The Fed, investors, and consumers have spent the last year navigating extraordinarily high inflation. As we all look for it to cool, there are questions on how it’s measured, what drives it, and how it can impact investment portfolios.

Inflation measures how much the prices of goods and services are increasing. Paying higher prices for what we consume certainly isn’t enjoyable, but some amount of inflation is healthy for the overall economy. Without some inflation, we run the risk of deflation. Deflation is harmful to economic growth because it may lead consumers and businesses to forgo purchases in hopes of lower prices later.

Several central banks around the world, including the Federal Reserve, target a 2% inflation rate to help ensure the economy avoids deflation. Then there’s the other end of the spectrum, unexpectedly high or volatile inflation, is also undesirable because it creates uncertainty and can result in misallocation of economic resources.

With careful tracking, there are several indicators that provide insight into inflation and its influence.

How is inflation measured?

With inflation being the answer to the question, ‘How much are prices increasing?’ there are several ways – or indicators – to measure.

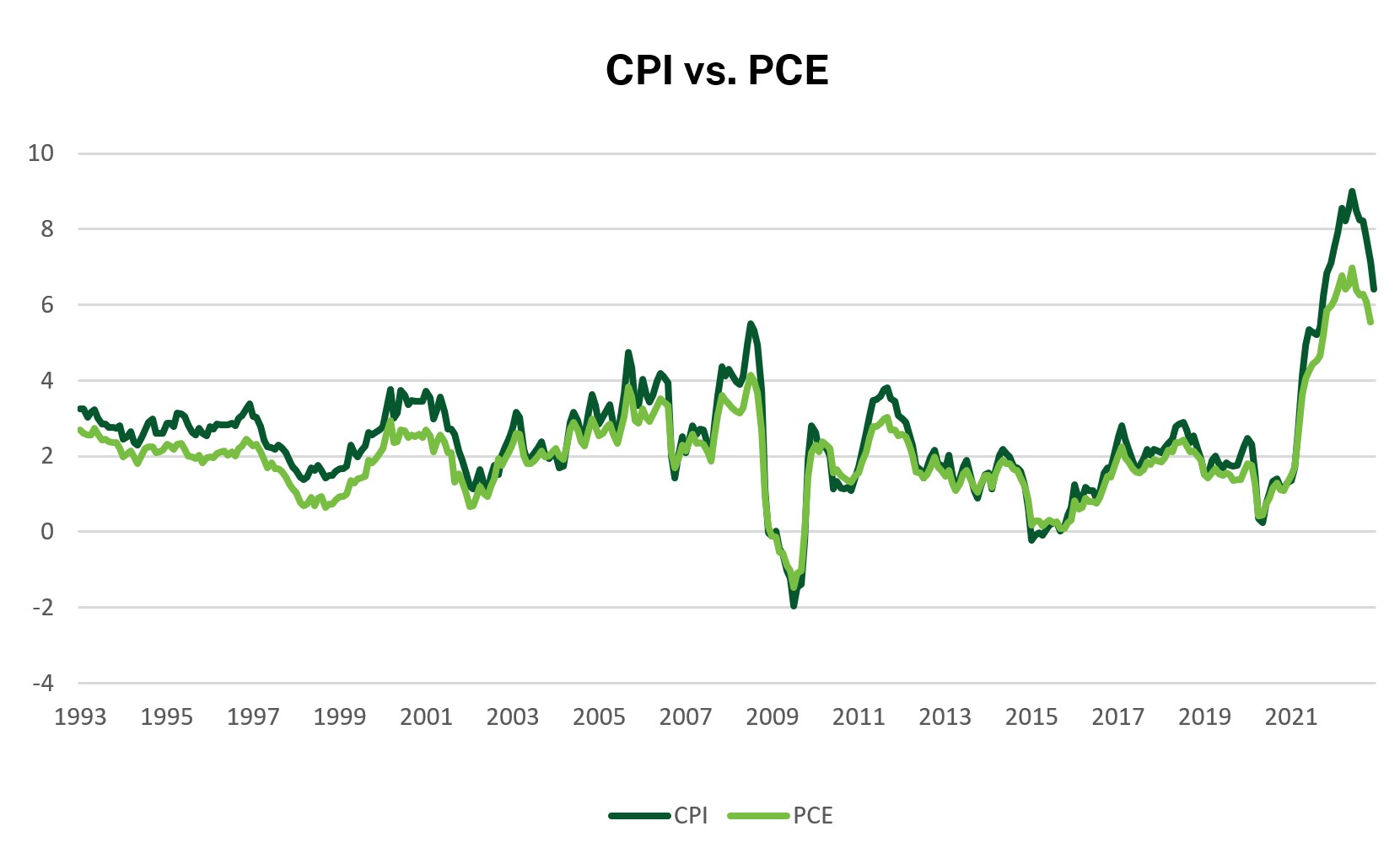

The two most common measures are the Consumer Price Index (CPI) and the Personal Consumption Expenditure (PCE) price index. Both track price increases for a basket of goods and services intended to represent purchases for a typical consumer. The two indices typically move in similar directions but differ for a few reasons.

Consumer Price Index: measures the out-of-pocket expenditures for a specific set of goods and services from the perspective of consumers. Things to note about CPI:

- It’s based on a survey of consumers compiled by the Bureau of Labor Statistics

