Millennials infamously found themselves as the generation who indulges in avocado toast and prefers to climb the corporate ladder by changing jobs. But they’re not the only generation making headlines and leaving their mark. Today, baby boomers, are retiring – or not retiring – and therefore influencing the labor market.

Baby boomers are those…

- Born between the years 1946-1964.

- During the baby boomer birth period, 4.2 million babies were added to the population each year.

- To put this into context, during the decade 1955-1964, 42 million more births were recorded than any other 10-year period.

- In 2023, this generation’s age ranges from 59-77.

65 has long been the magic number for many Americans when it comes to retirement age. So, as the tail end of the baby boomer generation blows out another batch of candles on their birthday cakes, many face the question, “Is this the year to trade in emails and meetings for relaxation and morning tee times?” One emerging trend is that more Americans are working through their 60s and even into their 70s. This can be attributed to longer life spans, the need to make ends meet, and financial incentives to retire later. Retirees are also easing into retirement with more part-time work. The bottom line is that the US workforce is aging.

While we have some continuing to participate in the workforce for longer, the other half is retiring. Since this generation is so large, we are seeing an impact on both sides. As the labor force navigates this generational shift, are there important lessons for investors assessing economic and market trends?

Are Baby Boomers Still Working?

Labor market discussions tend to focus on the changes in unemployment and wages that typically play out over the course of the business cycle. These measures get updated each month and change noticeably as the economy moves from expansion to ¬recession to and back to expansion. Demographic factors that drive long-term labor market supply move far slower and can be easily overlooked amidst the flood of economic data we are presented with every day. It is said that “demographics is destiny” and investors that ignore these long-term forces do so at their peril.

