Key takeaways:

- Although credits spreads have widened across bond markets in 2022, they are still relatively compressed per historical standards

- Swaps are a derivative tool primarily relevant to institutional investors, but they can provide useful insights for all investors

- Swap spreads are rapidly widening within parts of Europe, implying that significant financial and economic stress is on the horizon

Over the past twelve months, fixed income markets have experienced a moderate selloff across sectors and down the quality spectrum. Credit spreads have widened, from high yield debt to highly rated asset-backed securities, from the US to abroad, and from overseas developed countries to emerging market economies.

Yet while the spread widening has been broad-based, outside of a few idiosyncratic credits or sectors (e.g., Chinese real estate), most credit markets are still trading within shouting distance of their historical average—not exceedingly expensive, but also not cheap or indicating significant stress. An extensive widening? Yes. Signs of panic? No.

Of course, for every rule there is an exception, and there is one area that is now flashing a significant warning signal. And this signal is now at a level not seen in over a decade: European swap spreads.

Swaps 101

A quick primer on swaps and swap spreads. Put most simply, a swap is when an investor agrees to trade cash flows of one financial instrument for another. For example, swapping the semiannual interest payments on two different bonds (e.g., fixed payments for floating). There are other more complex swaps, but the exchanging of one series of expected cash flows for another is the gist of it.

In case it wasn’t obvious, and for clarity’s sake, the buyers of these derivatives are almost exclusively institutional investors, hedge funds, banks, etc. So, while swaps are not relevant investment vehicles for most financial professionals or their clients, the swap markets are relevant for the information that they tell us, and it is this informational piece where swap spreads come in.

Markets Are Trying to Tell You Something…

Swap spreads are the difference between plain vanilla swap yield from one of those institutional-grade financial institutions and the yield from a sovereign (e.g., a government bond), all else equal. This matters because, unlike financial institutions, sovereigns are perceived to have zero default risk. When you subtract that sovereign rate from the institutions rate, you get a sense for the market’s perceived credit risk assessment, a valuable piece of information!

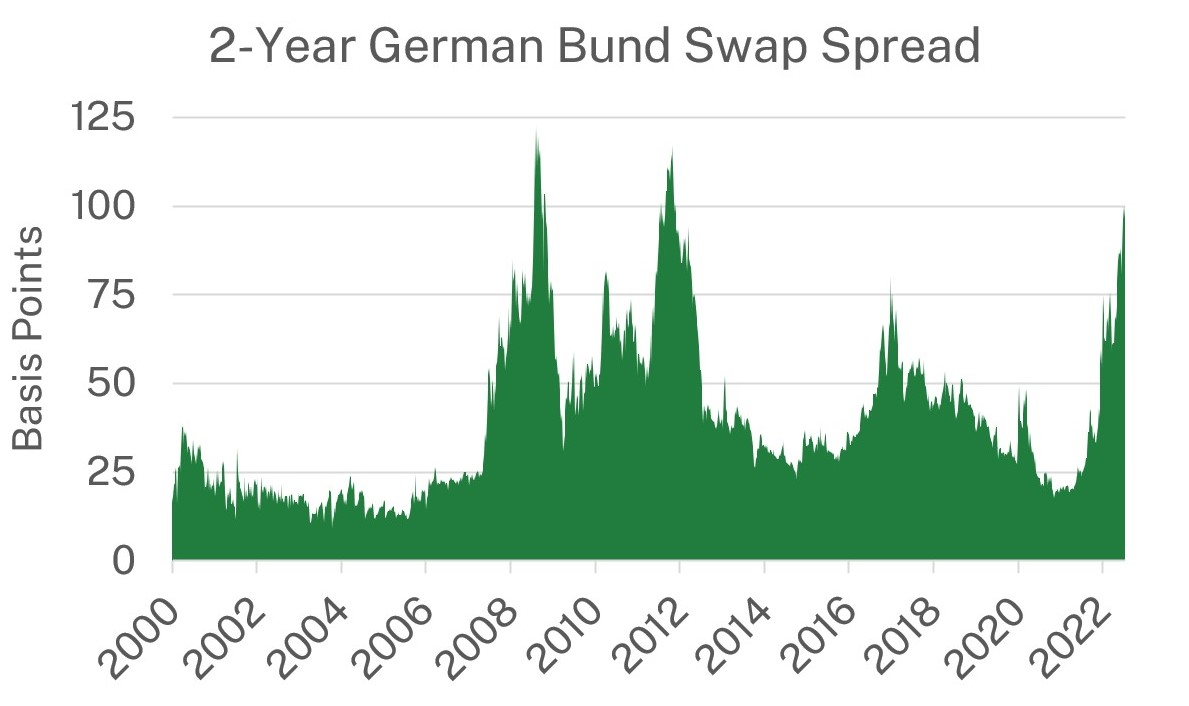

Below, the chart illustrates the 2-year German Bund swap spread. German bund swap spreads are now at their highest level since the European sovereign debt crisis in late 2011 and are approaching levels last seen during the depths of the Global Financial Crisis. During both of those instances, broader credit spreads were much wider than current levels, and they portended recessions in Europe.

Source: Bloomberg (03/03/2000 – 09/13/2022).

There is reason to believe the worries are somewhat isolated to Europe at this time. For one, the energy crisis stemming from the war in Ukraine is being magnified in Europe compared to the US. Secondly, EU markets are preparing for another Italian election whereby a coalition lead by a new up and coming far right party is adding uncertainty to an already fragile market.

We are not seeing as much stress in US swap spreads, for now, but we are on the lookout for other signs of credit stress in financial markets. We will continue to take a cautious approach to credit risk in client portfolios and, in the meantime, are waiting for better opportunities to add risk.

Our research team continues to monitor these topics and more. If you’re interested in hearing more of our monitoring points and views on an array of investing themes, then subscribe to our insights.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product.