The following outlines the rising tensions between Russia and Ukraine, with insight into all the factors contributing to the hostile environment, including energy supplies, political influences, and how different scenarios could impact investment decisions.

What is happening?

A confluence of forces and events in the former Soviet countries have rendered the security situation in Europe arguably worse than at any time since the Cold War. Russia has become more belligerent towards Ukraine, and US officials are meeting with their Russian counterparts to discuss any potential compromise concerning the recent buildup of Russian troops (100,000 to 175,000 by some estimates) near the Ukrainian border. This massive buildup is believed by US intelligence to be potentially used for an invasion of the country. Meanwhile, a crisis in Kazakhstan is likely only adding credence to perceptions among Russian authorities that their sphere of influence and possibly their territorial integrity is under threat by Western powers.

Russia has thus demanded that the US and its NATO allies halt military cooperation with countries it sees as part of its own backyard. The US has shown little willingness to compromise on Russia’s lines in the sand, and the chances of a near-term breakthrough are low, in our opinion. We believe that there is a good chance of things escalating from here.

Our take:

Although recent headlines have been alarming, the reality is that there’s been ongoing hostility toward Ukraine since the 2014 annexation of Crimea, with tactics involving cyberattacks, propaganda, and various threats from Russian leadership. While current events have caught world markets off guard, from a longer-term perspective, we view them as roughly par for the course. This is due to Russia’s current institutional composition, and the geopolitical ambitions and related insecurities of the country’s political and economic elite. We believe tensions will remain elevated and possibly escalate as we move through the year.

To add context, Russia is operating at a time of relative strength given the high level of energy prices and the dire energy supply environment in Europe. European gas storage facilities are barely more than 60% full, a level which is more than 10% below normal for this time of year. Russia supplies around a third of Europe’s natural gas, and gas comprises over 20% of Europe’s energy mix given the continent’s move away from coal and even nuclear energy in recent years. In a zero-sum analysis, Europe’s dependency is Russia’s leverage. The situation is very fluid and the risk for miscalculation or conflict is significant.

How we got here:

Ukraine is a former Soviet Republic, second only to Russia in terms of population among the fifteen former republics. It has deep historical cultural ties with Russia. This has divided the country as western parts of the country favor deeper integration with Europe and the West, while large Russian-speaking sections of the country in the east favor the historical relationship with Russia. Complicating the situation is that there are around 8 million ethnic Russians living in Ukraine, with Russia claiming a duty to protect them. This conflict came to a head in 2014 and resulted in Russia annexing a piece of Ukrainian territory known as Crimea, the first time since the Second World War where one European country took territory from another. Since then, Russia has sought to sow chaos and division in other parts of the country, most notably with its support of separatists in the Donbas region in the south-east of the country.

The Russian point of view:

While it is sometimes fashionable to attribute current events to the simple flailing of pieces around a proverbial chessboard by an adversarial madman with the hope of appearing as erratic and unpredictable as possible, we prefer an analytical approach that assumes a deep understanding of the incentives and constraints on the part of all actors. One could argue that Putin’s Russia is playing from an enviable position of not having to consider the various distractions and internal politics of an unwieldy proper democracy. It is probably even safer to assume that they are less distracted from a geopolitical standpoint, as compared to the US having to consider several flashpoints at once. At the very core of the issue, Russia wants to avoid two potential existential threats:

- Foreign influence in what it considers its buffer zone countries (and the potential to stage attacks from those places)

- A foreign orchestrated uprising in Moscow

By their calculation, the former risk would increase the likelihood of the latter. Russia wants to ensure that NATO expansion does not continue eastward in either membership or influence. Additionally, it wants NATO countries to refrain from defense cooperation with Ukraine, especially in the form of weapons or troops that could be used to attack Russia.

The Russian fears of eastward expansion are not unfounded. In 2004, NATO expanded for the 5th time, adding seven new members including several former Soviet Republics such as Latvia, Lithuania and Estonia. There have also been smaller expansions since then. In 2020, Ukraine was named as one of six ‘enhanced opportunity partners’, a group that also includes Australia, Finland, Georgia, Jordan, and Sweden.

