Nearly four months since the stimulus funds ended, the US economy is relatively in the same place it’s been all year. The economy is running hotter than it has in a long time, prices are clearly rising, and quality labor is still hard to find.

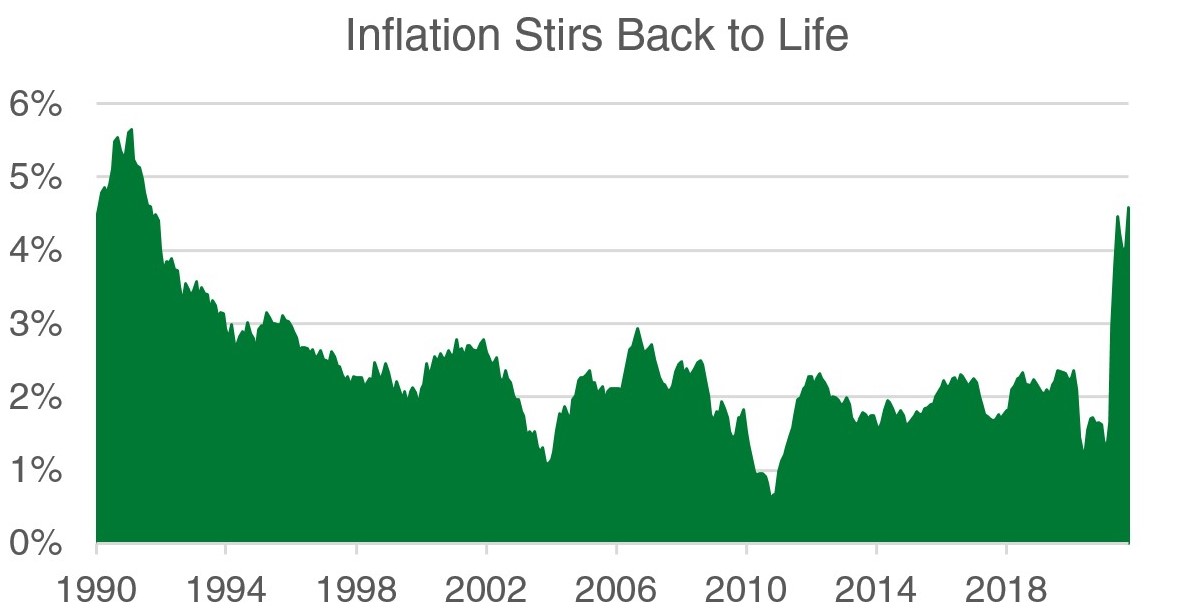

Surging economic growth without inflation is the ideal scenario, but that is not the case today. In November, the US Bureau of Labor Statistics recorded the biggest inflation jump in over 40 years at a 6.2% year-over-year Consumer Price Index increase. Rising prices in energy and food led the way, but even when stripping out those volatile components, into what is known as the ‘core’ reading, inflation rose a significant 4.6% over the past year, the quickest pace since the early 1990s.

Source: Federal Reserve. 01/01/1990 - 10/01/2021.

Inflation’s rise is causing serious handwringing by investors, and at the same time, wages are rising as well. Per the BLS Employment Situation report released in early November, the average hourly earnings for all private sector employees rose 4.9% since this time last year. Anecdotes of starting bonuses and widespread labor cost increases are real, even if they aren’t quite high enough to keep up with inflation.

The Great Resignation

More curiously is not that inflation and wages are surging together, but that they are doing so this soon after a major economic contraction.

