Cash Balance Plans have been around for many years, but were fraught with controversy stemming from age-discrimination lawsuits brought against plan sponsors who converted their traditional Defined Benefit (DB) Plans to Cash Balance Plans. It was not until the passage of the Pension Protection Act of 2006 (PPA) that plan sponsors finally received a green light to implement Cash Balance Plans without fear. Since then, these plans have regained popularity, especially among small- to mid-sized professional businesses.

Here are some statistics that illustrate the demographics of Cash Balance Plans among small- to mid-sized employers. As of 20171:

- 92% of Cash Balance Plans are sponsored by employers with fewer than 100 employees;

- 81% of Cash Balance Plans have 24 or fewer participants;

- 57% of Cash Balance Plans had less than 10 participants, and 24% of plans had 10 to 24 participants;

- 96% of Cash Balance Plans are paired with a Defined Contribution Plan (e.g., Profit Sharing or 401(k) plan);

- 66% of Cash Balance Plans are sponsored by medical, dental, scientific, technical, and legal firms

A Type of Defined Benefit Plan

A Cash Balance Plan is a type of DB Plan, but works a little differently. To illustrate the difference, we first review what a DB Plan is and then compare a traditional DB Plan to a Cash Balance Plan. A DB Plan is any plan that is not a Defined Contribution (DC) Plan2. A DC Plan must provide for individual participant accounts, the balances of which determine participants’ retirement benefits3.

Thus, a DB Plan is a plan for which retirement benefits are defined; as opposed to a DC Plan where present-day contributions are defined. And, based on IRC §414(j), a DB Plan cannot maintain physical individual account balances to reflect the accrued benefits of the plan participants. Rather, accrued benefits are determined by a formula stated in the plan. The annual contribution is calculated by an Enrolled Actuary. The contribution is an obligation on the part of the employer and can change from year to year. The employer bears the investment risk. A DB Plan must provide for definitely determinable benefits4. To do this, the Plan Document must specify the benefit formula and how benefits are accrued under that formula.

Because a Cash Balance Plan is a DB Plan, it provides guaranteed benefits for employees. Cash Balance Plans are often referred to as hybrid plans, because while technically DB Plans, they are perceived as DC Plans to participants. They are like DC Plans because they provide benefits to employees by alluding to an account balance that is hypothetical. Contributions to this hypothetical account are typically based on a percentage of compensation. The hypothetical account is credited with interest each year based on some objective index or other amount as defined in the Plan Document. While similar to DC Plans in appearance, it is important to note that Cash Balance Plans are significantly different from the employer’s standpoint than DC Plans because the actual plan assets are unrelated to the hypothetical account and cannot be separated into individual participant accounts.

Traditional Final Average Pay Defined Benefit Plans

In a traditional final average pay DB Plan, the benefit formula might look something like: “10% of average monthly compensation multiplied by years of participation up to a maximum of ten.” Accordingly, an individual aged 55 years, with a constant average monthly compensation of $19,167 and ten years of participation expected, will earn a projected monthly benefit at age 65 of $19,167, or (10%)($19,167)(10) = $19,167. The form of this benefit is assumed to be a single-life annuity. At each year along the way, the individual earns a fraction of the projected benefit. This fraction is called the accrued benefit. In this example, the accrued benefit increases by 1/10th the projected benefit each year. This accrual pattern is shown below.

| End of Year 1 | $1,917/mo. | End of Year 6 | $11,500/mo. |

| End of Year 2 | $3,833/mo. | End of Year 7 | $13,417/mo. |

| End of Year 3 | $5,750/mo. | End of Year 8 | $15,333/mo. |

| End of Year 4 | $7,667/mo. | End of Year 9 | $17,250/mo. |

| End of Year 5 | $9,583/mo. | End of Year 10 | $19,167/mo. |

Simply put, each year the Enrolled Actuary converts the current accrued benefit to a lump sum present value at retirement age. This lump sum is then discounted back to the current year for purposes of determining—reflective of current plan assets—the plan’s annual required contribution.