Russia’s optimal outcome:

In our view, Russia has sought to limit the expansion of NATO forces closer to its borders—which Ukraine strengthening ties with the EU prior to 2014 may have suggested as an eventuality—to maintain a proper buffer zone given Russia’s lack of physical geographic protection on its borders.

It is alleged, and we believe, that Russia (specifically Putin) wants perpetual instability and chaos in Ukraine to prevent the building of a prosperous, democratic, free-market society on its border for Russian citizens to admire with jealousy from afar.

Given this, we are not currently of the view that the end goal is to ever split western and eastern Ukraine and annex the former. Doing so would most likely increase the probability of:

- Western Ukraine becoming more purely united toward Western ideals

- Potentially bring the NATO border closer Moscow

- Open up the possibility of a (however truncated) prosperous democracy forming on the new Russian border

Given that the 2014 annexation of Crimea provides Russia better strategic military access to the Black Sea, it is unclear if there is more juice to squeeze from a strategic point of view. Given the above, we believe that the modus operandi for Putin will be to periodically and seemingly sporadically use covert and overt operations to ensure continued instability in Ukraine.

Relative power dynamics:

Any forecast or judgement of potential outcomes ought to center around whether Russia sees the current palate of consequences as prohibitive. As mentioned above, Russia’s relative strength and leverage tends to ebb and flow with the global macroeconomic environment, particularly as it concerns energy prices.

