Amid volatility and drug pricing rhetoric, stock prices of pharmaceuticals and biotech companies trailed the market in 2018.

Two weeks into 2019, however, biotech is enjoying its best-ever start to a year. We have found the sector attractive for some time due to strong fundamentals and high growth potential.

Innovation is Improving

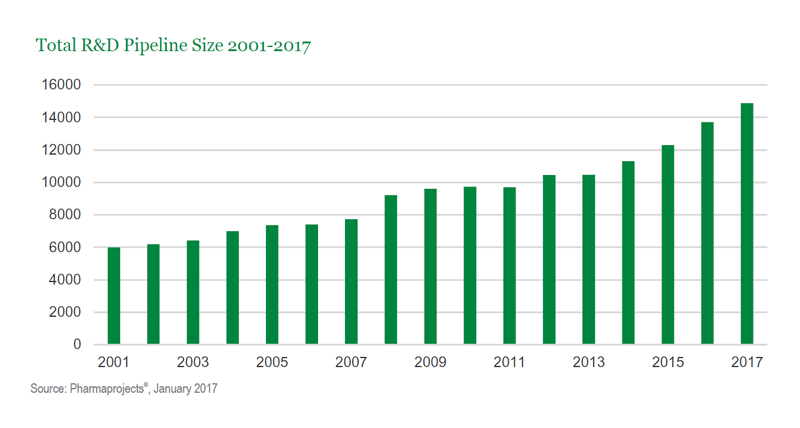

The pharmaceutical industry is undergoing an innovation renaissance. Research and development pipelines continue to grow, and FDA approvals have accelerated.

Technological advancements have enabled a dramatic improvement in our understanding of diseases. The first human genome took 15 years and $2.7 billion to sequence when it was completed in 2003. Today, we can sequence a person’s DNA in less than a day for about $1,000.

These innovations have lowered the scientific barriers to developing new treatments, allowing more complex and targeted therapies, known as specialty drugs, to come to market. Specialty drugs currently account for nearly half of US drug spend, vs. just 24.7% in 2008.

The number of approved drugs is rising as well. On average, the FDA has approved about 39 drugs annually over the past four years. For the eight years prior to that, the average was only 26 drugs per year. Even with the pricing controversy, 2018 was the strongest year yet, with 59 drugs approved.

|

The FDA has approved about 39 drugs annually over the past four years. |  |

For the eight years prior to that, the average was only 26 drugs per year. |  |

2018 was the strongest year yet, with 59 drugs approved. |

There are many companies taking advantage of the ongoing discovery renaissance, and we believe their products should retain pricing power given the value they bring to consumers.

BioMarin

BioMarin is one such company. It is developing a hemophilia gene therapy program called valoctocogene roxaparvovec, or valrox. Hemophilia, caused by a protein deficiency that reduces the blood’s ability to clot, affects about 20,000 people in the US. Even a small cut can be deadly, and internal bleeding can occur at any time.

Treatment for most with the disease has traditionally consisted of at least three doctor visits per week for IV injections, often costing hundreds of thousands of dollars each year and impairing quality of life.

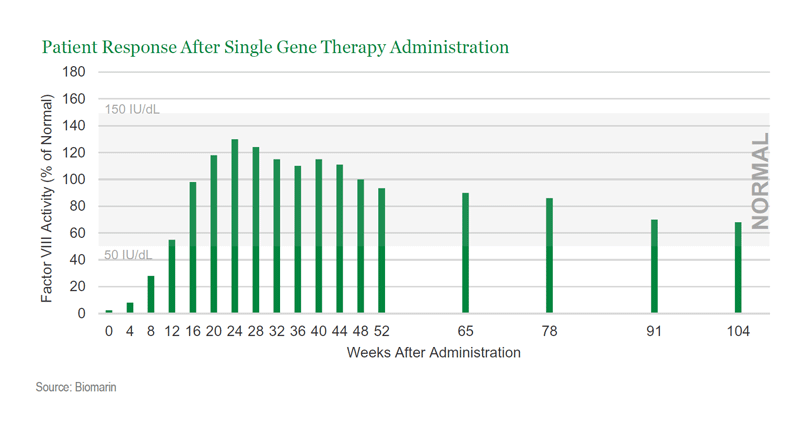

BioMarin’s gene therapy program is a potential game-changer for individuals with hemophilia. It essentially acts on the patients’ genes to increase clotting protein production. Importantly, it is administered as a one-time injection.

After just a single injection at one doctor visit, patients had blood clotting factor levels in the normal range for at least two years.

In the two years since clinical trials started, each patient has been spared 3-4 doctor visits each week – at least 450 total infusions (and counting). Phase 3 trials have begun, and BioMarin is hoping to file for FDA approval during the second half of 2019.

Vertex

Vertex Pharmaceuticals is another company revolutionizing the way patients live.

It has built significant expertise in treating cystic fibrosis, a serious genetic disease that affects the lungs and limits the ability to breathe over time. Cystic fibrosis is a life-threatening diagnosis, with no known cure and treatments that greatly affect quality of life.

Vertex has the only approved drugs that treat the underlying cause of cystic fibrosis, instead of just managing symptoms. It’s likely that all future therapies (made by Vertex or otherwise) will have to use one of Vertex’s drugs as a backbone therapy.

Currently, Vertex’s drug therapies treat up to 40% of cystic fibrosis patients, but the company has stated that in-development innovations could help as many as 90%. This translates to 44,000-68,000 more patients.

Depending on the outcome of trials, Vertex will submit a regimen to regulatory agencies worldwide by mid-2019.

There’s Still Room for Growth

Despite these innovations, thousands of diseases affect humans and only about 500 have approved treatments. This provides an enormous runway for growth in the pharmaceutical space.

Our active management approach allows us to take advantage of volatility to purchase strong companies at attractive valuations. Despite pricing controversy, we believe the immense value new drugs can bring to patients is likely to be rewarded.

The data presented is for informational purposes only. It is not to be considered a specific stock recommendation.