Every year the IRS releases new information on tax brackets, retirement savings limits, deductions or credits, and other key tax rules – all of which is applicable for the next tax year, yet necessary to know now to incorporate the appropriate strategies into your financial plan.

On top of IRS rules, recent legislation (the Inflation Reduction Act, the Secure Act 2.0, and the Tax Cuts and Jobs Act anticipated sunset in 2025) incorporates new guidelines and presents their own unique planning strategies.

If it sounds like a lot of information, that’s because it is. Don’t fret though, during our recent webinar, Tax Updates & Planning Considerations for 2023, members of our Advisory Services team went into detail on all the updates to keep you informed. We encourage you to watch the on-demand replay to get all the information, but in the meantime, here are some of the highlights.

Taxes, the current environment, and recent legislation:

Tax laws are considered favorable right now given the change in the market and economic environment over the last year. The key takeaway here is that there have been massive changes to the tax code to review with your advisor and accountant. As well as new opportunities from recent legislation changes such as:

- The Inflation Reduction Act offers new credits for home energy upgrades and electric vehicle purchases. There are strict criteria for receiving these credits, but if you’re in the market for either, be sure to review and consider these tax savings opportunities.

- The Secure Act 2.0. was a highly anticipated piece of legislation to follow the original Secure Act, that was passed back in 2019. Topics with notable takeaways include:

- Changes to required minimum distribution (RMD) rules including, age increase, penalty reductions, increased and indexed catch-up contributions, surviving spouse changes, and early withdrawal clarifications.

- There were significant updates to charitable giving. Qualified longevity annuity contracts (QLAC) and qualified charitable distribution (QCD) expansions provide more incentives for retirees to be charitable. The IRS also clarified rules on charitable conservation easement in an attempt to combat abuse.

- Increased access to emergency funds expands access to emergency cash penalty-free. Hardship loans are now capped at $1,000, domestic violence victims and terminal illnesses now have more favorable access, and “side-car” Roth accounts allow employees to save $2,500 a year alongside traditional retirement accounts that can be withdrawn penalty free.

- In addition to the “side-car” Roth accounts, additional changes to Roth accounts include penalty free 529 roll over options, changes to the Roth 401(k) RMD rule, and optional employer match. Roth accounts continue to be an attractive vehicle for retirement savings.

- Impactful long-term changes on the horizon over the next few years will address student loan employer matches, automatic enrollment in retirement accounts, retirement savings lost and found, and improvements to the retirement “savers match”.

- Many provisions included in the Tax Cuts & Jobs Act are anticipated to sunset in 2025. Although it is still a few years away, provisions will be eliminated so now is the time to maximize the opportunities included in the bill before they become unavailable:

- Business owners can still take advantage of bonus depreciation and Sec. 199A deductions. Bonus depreciation will begin to sunset by 20% annually starting in 2023.

- Standard Deductions and Estate Exemptions are both set to cut in half with the sunset.

- Personal Exemptions will be returning in 2026, allowing for a set deduction per dependent.

- SALT (State and Local Income Tax) had a $10,000 ceiling under TCJA, slated to revert to being uncapped.

- Pease Limitations for high earners, which were repealed during the TCJA, are set to return in 2026.

- Finally, most individuals will be faced with a tax rate increase beginning in 2026. This is another result of the Tax Cut and Jobs Act sunsetting, but important to highlight so everyone is aware.

Additional changes on the horizon for 2023:

There are several changes to note regarding cost-of-living adjustments, changes to savings limits, deductions and credits, and decreased Medicare costs.

Overall, these changes reflect the current economic environment with many areas seeing increases. For example, a large cost-of-living adjustment (COLA) for Social Security was announced and provides relief to those on a fixed budget to help manage the current high inflationary environment.

Planning tips and our planning guides:

A key takeaway is that planning is essential. Between new rules, old ones sunsetting and the fact that everyone’s situation is unique, working with the right professional will set you on the path to success while potentially incorporating these planning tips into your plan:

- Exploring the growing value of Roth IRAs

- Proper tax maintenance within a plan

- Charitable planning opportunities

- Estate planning opportunities

We offer a comprehensive Tax & Wealth Planning Guide that covers key facts, figures, tips and tricks, and strategies to optimize your tax plan for the year. When downloaded, get access to our Quick Reference Guides for 2022 and 2023 that summarize the information you need for taxes, Social Security, and Medicare on just one page.