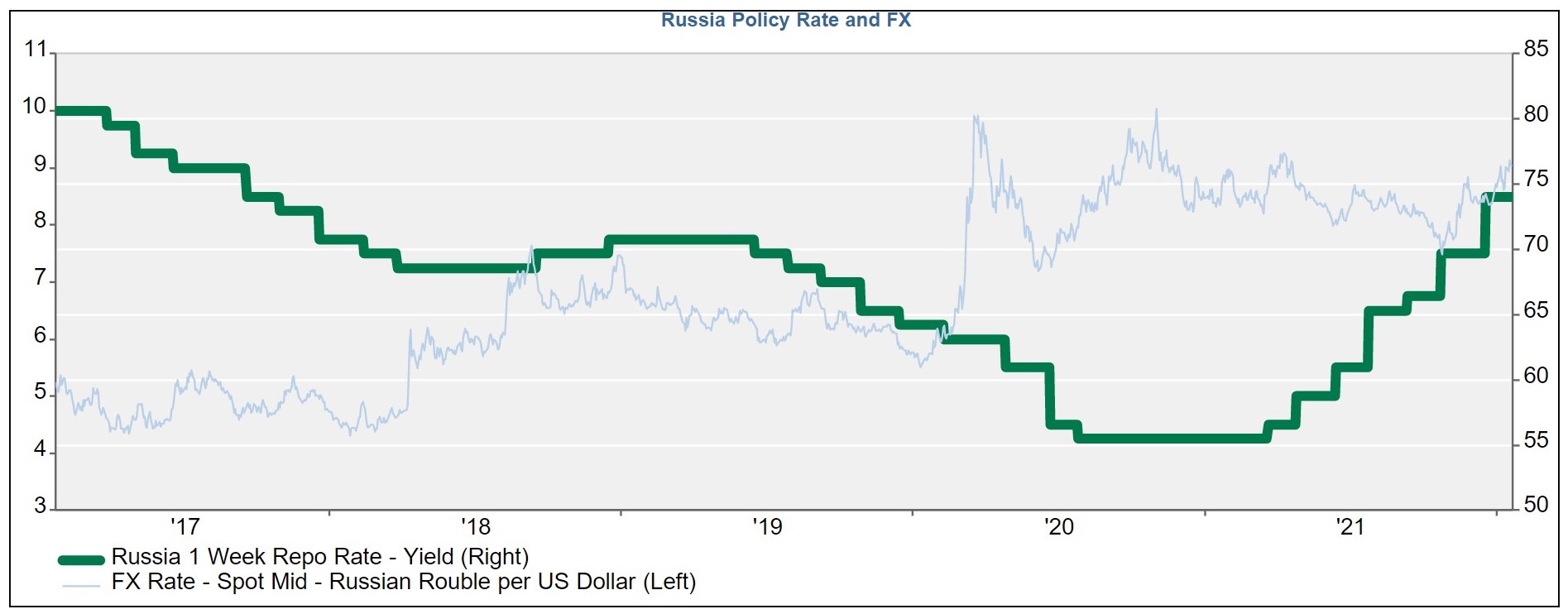

Today, Russia is more fundamentally resilient from a macro-perspective, or at least not prohibitively weak. It should therefore not be surprising that Russia is taking advantage of the current set of conditions to pursue its goals. In addition to a decent pricing environment for its energy exports, Russia has a solid fiscal position and plenty of reserves. This is not to say that Russia’s capacity to endure economic sanctions and consequences is limitless, a fall in the currency and higher inflation could weaken the economy substantially and cause domestic strife and unrest.

Furthermore, Russia is risking that they strengthen the positions of hawks, particularly as it concerns the Nord Stream 2 pipeline, which would damage Russia’s longer term economic prospects. Russia’s current adventurism could backfire in other ways, for example by hardening the resolve in favor of NATO membership in places like Finland and Sweden.

It is also useful to look at the other side of the relative power coin and consider the perceptions of Russia from this angle. Much ink has been spilled about the decline of US relative power in the world, a development that is either imminent or ongoing depending on who you ask. What is less debatable, however, is that the US does find itself in a challenging position, having to focus on at least three major geopolitical developments simultaneously.

The world is facing the prospect of conflict in Ukraine, Taiwan, and the Middle East all at once. All of these are of great concern to US foreign policy, and it is probably safe to assume that the adversaries in each case know that they are not the only one’s nipping at the Lion’s toes (so to speak) from different directions. Some have identified this multi-front scenario as collectively the biggest challenge to US foreign policy since the Cold War, and we don’t see that statement as much of a stretch. While there is no evidence of direct strategizing or secret handshakes among the US’s adversaries, each are eager to, at the very least, learn about the US appetite for conflict, as well as its resolve in terms of drawing lines in the sand following the recent sub-optimal conclusion to the multi-decade campaign in Afghanistan.

The risk of conflict and NATO’s retort:

In terms of the current state of negotiations, Putin wants the US to permanently rule out future NATO membership and defense cooperation with Ukraine. The key takeaway is that the Russians are asking the US to promise to prevent something that almost certainly will not happen anyway. This is not a steep ask because of the unanimous consent required for NATO membership, but rather the unanimous consent means that it shouldn’t be a big deal since every country would not vote for Ukraine to join NATO anyway.

Additionally, such a request not only makes the US appear malleable in the current environment, but also creates a precedent that the US can be coerced and intimidated, potentially creating moral hazard and inviting adventurism from other adversaries, possibly setting an example for China and Taiwan to mention one glaring instance. On a more basic level, one of the core foreign policy principles of the US has been that each nation has the right to self-determination as it pertains to foreign policy trajectory and alliances, and major powers do not have a right to a sphere of influence.

While the likelihood on assurances against NATO membership for Ukraine seems too unlikely for an agreement or compromise, there are still avenues for climbdown or ‘fudge’ solutions. For example, the US could agree to end defense aid to Ukraine. Having already increased Russia’s international prestige, this could be enough of a face-saving compromise for Putin to bring home to the Russian people. The US has reportedly indicated a willingness to discuss limits on intermediate-range missiles in Europe and limits on certain types of military exercises there as well.

The road ahead:

The full gamut of possibilities extends from a quiet retreat to meddle another day, to a blatant ground incursion and occupation of Ukrainian territory. Within those bookends is a lot of grey area that includes preserving the unstable status quo by use of covert sowing of discord or activity of pro-Russian militias, cyberattacks, or continued threats and posturing. We could see further escalation of conflict in the Donbass region, characterized either by covert or overt Russian involvement, a small-scale Russian encroachment, or a large-scale invasion. There are many variables at play and the current path may even depend on things as seemingly insignificant as the weather and how the ongoing energy shortages in Europe dictate the relative tactical advantages for each side. Similarly, the decisions of other US adversaries will also factor into the equation. One could reasonably expect Putin to push his luck more if, for example, the US were to become more distracted by tensions regarding Taiwan or Iran.

