After a rocky end to 2018, global financial markets have bounced back. Stocks have showed their resilience. They’ve recovered most, if not all, of last year’s losses, rewarding investors who have stayed the course.

Although financial markets appear to be back on solid footing, slower growth, trade wars, high debt, and income inequality are putting markets in a precarious position. Sure, this seemingly endless summer may go on, but how much risk are you willing to take?

In this edition of our Semi-Annual Outlook series, we describe the businesses we are willing to invest in and provide our view on potential portfolio impacts heading into the second half of 2019.

It’s Déjà Vu All Over Again

Key Points

- As the economy decelerates to a slower rate, markets may become volatile

- Global financial assets look expensive in many countries, regions, and sectors

- It’s not that we’re negative, it’s that we’re being selective and deliberate with risk

If you are an investor, you’ve probably fared well this year. After a gut-wrenching December, markets have enjoyed a strong rally. It has not been smooth, however, and we expect the ride to remain rocky.

In our 2019 Outlook, we identified several key risks facing markets and the economy. Many of those risks remain issues today. The economic boost from tax reform seems to be wearing off, and the economy is fading back into its prior slow growth reality. Demographic changes, high debt levels, and rising income inequality are still holding the American economy back.

In January, we also wrote that US-China trade tensions were likely to linger, and indeed, they have only gotten worse. Tariffs can have far-reaching economic consequences. They hurt demand in the short run, and weaken confidence in the long run. In our view, the US-China political battle extends beyond tariffs, and we think the issue will simmer on and off for years to come.

Several other risks remain present throughout the world. We still don’t know to what extent populism and protectionism will impact financial markets. Brexit continues to be an ongoing soap opera that threatens the UK economy, and several emerging markets such as Brazil are facing geopolitical challenges. The US faces its own political uncertainty as it heads into the Democratic presidential debates and the 2020 election cycle.

By many valuation metrics, the US equity market is expensive with some sectors trading at even more extreme levels. In fixed income, low interest rates and tight credit spreads remain a challenge.

It’s easy to look at all of these risks and more, and decide investing is too scary. But if you take a selective and deliberate investment approach, you might find that there’s more opportunity.

Taking Action

We believe the US economy is showing signs of moving into later cycle territory. There are a number of risks, including the ones described here, adding another cloud of uncertainty over an otherwise sunny first half of the year.

In our view, markets are not fully appreciating the possible impacts of these concerns. The risk/reward balance for equities is not where we’d like it to be. Markets are likely to remain volatile, and stock market returns may be low in future years. We are positioning portfolios to be modestly underweight equities.

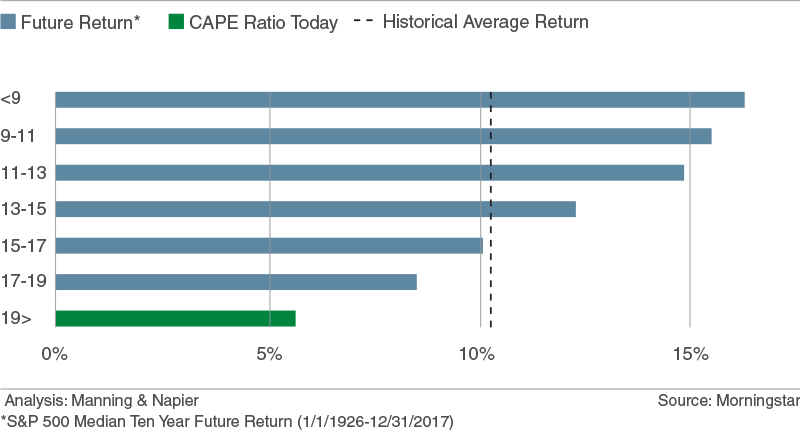

The Cost of Paying Too Much

Historical Returns Based on Starting Valuations (CAPE)

What is the CAPE ratio?

The Cyclically-Adjusted Price-to-Earnings (CAPE) ratio is a helpful valuation metric in determining market price. Higher starting CAPEs tend to result in lower future returns.

Be Thoughtful and Take a Hands-on Approach

Key Points

- Within quickly expanding companies, look for growth at a reasonable price

- We prefer quality companies you’d want to own throughout an economic cycle

- Businesses with large economies of scale in concentrated industries remain attractive

When we look at where the market is today, we see a slowing economy with the potential for disappointing returns ahead.

Although we don’t love the macroeconomic environment, it doesn’t mean that we are taking all of our chips off the table. Our investment process suggests there are still a number of good opportunities out there if you take a selective approach, and that is what we are doing.

While there are dozens of individual securities across our multi-asset class portfolios, many of our investments tend to share similar characteristics. We are finding opportunities in a number of companies with features that could be grouped into these categories:

Growth at a reasonable price

We are keying in on areas of the market that are generating growth. Many of these kinds of companies can be risky. They are often growing rapidly and can be unprofitable, so we are being selective. For example, we like several names in cloud computing, digital advertising, and semiconductors.

