For thousands of years, people have used gold to trade goods and services, store wealth, and protect against the pernicious effects of inflation. While gold may not be as essential to the plumbing of our financial system as it was decades ago, it remains a popular investment.

The United States came off the gold standard a long time ago, and 2021 is the 50-year anniversary of the delinking of the US dollar from gold, known as the end of the gold standard. Despite the decoupling, there have still been a handful of bull markets in gold since then. During these periods, gold generated strong absolute returns and performed very well when compared to the equity markets.

We are always monitoring gold for its investment potential (see our most recent note last year), keeping an eye on its supply and demand balance, as well as other variables such as money supply, inflation, and real interest rates. We believe that current financial conditions favor a position in gold.

Shelter in the Storm

Gold has historically performed well during times of market stress. When markets become rocky, investors flock to the metal as the ultimate safe haven.

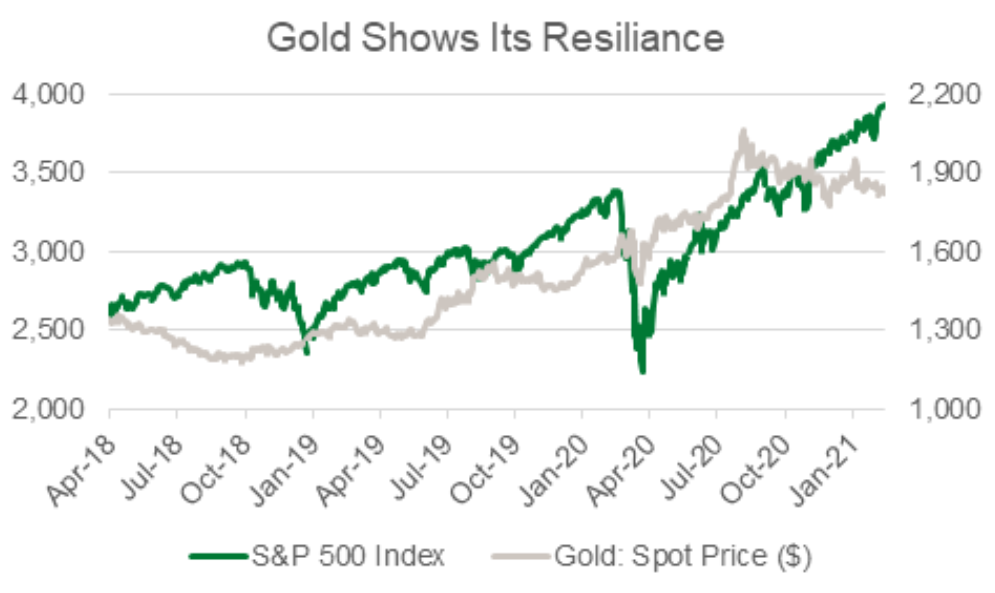

Past analysis of severe equity bear markets, as well as times of rising inflation, show that gold has had a positive effect on investor portfolios. Most recently, this dynamic held true during the Covid-19 induced market selloff in early 2020, as well as during the brief, albeit sharp correction of late 2018. During both periods, gold offered a degree of downside protection when equity markets were sharply selling off.

In addition to offering a level of protection in adverse market conditions, gold also tends to have little correlation with stocks and bonds, or at least little consistent correlation. Low or zero correlation is good because it means that gold is less likely to fall in unison with stocks or bonds. This provides investor portfolios diversification benefits, helping mitigate market volatility.

Source: Bloomberg (04/02/2018 – 02/12/2021).

Learning from the Past

History doesn’t repeat itself, but it does rhyme. After studying prior bull markets in gold, we identified three significant economic factors that have historically provided some insight into the future direction of gold prices.

Every gold bull market over the last 50 years has begun with a catalyst that propelled significant growth in the money supply. Each of those prior bull markets were proceeded by substantial US dollar money supply growth, making monetary expansion a key indicator. It is important to note that this alone does not guarantee a gold bull market, as there are many other variables at play.

Inflation is another metric that has traditionally been associated with gold bull markets. Our analysis shows that gold has a fairly consistent pattern of generating positive absolute returns when inflation is rising. Conversely, gold has generally fared poorly during periods of falling inflation.

Lastly, real interest rates deserve specific mention too as falling real rates have generally been a positive for gold, and vice versa. In our historical analysis, higher real rates have been associated with poor returns for gold, and lower real rates have been associated with strong returns for gold.

Where We Stand Today

We see the status of each of these economic factors, money supply growth, inflation, and real interest rates, as supportive of higher gold prices ahead.

Policymakers have been remarkably forceful in responding to Covid-19, resulting in substantial recent money supply growth in the US, and they appear willing to continue to throw money at the crisis in the year ahead. These current and future policy aims are contributing to growing inflation worries, and bond market inflation expectations have already climbed to multi-year highs. Moreover, the Federal Reserve’s desire to maintain interest rates at extraordinarily low levels has pressured real interest rates lower, and they now sit well below 0%.

At the same time, financial market sentiment is perhaps overly enthusiastic. Equity markets have climbed to all-time highs and valuations look stretched, and bond market yields are at very low levels, potentially challenging future returns in fixed income. Considering economic and market conditions, we have added to a basket of gold miners in our traditional, bottom-up investment strategies. As always, you can count on us to be willing to stand out from the crowd if our disciplines and convictions take us there, and we will continue adjusting portfolios as market conditions evolve.

Enjoying this information? Sign up to have new insights delivered directly to your inbox.

The S&P 500 Index is an unmanaged, capitalization-weighted measure comprised of 500 leading U.S. companies to gauge U.S. large cap equities. The Index returns do not reflect any fees or expenses. Dividends are accounted for on a monthly basis. Index returns provided by Bloomberg. S&P Dow Jones Indices LLC, a division of S&P Global Inc., is the publisher of various index based data products and services, certain of which have been licensed for use to Manning & Napier. All such content Copyright © 2021 by S&P Dow Jones Indices LLC and/or its affiliates. All rights reserved. Data provided is not a representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none of these parties shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.