Ebrahim Busheri is the Director of Investments at Manning & Napier. In his more than 30 year investment management career, he has served as Director of Research and as the head of various sector groups within the firm. He has also served as Director of Investments and as a consultant at other firms.

From my viewpoint

We’ve never seen an economic recovery quite like this. The US economy is heating up, and the stock market is rising as well. US equities are solidly higher halfway through 2021, extending on the rally that first began with the COVID-induced selloff early last year.

At that time, few would have expected the market to snap back as sharply and significantly as it has. Up over 100% from the trough, US equities have had a remarkable run. The recovery has been so strong and so swift that we know many of you are wondering if it’s gone too far too fast and is poised to fall back.

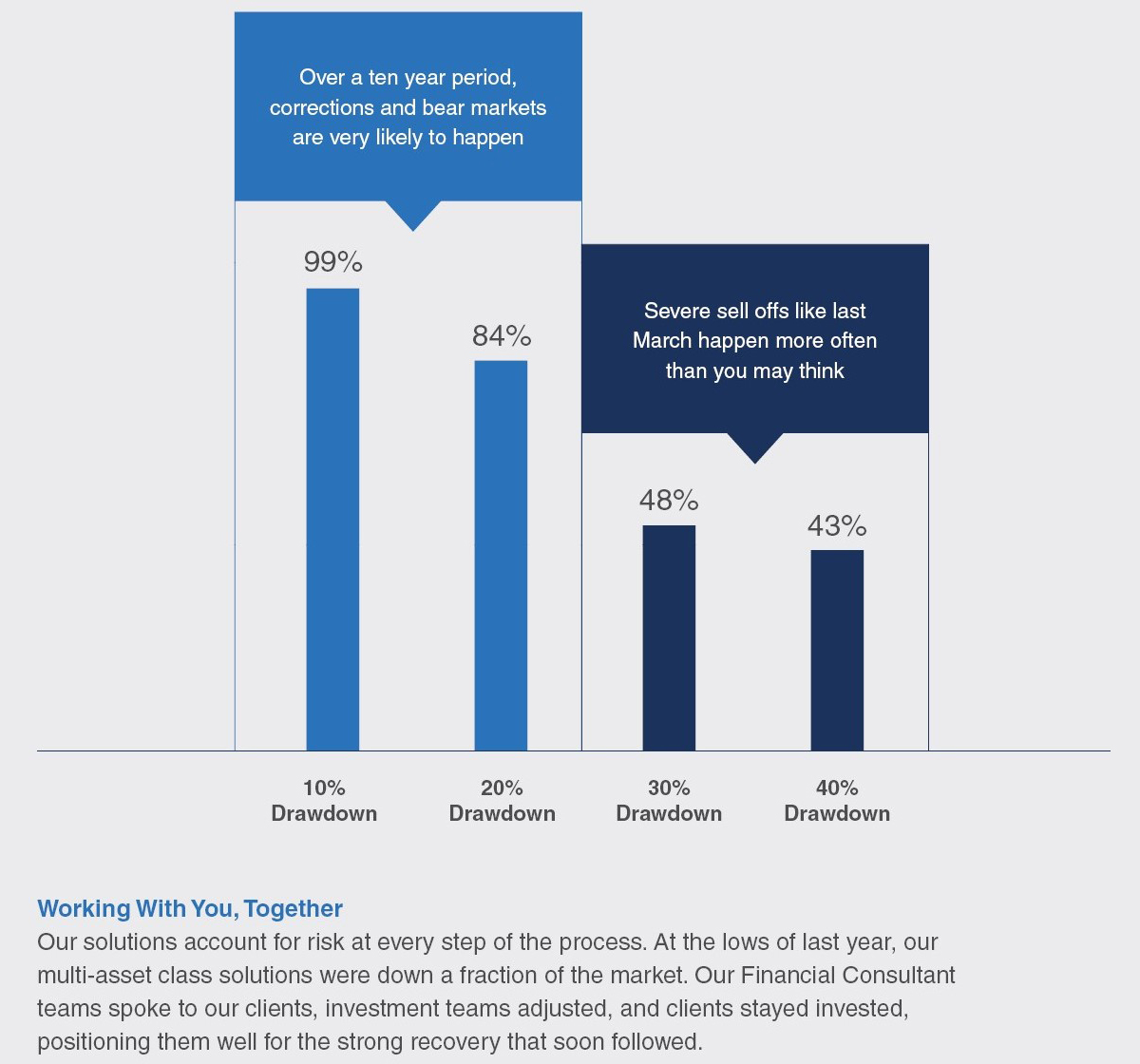

Markets go up, markets go down, and trying to time those turns perfectly is impossible, which is why we focus on what we can control: our process. That is why our disciplines fully incorporate dynamic asset allocation, meaning we adjust as markets adjust, allowing us to continue putting your hard-earned money into what we believe are the best possible investment opportunities at every point in time.

