China has been a bit of an outlier globally in terms of its response to COVID and the resulting economic cycle that has followed. Conspiracy theories and differences of opinion with regard to the origin of the virus aside, one could argue that China was uniquely suited to handle this pandemic from a political and economic-structure standpoint.

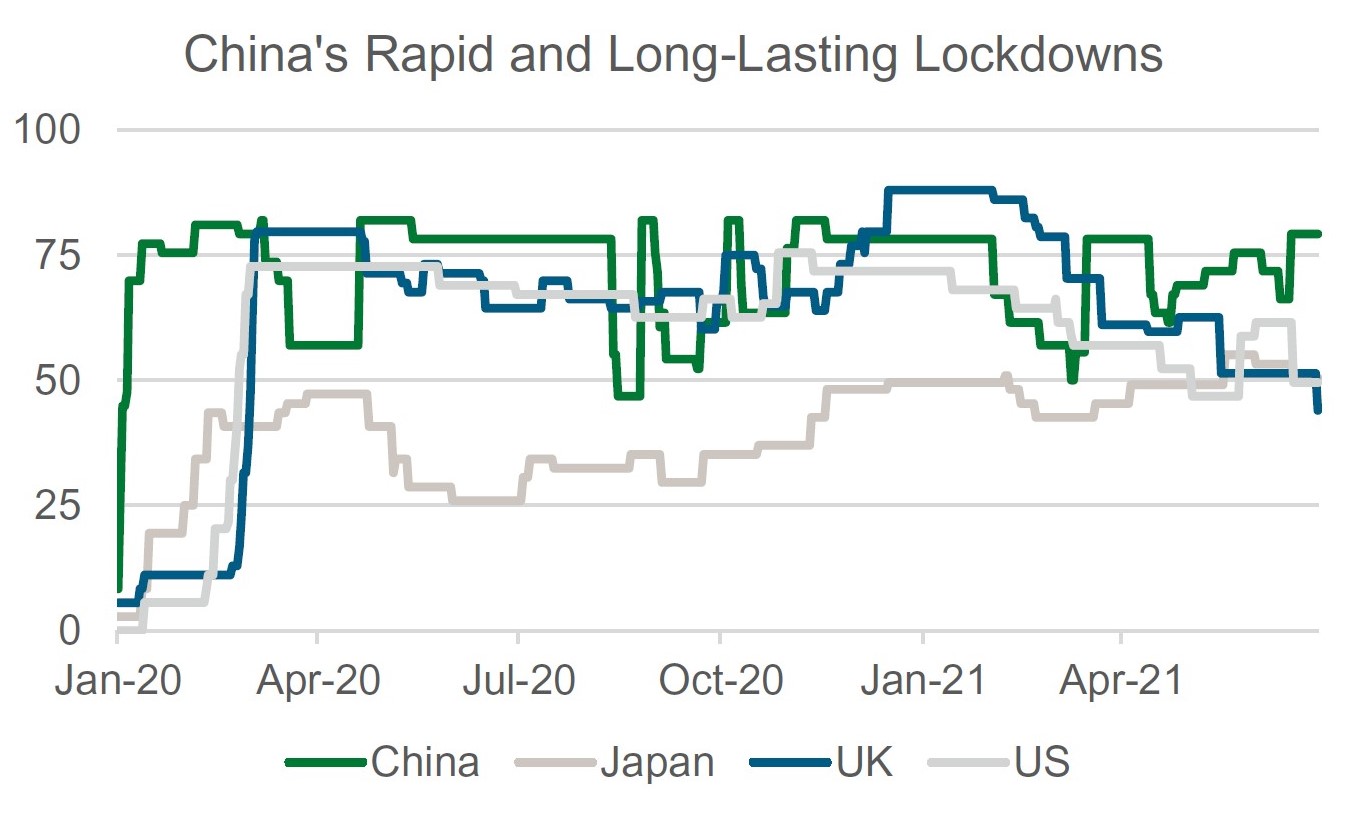

Politically, China’s general lack of regard for individual liberties enabled it to act quickly and decisively. The country enacted among the most heavy-handed and swift isolation regimes of any major country, focusing on stringent local lockdowns in problem areas and aggressive contact tracing. These political realities, in addition to China’s prior experience with various other viral outbreaks in their recent past, created an environment more conducive and/or accustomed to stay-at-home quarantines, social distancing, and the like.