Cash Balance Plans

A Cash Balance Plan works differently than a final average pay DB Plan, by defining the benefit to be the accumulation of a hypothetical account. A percent-of-pay allocation formula is specified in the Plan Document, instead of the type of benefit formula described above. Also defined in the Plan Document is an interest crediting rate. A hypothetical account (aka: the “cash balance” account) is created for each participant, and is maintained on paper as a bookkeeping artifice. Each year, the hypothetical account receives the allocations as defined in the Plan Document, as well as the guaranteed interest credits. It is the current accumulation of the hypothetical account that is then actuarially converted to an accrued benefit, payable at retirement age. Indeed, PPA has formally set forth that a Cash Balance Plan participant’s present value of accrued benefit is equal to the hypothetical account balance.

Separate from the hypothetical account bookkeeping are the actual plan assets. The hypothetical account is not related to actual plan assets and does NOT represent a participant’s share of actual plan assets. It is merely a bookkeeping artifice that defines participants’ accrued benefits. Because Cash Balance Plans are DB Plans, employer contributions are based on an actuarial valuation and may not equal the sum of participants’ hypothetical account additions. It is important to remember that the investment risk in a Cash Balance Plan, as with any DB Plan, remains with the plan sponsor, not the participants.

In a Cash Balance Plan, the benefit formula looks something like this: “For each plan year, a participant shall have such participant’s hypothetical account credited for that plan year with a hypothetical allocation equal to 51% of determination period compensation.” We assume that the plan document defines the interest crediting rate to be 4.5%; and that the normal retirement age is 65. For a participant aged 55 years earning $200,000 annually, the allocation for one year is 51% of $200,000 or $102,000. The accumulation of this single allocation at 4.5% over ten years (age 55 to age 65) is $158,403. This hypothetical accumulation is actuarially converted to a monthly accrued benefit (single-life annuity), from which the plan’s minimum required and maximum deductible contributions are derived. The hypothetical account addition—or $102,000 in this case—will generally be greater than the minimum required contribution and less than the maximum deductible contribution.

In summary, a final average pay DB Plan defines benefits as a function of average compensation and years of service. A Cash Balance Plan defines benefits as the accumulation of a hypothetical account that earns a specified rate of interest and receives additions generally based on a percentage of current pay.

The Appeal of Cash Balance Plans

The following question illustrates the appeal of Cash Balance Plans: Which plan would you rather have?

Plan A |

Plan B |

|

“If you work here for 30 years you’ll accrue a benefit equal to 3 and 1/3% of your average earnings for each year of paritcipation at age 65.” |

“You’ll get 18% of pay into your ‘account’ each year and it will earn interest at a rate of 4.5% annually.” |

If you’re like many, you probably don’t know what Plan A really means. You may then look at Plan B and remark “Now this I can understand… Cash… in my account!” But surprisingly, each plan is exactly the same in terms of the actuarially projected monthly benefit available at age 655. The difference is that Plan A is a final average pay DB Plan and Plan B is a Cash Balance Plan.

The exercise illustrates one reason for the popularity of Cash Balance Plans among employers today—the ease of communication and explanation to participants. From a participant’s perspective, the vested share of the hypothetical account balance is what can be distributed upon retirement or separation from service. Indeed, the participant receives a benefit statement at least every three years (and oftentimes annually) showing the value of the account.

A second reason for the popularity of Cash Balance Plans is the ability to control the cost of benefits for non-owner employees. Designing a plan to assign different percentage of pay allocations to different employee groups is known as New Comparability. New Comparability is designed to provide meaningful benefits to non-owners, while maximizing benefits for the owners—so long as complex non-discrimination testing is satisfied. Using the New Comparability approach in a Cash Balance Plan creates a plan that is both flexible in benefit cost and easy to communicate to employees. In general, benefits for all must be demonstrably comparable, but comparable doesn’t necessarily mean equal.