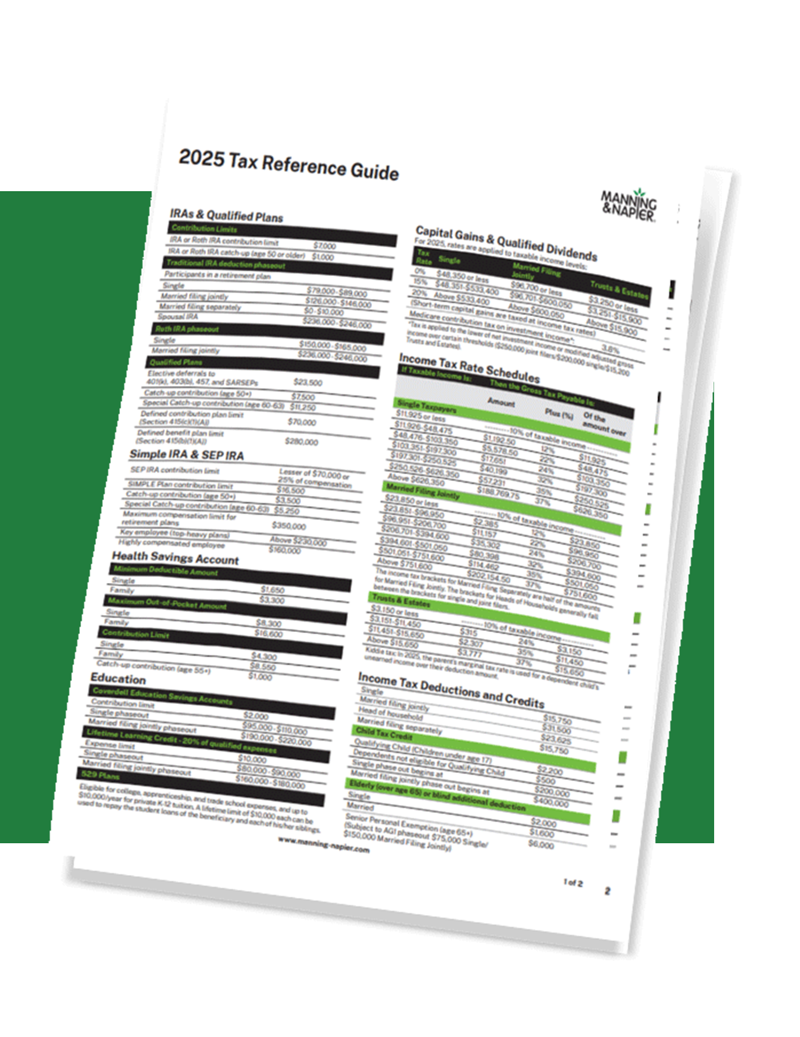

2025 Tax & Planning Guides

Download these quick reference guides for all you need to know about taxes, Social Security, and Medicare for the 2025 tax year in just one place.

Download your free copiesThe Questions…

Taxes bring a slew of questions with them, especially when rules and regulations are always changing. To help in your journey, here are common questions we’re receiving from clients like you.

- I am 73 during 2023. Am I liable for my first RMD this year?

The RMD age increase to 73 is effective as of Jan 1st, 2023. If you turned 72 during 2022, you were required to take an RMD distribution for 2022. Since it would have been your first withdrawal, you have until the tax filing deadline of April 18th, 2023, to take this withdrawal penalty free. - Please clarify the annual gift tax. Does the recipient pay tax? Does the gift have to be given in a lump sum?

Potential gift tax only applies to gifts that exceed the annual gift exclusion ($17,000 for 2023). The person making the gift pays the tax, not the recipient. Gifting above the annual gift exclusion threshold does require you to file form 709 to disclose the gift, however, this doesn’t mean that you will necessarily owe gift tax. In addition to the annual exclusion, you have a lifetime gift tax exclusion. That means you would have to gift above a $12.92 million dollar threshold to generate a gift tax liability. It is important to note, any amount you gift above the annual exclusion will net against your lifetime exclusion, resulting in less of an estate tax exemption when passing on your assets at death. - Is there a way to determine in advance if a dividend will be qualified vs non-qualified?

In order for a dividend to be qualified, and treated at more preferential tax rates, there must be two factors: 1. The dividend must have been paid by a US Corporation or a qualified Foreign Corporation and 2. The investor must have adhered to a minimum holding period. One key factor is the holding period before the ex-dividend date. For common stock, the investor must hold the shares for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date. While a portfolio containing mostly publicly traded stocks will likely generate primarily qualified dividends over time, dividends from REITs, master limited partnerships (MLPs), employee stock options, and tax-exempt companies are generally not qualified. The classification of qualified vs non-qualified dividends is indicated in your 1099-Div issued by your broker each year. - In the event of a Conversion from an IRA to a Roth IRA, does the 5-year rule apply if I already have a Roth IRA set up 20 years ago?

Yes, the 5-year rule starts a new clock on every conversion. This is why it is important to take advantage of more favorable tax rates and brackets and start planning conversions as soon as possible.

To further clarify, there are two separate 5-year rules when it comes to Roth IRA’s. The first rule is that upon the first contribution, or conversion, a 5-year clock starts. This is commonly referred to as a “forever 5-year rule.” This clock – which never gets reset –determines when the earnings on the account become tax free.

The second rule is the “5-year conversion rule” and was created as a way to close a tax loophole for those under 59 ½ years old. Before this clarifying rule, a person who would normally be penalized 10% for withdrawing funds from their traditional IRA (because of age) could covert the funds into a Roth, pay tax on the conversion, and withdrawal the funds immediately. This could allow them to access traditional IRA funds early, without paying an early withdrawal penalty. The IRS didn’t like this so this is where the 5-year conversion period for those under 59 ½ was imposed. Every conversion from a traditional IRA to a Roth starts a new 5-year clock on those assets before they can be accessed penalty free for those under 59 ½. If the funds were to be accessed before the 5-year clock, not only would they be subjected to the 10% penalty, but the gains (which would have normally been tax free) would be subject to federal and state income tax. - If realized tax losses exceed realized gains in a given year, can the excess losses be used to offset gains in future tax years?

If your capital losses exceed your capital gains, as an individual you can carry forward the losses indefinitely into future tax years. Also, it is noteworthy to know that capital losses can also offset $3,000 of ordinary income annually.

We warned you that it was a lot of information – if at any point of your financial and tax planning journey you need help, then we’re here. Simply schedule a call and we’ll connect you with the right team to assist.

Please consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.