How do you build wealth? Saving and investing are an extremely powerful duo to do so. Of course, learning to be disciplined, practice good habits, and set goals are also instrumental in your success. The ability for savers to adopt those habits and convert such a modest lifestyle into long-standing, legacy building wealth is all about the power of compounding.

Compounding describes how money builds on itself, creating even more money over time, in an exponential manner. The more time you allow for compounding to work its magic, the greater your rewards.

Using Time to Help Your Investments Grow

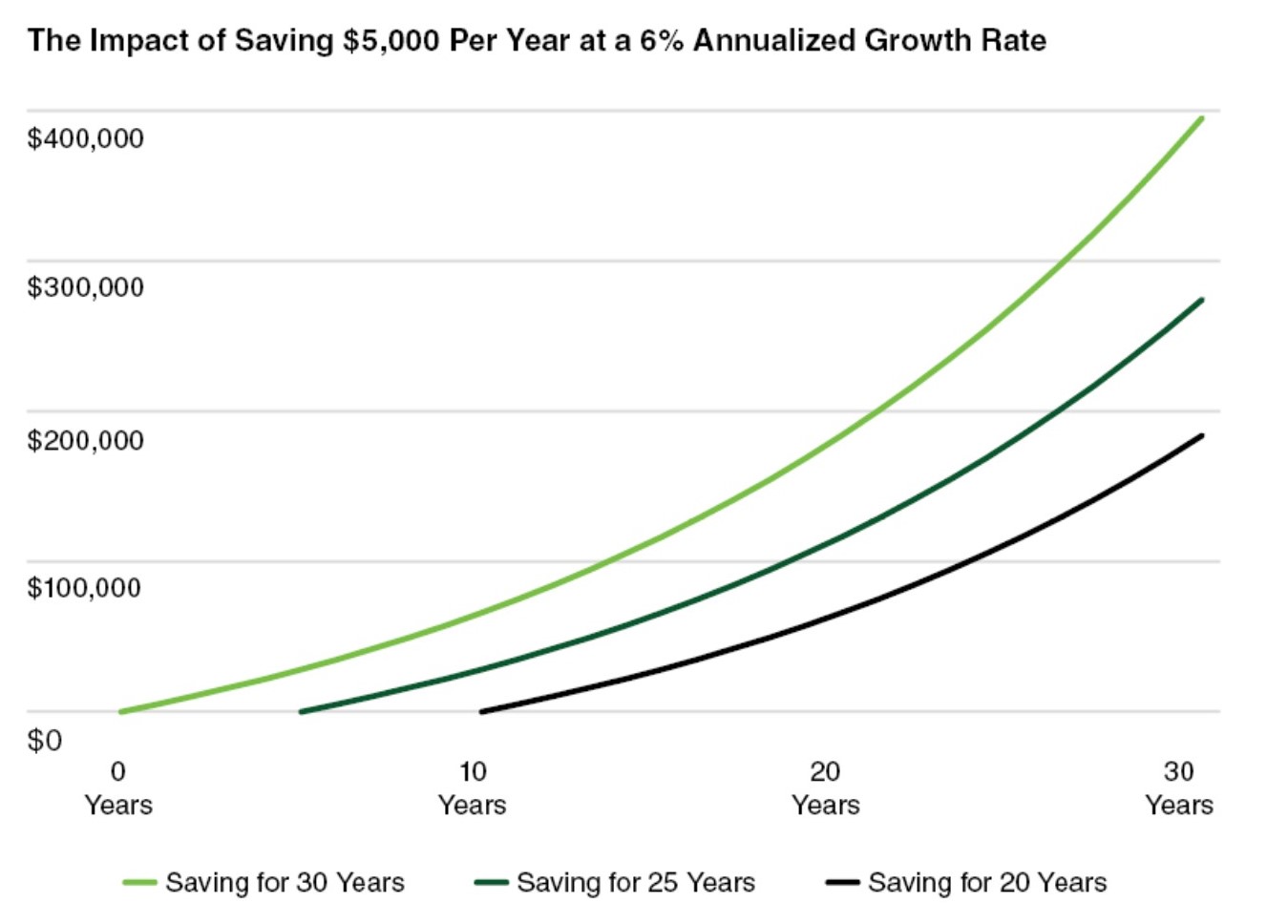

The below visual highlights this magic in real dollars and cents, showing how a five- or ten-year head start on saving and investing can make an enormous difference down the line.

For illustrative purposes only.

3 Tips for Getting Started

The numbers and graph don’t lie. The longer you can save and invest, the more impact it has to your long-term financial goals. If this strategy is not one you’ve implemented in the past, don’t dwell on what you’ve missed out on. Act on the opportunity of today to use the power of saving to achieve your future goals spearheaded with these three tips.

- Determine a realistic amount for spending, saving, and investing each month.

- Pay yourself first through an emergency fund and retirement savings.

- Set long-term goals and invest accordingly.

When executed corrected, this method has substantial results. And always remember to be disciplined, practice good habits, and set goals. When you hit a fork in the road on what to do, or want a professional opinion on your plan, then our team of consultants and advisors are ready to help.