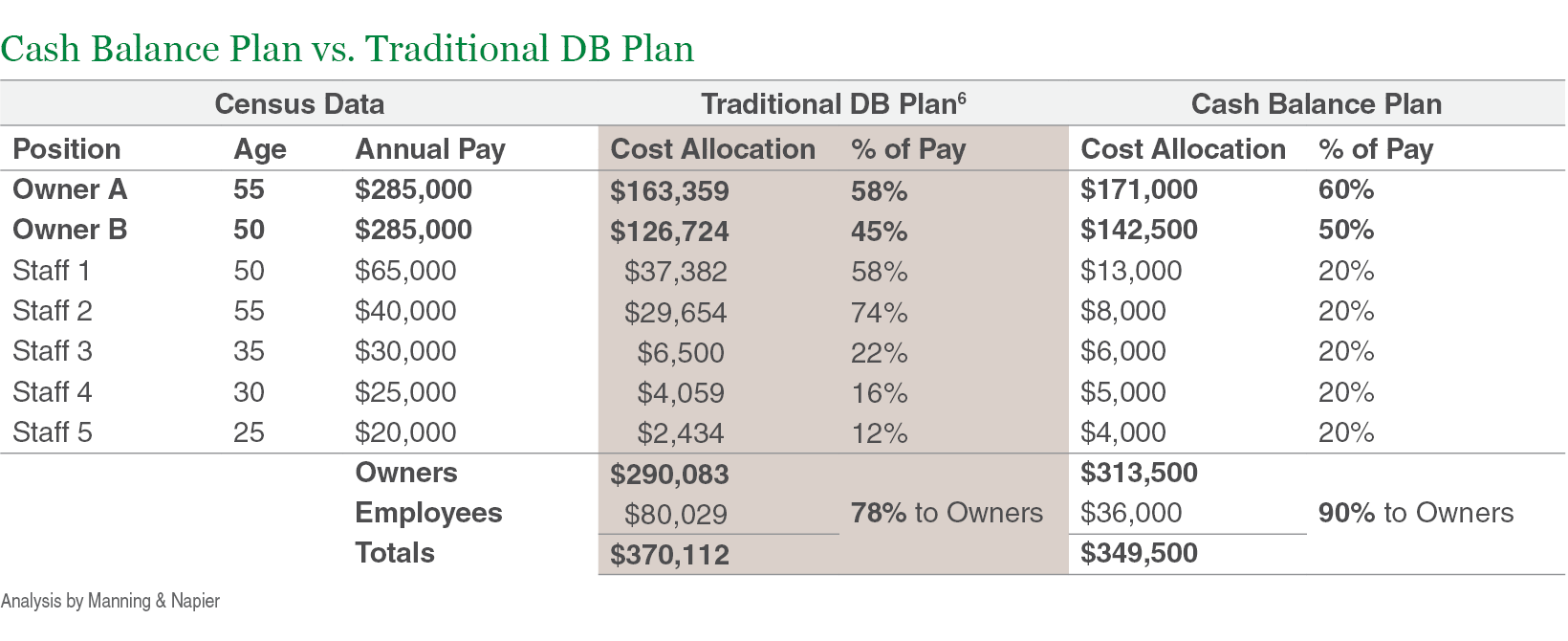

To understand this, it’s helpful to see a comparison of a New Comparability Cash Balance Plan formula to a traditional final average pay DB Plan with a uniform benefit formula. We’ll use a census for a typical small business with two owners and five other employees. The table below illustrates the first year cost allocation to participants for each such plan.

The “% of Pay” column under the traditional DB Plan is for illustrative purposes only, and has nothing to do with the actual final average pay benefit formula. A disadvantage of this design is the comparatively high cost of benefits for Staff 1 and Staff 2. The fact that their cost allocation as a percentage of pay is as high as that of the owners is an objection for many business owners.

On the other hand, the New Comparability Cash Balance Plan allows relatively comparable allocations to each owner, but reduces the cost on the non-owners by $44,029. Additionally, the owners’ share of the overall contribution increases from 78% to 90%.