This active approach extends beyond our investment strategies; it is ingrained in everything we do. Our Financial Consultant teams work closely with our investment teams, combining your plan and investments into one tightly integrated, holistic solution. Most of you have goals and objectives measured in decades, not months, and our wealth management solutions are designed to help you achieve your goals.

It’s been a rewarding time to be here at Manning & Napier. The past year and a half has been unprecedented, challenging, and deeply energizing. Our teams have reacted to adversity in the same manner as all the various market challenges of the past. I’m fully confident in our team, our tools, and our structure as we seek to continue delivering investment excellence, regardless of what challenges the world throws at us next. Thank you for your continued trust and partnership.

Riding the Economic Wave

The economy is reopening with vigor, and businesses, investors, markets, politicians, and central bank policy makers are all letting it ride.

Some degree of a snap back should have been expected. As the vaccine roll out commenced, and as the US economy re-opened once and for all, a wave of pent-up demand was destined to be unleashed. We believe the economy is experiencing that spending rush right now, but we think there’s more to the story than this one-time burst.

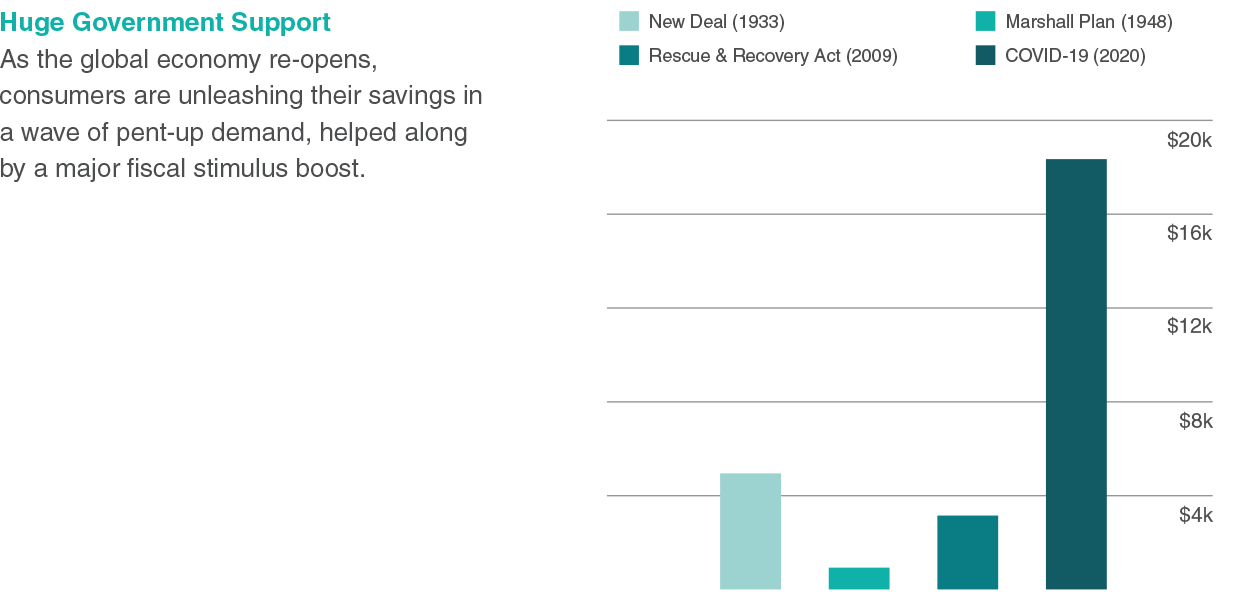

The pandemic presented our economy with a remarkably complex list of problems, and when our government responded, it did so with incredibly aggressive, broad-based, long-lasting fiscal and monetary policy—grants, loans, and bailouts for businesses, and checks and unemployment insurance for consumers.

All these measures poured an immense amount of funding into the economy, helping ease the impact of the pandemic. But unlike a normal economic cycle, it also prevented any real clearing of excesses from the system.