- CPI data tends to be subject to fewer broad-based revisions and therefore sees greater utilization for contract purposes, such as investment policy statements, contract indexation, and as the reference for Treasury Inflation-Protected Securities (TIPS)

Personal Consumption Expenditures Price Index: generally considered the most comprehensive and representative inflation measure. Things to note about PCE:

- It’s based on a survey of businesses compiled by the Bureau of Economic Analysis

- PCE accounts for substitution effects (i.e., consumers shifting consumption from one item to another as relative prices change). For example, a rapid increase in the price of chicken could lead to consumers opting for beef over chicken. The PCE attempts to account for these changes in behavior.

- The substitution effects are a key reason why the Fed uses the PCE indicator when crafting its monetary policy

The upshot of these calculation differences is individual goods and services carry different weights in different indices. For example, transportation carries more weight in the CPI, while medical is a larger component of the PCE index. See how these differences result in different inflation measurements:

Source: FactSet. (01/1993 – 12/2022).

What ‘Core’ inflation readings mean

CPI and PCE both have “core” readings that remove the impact of food and energy. This is done because food and energy tend to be more volatile than other components of the price indices.

A large portion of food and energy movement can be related to external factors that may be short-lived. Consider crop harvests or changes in oil supply from OPEC (Organization of the Petroleum Exporting Countries) as two key examples.

Overall, core inflation can help give a sense of components of inflation that might be more durable, and therefore most relevant for central banks as they craft their policies. You’ll commonly see Core PCE cited by Fed officials when measuring or forecasting inflation. However, food and energy are important components of consumption, so they will not be completely ignored by policymakers.