This is a composite measure based on nine response indicators including shcool closures, workplace closures, and travel bans, rescaled to a value from 0 to 100 (100 = strictest). If policies vary at the subnational level, the index is shown as the response level of the strictest sub-region.

Source: Our World in Data (01/21/2020 - 07/19/2021).

China’s economy also has some unique features that served to soften the blow. China’s e-commerce penetration is among the highest in the world, making the disruption to brick-and-mortar retail much less economically debilitating. Beyond that, China is still the ‘factory of the world’, a factory that happens to make and export a lot of the things that foreigners need to work from home and be safe during a global pandemic; especially communication technology equipment and personal protective equipment to name a few. China was quickly able to reactivate its manufacturing sector and export these goods to the world, propping up its economy with exports and requiring a relatively much smaller fiscal and monetary response than most other major countries.

While the rest of the world has experienced one of the sharpest and most brief economic recessions in decades, China experienced something that has looked much more like a normal economic cycle. As most of the rest of the world engaged in a race to out-do each other with unprecedented monetary easing and massive fiscal deficits, China’s recovery was so swift that the country has already reversed its previous easing and has been engaging in a multifaceted approach to policy tightening.

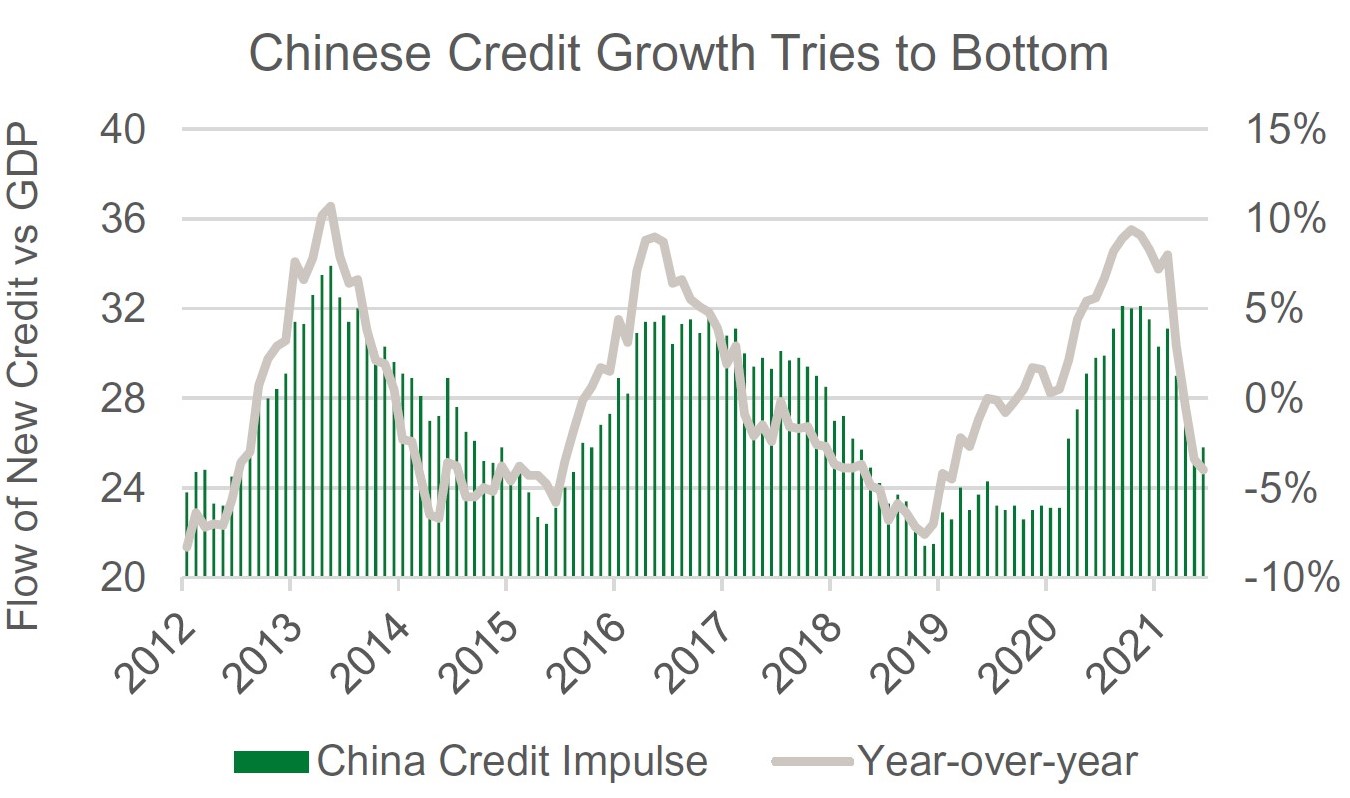

For China, this has been characterized by a simultaneous tightening of both fiscal and monetary policy, as well as a campaign of regulatory tightening affecting a broad range of sectors, focused primarily on property, finance, environmental protection, and technology. The increased regulatory scrutiny on technology has drawn significant attention of late, taking the form of a series of surprise announcements having to do with antitrust issues, data security, and the impact of technology on society in general. The totality of these various approaches to policy tightening have resulted in a slowdown in Chinese credit growth and some softening of momentum in the real economy. We expect that this is likely to become more evident moving forward, but we also expect the economy to remain at healthy levels of growth despite some marginal deceleration.

Shifting Back the Other Way

Whereas China has been on a bit of an island for the past year, tightening policy as others loosened, the tables now appear to be turning. As the US and many other countries move through what amounts to a bit of an inflation-scare scenario, with hawkish noises and incremental policy tightening cropping up around the globe, China again finds itself alone in its approach with the country recently signaling a shift toward looser policy going forward.

