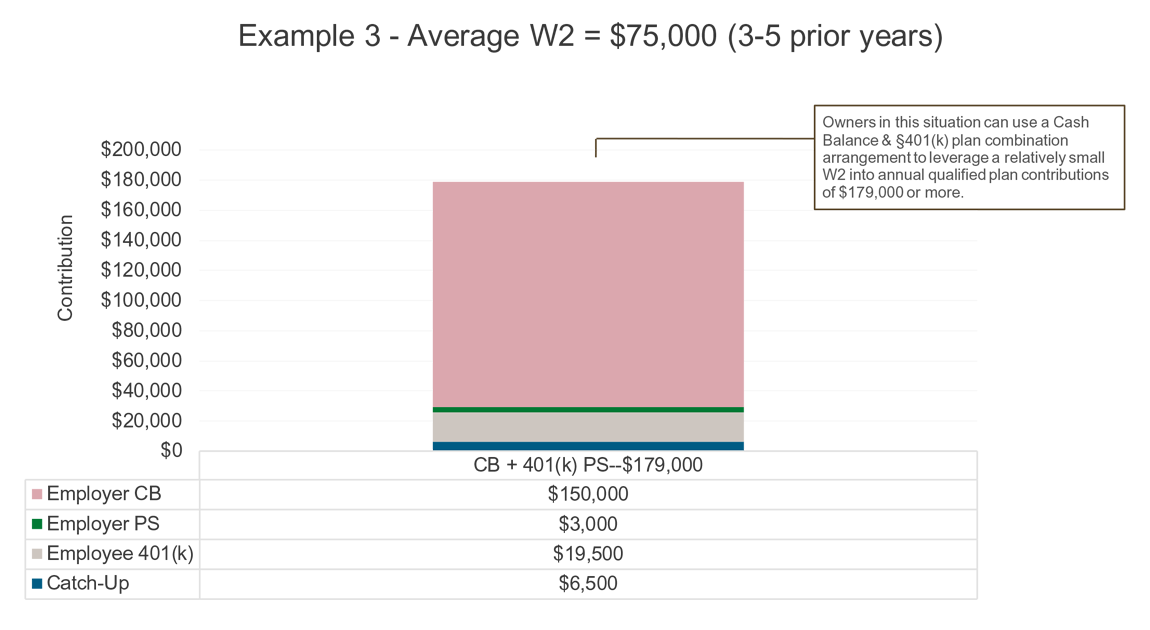

Leverage a $75,000 W2 into a $179,000 retirement allocation

S-Corporations (S-Corps) that are consistently and highly profitable (e.g. $350,000+/year in earnings) can leverage a relatively small annual W2 salary to minimize self-employment taxes and maximize qualified plan contributions by considering a range of plan designs.

S-Corps are unique in that owners can control how much self-employment tax (Social Security and Medicare taxes) they pay by controlling how much income is paid as a salary (i.e., reported on IRS Form W2) versus paid as a distribution of return on investment.

Owners of owner-only S-Corps are in the unique position of being able to avoid self-employment tax completely because they can elect not to pay themselves a W2 salary and they have no employees that require a W2 salary. These S-Corporation owners are often advised to take a minimally reasonable W2 income to prevent the appearance of avoiding self-employment taxes. Any remaining income over and above the W2 amount is considered pass-through income and avoids self-employment taxes.

