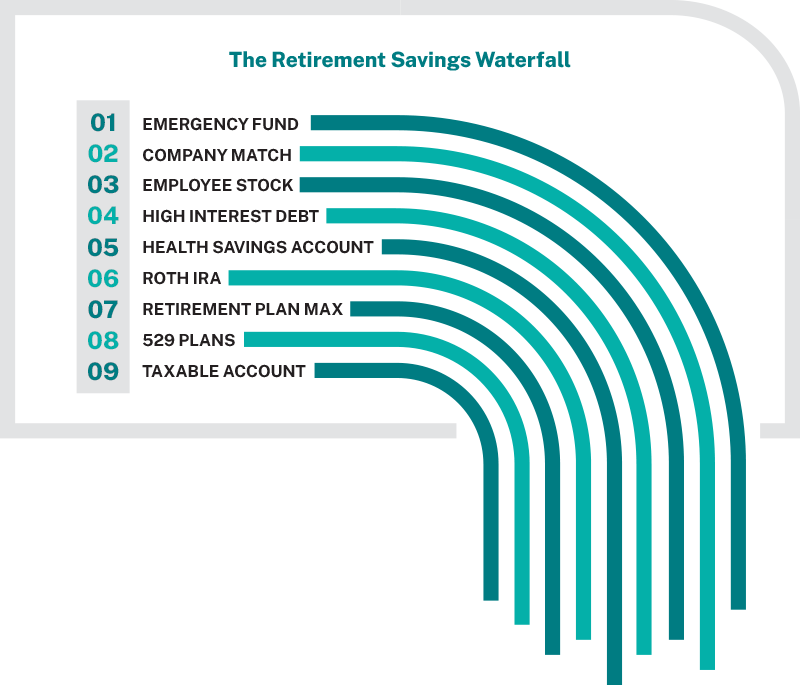

Saving for retirement can be hard. Add in all the various options and it can feel almost impossible knowing where to start. Instead of falling back on a scattershot approach, consider using what is often called the waterfall technique.

This retirement savings technique works by filling up one account bucket then letting additional savings cascade into the next bucket and so on.

The precise order of operations may vary depending on your specific circumstances, though the concept remains the same. There is no one-size-fits-all approach to financial planning but starting with this framework can help to prioritize strategies and set you on the path to a secure retirement.

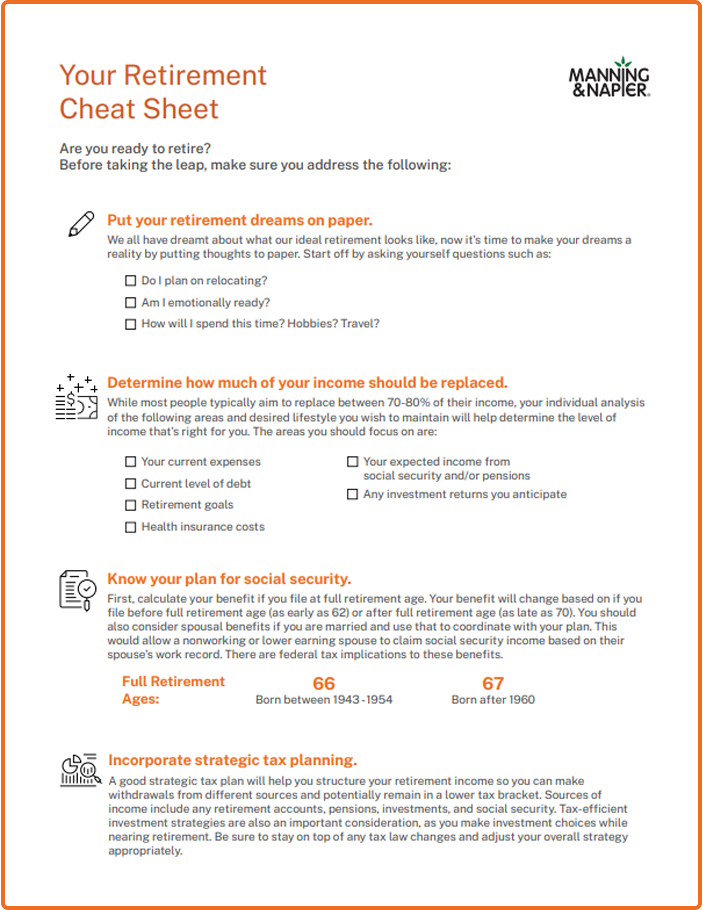

Retirement Planning Cheat Sheet

No matter what your retirement timeline is, planning early can help ease the transition. Our Retirement Cheat Sheet is full of helpful tips and to-dos to help you get started and ensure you’re on track to live the retirement you've been dreaming of.

