflation is a runaway train. Major disinflationary forces, such as automation for example, may continue keeping a lid on inflation. In our view, the risk of sustained inflation are rising, but in general, we believe today’s inflation uptick is largely transitory. We expect the pace of economic growth to have peaked for this cycle, and that the next step for the economy is lower and slower gains from here.

Investment Implications

A mid-cycle environment is not one where we would typically see excessive valuations. Yet across financial markets today, that is exactly what we are seeing.

Equity valuations, while not at dot-com era extremes, are certainly elevated, and in fixed income, bond yields are either at or near historic lows for most bond market asset classes. Only in a world awash with liquidity would we see a scenario like this: a mid-cycle economy with late-cycle valuations. We are now past the peak of money supply growth, something that is likely to turn from a tailwind to a headwind soon.

With valuations where they are and considering the state of the economy, we believe that a relatively balanced asset allocation approach is warranted, maintaining flexibility to tactically respond should market volatility continue.

More than anything, we believe investors should be using all of the tools in their toolbox to meet goals and objectives. This means deploying an active investment approach with the ability to generate beyond passive benchmarks. There is no such thing as ‘easy money,’ and lower returns should be expected. We know it may not be what investors want to hear, but this type of clear-eyed, realistic approach to risk management is the only way we know how.

Our research team continues to monitor these topics and more. If you’re interested in hearing more of our monitoring points and views on an array of investing themes, then subscribe to our insights.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. The reader should not assume that investments in the securities identified and discussed were or will be profitable.