The SECURE Act, which was signed into law late last year, has several provisions that impact distribution rules for IRAs. Perhaps the change causing the most planning considerations is the new 10-year rule.

Starting in 2020, for IRAs passing to most non-spouse beneficiaries (not including minor children of the owner, chronically ill or disabled, those less than 10 years younger, and properly drafted “see-through” trusts), the entire IRA must be distributed by the end of the 10th year following the owner’s death. It’s worth noting here that while the recent CARES Act eliminated RMDs for 2020, it doesn’t technically impact the 10-year rule for beneficiaries. That’s because the 10-year “clock” starts the year following the IRA owner’s death and the SECURE Act’s rules apply to IRA owners who pass away starting in 2020. While RMDs are waived this year, the 10-year period for inherited IRAs doesn’t begin until 2021 anyway.

In our March blog post, we outlined the potential impact of the 10-year rule relative to the ability to “stretch” distributions over a beneficiary’s life expectancy, as was the case under pre-SECURE Act rules. The general impact is that the 10-year rule is less tax-efficient because traditional IRA distributions are condensed and therefore taxed at higher rates. Knowing that, what are some things to know if you are an account owner or beneficiary to help you be more strategic with distributions and potentially reduce the tax impact?

IRA Owner

When naming your beneficiaries for your IRA(s), consider the impact of naming more beneficiaries. As an example: a large IRA passing to fewer people results in larger distribution amounts and potentially higher tax rates. This can reduce the net amount going to beneficiaries. More beneficiaries can spread out the distributions and result in lower taxes, thereby increasing the net amount passing to beneficiaries. While this might be a simple concept to increase the total net IRA amount passing to beneficiaries, it may not be practical for your family structure or wealth transfer goals.

Another option can be to bypass a spouse (use caution when applying this strategy!). This may be a good approach if both spouses have large IRAs and the surviving spouse won’t necessarily depend on their spouse’s IRA to meet spending needs over their remaining lifetime. Rather than combining both IRAs for the survivor and then having one 10-year “clock” for the large IRA when the surviving spouse dies, you can create two staggered 10-year “clocks” with smaller IRAs.

It may also be worthwhile to consider your beneficiaries’ financial situations and target certain accounts for certain beneficiaries. Accounts such as taxable investment accounts and/or Roth IRAs may be better for higher earning beneficiaries, while traditional IRAs may be better for beneficiaries earning less. Of course, this requires a meaningful understanding of your beneficiaries’ financial situations, which may not be apparent or forthcoming. Also, circumstances can change and create unintended tax challenges for beneficiaries if plans aren’t reviewed and/or updated regularly.

IRA Beneficiaries

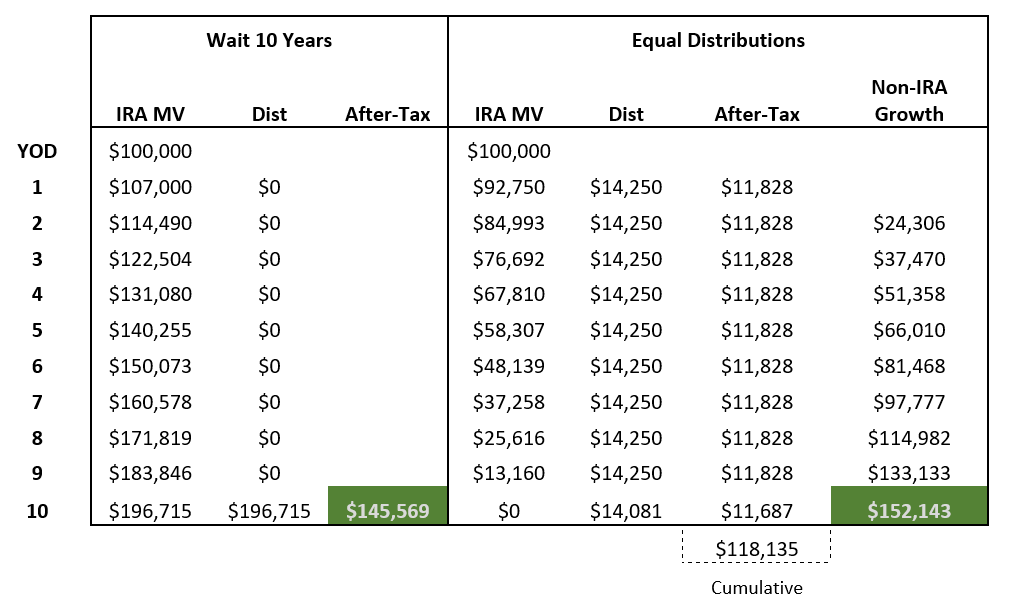

We mentioned the 10-year “clock” for beneficiaries several times and net amounts, but what are some ways to manage the tax impact if you are the beneficiary of an IRA? The table below illustrates two possible approaches using an inherited IRA amount of $100,000. The left side of the table outlines a delayed approach, while the right shows an approach that spreads out distributions equally.

For illustrative purposes only. Assumes a 7% return in the IRA and 5.5% net return in the non-IRA portfolio.

Beneficiary has $100,000 of other income.

Does not include state taxes. Federal effective rate is 26% in year 10 and 17% in annual distributions.

Delaying distributions, as illustrated on the left side of the table, allows for longer tax-deferred growth. This is a good approach if you have meaningful income already and you don’t expect to withdraw from the IRA to meet spending needs. It’s also the ideal approach for a Roth IRA since the account’s growth can remain tax-free for 10 years.

The approach on the right side of the table distributes the IRA equally over time and then reinvests those distributions. If you look at the after-tax values in year 10, you can see that the equal distribution approach is beneficial in this particular scenario. This is because the smaller distributions each year, along with the other income, will result in a lower tax rate. Now, in order for this to truly “win out”, you have to reinvest the distributions each year, which may be a challenge for even the most disciplined investors. It does indicate, however, that it’s an approach that is worth considering if you have generally modest income (facing lower tax rates) and you don’t necessarily need the distributions to fund current spending needs.

Finally, a blend of these two approaches can be appropriate if your income level is less predictable or perhaps you are expecting to retire at some point within the 10-year period and it’s beneficial to delay a majority of distributions until you no longer have earned income.

There’s no simple formula to follow for all owners/beneficiaries of IRAs. However, what is consistent is the need to review IRA beneficiary designations in light of the recently enacted SECURE Act and consider its implications on your multi-generational goals.

Consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.