What has Russia already accomplished?

Another angle worth exploring as it relates to the path forward is to examine what has already been accomplished for clues as to the likelihood of a tactical retreat and becoming yesterday’s news. Putin has already increased Russian international prestige and in doing so, will most likely have improved his political standing and popularity among Russians. There is historical precedent for this objective as it reads like something out of a familiar playbook used since the conflict with Chechnya in 2000, the invasion of Georgia in 2008, and the annexation of Crimea in 2014. These foreign adventures boosted Putin’s credentials as a strongman leader and champion of Russia. He has also already caused a good deal of anxiety and sowed division within the US.

Perhaps more importantly, Putin has already sent a reminder message to the people of Ukraine. Only around 40-50% of people in Ukraine favor joining NATO. Russia established a credible threat of involvement, unrest, and violence if Ukrainians pushed to join. Similar to the tactics China uses in Taiwan, where despite increasingly identifying as Taiwanese rather than Chinese, most favor the status quo knowing that full independence would almost certainly entail conflict and violence with a greater power.

At the end of the day, it’s about reducing the temptation to align with Europe since Russia simply cannot offer countries the type of economic incentives that the EU can. An example of this would be the relative economic outperformance of countries like Poland vs. Russia, since the former chose to align with the West. In other words, Russia does not have as many carrots, so they feel compelled to use sticks. Given what has been accomplished already, it is certainly not out of the realm of possibility for Putin to decide to go quietly into to the night, at least for the time being. Indeed, this scenario could become more likely if the situation in Kazakhstan evolves in such a way to require more attention.

How will the US respond?

The US has a decently formidable collection of non-military tools at its disposal. Following the annexation of Crimea, the US employed a host of economic sanctions including asset freezes, travel bans, trade restrictions, financial restrictions for Russian banks, and others.

While it can be argued that targeted sanctions have been a less effective deterrent in recent years, the US has indicated an increased willingness to weaponize its financial system in other ways, which could eventually include:

- Cutting Russia off from the SWIFT global payments system

- Restricting its ability to convert its currency into dollars or Euros

- Pressuring Germany to abandon planned use of the Nord Stream 2 pipeline.

A lack of consistent interests is the main constraint to a forceful Western response, hindering a unified approach. The EU has much more to lose given its current energy situation, and even within the EU, there are vast differences, with Germany in particular being very aware of its relative energy vulnerability since its decision to abandon nuclear energy. Germany has been much more open to allowing the Nord Stream 2 pipeline to move forward than other countries in Europe or the US.

Additional monitoring:

Besides signs of further Russian aggression and/or a US response to various scenarios, investors should also be monitoring for:

- Signs of a troop drawdown on the border

- Indications the US is willing to delay or stop arms shipments to Ukraine

On the other hand, we should also be on the lookout for:

- Signs that Russia is looking to destabilize the situation in Ukraine via propaganda, targeted misinformation, or orchestrated protests

- Or the use of agents provocateurs as a pretext for military interventions to protect Russians and Russian speaking people within Ukraine

Perhaps most important will be to simply monitor the rhetoric and communications from both sides. For example, Putin has recently referred to Ukrainian policy in the Donbass as “genocide”, which some fear may be a pretext to invade in defense of Russian speakers in the region. It always helps to try to claim the moral high ground in battles for hearts and minds.