More recently, China announced a surprise cut in its reserve requirement ratio (RRR), which we view as a signal that at least the monetary front of the comprehensive tightening campaign will be less of a negative going forward. The monetary policy backdrop in China should be thought of as an incremental positive, or a reduction of a negative pressure on the economy and market, rather than a wholesale shift to stimulus and an off-to-the-races effort to boost the economy. A bearish interpretation could be that the move may have been preemptive to prepare markets for something that only they know.

Source: Bloomberg Economics (01/2012 – 06/2021).

This risk may seem unlikely to US-based investors, but it is a reality of Chinese investing. Could there be local government financing vehicle default on the horizon, a destabilizing property tax announcement, a worsening of the precarious financial situation of China Evergrande (China’s largest homebuilder), or more surprise tech regulations? The subsequent crackdown on online education names could certainly fit this theory (but more on that later). A more benign explanation could be that they simply wanted to increase the probability of economic smooth sailing heading into the next scheduled leadership shakeup. Any of these are possibilities, but regardless, we do not expect the macro environment to change much, and we do not expect policy to become very supportive, it will just become less of a problem.

The Chinese Tech Crackdown

China is showing no signs of reversing course on its tighter regulatory and capital market scrutiny regime. A series of recent high-profile crackdowns on certain companies and sectors in the internet space have caused serious concerns about China’s commitment to the rule of law. The growing list includes halting of the Ant Group IPO, an antitrust investigation into Alibaba, a cybersecurity review of Didi Global, announced immediately following its IPO, draconian regulations on online education companies, and several others. The question is whether these actions are a collection of unrelated, isolated examples of authorities asserting themselves, or an unmistakable pattern of a new approach to the treatment of private capital. As with most complex issues in China, the reality is that the truth probably lies somewhere in between.

There is a risk of taking a few recent events and extrapolating them to get overly bearish on China, as there may be a case to be made that each of these recent events has its own idiosyncrasies and that the broad conclusions of a deliberate and ideological assault on private capital are overblown. For example, the Ant Group IPO was halted late last year and the company’s leader, Jack Ma, had previously publicly rebuked government thinking on regulation. Perhaps they felt they had to make an example out of him. The crackdown on Didi came after they were allegedly told to wait on the IPO and went ahead anyway. Additionally, in this case data security issues likely did have something to do with what transpired, as there are certain disclosures to be required for US listings and some of that may have compromised sensitive data on Chinese citizens. For the Chinese government, it is probably better to be safe than sorry, as they seem to be increasingly obsessed with data security as a national security issue.