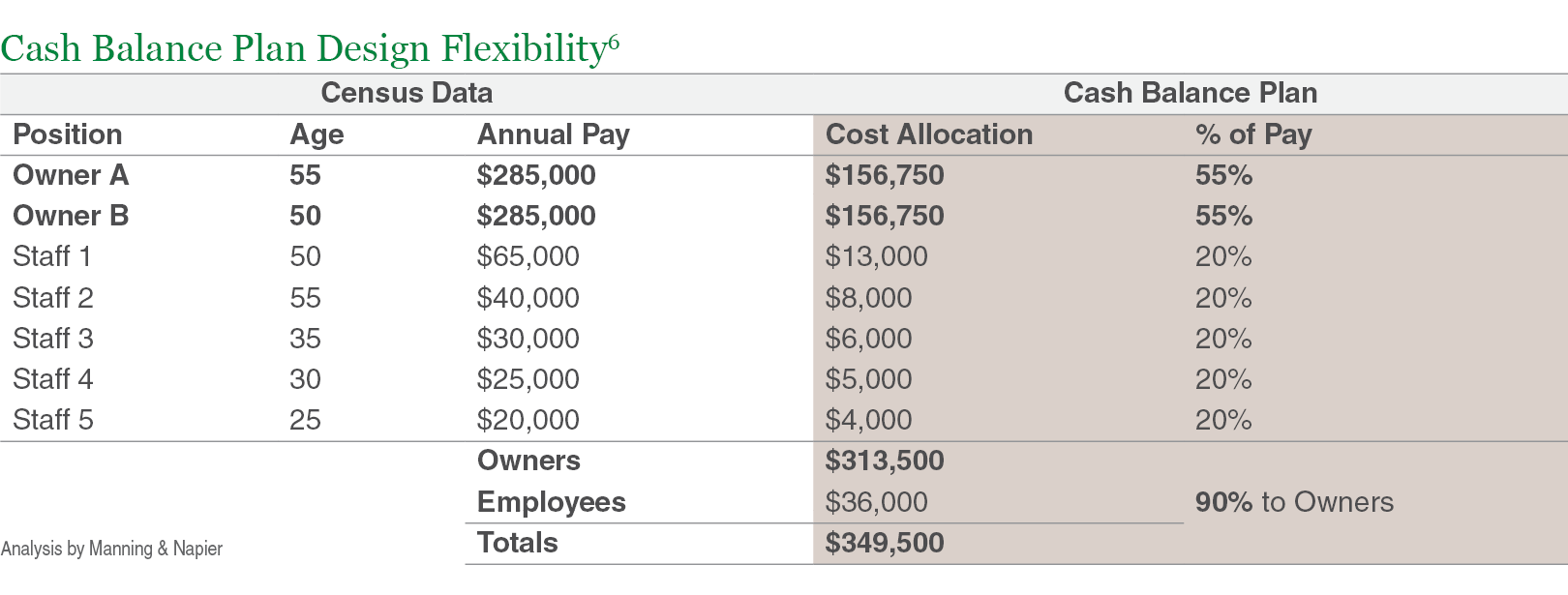

Another important advantage of the New Comparability Cash Balance Plan design is the ability to match the owners’ allocations to their respective percentage share of the business. This is especially true in partnerships and limited liability companies taxed as partnerships. If, for example, Owners A and B are each 50% partners in a partnership, it’s logical to assume that they want to equalize their allocations. With a uniform benefit formula in a traditional DB Plan, this is impossible when the owners’ ages vary because the benefit formula is based on years of participation until retirement. But by incorporating New Comparability in the Cash Balance Plan, the allocation percentages to owners can be customized, as illustrated in the table on the following page.

Here, because we’re equalizing the percentage allocations to the owners, we can reduce the allocation to each “staff” or “non-owner” participant and still satisfy non-discrimination requirements. In this design, almost 90% of the overall contribution attributes to the owners.