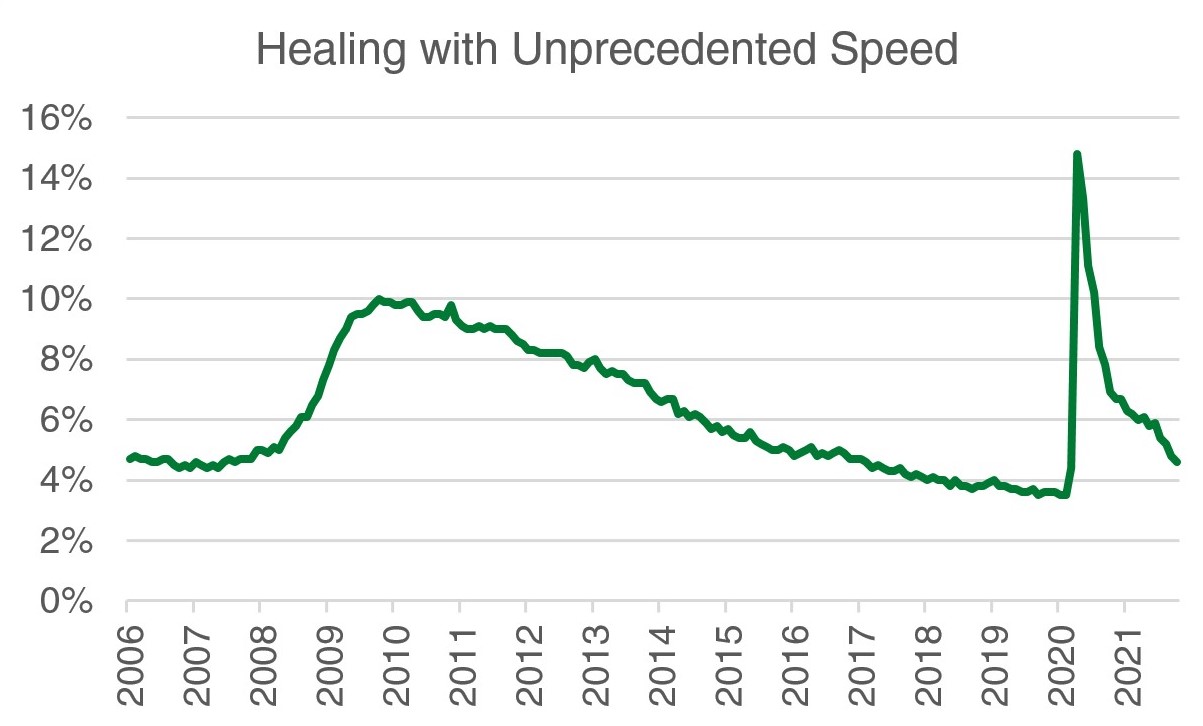

During the last cycle, it took the labor market almost 10 full years to recoup its pre-crisis peak. The unemployment rate bottomed at 4.4% on May 2007, only to return to that level in March 2017. Today’s cycle is like the supersonic equivalent of that process. As of October, less than two years from the start of the pandemic, the unemployment rate stands at a remarkably low 4.6%. This is unheard of speed.

Source: Federal Reserve. 01/01/2006 - 10/01/2021.

