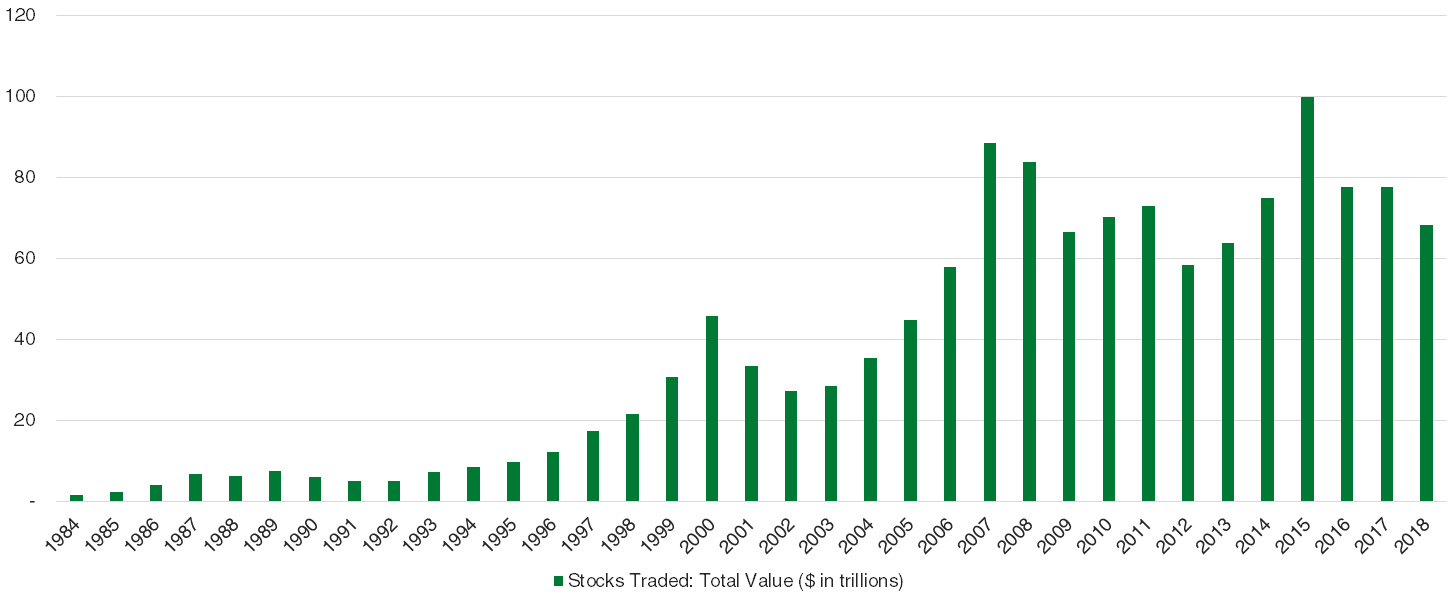

What if we told you that over $5 trillion worth of shares are traded every month? Or that every year, the entirety of the world’s GDP changes hands on stock exchanges all across the globe?

Stock investing is big business, but few think of how a trade is actually processed. When orders are sent, the financial exchanges play a huge role in making trades happen.

The Explosive Growth of Trading

Equities trading (or stock trading) is the most famous financial exchange venue. Nearly $80 trillion worth of global stock trades each year, but this glamorized business isn’t the reason why we started looking at financial exchanges as a potential investment opportunity. In fact, it was the lesser-known businesses that drew us in.

Unique Profile

We find the financial exchanges attractive for several reasons. From a big picture view, the financial exchanges have an important feature that separates them from many other investments. Because investors tend to trade more frequently when markets are stressed, the exchanges have generally done well in downturns. This dynamic made them a compelling fit with our more cautious economic outlook.

From a company by company standpoint, we were looking for businesses that fit our investment criteria by having sustainable competitive advantages. This required stock-by-stock research: there are more than a dozen mid- to large-cap financial exchanges across the globe, and they make money in several different ways.

More Than Meets the Eye

We analyzed the dominant financial exchanges both in the US and abroad and were able to group their business into six different categories: stock trading (developed and emerging markets), derivatives trading, market data, listings, and custody. We then categorized the business units by attractiveness based on our investment strategy criteria.

| Exchange Revenue Stream | Defensibility | Growth |

| Derivatives Trading/Clearing | High | High |

| Market Data | High | High |

| Cash Equities Trading/Clearing (Emerging Markets) |

Medium | High |

| Listings | Medium | Low |

| Custody | Low | Low |

| Cash Equities Trading/Clearing (Developed Markets) |

Low | Low |

Businesses that relied on derivatives trading and market data for revenues were particularly attractive as they had high barriers to entry and robust growth profiles. These business units were largely supported by fixed expenses and have lower capital expenditure needs.

For the derivatives business, traders enjoy low trading costs, but these low fees are offset by the much more lucrative margin costs, which they are required to hold. This is why derivatives traders look to reduce margin costs by netting their holdings. In order to net holdings, traders must have traded those holdings on the same exchange, and creating much stickier business for the derivative exchanges than you might think at first glance. It also makes derivatives trading a strong business for whichever exchange operator is able to be the first to setup shop.

Similarly, market data, and index licensing specifically, is an attractive growth area. As growth in exchange traded funds (ETFs) increases, fund managers look to use the most well-known and trusted index providers for their benchmarks. This creates positive network effects for the largest index providers and barriers to entry for competitors.

Large and Still Growing

The dominant exchanges in these businesses are already benefitting from network effects and possess massive scale. They include companies such as the CME Group, Intercontinental Exchange, and CBOE Global Holdings in the US, as well as the London Stock Exchange Group and B3 abroad.

We view companies with the above characteristics as potentially attractive investments. In general, we believe they are likely to grow earnings faster over the next decade than they have in the last one. Given the growth potential, we would be willing to hold a basket of these businesses at slightly more expensive prices as long as we like the risk/reward.

This material contains the opinions of Manning & Napier, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.