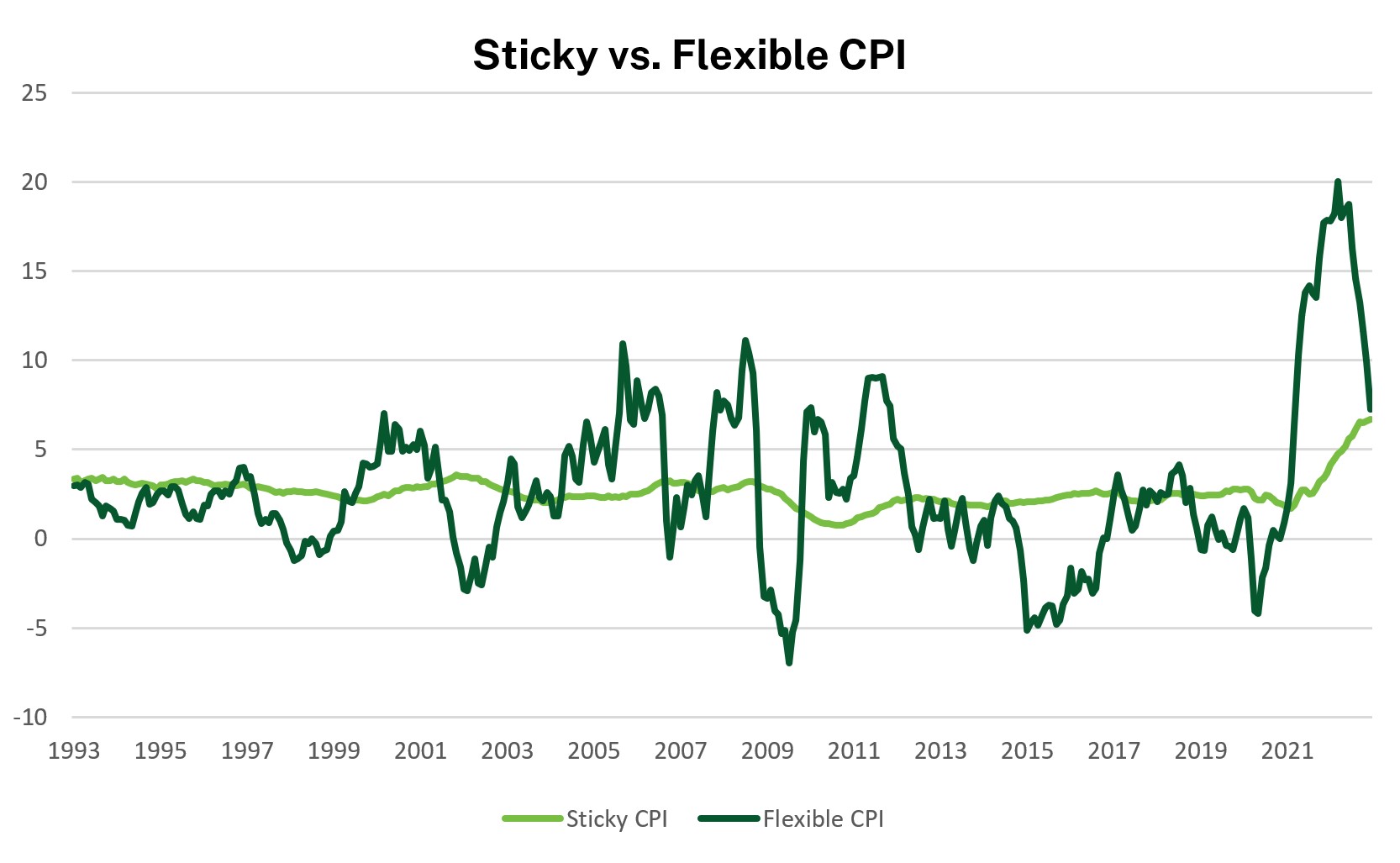

Sticky-Price CPI’s role in measuring inflation

To take measuring inflation a step further, there’s another indicator used to even more directly estimate inflation that is likely to be persistent – Sticky-Price CPI.

The Sticky-Price CPI (which includes both core and non-core) is published by the Atlanta Fed and contains items that change prices relatively infrequently. Items with more frequent price changes are labeled and reflected in the Flexible CPI.

Source: FactSet. (01/1993 – 12/2022).