Core/quality names

We are finding value in companies whose businesses are stable and strong. These companies have well-known brands and leading market positions. They are stocks we would be comfortable owning throughout an economic cycle. They include industries such as consumer packaged goods, food and beverage, and household product manufacturers.

Businesses in concentrated industries

Some business sectors tend to gravitate toward a small number of dominant players. With economies of scale, these winners can often grow into lucrative investments. We’ve identified a number of these potential industry leaders, including names within credit card payment networks, bond rating agencies, financial exchanges, and cell tower REITs.

Taking Action

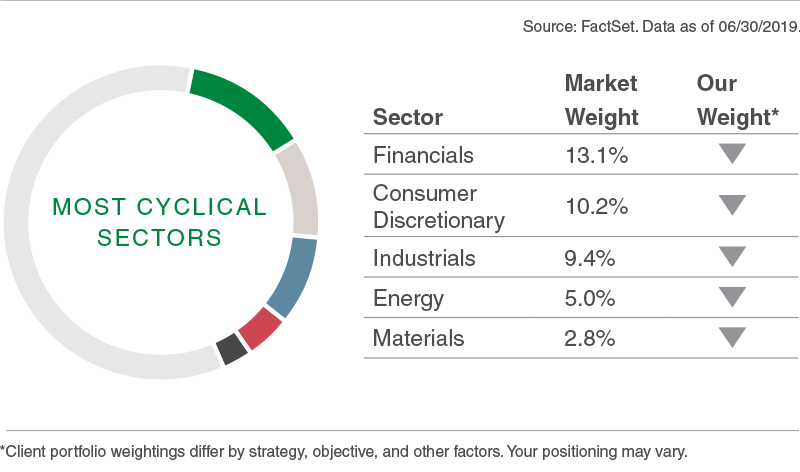

Companies that do exceptionally well/poor when the economy is expanding/contracting are known as cyclical. These cyclical businesses can generate outsized gains when times are good, but they can experience exceedingly difficult losses when times are bad.

Today’s stock market is in a tenuous place. That is why we are encouraging you to be thoughtful with your investments. Keep your hands on the wheel and use an active investment manager.

We’re Avoiding Overly Cyclical Stocks

You won’t always have the wind at your back

We are finding better opportunity in companies capable of generating their own growth regardless of the economic environment.

Reading the Tea Leaves of the Bond Market

Key Points

- As a result of growing concerns, the market is expecting the Fed to cut interest rates

- Meanwhile, the corporate bond market remains strong, conflicting with rate cut expectations

- These differing views reflect an uncertain future for fixed income, and we are positioning portfolios accordingly

Stock market forecasts get all the attention, but the fixed income side of the world has its own set of views. Right now, that crystal ball is cloudy.

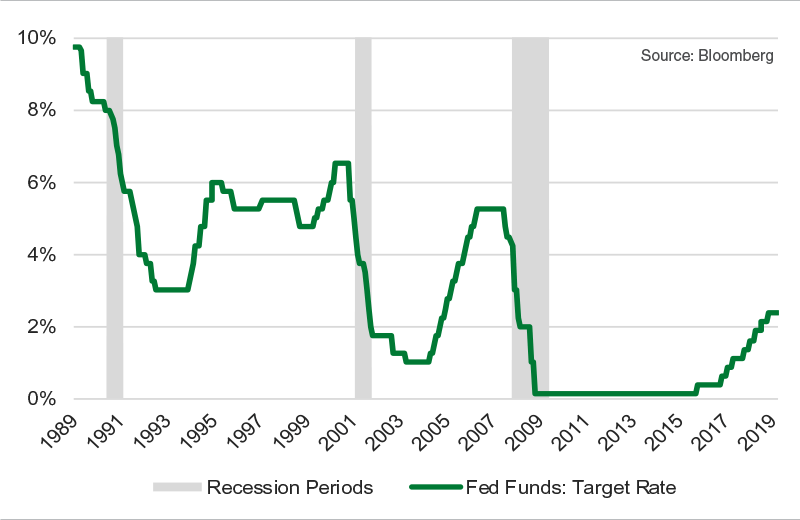

After raising interest rates four times in 2018, the Fed has done an about-face. It is now considering lower rates as the economic forecast becomes more uncertain. Over the next 12-18 months, the bond market is expecting a number of Fed cuts.

Fed rate cuts are a big deal. Most of the time, when the Fed reduces interest rates, they are doing so to stave off a downturn. There have been three major recessions over the past thirty years. As shown in the chart on the right, only twice has the Fed lowered rates outside of one of those recession cycles (1995-96 and 1998).

On the other hand, other areas of fixed income, such as corporate bonds (and credit spreads specifically) are more optimistic.

A credit spread is the difference in yield between a US Treasury bond and a corporate bond with the same maturity. Corporate bonds are viewed as riskier investments—businesses are more likely to default on payments than the US government—so investors expect to be paid more for taking on the risk.

A larger credit spread between US Treasuries and corporate bonds can indicate a worsening economy, since there is less confidence that companies will be able to pay back their debt. Although spreads have crept up, they are relatively low today.