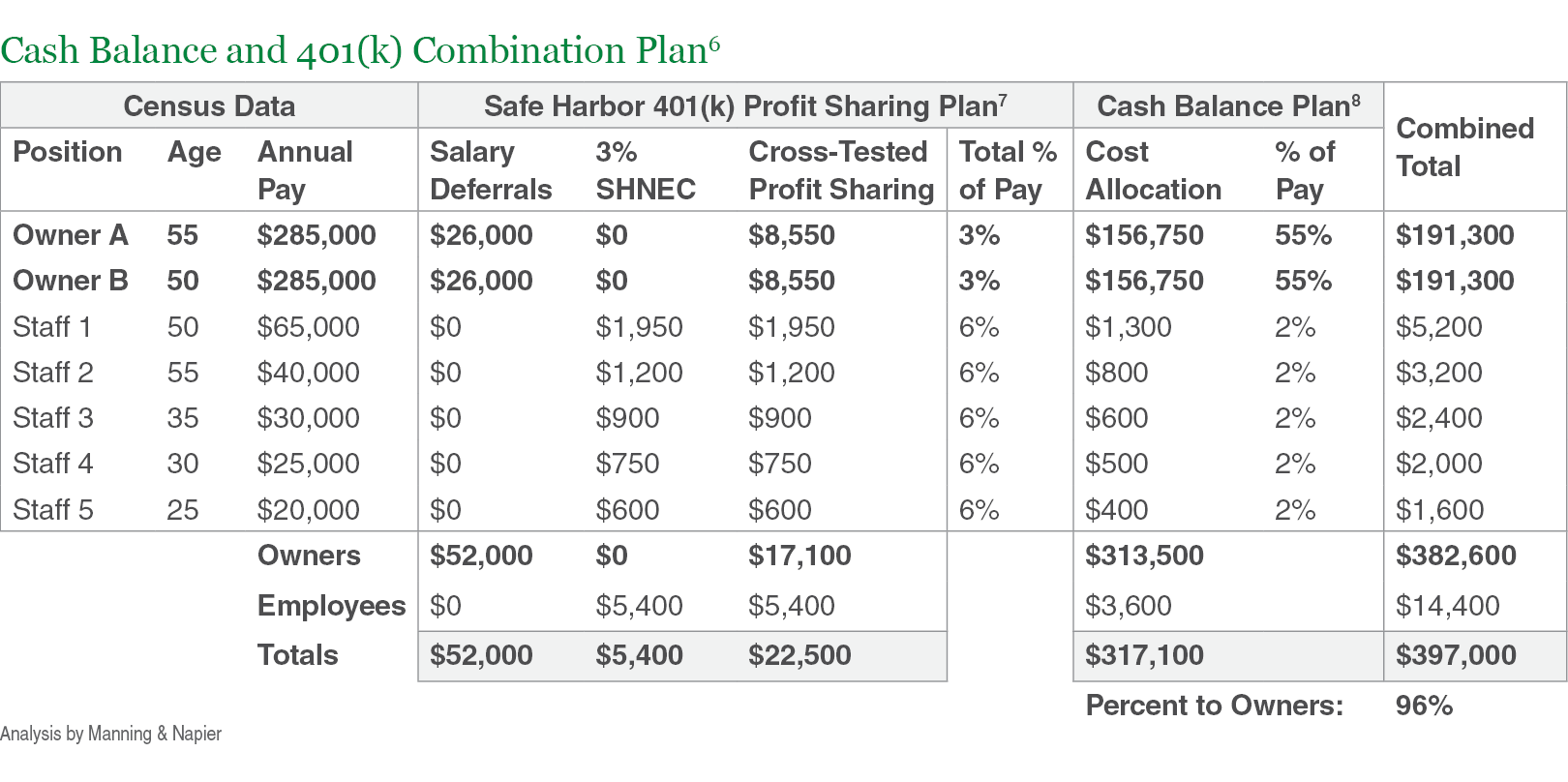

Many small business owners want to control costs even more, while further increasing their own allocations. In such cases, we turn to a combination arrangement, where the employer adopts two plans, a 401(k) Profit Sharing Plan and a Cash Balance Plan. The two plans are aggregated, which means they’re tested together to demonstrate non-discrimination. The next table illustrates the unparalleled flexibility of the Cash Balance and 401(k) Combination Plan arrangement.

In this design, the 401(k) Plan portion uses a 3% Safe Harbor Non-Elective Contribution (SHNEC) for all non-owners to allow the owners to make maximum salary deferrals plus catch-up contributions, without fear of failing the ADP Test for non-discrimination of deferrals. The 3% SHNEC also helps to satisfy complex dual plan Top Heavy Minimum and Gateway Test requirements.

