There are over 26 million owner-only businesses in the nation today. Many of these businesses can benefit from substantially increased retirement savings through the use of cash balance or traditional defined benefit plans. In general, an owner-only business consists exclusively of owners, partners and spouses; and has no non-owner (i.e., common-law) employees. Owner-only businesses are commonly formed as Sole Proprietorships, Limited Liability Companies or S-Corporations, and can be very profitable endeavors.

Consistently profitable owner-only businesses are uniquely suited for cash balance plans, as well as traditional average pay defined benefit plans. The following examples illustrate how a qualified pension—like a cash balance or traditional defined benefit plan—can meet the retirement savings objectives of successful business owners, young and old alike.

We can help

You don’t have to be a plan design expert to bring these ideas to your business owner prospects and clients. We can help you identify candidates and provide expertise to help you navigate specific situations.

Contact usA Young Business Takes Off

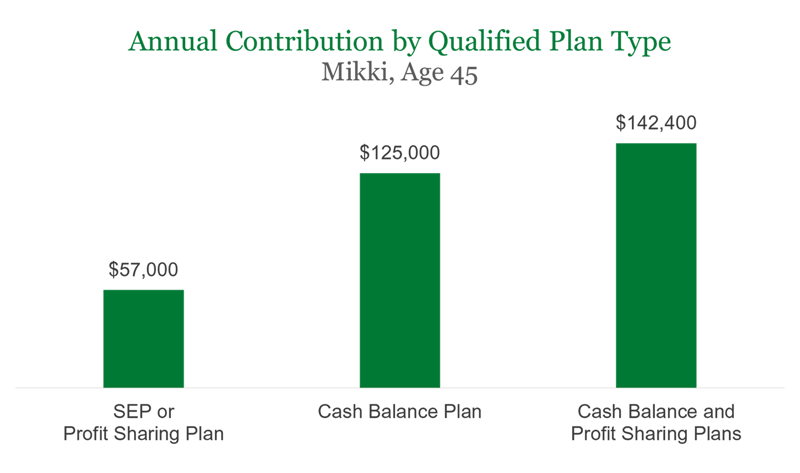

Mikki is a hard-working business entrepreneur. She’ll be 45 years old in 2021. She started her business in 2016. Between 2016 and 2021, the only income she took was a $50,000 annual salary. Finally, in 2021, after working tirelessly and pouring every available dollar back into her dream business, Mikki has hit her stride and will increase her annual salary to $290,000 for the foreseeable future. She knows she can do a SEP (simplified employee pension) or profit-sharing plan and save up to $58,000 this year and thereafter. But she’s confident that her business and income will continue to grow; and would like to save $125,000 a year if possible, on a tax-qualified basis.

After working with her financial professional and an actuary, Mikki learns that it is absolutely possible to meet her retirement savings objective—with a single cash balance plan! Based on her age, service and compensation history, Mikki can adopt a cash balance plan effective on 01/01/2021 and create a maximum deductible plan contribution of almost $232,000 for year one. To avoid front-loading the plan too soon, the actuary advises Mikki that annual deposits of $125,000 will sufficiently fund the liability. In fact, Mikki could achieve the same results with either a cash balance or a traditional average pay defined benefit pension. Furthermore, if Mikki wants the discretion each year to save an additional 6% of pay (up to $17,400 in her case), she can adopt a profit-sharing plan alongside the pension. The following chart summarizes Mikki’s alternatives.

For illustrative purposes only. Analysis: Manning & Napier.

The One-Hit-Wonder

Oftentimes principals of owner-only concerns generate a consistent annual income but may experience significantly increased income in a given year for various reasons. Examples are the trial attorney who wins a really big case; the songwriter who pens a hit song; or the independent consultant who earns a lucrative short-term contract. We refer to these situations as one-hit-wonders. While a large increase in income is generally considered a good thing, the one-hit-wonder is generally not enthused with the taxable impact and requires help to mitigate it.

While owner-only businesses establish qualified retirement plans for typical reasons that include increasing retirement savings, reducing taxes and sheltering assets from creditors, the one-hit-wonder can use a qualified defined benefit plan to alleviate or even eliminate the tax-bite of a short-term income surge, so long as the plan is intended to be permanent and funded.