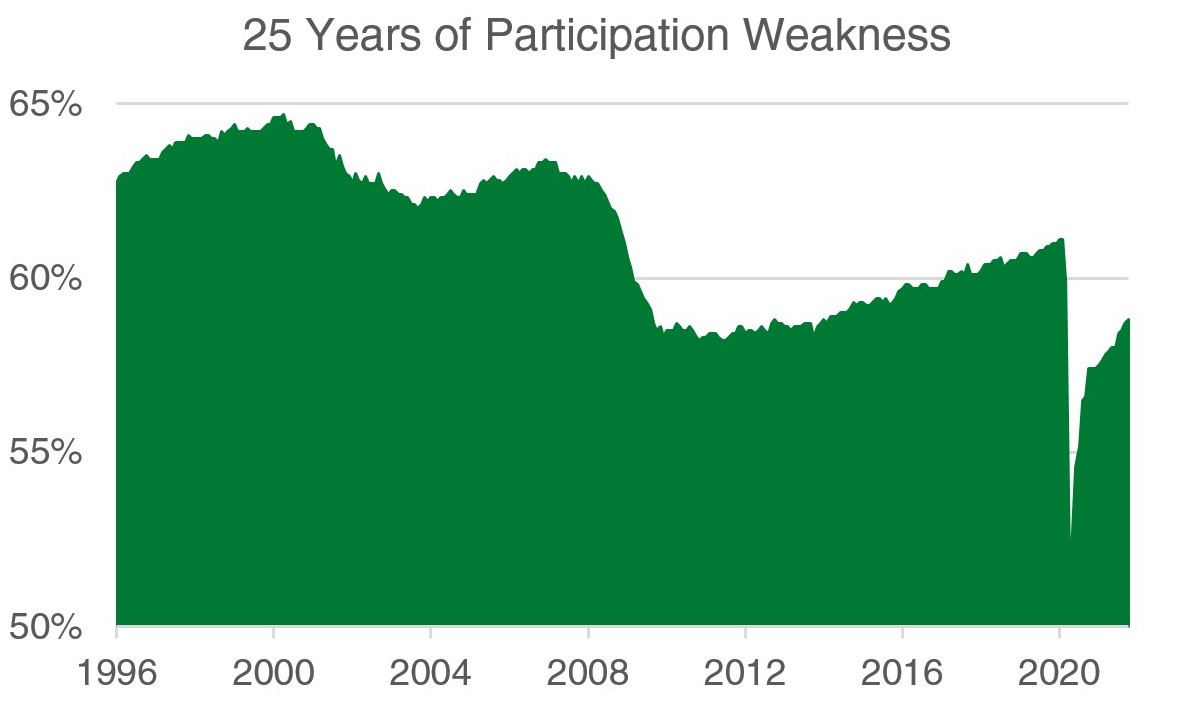

Yet the unemployment rate doesn’t tell the full story this time around. While many unemployed have found jobs, many others are leaving the labor force entirely. Today, 58.8% of the US population is employed versus 61.1% pre-pandemic. The 2.3% percentage difference may seem small, but at a size of approximately 330 million people, it equates to roughly 7.5 million fewer people working or actively seeking employment today.

Other metrics further confirm the existence of this ‘Great Resignation.’ Job openings are at all-time highs, and employees are quitting their jobs at a record pace, a clear sign that they are either finding other work or are comfortable enough in their financial situations to take the leap of faith to quit. With unemployment so low, and with wages on the rise, why have so many people stepped out of the labor force? Where have all the people gone?

Demographics and Destiny

The pandemic-driven stimulus has clearly played a catalytic role. Able to make ends meet on juiced unemployment insurance and one-time stimulus checks, there is a trend of young, healthy people choosing not to work.

But as those stimulus measures fade away, we can see that this group isn’t the main driver. Over the past 20+ years, America has experienced a gradual exodus of workers, with each economic recession acting to push out another several percentage points of workers from its labor force ranks. This time has been no exception, and the underlying causes of the structural shift are both powerfully potent and phenomenally boring.

Source: Federal Reserve. 01/01/1996 - 10/01/2021.

America is getting older and living longer. Mass layoffs, elevated stimulus payments, the subsequent stock market surge, medical considerations, and the changing priorities of life have all made the work-vs-retirement calculus all that more enticing to the older generations. According to the Pew Research Center, over 3 million Baby Boomers retired in 2020, and another 1.1 million were pushed out of the labor by COVID and its related policies. This is over twice as much in a normal year.

These retirements coincide with a startling decline in US fertility. As compared to a Baby Boom generation that grew up with an average of 4 children per family, since 1971, the fertility rate of America fallen below the replacement level of 2.1 births per woman. There simply aren’t enough babies being born to support the population as it is today, let alone a population that is rapidly aging.

Aging Gracefully

The ‘Great Resignation’ is less of a phenomenon of the moment, and more of a grand finale for what has been years in the making. The desire of the Baby Boom generation to step out of the labor force and into retirement is entirely understandable. Yet while it may make sense on a generational scale, it isn’t without consequences.

A shrinking workforce reduces the GDP potential of the economy and puts greater strain on the elderly entitlement programs they support. Both are likely to weigh on economic growth are a piece of the puzzle driving our current economic outlook—that elevated debt levels and demographic challenges are likely to cause the higher growth rates of today to slow back toward pre-pandemic levels.

Our top-down investment groups continuously monitor these types of structural labor market indicators for their potential impact on the economy, the economic cycle, and global financial markets. As a result, indications suggest the economy is in a middle-to-later phase of the economic cycle, with certain areas of risk, such as inflation, building in the system. We view a neutral asset allocation approach as appropriate at this time, and we believe investors should be looking to deploy all the tools in their toolbox to meet goals and objectives.

Our research team continues to monitor these topics and more. If you’re interested in hearing more of our monitoring points and views on an array of investing themes, then subscribe to our insights.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. The reader should not assume that investments in the securities identified and discussed were or will be profitable.