Download the cheat sheetStep 1: Secure your emergency fund

Before sending your money elsewhere, you should start by filling up your emergency fund bucket. Everyone’s bucket will be a different size depending on your personal situation, income, and job stability, but most experts recommend setting aside the equivalent of at least three to six months of expenses. Consider a high-yield savings account for this bucket. When deciding the account, be sure you can access these assets quickly if you find yourself in a pinch.

Step 2: Capture your company match

A retirement plan’s company match is “free money.” Take advantage by contributing enough to capture this perk and not leave free money on the table. However, each company operates differently. It’s worth familiarizing yourself with your company’s matching formula and vesting requirements in case you are looking to make an employment change soon. For example, you may have to be employed for a certain length of time before the matching contributions vest.

Step 3: Explore an Employee Stock Purchase Plan

If your company provides an Employee Stock Purchase Plan (ESPP), the shares are typically offered at a discounted price, similar to the “free money” concept of a company match.

The contribution limit on these plans can go up to $25,000. To avoid putting all your eggs in one bucket, we recommend limiting concentration in a company’s stock to 5% of your investment portfolio, then moving on to the next bucket.

Step 4: Pay off high-interest debt

In a backward way, paying down high-interest debt is a form of saving. You’re able to save more by not having to pay unnecessary interest payments. If your debt has a 20% interest rate, which is around the common rate on credit cards, you are getting a 20% return by paying off the debt and not incurring the interest penalty.

Step 5: Contribute to a Health Savings Account (HSA)

The next two buckets, an HSA and Roth IRA (Individual Retirement Account), are somewhat interchangeable depending on your personal situation and tax rate. Those with a high deductible health care plan and in relatively good health should consider prioritizing contributions to an HSA, then move on to their Roth IRA bucket. There is a long list of reasons HSAs are called “stealth” or “supercharged” IRAs. To find out why, start here for an overview of all the benefits that make these accounts so powerful.

Step 6: Contribute to a Roth IRA

Most of us tend to overweight the present by doing everything we can to avoid taxes now, sometimes to the detriment of our future selves. Putting all your money in tax-deferred accounts may one day force you into a corner with large tax bills and RMDs (Required Minimum Distributions) you won’t fully spend. If this sounds like you, consider the benefits of tax diversification with Roth IRA contributions that go in after-tax but come out tax-free.

If you’re over the income limits for Roth IRA contributions (i.e., greater than $228,000 for married filing jointly and $153,000 for single filers in 2023), consider “back-door” Roth contributions where you contribute to an IRA then immediately move or convert the contribution to a Roth IRA. An important note: Utilize back-door Roth conversions with an empty IRA or you could run up against the IRS’s pro-rata rule.

Step 7: Max out retirement account contributions

You likely have room left in this bucket to maximize your retirement account contributions – now is the time to come back and fill up this tax-advantaged bucket.

This bucket might include 401(k)s, 403(b)s, and 457(b) plans, but can also include other tax-advantaged accounts like cash balance plans, non-qualified deferred compensation, and accounts that allow “mega” backdoor Roth contributions.

You likely have a choice between making pre-tax or Roth contributions, a decision largely driven by when you expect to be in a higher tax bracket. If the answer is in retirement, you’re better off paying taxes now by making Roth contributions. If you’re like most people though, you’re probably unsure when you will be in a lower tax bracket so making both pre-tax and Roth contributions isn’t a bad idea either. Either way, if you’ve made it this far down the waterfall, you are on the right track.

Step 8: Saving with 529 Plans

While saving for education is a priority for some, we recommend waiting until your own retirement buckets are overflowing before prioritizing this one. While it’s a noble act, remember that you can borrow money for education, but generally not for your own retirement.

Step 9: Fill Taxable Accounts

Your “cup runneth over” and you have reached the end of the waterfall – congratulations on being a great saver! For the final bucket, we recommend filling up a taxable account. While these accounts have no special tax breaks, certain investments may qualify for favorable capital gain and dividend tax rates if certain requirements are met. While there are some taxes, these accounts also provide great flexibility for quick withdrawals and additional capacity to save for other major financial goals.

As we mentioned in the beginning, rarely does one-size-fit-all when it comes to financial planning. However, there’s no question that establishing a disciplined savings program is a key to retirement success and this savings waterfall approach is a great strategy.

Our Complimentary Financial Planning Magazine

It can be easy to feel overwhelmed by the ever-changing world of wealth management. But that’s where Prosper comes in. This free financial planning magazine is designed to give you the knowledge you need to keep your financial plan on track.

Get your copyPlease consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.