We believe today’s very pro-growth fiscal and monetary policies, paired with resurgent consumer demand, are driving a sharp acceleration in economic growth, so much so, that we believe the economy could quickly find itself in the middle- to later-stages of the economic cycle. Certain key cyclical risks, such as inflation, are beginning to emerge as significant monitoring points for markets, investors, and central bankers.

This perspective is being informed by a variety of other key monitoring points as well. In the labor market, for example, we see many commentators suggesting that it is already far too tight, pointing to indicators such as job openings data, labor surveys, and rising wages. Yet at the same time, the unemployment and labor force participation rates suggest that there is still plenty of healing left to do.

Big picture, we believe the economy will drift back to a more normal pace of growth over the next year, even if normal is not exactly the same as it was pre-pandemic. We aren’t calling for a return of the roaring 20s, as some say, but we do believe growth may be somewhat stronger than before.

US demographics, something that evolves very, very gradually, is less likely to be such a major headwind as the large, echo-boom Millennial generation moves into their prime earning and spending years. Debt levels, another structural headwind holding back growth for so long, have somewhat healed. Consumer balance sheets are actually quite healthy, and while corporate and government debt is elevated, both remain okay with interest rates at such low levels.

All these post- and pre-pandemic forces are coming together to make for a remarkably uncertain economic environment today. We expect growth to be elevated in the short-term but to return to a slower pace over the intermediate-term, and we are positioning your portfolios to reflect that.

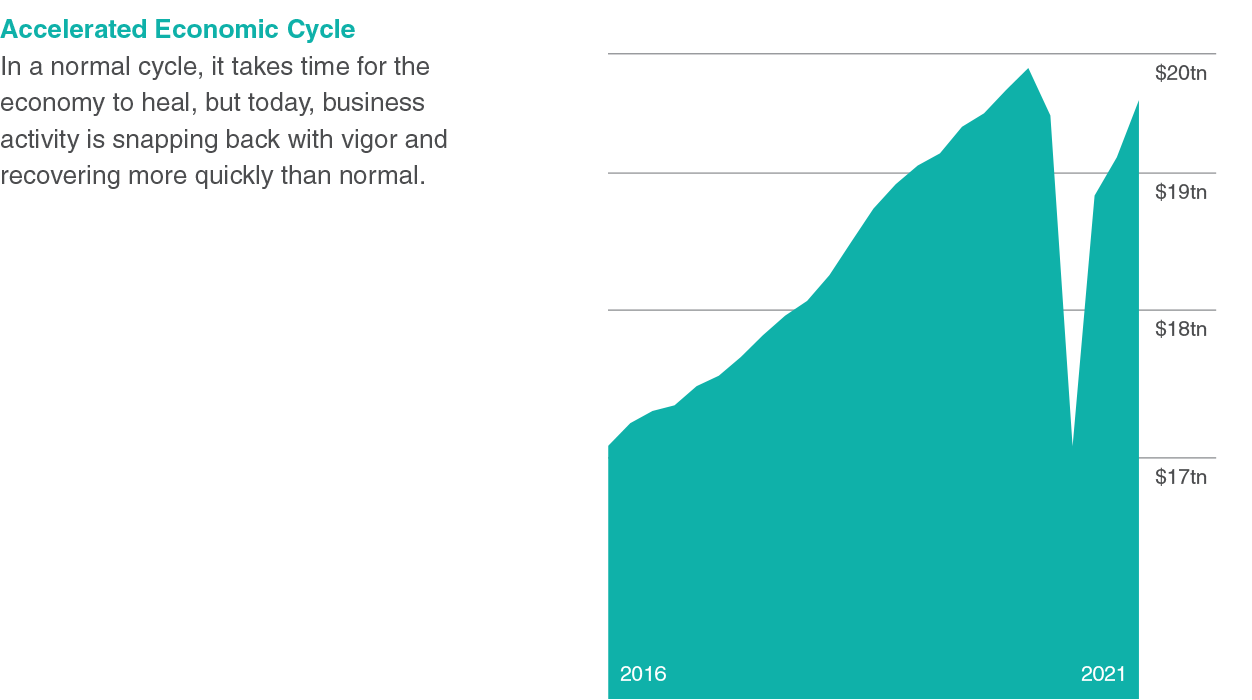

Slowing the Blow, Speeding the Recovery

US Economic Output: Real GDP

Seasonally-adjusted. Inflation-adjusted. 2012 dollars.