Broad investment implications:

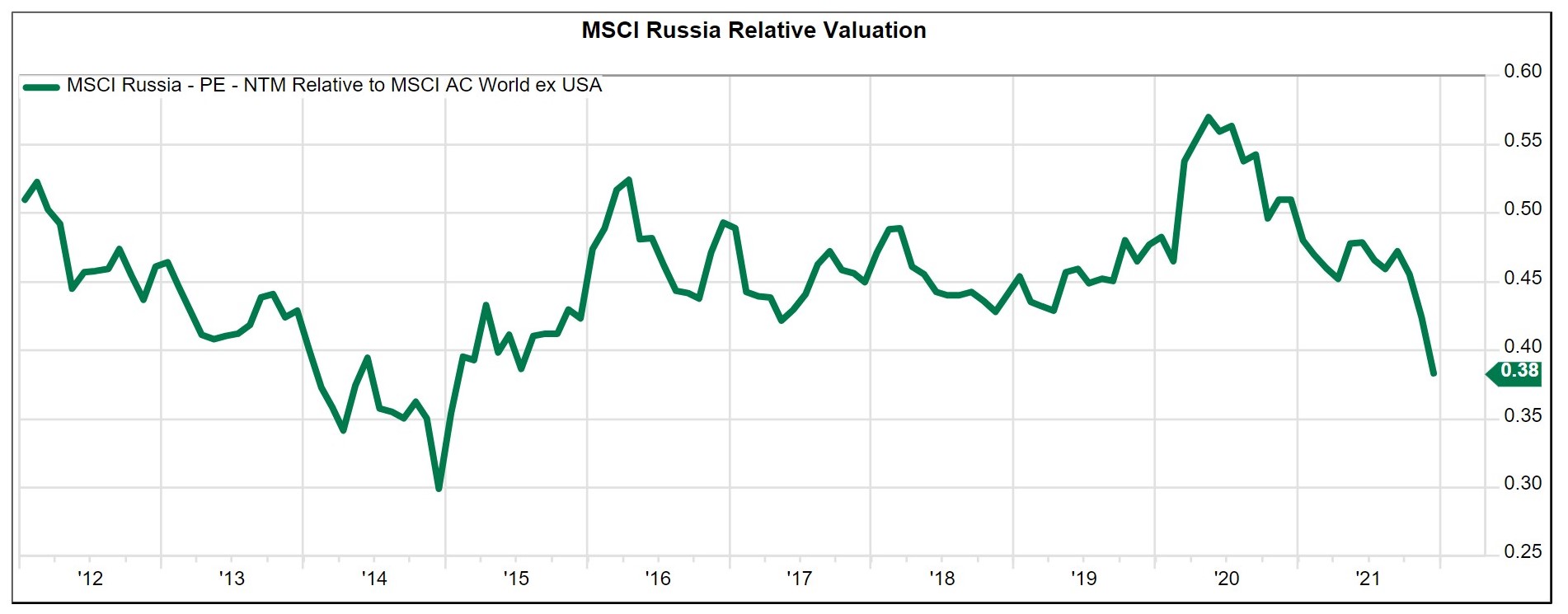

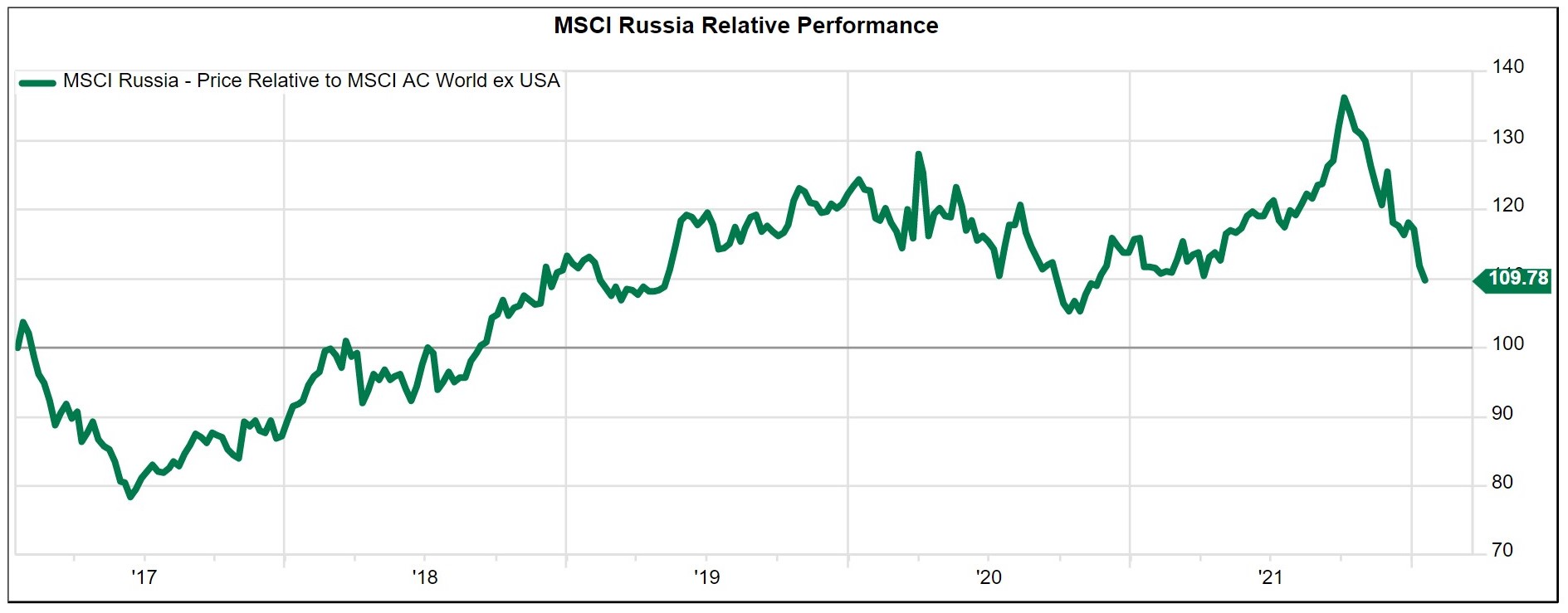

For Russian assets, the current situation only corroborates our view that Russia is a high-risk investment destination. This view is predicated on the country’s very feeble and corrupted institutions. The legislature and the judiciary are weak, and there are very few checks and balances within a political system that is centralized around an increasingly authoritative Putin. Not to mention, the Russian state has a well-documented history of seizing foreign assets and being very hostile to foreign investors.

Fundamentally, we generally seek to avoid investing in countries where the prevailing political system inherently incentivizes its leaders to take actions that are directly and vehemently at odds with the economic prosperity and entrepreneurialism of that country. In this case, Putin often sees improvement in his personal popularity following Russia’s recent economic sanction-inducing, quasi-invasions. The public’s response to those foreign adventures suggests that a subsequent slump in popularity could, at any time, elicit a similar action in an effort to stir up nationalist sentiment.

Therefore, at best we are looking at a system which creates apathy to foreign investors, and at worse, one that puts political success directly at odds with the welfare of foreign investors. When the obvious incentives of the system change, we would likely become more enthusiastic about investing in Russia. Until then, investors face an infinite degree of political risk and uncertainty, despite some very compelling company-specific opportunities that do periodically arise.