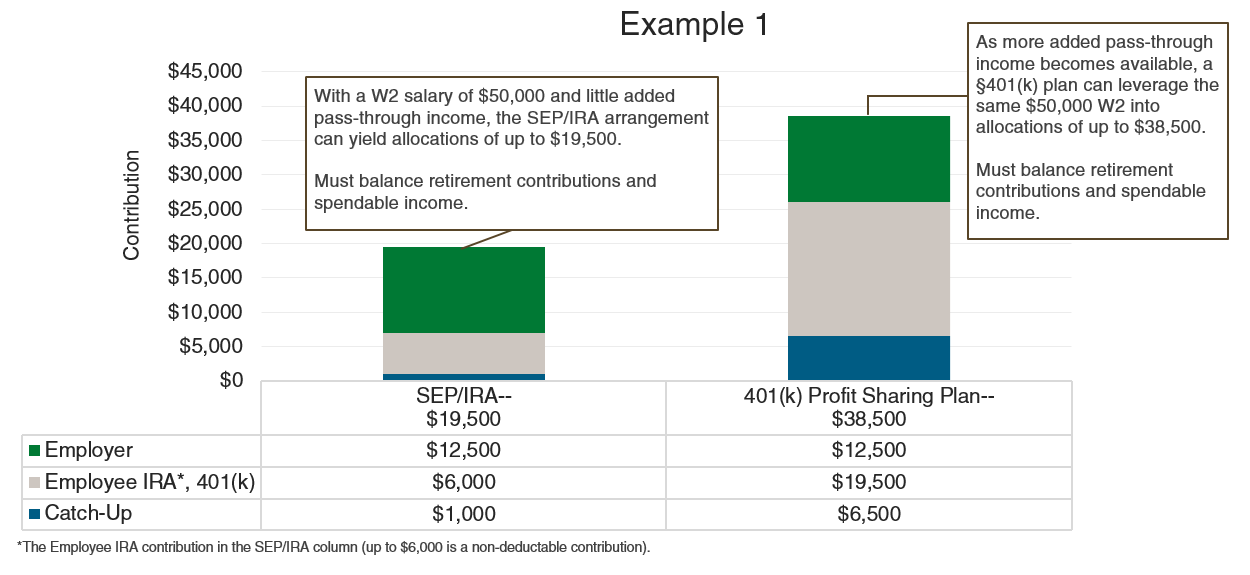

Unfortunately for S-Corp owners, only W2 income can be recognized for qualified retirement plan purposes (not the pass-through income). Therefore, if a W2 is minimized, so too will be the contribution to a Simplified Employee Pension (SEP) or other defined contribution plan. For example, for a W2 of $50,000 the maximum SEP contribution is limited to $12,500 (i.e., 25% of $50,000).

The amount of available pass-through income drives the ability to generate qualified plan contributions that exceed 25% of the owner’s W2 income. Consider the following business profile:

- Single owner S-Corporation

- Age 55

- Average W2 = $50,000 (3-5 prior years)

We can help

You don’t have to be a plan design expert to bring these ideas to your business owner prospects and clients. We can help you identify candidates and provide expertise to help you navigate specific situations.

Contact usExample 1

Additional pass-through income: $0 - $100,000/year

These owners can generally benefit from either a SEP or a 401(k)/profit sharing arrangement.