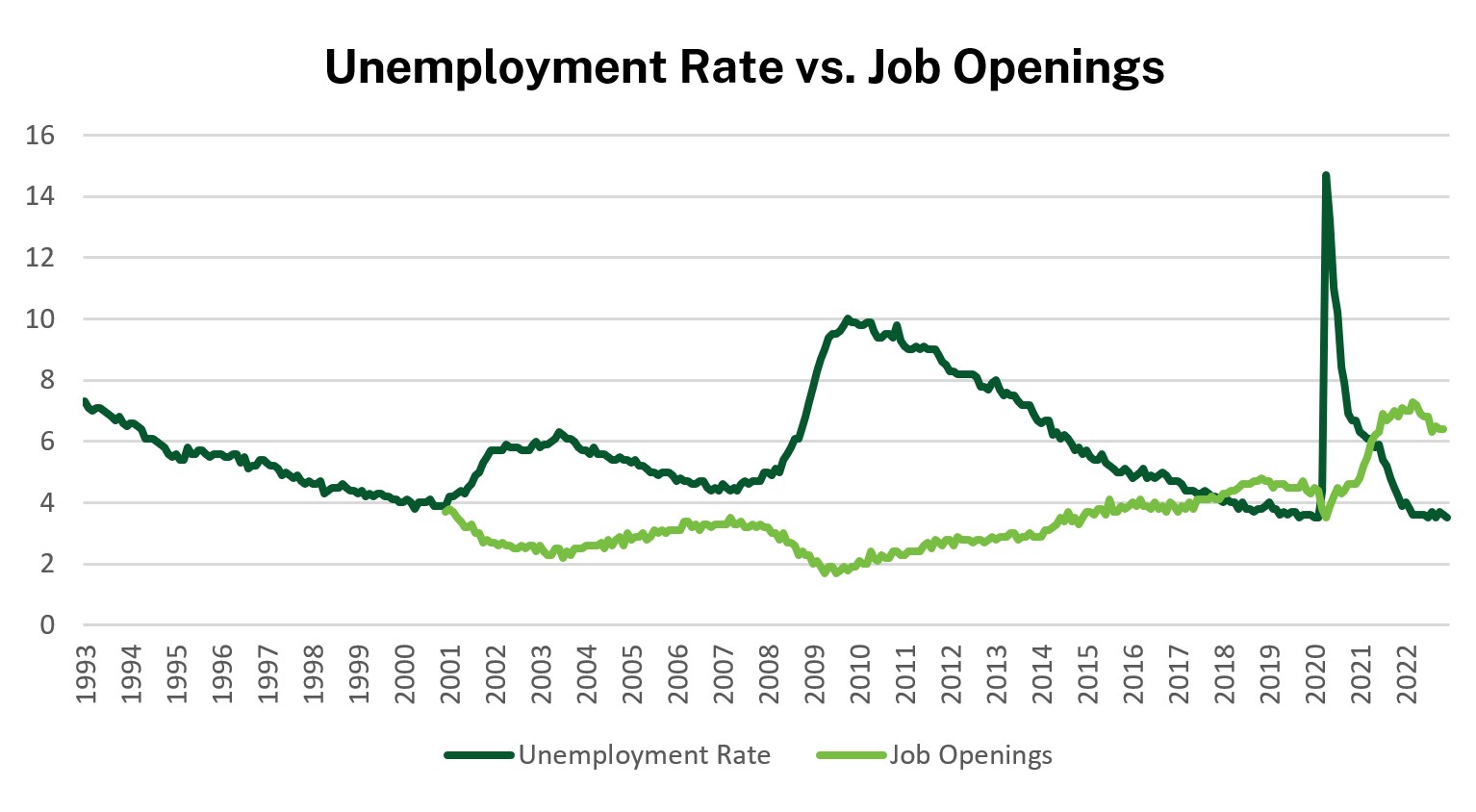

Looking forward: Services CPI and the labor market

The common inflation measurements are all lagging indicators – meaning they reflect what happened in the past. So, how do we try to assess where inflation might go in the future? First, it helps to understand what industries and areas of the economy are experiencing the most rapid price increases.

Today, policymakers are keeping a close eye on Services CPI. Recently, it has remained high, even as goods inflation has come down. To understand why, we look to wage growth and the labor market. Labor is a key input across many industries and is particularly important for services; therefore, Services CPI is closely linked to wage growth.

Today, unemployment is still relatively low while job openings are high. This dynamic is significant since it provides workers bargaining power to demand higher wages. We are however starting to see weakness appear particularly in the job openings number – this could provide a “release valve” for inflationary pressure.

Source: FactSet. (01/1993 – 12/2022).

Inflation’s impact on investment portfolios

Many investors are wondering how high inflation impacts their portfolio, “How does high inflation impact my portfolio?” At the end of the day, investors care about real returns (returns after subtracting inflation), as this represents the purchasing power of their portfolio. During periods of unexpectedly high inflation, real returns can be difficult to achieve.

Bonds typically do not offer protection from inflation because many pay a fixed coupon over the life of the bond, and inflation erodes the real value of those future coupon payments. Equities can also suffer in inflationary times because high inflation dampens consumer sentiment and in turn, consumer spending. However, the positive of equities is that companies can pass through some cost increases to consumers. It is in inflationary times that companies with this kind of pricing power are particularly valuable.

With high inflation reaches a certain point, central banks raise interest rates enough to start to bring inflation down. We saw this happen throughout 2022 as the Fed approved consecutive increases in the Fed Funds Rate in effort to combat inflation. However, this isn’t without risk, and typically creates economic pain (i.e., a recession). As this occurs, bonds should revert to playing their traditionally defensive role, offering a potential buffer to negative returns in equities.

Enjoying this information? Sign up to have new insights delivered directly to your inbox.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product.