More recently came an unexpected crackdown on a number of online education companies, upending their business models by regulatory fiat. It was always quite clear that this industry propagated ’social ills,’ at least from the Party’s perspective, as these companies were primarily accessible by the wealthy and seen as widening the inequality gap. Eventually, a scapegoat would be needed and even though these companies serve an obvious social good—educating the population, particularly in the STEM fields—actions were likely taken in the name of “common prosperity”, a phrase increasingly used by top officials.

Perhaps the best way to perceive these things is to attribute more weight to the current political spirit, which can trump long-term goals. Even inequality of outcomes is a powerful force driving hearts and minds in even the most capitalistic countries. Perhaps the best example of the current intellectual framework is that the Fed is now openly talking about using monetary policy to solve various forms of inequality. In China’s case, the issue was quite clearly a matter of inequality of opportunity, so it shouldn’t have surprised us to see the Chinese act on this instinct.

In short, if we are seeing one of the most capitalistic countries on earth attempt to remedy inequality of outcomes via monetary policy, then perhaps the world ought to have expected the Chinese Communist Party to attempt to remedy inequality with direct government action. It is clear that governments everywhere are showing a renewed willingness to contest excess wealth, regardless of what it means for private capital. We think financial market risks have increased in this regard.

Implications for the Here and Now

However, while China remains in an environment of increased ‘stroke of pen’ risk, we should avoid being too tempted to extrapolate recent crackdowns to affect companies that are much less in the crosshairs for social or political issues. Beyond avoiding sectors likely to be targeted by adverse government action, markets must contend with the fact that these types of uncertainties may weigh on market sentiment for some time. While it is extremely difficult to predict how bad the regulatory onslaught will become, or how long it will last, an understanding of the basic motivations and constraints of authorities can add context and perhaps give us some clues.

It is critical to understand that China’s macro backdrop currently presents somewhat of a paradox for investors. The resiliency of the economy and the strength of its rebound has given authorities space to focus on ‘necessary’ structural reforms that may be painful in the short-term. These structural reforms can be thought of as anything that would threaten the CCP’s grip on power, whether that be a financial collapse, too much clout by outspoken billionaires, troves of data falling into wrong hands etc.

In our view, almost all actions of the recent tightening campaign can be seen through this lens. Limits on housing developer leverage, limits on property lending, production curbs on polluting industries, preventative intervention in data security, and leveling the playing field in terms of educational opportunities, can all be seen as measures taken to avoid larger and less controllable problems in the future. Right now, they are fixing their roof while the sun is shining, and we believe this regulatory environment is here to stay.

China’s Long-Term Headwind

The major constraint to China’s current approach of increased government interventionism comes from the opposing forces of China’s global geopolitical ambitions and the hard reality of its demographics. With a shrinking working aged population, China's growth will rely ever more on productivity, and specifically on capital productivity. Throwing ever larger quantities of debt financed money at the economy is no longer feasible or desirable, as illustrated by the relentless worsening trend in China’s incremental capital to output ratio (ICOR), a measure of the amount of capital required to produce one unit of incremental GDP.

With the current regulatory approach, they risk crushing ‘animal spirits’ and restricting productivity improvements that result from market-based capital allocation. Furthermore, creating a perception of being hostile to private capital would almost certainly reduce entrepreneurialism and China’s capacity to innovate, thus dampening its technological ambitions.

Nevertheless, China has historically shown a propensity for very long-term thinking, and it is probably not wise to overestimate their desire for growth. It has been the right call not to have expected massive stimulus in recent years as China's growth at all costs mindset was overestimated by markets, especially since the working age population peaked. Perhaps the Chinese authorities value growth even less than the West does now, instead favoring control and redistribution, while targeting a technological geopolitical rise that is less immediate but more relentless. If this diagnosis is correct, then it may be prudent to expect a higher degree of government involvement and a less predictable regulatory environment in the years to come. While these negative scenarios are by no means inevitable, it is probably safe to say that investors in Chinese assets will face a more uncertain risk environment for the foreseeable future.

Enjoying this information? Sign up to have new insights delivered directly to your inbox.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. The reader should not assume that investments in the securities identified and discussed were or will be profitable.