Essentially, credit spreads are saying everything’s fine, while interest rates reflect concern over an economic slowdown. Eventually something will have to give. We are considering all possible outcomes, as well as our later cycle reality, as we make investment decisions.

Taking Action

As the economy has moved later cycle, we have been adjusting fixed income portfolios accordingly. Over the past several years, we have been gradually reducing our significant ownership of corporate bonds down to more conservative levels.

Within corporate bonds, we are also adjusting what we own and are taking on less risk. Instead, we are preferring to buy higher-quality securities while remaining active and selective. Wherever the market ultimately goes, we are prepared to be nimble to find the best possible opportunities.

Rate Cuts Often Align With Downturns

Not yet over the cliff

The Fed cut rates in ‘95-96, and again in 1998. The recession eventually followed in 2000, but only after the market had several more strong years.

We Know You Want Income, but Munis are Expensive

Key Points

- Municipal bonds have done very well for tax-sensitive investors

- The new tax code is driving changes to the municipal bond market

- Everyone’s situation is different, so make sure munis are appropriate for you

Municipal bonds (munis) are on a hot streak. The muni sector is almost on pace to draw in more money this year than in any single year of the past three decades. Demand is strong.

The inflows are drawing attention to what is normally a sleepy space. Muni bonds have long been considered an effective tax shelter. Their income is exempt from federal taxes—and can be exempt from state taxes too—making them very attractive if you are seeking tax-free income.

President Trump’s Tax Cuts and Jobs Act of 2017 had a profound impact on the market. The new tax law lowered individual tax rates for many households, generating speculation that muni bonds would become less relevant. The opposite has been true.

By capping the deductibility of state and local taxes (SALT) to $10,000 a year, the bill left many individual investors in high-tax states with significant tax bills. Those individuals are now turning to munis en masse as a source of tax-exempt income.

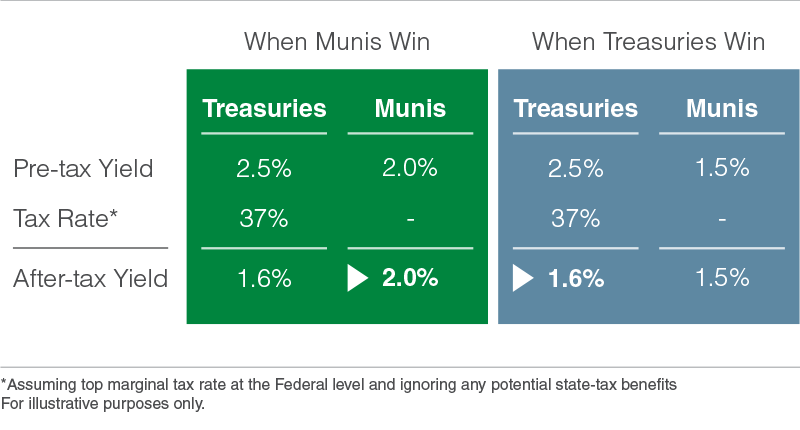

As a result, the muni bond market is being bid up, especially in high-tax states. New deals are frequently outstripping net supply, and bond yields are falling. As compared to Treasury bonds, which are not tax-deductible at the federal level, muni bond prices are as expensive as they have been in many years.

For high-net-worth individuals, as well as other tax-sensitive investors, the decision of whether to invest in muni bonds has become more difficult. Similar to corporate bonds, munis have credit risk that also needs to be taken into consideration.

Investors need to take a more deliberate approach to munis. You should holistically assess your entire financial and investment situation, and then speak with your advisor on whether munis are appropriate for you.

Taking Action

Muni bonds usually yield less than comparable Treasury bonds. As muni bonds have become more popular, their yields have fallen further. Today, the after-tax benefit of owning muni bonds versus Treasury bonds is as low as it has been in a decade.

Whether muni bonds remain appropriate for you depends on a number of considerations including the maturity length and credit quality of the bond, the location of the bond (for state tax purposes), and your own tax situation.

The Muni-Treasury Relationship

Hunting for a good deal

Depending on the bond, some munis remain a better deal than others, reinforcing why investors should use an active investment manager.

Watch Our Semi-Annual Outlook Webinar

Markets have had a great first half of the year. The good times, however, cannot go on forever, and issues such as slowing growth, trade, and politics are threatening the market expansion. In this second half update to our 2019 Outlook, our Director of Investments, Ebrahim Busheri, provides his perspective on markets and more.

Past performance does not guarantee future results. Unless otherwise noted, all figures are based in USD.

Morningstar, Inc. is a global investment research firm providing data, information, and analysis of stocks and mutual funds. ©2019 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

Manning & Napier Advisors, LLC (Manning & Napier) is governed under the regulations of the United States Securities & Exchange Commission as an Investment Advisor under the Investment Advisers Act of 1940. This newsletter may contain factual business information concerning Manning & Napier, Inc. and is not intended for the use of investors or potential investors in Manning & Napier, Inc. It is not an offer to sell securities and it is not soliciting an offer to buy any securities of Manning & Napier, Inc.

All investments contain risk and may lose value. This material contains the opinions of Manning & Napier, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.