Source: Federal Reserve (Q1 2015 - Q1 2021).

Stimulus to the Rescue

US Government Spending: Per Capita Fiscal Expenditures

Inflation-adjusted. 2020 dollars. Analysis: Manning & Napier.

Source: Data Commons, Federal Reserve Bank of St. Louis, International Monetary Fund, U.S. Census Bureau (2020), U.S Department of State.

Living in a Stock Picker’s Dreamland

Accelerating economic growth can be a great time to own stocks, but bubbly investor sentiment and rich valuations should temper expectations.

Investing is all about expectations, and market expectations have picked up significantly. The economy is heating up, but many sectors are not yet back to pre-pandemic levels, and investors are pricing these businesses as if they are already there.

It’s not just the quotes you see in the stock market, it’s the underlying value the market is placing on these businesses. Value, or in other words, the valuation on the stock, is a function of price, but also the earnings power of the business. If price goes up but earnings stay the same, valuation rises, meaning investors are paying more for the same business as before.

Hand in hand with valuations is investor sentiment, or the way investors are ‘feeling’ about the market. When investors are paying higher prices for the same business, they are often overly optimistic about the market as well. We are seeing pockets of excess enthusiasm for stock market investing, and along with valuations, it is giving us pause as well.

Eager buying activity in a variety of troubled businesses (i.e., the so-called ‘meme stocks’), unproven asset classes (e.g., cryptocurrencies), and unreliable private investments (e.g., SPACs) should raise flags for risk-conscious investors. The speculative investment decisions of a few do not spoil the bunch, but they do warrant monitoring.

Big picture, there is no doubt that America is back open for business, and today’s accelerating economic backdrop makes for an attractive time to invest in equities. We are constructive on equities in general, but our concerns around valuations and sentiment temper our optimism to some degree, and we believe discernment and selectivity remain key.

Our active investment processes are helping us find attractive investments while avoiding undo risk. For example, we continue to like several areas of the real estate market, including sectors such as housing (e.g., single family housing, apartments, etc.), as well as non-residential sectors including data center and cellular tower REITs. As these industries have performed well, we’ve been trimming into strength consistent with our pricing disciplines.

We also like what we are seeing in the energy space. Our analysts believe we are in the middle of a supply-demand imbalance within both the oil and natural gas industries. We expect demand to snap back faster than supply can respond. We have also found opportunity in less common energy areas as well, including uranium, as we expect demand for nuclear energy to rise as an alternative clean energy source.

Other businesses we like include: video gaming, a huge pandemic beneficiary; financial technology, both traditional payment processors and their upstart challengers; animal health care, a wildly overlooked, fast growing segment; and cloud computing/artificial intelligence, an emerging area that continues to deliver outsized innovation and growth.

These themes cover a few of the areas where we see value today, and we hope they give you a flavor of what we mean when we say selectivity is key.

Stocks After the Snap Back

US Stock Market Annual Performance: S&P 500 Price Return

Return from date of trough. Daily data.

Analysis: Manning & Napier. Source: Morningstar (01/03/1928 - 03/30/2021).

Bear market date ranges: (05/26/1970-72; 10/03/1974-1976; 12/04/1987-89; 10/09/2002-04; 03/09/2009-11; 03/23/2020-03/30/2021).