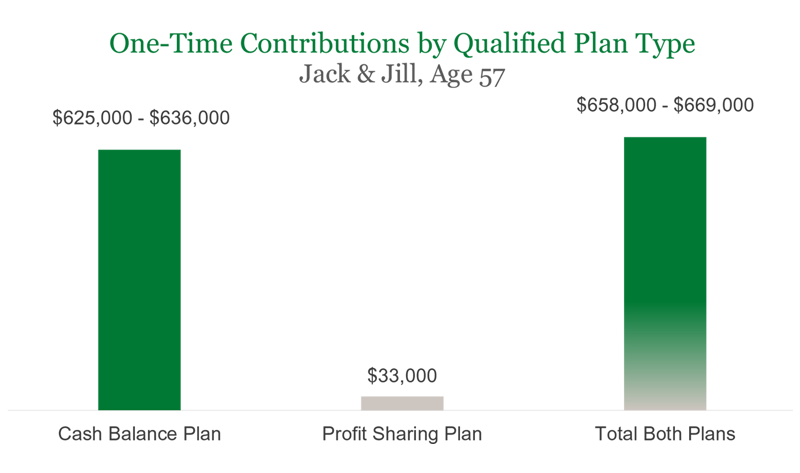

Let’s review an example. Jack and Jill are trial attorneys, each aged 57. They are married and operate their law firm as an S-Corporation. They have no other employees, and consistently pay themselves a $275,000 annual salary, each. They have been in business for 15 years and intend to retire in five years. In 2021, they won an extremely lucrative lawsuit and will receive a one-time payment of $625,000 for their efforts.

In addition to annual incomes of $275,000 each for 2021, Jack and Jill must deal with the taxes on the one-time payment of $625,000. Using either a cash balance or a traditional defined benefit plan, Jack and Jill can offset the taxable impact that’s headed their way. A properly designed benefit formula will create a lump sum liability of roughly $740,000 at age 62; and will support a Maximum Deductible Contribution of up to $636,000 for 2021. At a 5% annual return, a contribution of $625,000 will accumulate to about $797,675. Plan assets in excess of the projected lump sum can be used to pay plan expenses. Also, there is plenty of room under allowable limits to increase benefits and avoid overfunding.

To offset even more taxable income, Jack and Jill can also adopt a discretionary profit-sharing plan which will allow a contribution of up to $33,000 (limited to 6% of pay). And, at the end of 5 years they can each roll the lump sum present value of their respective benefits, and profit-sharing plan balance, into an IRA. The chart below summarizes these amounts.

For illustrative purposes only. Analysis: Manning & Napier.

Oars Out!

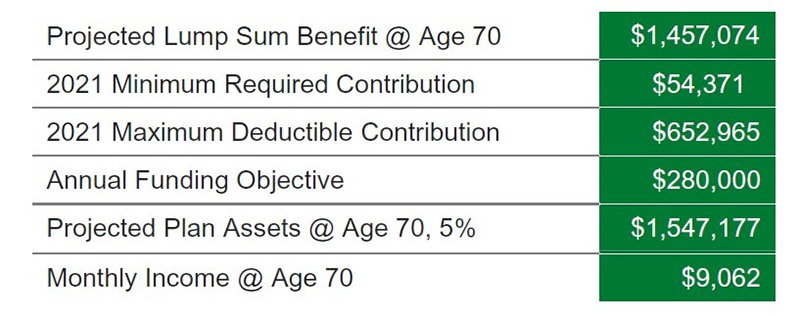

At age 64, Archie is in excellent health and still going strong. He’s built a successful architecture practice, from which he has derived an annual income of $300,000 to $500,000 in each of the last 20 years. He would like to work another 5 years and take his oars out by age 70. Archie and his spouse have various investments, and they own their home. But Archie would like to devote his remaining income producing years to funding a guaranteed baseline retirement income for his spouse in case he predeceases her during retirement.

Using either a cash balance or a traditional defined benefit plan, Archie can fund a joint and 100% contingent annuity of $9,062 per month. This means that at retirement age 70, the plan will begin to pay Archie $9,062 per month for the rest of his life. If he dies before his spouse, the plan will continue to pay the $9,062 monthly life annuity to her.

The lump sum dollar amount needed to pay this monthly joint and contingent annuity is slightly more than $1,460,000. To fund this benefit, Archie can make annual tax-deductible contributions of roughly $280,000 for each of the next 5 years. Assuming a 5% rate of return, plan assets would grow to over $1,500,000. This information is summarized in the table below.

For illustrative purposes only. Analysis: Manning & Napier.

Upon reaching age 70, Archie has some options. He can use excess plan assets to continue paying the actuary for servicing the plan and managing the monthly income distributions. He can also transfer the monthly benefit obligation to a structured settlement; and terminate the plan. If the plan is maintained and Archie predeceases his spouse, the estate can continue overseeing the plan actuary who continues work per usual. Alternatively, the estate can still terminate the plan and the remaining monthly benefit obligation can still be transferred to a structured settlement.

Summary

Cash balance and traditional defined benefit pensions can be powerful planning tools for owner-only businesses at virtually any age. Despite the perceived complexity versus their defined contribution counterparts, pensions still allow great flexibility for these businesses stemming from the fact that only owners participate; and there are no non-highly compensated employees (i.e., “NHCs” as defined in IRC §414(q)). Without NHCs, pensions are unencumbered with complex non-discrimination testing. Benefits can be crafted differently for different owners of different ages with relatively ease. Also, defined benefit plans are, by definition, all trustee-directed arrangements as individual participant accounts are not allowed. From the advisor’s perspective, this means you are working with only principals of the employer, and generally one single investment account.

Schedule a call today to learn what might be possible for your owner-only business prospects.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.