In his capacity as Managing Director of Fixed Income, Marc and his team manage the implementation of our Fixed Income processes and frameworks for both multi-asset and fixed income specific strategies. In addition, Marc is a member of the Investment Policy Group, responsible for our economic and market overviews and asset allocation decision making. He oversees the firm’s core, high yield, and nontraditional fixed income strategies, brings over 20 years of industry experience, with 16 of those at Manning & Napier.

In this From the Desk letter, our Managing Director of Fixed Income dissects the rising rate environment, whether or not inflation has reached an inflection point, and portfolio construction considerations to prepare for a potential regime change.

Inflation - the Inflection Point?

For the past 6+ months, financial markets have been focused squarely on inflation. Accelerating aggressively to levels not seen since the early 1980s, inflation has led to an abrupt shift in developed market central bank policy, driving interest rates higher, the yield curve flatter, and putting an end to the ‘everything risk rally’ that has been partying on uninterrupted since the COVID-induced bottom in March 2020.

What is our view on inflation?

We expect inflation to decelerate from today’s very high levels over the remainder of 2022. Inflation’s rise has been driven by a combination of the pandemic, where service spending shifted to goods spending, and government support (e.g., enhanced unemployment, stimulus checks, etc.). These twin factors created a goods demand surge at the same time that supply chains were adversely impacted. For inflation, this was a toxic combination, further exacerbated by rising commodity prices.

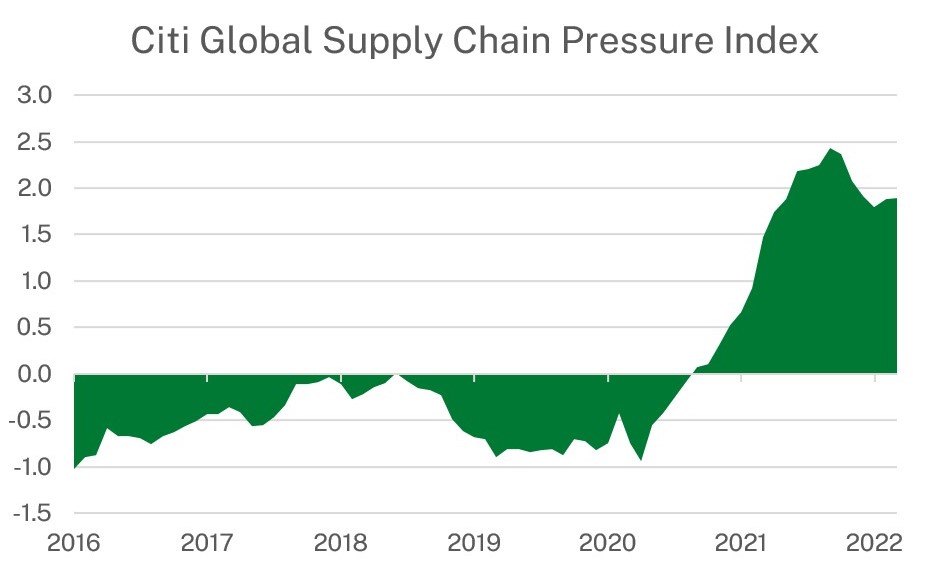

Source: Bloomberg (01/2016 – 03/2022).

As economies normalize; however, we are finally seeing demand swing back from goods into services as elevated supply chain pressures begin to ease. So, is the inflation problem now behind us? Unlikely in our view…

We expect inflation to come down from excessively high levels, but we continue to expect inflation to remain elevated. Specifically, we believe inflation will remain above the Federal Reserve’s two percent target rate. Key drivers include:

- Limited slack in labor markets, leading to robust wage gains and arguing that the economy is later cycle

- Underinvestment globally over the past decade, suggesting that commodity prices may remain elevated

- Sticky service inflation, which is likely to linger at higher levels given shifting consumer preferences, wage gains, and housing demand

- Inflecting secular forces (i.e., populism, globalization, and monetary and fiscal policy) that may become less of an anchor on inflation then we have seen over the past decade

Inflection Point?

We view the recent March CPI release (released on April 12, 2022) as having the potential to be one of the more significant data points of the year. While both the headline CPI number, +8.5% y/y, and core CPI, +6.5% y/y, set new highs, the rate of change decelerated, leaving us to wonder whether inflation is in the process of topping out. Notably, core CPI only increased +0.3% m/m, ~3.6% annualized. Decelerating inflation is in-line with our expectations, based on our analysis of survey data, base effects, easing supply constraints, changing consumer preferences, and the impact of a slowing global economy.

Although this is only one data point, should it represent a trend change, we believe it would have important impacts on the economy, monetary policy, and markets going forward.