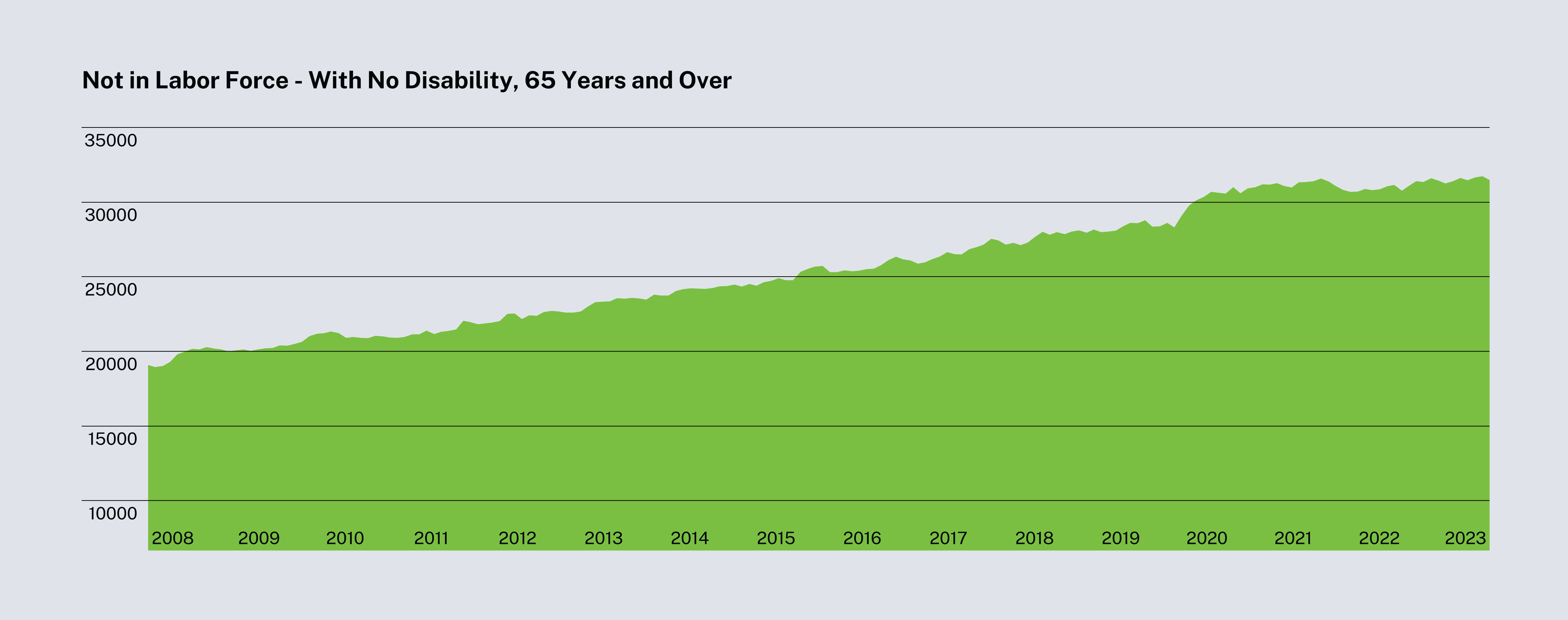

With that said, we are witnessing a notable labor force shift as more of the population is now in the 65+ age cohort, which has always been less likely to work. Tightness within the labor market stems from a labor force shift. This pushes the worker-to-retiree ratio lower. When the worker-to-retiree ratio gets moved lower, and the number of people in the labor force shrinks, so does that source of money. Today, that is translating to the ranks of retirees growing much faster than the number of new workers.

Ultimately, even without the pandemic as a boost, baby boomers would have begun retiring around this time, and the obstacles we are seeing arise today would still be there. Knowing this shift is occurring, younger generations will have opportunities to fill the gaps.

Source: Federal Reserve Bank of St. Louis. 06/01/2008 - 09/01/2023.

What are some of the potential long-term consequences of demographic shifts?

The generations following the baby boom have all had a smaller birth rate, meaning they make up a smaller portion of the population than the boomers did at the same age. There are not enough young people in the population to balance out the growing number of retirees creating a tighter labor supply.

Potential consequences include:

- Greater Wage Pressure: Relatively fewer workers in the labor force means that firms will need to compete harder to attract and retain workers. One notable way this is typically done is through higher wages and increased benefits.

- Wage Driven Inflation: As a result of higher labor costs, driven from the need for companies to pay their employees more, the cost of producing goods and services goes up as well. Many companies will seek to raise their selling prices to recoup the additional bite that higher labor costs take out of profits to maintain the same level of profitability.

- Lower Profit Margins: Ideally, all firms would be able to hike their prices to offset labor costs, however this is not the case. The firms that are unable to do so will face the prospect of declining profitability, which could lead to a variety of outcomes, such as struggling to meet debt obligations. When debt obligations are not met, a company could be forced to default, which could result in a loss of creditors and/or a strained relationship with suppliers and customers.

- Innovation and Productivity Enhancement: Firms will seek out solutions that can make their workers more productive. This will likely create investment opportunities for those companies that can provide tools to boost productivity as well as those businesses that lead their peers in operating efficiency.

- Lower Peak Unemployment: If labor is a scarce resource, firms may show a greater reluctance to lay off workers until absolutely necessary. This would be beneficial to consumer spending and in turn help lessen the economic fallout economy wide.

This shift will decrease economic growth, partially because older populations are no longer participating in the labor market, and, partially because of the effect that an aging population has on productivity. These dynamics may be perceived broadly as headwinds to future growth, but it is important to not lose sight of potential opportunities that may be created along the way.

Although there are downsides, there is an area of promise for the younger generations: wage growth. When the baby boomers were of prime working age, there was heavy competition for positions and growth mitigated because of the increased number of workers. Today, with fewer workers, there is more room for wage negotiations and upside growth.

Additionally, there could be increased opportunities for skilled workers. Skilled laborers are highly trained professionals with experience in a specific trade. Today, we are seeing major job shortages in this sector, in addition to increased reshoring trends.

What are the market impacts of an aging population?

There are various pros and cons to an aging society. While there are negative economic growth implications of an aging population, there are some sectors of the market that will thrive in this setting. The health care industry is expected to create more jobs than any other industry over this next decade because of the elevated demand that is anticipated for health care services.

While the demographic story will never have an ending point, there are always emerging trends that investors, economists, employers, and everyone in between can learn from to gain a better understanding of how different themes play a role in markets and the economy.

Enjoying this information? Sign up to have new insights delivered directly to your inbox.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.