Russia’s more nationalist posture and assertiveness over its claimed sphere of influence are symptoms of a world that is becoming increasingly multi-polar and unpredictable. A gradual shift in relative power dynamics over time, along with new communication technology avenues and a renewed race for technology hardware supremacy, are all coalescing to form a geopolitical risk environment that we expect will be markedly different than the recent past.

There will likely be periods in which risk appetite shifts rapidly, and volatility and risk premiums rise. Lastly, we believe an environment of elevated geopolitical risks over the next 3-12 months would lend upward support to the dollar, as well as gold, all else equal. We expect geopolitical tensions to ebb and flow over time but to be characterized by higher highs and higher lows in terms of their intensity and their effect on global risk assets. In such an environment, it is of paramount importance that investors remain alert and vigilant, but also to maintain the courage and conviction to step in and take advantage of opportunities when we believe market fears are exaggerated.

The details in visuals:

Source: FactSet (12/29/2006 – 03/30/2021)

Source: FactSet (12/16/2016 – 12/17/2021)

Source: FactSet (12/30/2011 – 11/30/2021)

Source: FactSet (12/23/2016 – 12/20/2021)

Our research team continues to monitor these topics and more. If you’re interested in hearing more of our monitoring points and views on an array of investing themes, then subscribe to our insights.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. The reader should not assume that investments in the securities identified and discussed were or will be profitable.