- For the economy, slower inflation would improve the outlook for consumers who, despite strong nominal wage gains, have seen a reduction in purchasing power, pressuring consumption (negative real income growth à wage growth less inflation).

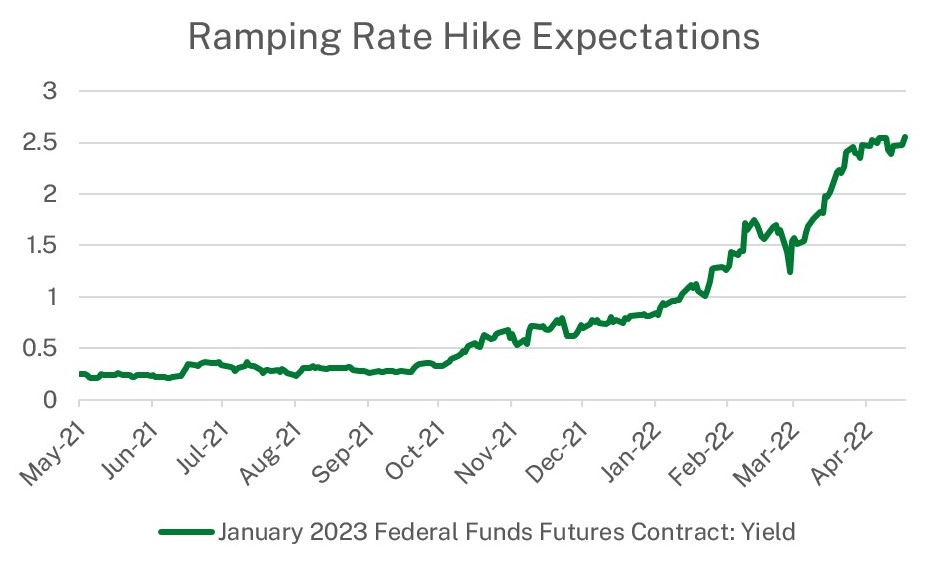

- Critically, peak inflation may lead to peak central bank hawkishness. This need not involve rate cuts or even a reduction in market expectations for upcoming interest rate increases. Instead, it may lead to an end of the market trend of consistently pricing in an ever higher level of the Federal Funds rate.

Source: Bloomberg (05/03/2021 – 04/19/2022).

The impact may manifest in a shift in narrative and in investment backdrop, away from the very challenging one we have experienced over the past few quarters with respect to interest rates and risk assets. Specifically, it may provide a period of consolidation, perhaps halting both the increase in interest rates, as well as the curve flattening, both of which have been pressuring risk assets (i.e., credit spreads and equities).

What are we doing with our client’s portfolios?

The past two market cycles were each roughly a decade long. Yet just 2 years removed from the depths of the pandemic sell-off, we believe the economy and markets are already in the later stages of the cycle. There are an infinite number of paths going forward, but our current thinking is that we believe the economy and markets are likely to move in one of two directions:

- Aggressive rate hikes. More central bank aggression at a time when the economy is already slowing could likely lead to a recession, perhaps in mid- to late-2023, and argues for lower treasury yields and wider credit spreads over the next 12-24 months.

- More cautious rate hikes. Central banks find balance in removing accommodation without causing a recession, achieving a ‘soft landing’. In our view, this could lead to a period of consolidation in interest rates and a reprieve for risk assets. Although this period could sustain for half a year or so, given that the labor market is already very tight and that we expect underlying inflation pressures keep building, we would therefore expect the Fed to still need to increase interest rates anyway. This scenario would require rates materially above current expectations for 2023 and 2024 and eventually lead to another difficult period for rates, risk assets, and the economy (i.e., a recession).

We have been de-risking our credit exposure—decreasing the amounts and increasing quality—across our fixed income portfolios over the last 6 months. Despite the potential for a temporary reprieve, we view this as appropriate positioning for clients, particularly as credit spreads remain at low levels. With respect to duration, the outlook is more challenging. We have used the significant increase in interest rates over the past 6 to 9 months to add longer maturity bonds to client portfolios, while remaining marginally below a normal duration as long duration valuations remain modest. Going forward, if we see evidence of a ‘soft landing’ scenario playing out, we would protect client capital by reducing interest rate exposure (i.e., duration).

The past 6 months have been a difficult and volatile period across the financial markets. We believe that the potential peaking of inflation may be an important data point. The pace of the decline in inflation and subsequent Fed reaction function are likely to be key drivers of both the short-term trading environment, and ultimately, in determining the length of the current economic and market cycles.

Our research team continues to monitor these topics and more. If you’re interested in hearing more of our monitoring points and views on an array of investing themes, then subscribe to our insights.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product.