Navigating Inflation and Interest Rates

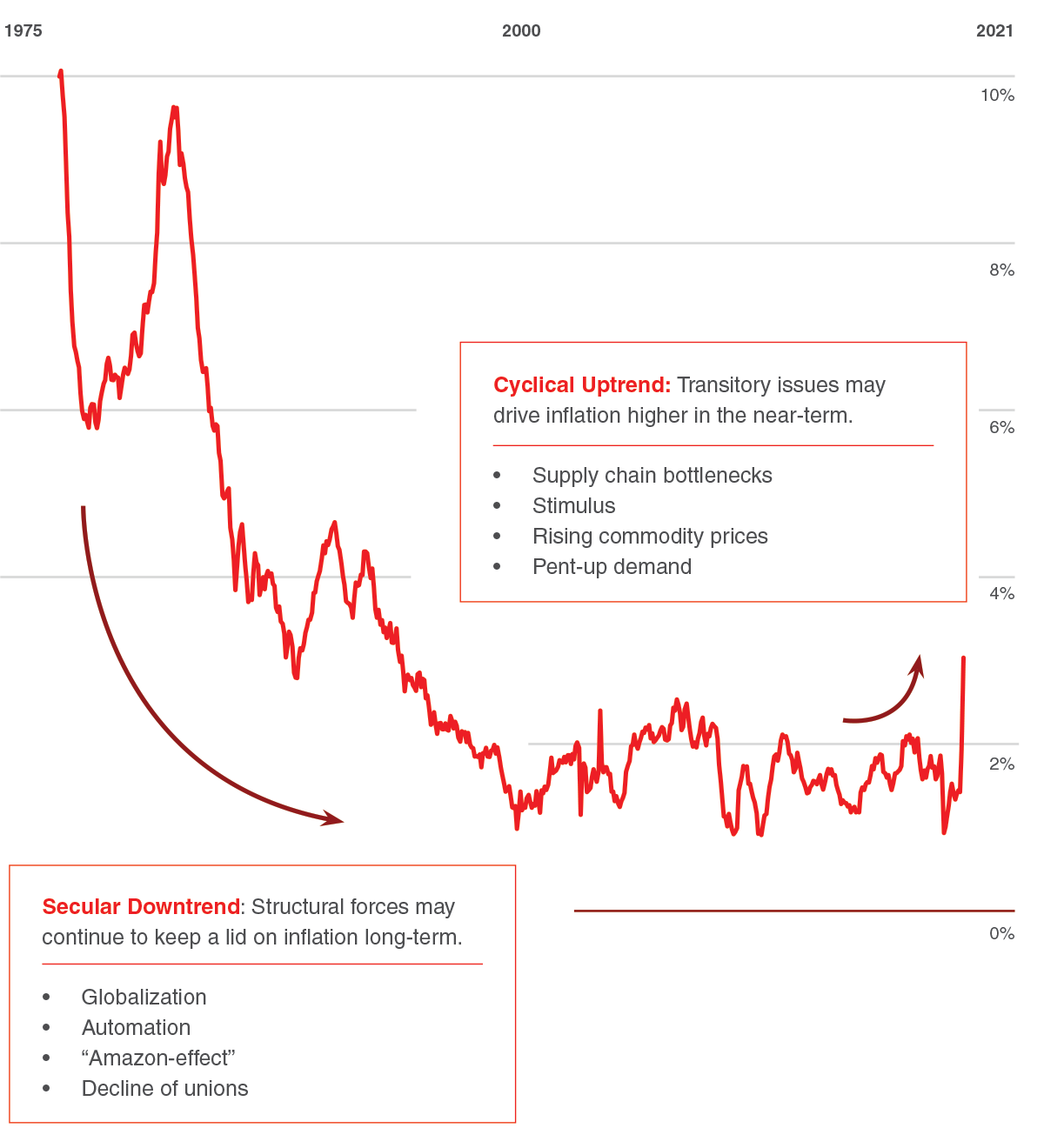

Inflation is on the rise, and many are wondering if it is finally here to stay or whether inflation will again drift away.

Gas prices are moving higher, and costs are going up at the grocery store, but these aren’t the kinds of inflation we are talking about.

The kind of inflation causing today’s hand wringing is the structural, ‘let’s hope this doesn’t spiral out of control’ type. We are not there today, nor do we think we are heading there, but we do think inflation may rise faster in the years ahead.

The structural forces holding down inflation for the past four decades do not change on a dime. The twin forces of globalization and automation, while under some pressure, appear to remain in place. And labor issues regarding mixed demographic trends and the decline of unions are inflation headwinds as well. As for the 1970s, today it is decidedly not.

Short-term, the story is different. Supply chain disruptions, rising commodity prices, policy choices, and pent-up demand are all coming together to cause substantial supply shortages in a variety of areas.

As these transitory bottlenecks work their way through the system, and as government stimulus is pulled back, we expect supply chains to catch up, and for supply and demand to return to balance. For these reasons, we are keeping a watchful eye on inflation and how it may impact our fixed income portfolios, but we aren’t making wholesale changes.

While we expect the potential for better growth and more inflation to pressure interest rates higher, we do not yet see this as a full scale regime shift. Our portfolios continue to invest in a mixture of both short- and long-dated bonds.

Ultra-low interest rates are the far larger challenge. While off their post-pandemic lows, Treasury rates remain depressed, and for most multi-class investors, yields of 1 or 2 percent simply do not suffice.

This is why our selective process is key. Rather than pouring into riskier bonds wholesale, we’re seeking out specific areas of opportunity within corporate bonds, municipal bonds, and securitized credit.