| Owner-Only SEP Benefits | Owner-Only 401(k) Benefits |

| Zero to low cost administration | Higher contribution limits |

| No IRS filing requirements | Loans and Roth available |

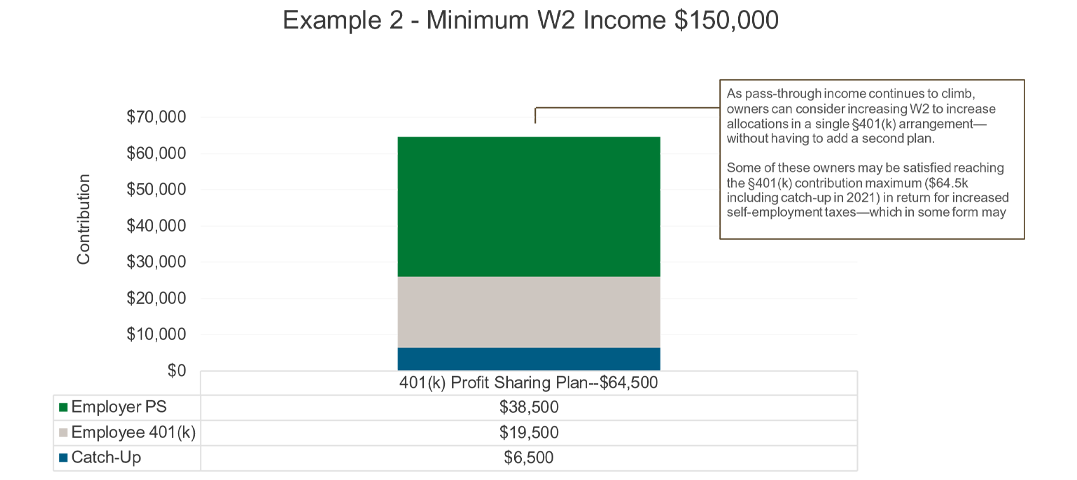

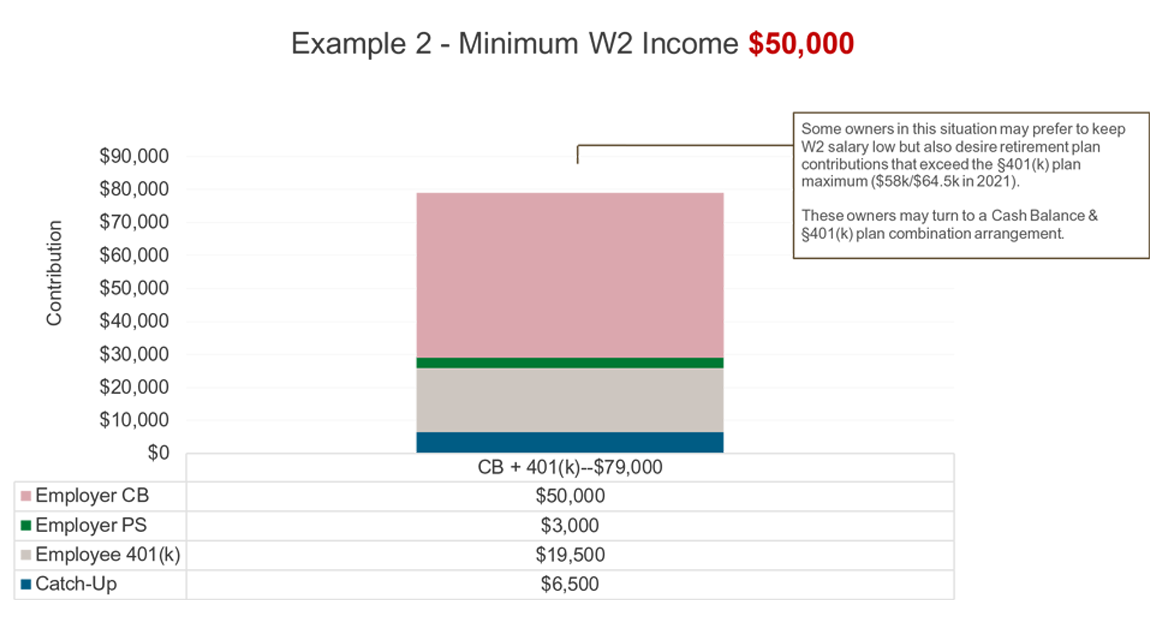

Example 2

Additional pass-through income: $100,000 - $300,000/year

Owners with more substantial pass-through income, sufficient historical average of non-dividend earned income, have more flexibility to build retirement savings. As illustrated in the previous example, a 401(k) Profit Sharing plan can create allocations of up to $38,500 (based on $50,000 W2 income). Owners can increase W2 income (up to $150,000) to increase plan allocations to as much as $64,500 (in 2021).

If the owner would rather not increase W2 income, a Cash Balance & 401(k) Plan combination can be easily customized to meet the desired annual contribution amount.

Example 3

Pass-through income: $300,000/year +

With even greater pass-through income, and a sufficient historical earned income average, comes even greater flexibility. This is common in Limited Liability Companies (LLCs) that did not make S-Corp elections in prior years. These highly profitable owner-only businesses can use the Cash Balance and 401(k) Plan combination to the greatest extent, while still maintaining a minimally reasonable W2 income.

When working with owner-only S-Corps, presenting these various options to increase retirement savings can be a powerful discussion that may add value to your practice. Owner-only S-Corps with limited pass-through income, are likely best served by a SEP. Owners with pass-through income consistently above the $100,000 mark may wish to graduate from the SEP to a traditional 401(k) Profit Sharing plan. These owners can adjust their W2 salary amount to generate the desired tax-qualified contributions; as well as consider adding a Cash Balance plan. Owners with increased pass-through income of $300,000, and sufficient historical non-dividend earned income, can leverage a relatively small W2 of only $75,000 into tax-qualified contributions of $179,000 or more using a Cash Balance and 401(k) plan combination. Another advantage for owners of businesses in litigious industries is that both the Cash Balance and 401(k) plan assets are protected from the claims of business creditors. Cash balance plans provide a unique planning opportunity for not solely owner-only businesses but are also appropriate for businesses of virtually any size that have strong, predictable, consistently high earnings and are willing to commit to larger plan contributions.

You don’t have to be a plan design expert to bring these ideas to your business owner prospects and clients. We can help you identify candidates and provide expertise to help you navigate specific situations. Please contact us today to learn more about how we can help grow your practice.

Analysis by Manning & Napier. Examples provided are for illustrative purposes. This material is for educational purposes only and does not constitute a recommendation or investment advice. It is not impartial and does not take into account an investor’s personal circumstances, or suggest any specific course of action. An investor should make investment decisions in consultation with their personal advisor based on their individual objectives and overall financial picture.