Over and above the 3% SHNEC, a New Comparability profit sharing formula gives 3% of pay to the owners and an additional 5% of pay to non-owners. Combined, non-owners receive an 8% allocation in the 401(k) Plan, plus a 2% allocation in the Cash Balance Plan.

The non-owners receive the bulk of their benefits in the 401(k) Plan, while the owners receive the bulk of their benefits in the Cash Balance Plan (55% of pay). The profit sharing allocations are converted to benefit accruals at age 65 and are cross-tested in aggregation with the Cash Balance Plan benefits to demonstrate that combined employer contributions are non-discriminatory. Although assumed to be zero, additional voluntary salary deferrals by non-owners will not impact the testing of this arrangement.

Compared to the previous design, the combination design reduces the non-owner plan cost by $21,600, while increasing total allocations to the owners by $69,100. The percent of total plan contributions that attributes to the owners is an astounding 96%. We believe the flexibility of the Cash Balance and 401(k) Combination Plan is unrivaled by any other qualified plan design.

Watch on-demand: Cash Balance and 401(k) Combination Plan Design Case Study

Learn how a combination of cash balance and 401(k) plans can help business owners increase annual tax-advantaged retirement savings.

Watch nowConclusions

Cash Balance Plans have been around for many years, and have experienced renewed popularity among small- to mid-sized professional firms since the passage of PPA in 2006. Cash Balance Plans are DB Plans for which the employer bears the investment risk. They require annual contributions that can change from year to year. Cash Balance Plans are known as hybrid plans, because they share some characteristics of DC Plans, and resemble an individual account plan to participants. They work differently from traditional DB Plans because they define benefits as the balance of a hypothetical account. We believe Cash Balance Plans are more easily communicated to, understood, and appreciated by participants. When designed with a New Comparability chassis, Cash Balance Plans help employers to control the cost of benefits more so than a traditional DB Plan using a uniform benefit formula. When aggregated for testing purposes, a Cash Balance and 401(k) Combination Plan arrangement can provide extreme flexibility in controlling costs and maximizing benefits for business owners.

Manning & Napier offers other white papers covering topics relevant to qualified plans. Feel free to ask your representative about these and how we can help you design and implement the plan that is right for your business.

The information in this white paper is not intended as legal or tax advice.

Sources: ERISA Outline Book 2020, Internal Revenue Code, Treasury Regulations.

Use of the word “guaranteed” in the context of defined benefit plans refers only to the employers’ obligation to pay accrued benefits when due, and does not reflect potential eventualities, such as employer insolvency, that may require a participant to seek enforcement through legal recourse. Regulations require that benefits accrued under a defined benefit plan must be definitely determinable and cannot be reduced.

1Kavitz, Inc. 2018 National Cash Balance Research Report

2IRC §414(j): “The term ‘defined benefit plan’ means any plan which is not a defined contribution plan.”

3IRC §414(i): “The term ‘defined contribution plan’ means a plan which provides for an individual account for each participant and for benefits based solely on the amount contributed to the participant’s account, and any income, expenses, gains and losses, and any forfeitures of accounts of other participants which may be allocated to such participant’s account.”

4Treas. Reg. §1.401-1(b)(1)(i)

5Assumes the participant is 35 years of age nearest a plan valuation date of 12/31/2020, with average annual compensation of $30,000 and 30 years of projected plan participation.

6Assumes a benefit based on 7% of average monthly compensation multiplied by a maximum of ten years of participation, and a Target Normal Cost calculated using mandated segment rates for January 2020.

7A 3% Safe Harbor Non-Elective employer contribution is allocated to all eligible participants plus a 3% regular employer Profit Sharing allocation to non-owner participants. Complying with Safe Harbor provisions allows the owners to make maximum salary deferrals without failing required non-discrimination testing.

8Profit Sharing, Safe Harbor, Salary Deferral and Cash Balance allocations are converted to monthly benefits at age 65 (Normal Retirement Age) and aggregated to pass non-discrimination testing.