For example, within corporate bonds, we see particular value within communications, energy, and financial services issuers. In securitized credit, we are referring to various asset-backed and commercial mortgage-backed securities where we are buying portions of large pools of loans (e.g., select student loan and prime credit auto loans, as well as in pools of single family and multifamily rental properties).

Fixed income plays a vital diversification role in multi-asset class portfolios. Low yields may be a challenge, but we believe our active approach enables clients to continue capturing value while minimizing risk.

The Inflation Give and Take

US Inflation: Personal Consumption Expenditures ex Food & Energy (price index, 01/1975 - 04/2021)

Chain-type price index. Percent change from one-year prior. Seasonally-adjusted.

Source: Federal Reserve (01/1975 - 04/2021).

Managing risk in an uncertain world

Proactive financial planning means we do the work ahead of time, anticipating future challenges and changes so you don’t have to.

There’s so much more to it than taxes. Estate law, legal rulings, precedents, IRS guidance and more, all play a role in creating the financial planning environment we live in today. Throw in new legislation, proposed legislation, executive orders, judicial decisions and appeals, and you get a far more dynamic landscape than you might expect.

So when clients come to us with questions, we know that one of the most important things we can give them is context. Context in both the answers we provide, but also in why we are giving the advice we give. The kind of advice that takes years of experience and practice, learning the nuances of how regulation evolves and how the system interprets these rulings. Reality is painted in shades of grey.

It is in this, dare we say, fast moving planning environment that we received multiple pieces of legislation last year, and are staring down the barrel of several more potentially comprehensive overhauls this year as well. Changes to tax law, both in rates and structure, appear high on the priority list, alongside additional proposals to the treatment of capital gains and dividends, estate taxes, and more.

We believe there is a real possibility that tax law changes are passed in the near future, and depending on your situation, these changes may directly impact your plan. They may also have near-term impacts on markets as well, although we believe market performance is determined by long-run fundamentals, not short-term policy changes.

Rather than sitting back and waiting to see what regulators do, we are anticipating potential changes and advising clients of different ways we can help them get out in front of these risks. Ideas include potentially realizing long-term capital gains sooner, at today’s lower tax rates. If, for example, you have an ownership interest in a small business, long-held stock in taxable investment accounts, or equity held from vested stock options, this could amount to a huge savings should tax rates rise.

We also believe changes to the estate tax threshold are coming, in part due to the sunsetting provision already in place. While you may believe you do not meet the thresholds, recent proposals are calling for a substantial slashing of the limit that could make this a very real consideration for far, far more people. Options such as accelerated gifting strategies, grantor trusts, qualified personal residence trusts, and spousal lifetime access trusts—currently a heavily utilized planning tool—are all potential avenues to consider.

Financial planning is an ongoing process, and regardless of your situation, there are a variety of rules and regulations that can make a huge difference for your unique financial plan. It pays to be on the ball.

You Can’t Put a Price on Good Advice

Likelihood of Drawdown Over a Decade: S&P 500 Price Index

Percent chance of one or more occurance over subsequent ten-year period.

Analysis: Manning & Napier. Source: Morningstar (01/1926 - 12/2019).

Watch our Mid-Year Outlook Webinar

In this webinar, our experts discussed the roaring economic recovery, where we think markets are heading next, and how inflation can impact your portfolio, your plan, and more.

Unless otherwise noted, analysis provided by Manning & Napier. Past performance does not guarantee future results.

Morningstar, Inc. is a global investment research firm providing data, information, and analysis of stocks and mutual funds. 2021 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

The S&P 500 Price Return Index is an unmanaged, capitalization-weighted measure comprised of 500 leading U.S. companies to gauge U.S. large cap equities. The Index returns do not reflect any fees, expenses, or adjust for cash dividends. Index returns provided by Morningstar. S&P Dow Jones Indices LLC, a division of S&P Global Inc., is the publisher of various index based data products and services, certain of which have been licensed for use to Manning & Napier. All such content Copyright© 2021 by S&P Dow Jones Indices LLC and/or its affiliates. All rights reserved. Data provided is not a representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none of these parties shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

All investments contain risk and may lose value. This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

This publication may contain factual business information concerning Manning & Napier, Inc. and is not intended for the use of investors or potential investors in Manning & Napier, Inc. It is not an offer to sell securities and it is not soliciting an offer to buy any securities of Manning & Napier, Inc.