Endowment funds are powerful financial tools that provide long-term stability and sustainability for non-profit organizations, educational institutions, and mission-driven entities. By establishing an endowment, an organization creates a permanent, income-generating asset that supports its core mission not just for a few years, but often in perpetuity.

We can help

Endowments can provide a stable, long-term funding source for your organization, but take strategic planning and management. Whether you're looking to start an endowment for your organization or need support managing your existing endowment, we can help. Schedule a call today to learn more about the ways we can help.

Connect with usThe primary benefit of an endowment fund lies in its ability to generate a consistent and reliable stream of income through prudent investment of donations. The stability of the income helps organizations navigate market and economic fluctuations, reduce dependence on annual fundraising, and plan strategically. In essence, an endowment fund fosters financial independence, enabling organizations to focus on impact rather than short-term survival.

If you’ve determined that now is the right time for your organization to start an endowment, there are several steps you should take. We’ve organized these steps into three main categories: governance and legal structure, funding, and investment.

Governance & Legal Structure

Endowments and foundations are generally organized as tax-exempt entities under section 501(c)(3) of the IRS code. They can be incorporated under the provisions of the state in which they reside, or they can be set up as trusts. Under either approach, the proper filing requirements must be met. It’s important to obtain legal counsel to ensure compliance with all necessary federal and state requirements. An attorney that is knowledgeable in charitable, tax-exempt law can advise in this area.

There will also be governance considerations. For example, most endowments are set up as separate entities from the non-profit they support, paying formal grants to the non-profit. This structure requires a separate board of directors, officers, mission statement, and internal policies (e.g., spending, fundraising, mission statement, etc.). In our experience, the most common practice is a volunteer board made up of community leaders or affiliated personnel, and a professional executive director whose role is to run the endowment’s day-to-day administration, oversee fundraising efforts, and coordinate oversight with the board of directors.

Funding

There is no minimum amount of assets required to start an endowment. As mentioned before, a non-profit will sometimes seed an endowment with excess cash from its operations or fundraising. This is a good starting point, but to really make a difference, it’s crucial that you involve your community of supporters.

Every organization will be different in this regard. Some will choose to focus on a small pool of affluent, long-time donors who may be interested in making a major gift or bequest. An endowment is a great place to house such a gift because of its alignment with a donor’s idea of leaving a legacy.

For example, suppose you have identified a consistent annual giver who has made a conscious decision to support your cause over many years. Clearly, providing sustainable support is important to them. This person can be an excellent candidate for an endowed gift because an endowment allows them to continue to make a regular, annual impact for years to come, even after they’ve passed away. They want that gift to continue, and your organization can help them accomplish that goal.

Other organizations will decide to create a kick-off campaign focused on a larger pool of donors. In this case, it’s important to turn your campaign into an event. Create a case for support, set a goal, and broadcast your message widely: “We’re starting an endowment! Help us create a sustainable future for our organization.”

All of this supposes you have a large base of already existing supporters. Not all do, but with careful cultivation and solicitation, many organizations can transform their constituency (e.g., alumni, family, friends, or anyone receiving your services) into a base of long-term support. Establish an infrastructure, including a fundraising database, a giving section of your website, and communication tools (e.g., email, mailings, etc.) to spread your organization’s message.

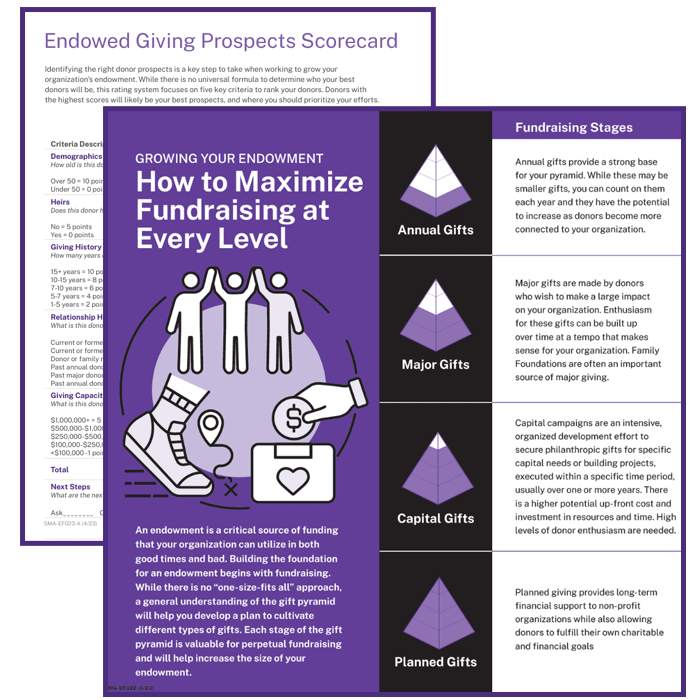

Your roadmap to growing your endowment

If you’re looking for ways to effectively grow your organization’s endowment, our toolkit can help you get there! Featuring multiple donor outreach templates, an endowed giving prospect scorecard, infographics, and more, this toolkit is filled with actionable resources to help enhance your fundraising.

DownloadInvestment

The final step is to ensure your endowment’s assets are properly invested for the long-term. Setting investment objectives means prioritization. Is it more important to grow a foundation’s assets or preserve what it already has in order to safeguard future withdrawals?

For most, the answer lies somewhere in the middle. A typical endowment intended to last in perpetuity must balance both growth and preservation. This prioritization then feeds into a portfolio’s asset allocation. For example, stocks can be excellent for growing capital over the long-term, while bonds are generally better suited for preservation. Work with an advisor who has the skills, tools, and expertise to create a portfolio specifically customized to your endowments needs. Then, write down those policies to convey and clarify the intention with a formal spending rule and statement of investment objectives.

And finally, know that board members and other leaders are fiduciaries when it comes to managing these assets. This means the interest of the organization must be put ahead of personal interests. It also means the portfolio must be regularly monitored and maintained over time to keep the endowment on track to reach its goals.

Funding consistently ranks as a top challenge for non-profits, especially in today’s changing landscape of government support, tax rules, and uncertain economy. If your organization has gained donors’ trust by demonstrating its commitment and value to the community, it’s time to consider starting an endowment. We are here to help navigate this process.

The information in this paper is not intended as legal or tax advice. Consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation.