In recent years, many employers have frozen their defined benefit plans as 401(k) and other defined contribution plans have grown to become the primary retirement savings vehicles. Given that popularity, the structure and cost of 401(k) plans has come under greater scrutiny, resulting in an increase in lawsuits – many focused on excessive plan fees. In 2020 alone, there were almost 100 excessive-fee lawsuits filed against plan sponsors and service providers. Some of these cases specifically mention the consideration of lower cost Collective Investment Trusts (CITs) as an alternative to mutual funds. CITs are often less expensive to create/maintain and may be more flexible than their mutual fund counterparts given that they are subject to a different regulatory framework. While this may be a benefit to their fee structure, it can also be challenging because CITs often suffer misconceptions when compared to mutual funds. Below are the most common misconceptions and frequently asked questions by fiduciaries.

What is a CIT?

CITs are pools of securities, which are sponsored by a bank or trust company, and are designed exclusively for qualified employee benefit plans like 401(k) and pension plans. They look and feel like mutual funds, but haven’t historically been as broadly available — especially for small and mid-sized 401(k) plans (but this is changing rapidly). As the retirement plan industry evolves, so does the structure of a plan’s investment menu, including CITs.

Who can invest in a CIT?

Investment in CITs is limited to certain types of qualified retirement plans as illustrated below. There is also current legislation being considered that could make 403(b) plans eligible as well.

| Eligible | Not Eligible |

| Qualified 401(k) plans | 403(b) plans |

| 401(a) government plans | 457(f) government plans |

| 457(b) government plans | IRAs |

| Qualified profit sharing plans | Keogh accounts |

| Qualified stock bonus plans | Endowment plans |

| Qualified pension plans | Foundation plans |

| Certain separate accounts and contracts of insurance companies | Health and welfare plans |

| Taft-Hartley plans | Plans with self employed investors |

Are CITs new?

CITs were first launched in 1927 and were a popular choice among defined benefit plans for decades. When 401(k) plans were developed in the 1980s, CITs were an option in many of the early plans; however, given the operational constraints of CITs and their lack of widely available information, mutual funds soon became the preferred vehicle in most 401(k) plans. That said, CITs have undergone significant developments over the years, making them comparable to their mutual fund counterparts, while also offering distinct advantages.

Is CIT data broadly available?

Early CITs were traded manually and typically valued only once per calendar quarter. Furthermore, since early CITs were unique to each bank and portfolio manager, information was generally not publicly available. Fast forward to their current form, CITs, like mutual funds, are typically traded and valued daily. Additionally, reporting has vastly improved over the years, allowing for further analysis when conducting manager due diligence. In fact many of the data aggregation and evaluation tools that have become commonplace in the industry (such as Morningstar, eVestment Alliance, FI360, RPAG and others) report information on a wide range of CITs side by side with mutual funds. From a participant perspective, daily unit values, performance and fact sheets are commonplace on many recordkeeping platforms where investors typically access their retirement plan assets. Some CITs are also offering tickers, similar to mutual funds, that allow investors to find information on public databases.

Are CITs regulated?

A common misconception regarding CITs is that they are not regulated. While CITs are not regulated by the Securities Exchange Commission (SEC) like mutual funds, they are regulated by the Office of the Comptroller of the Currency (OCC), which is part of the U.S. Treasury; If at a nationally chartered bank or trust company or at a state chartered institution, CITs are regulated by their respective state authorities. In addition, CITs may also be subject to oversight by the Federal Reserve Board, Federal Deposit Insurance Corporation, Internal Revenue Service (IRS), and the DOL.

As CITs are not regulated by the same federal securities laws as mutual funds, they do not have the additional compliance costs associated with SEC required disclosures and filings. Without these additional costs, CITs can potentially provide considerable savings that can be passed on to plan fiduciaries and participants.

Why are CITs getting so much press recently?

The retirement industry has evolved over the years, and as such, so has investment menu construction. In addition to determining which types of investment strategies are to be used, plan fiduciaries are also tasked with determining which type of investment vehicle is most appropriate for their plan and the cost structure to be used.

With recent fee disclosure requirements (and litigation) creating additional awareness on fees and fiduciary responsibility, it is not surprising that CITs are gaining significant attention by plans of all sizes. As previously mentioned, CITs can potentially provide considerable savings compared to their mutual fund counterparts. From a fiduciary perspective, unlike mutual fund managers, CIT trustees are considered fiduciaries under the Employee Retirement Income Security Act (ERISA) and are held to ERISA fiduciary standards. That said, CIT trustees must act solely in the best interest of the plan participants and beneficiaries, potentially making them more alluring in light of today’s legal environment.

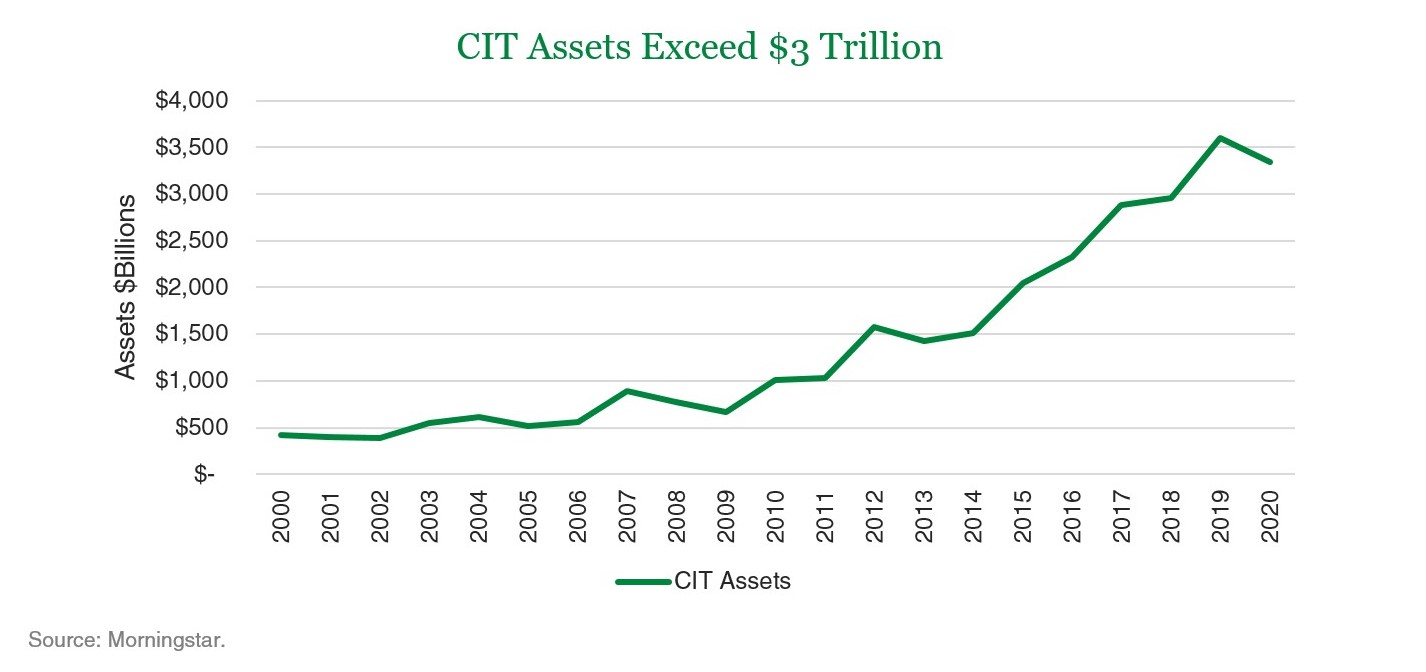

With this backdrop, CITs are gaining market share rapidly. As the focus on QDIA evaluation has grown, Target Date funds have seen dramatic increases - with approximately 43% of all target-date assets invested in CITs, up from 25% just five years ago. Also, for plans with more than 100 participants, almost a quarter of overall plan assets are invested in CITs, up from only 6% in 2000.

Making a Decision on the Investment Vehicle

When it comes to retirement plans, fiduciaries are charged with selecting an appropriate number of investment options as well as a suitable mix of investment objectives so that participants have access to the right balance of choices to create an appropriate asset allocation design. However, as investment platforms continue to add CITs and other investments to the mix of available options, fiduciaries have the added responsibility of selecting the vehicle type. With continued expansion in the CIT marketplace and growing acceptance, CIT utilization will likely continue for plans of all sizes. As such, plan fiduciaries and their advisors may be well served to inquire about CITs in addition to mutual fund alternatives.

Enjoying what you're reading? Sign up to have new insights delivered directly to your inbox.

Education for you

We’ve been working with advisors like you for more than 20 years, so we know it takes more than great investments to stand out. We offer specialized resources to help you grow your practice with business owners, non-profits, and more.

Education for your clients

The information in this article is for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product.

Morningstar, Inc. is a global investment research firm providing data, information, and analysis of stocks and mutual funds. ©2021 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.