Inflation has moved higher in 2021 as the US economy began a once-and-for-all reopening. Surging demand, supply chain shortages, and government stimulus have combined to cause eye-popping price hikes for goods and services closely linked to a return to pre-pandemic life.

In today’s blog post, we take a closer look at the speed of the economic recovery, the rapidly healing labor market, and underlying inflation trends, as well as attempt to determine if inflation is here to stay or if it is still too early to tell.

An Unusually Quick Recovery

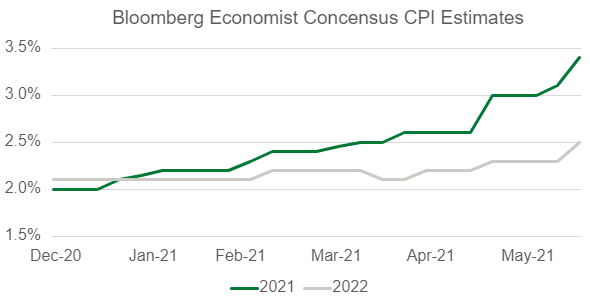

They're not just one-off anecdotes; prices are rising, and inflation measures have moved higher in 2021. Yet most economists, including those at the Federal Reserve, expect these inflationary pressures to eventually cool off and be temporary. A look at full Consumer Price Index (CPI) estimates, shown below, helps illustrate the story. CPI estimates for 2021 have moved higher over the past few months, reflecting the rise in prices, but expectations for next year, 2022, remain well-contained.

Source: Bloomberg (12/31/2020 – 06/17/2021).

It is unusual to be concerned about inflationary pressures so soon after a recession, but the current environment is far from ordinary. Wages are a key driver of a sustainable rise in inflation, and when unemployment is elevated, as it is today, wages tend not to rise. Typically, businesses have a deep labor pool of candidates to draw from and can fill open positions with relative ease.

COVID-19 has disrupted the labor market supply in a variety of ways, creating significant obstacles to work for many (e.g., family care responsibilities and health concerns), and leading others to retire from the labor force permanently. The labor force participation rate today is 1.7% lower than where it stood at the end of 2019, translating to over 4 million fewer Americans in the labor pool. Elevated unemployment rates and weak labor force participation suggest that there remains significant slack in the job market.

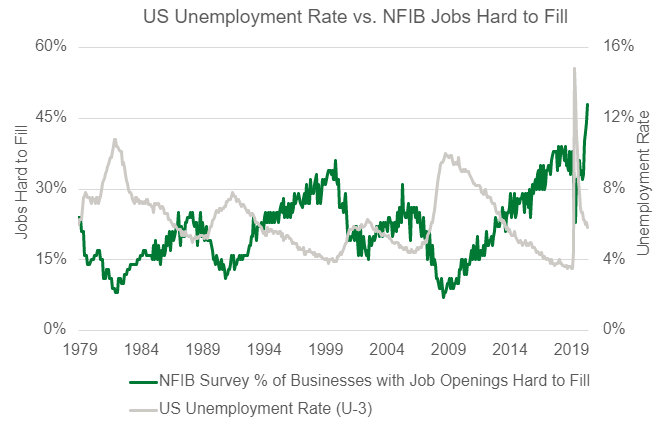

Hiring is Hard

Although the job market appears to have slack, employers are having a hard time finding labor. Unprecedented unemployment benefits have allowed those out of work to be more selective when seeking a new job. Meanwhile, companies are seeing strong demand for goods and services as pandemic restrictions are lifted and as growth accelerates. Taken together, the nation has record job openings, and one survey of small businesses shows an all-time high in a measure of employers difficulty in filling jobs (per the NFIB small business survey). These are surprising readings given today’s 5.8% unemployment rate.

Source: Bloomberg (12/1979 – 05/2021).

The leisure and hospitality industries provide a great, tangible example of this very unique labor market dynamic, especially given that these industries were ground zero for COVID-19 induced closures. The onset of the pandemic can clearly be seen in the chart below as unemployment soared toward 40% and job openings plummeted. Today, however, job openings are at a record level even though unemployment for those in these industries still sits around 10%, highlighting today’s odd labor market mismatch.

Source: Bloomberg (12/2000 – 05/2021).

This mismatch may resolve itself over time should workers return to the labor force voluntarily as vaccination rates climb, schools reopen full-time this fall, and supplemental unemployment benefits expire. In this scenario, a surge in labor supply would diminish the need for businesses to increase wages and benefits to attract new workers, in turn reducing pressure on profit margins and alleviating the need for price increases (i.e., inflation).

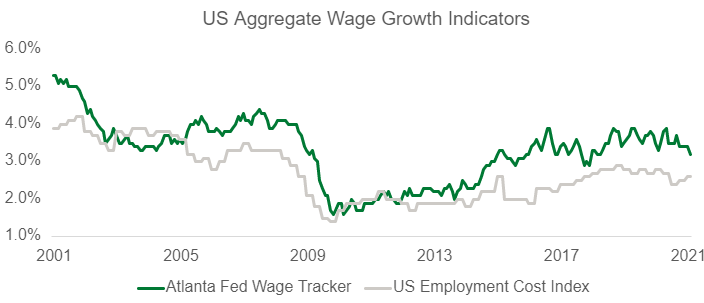

A Close Eye on Wages

There is, however, an alternate scenario where the labor force participation rate does not return to pre-pandemic levels quickly enough, and companies are subsequently forced to increase wages as they compete with one another for scarce employees. There are numerous anecdotes today of companies instituting signing bonuses and wage increases to attract workers, but most aggregate measures of wage growth do not yet reflect these pressures.

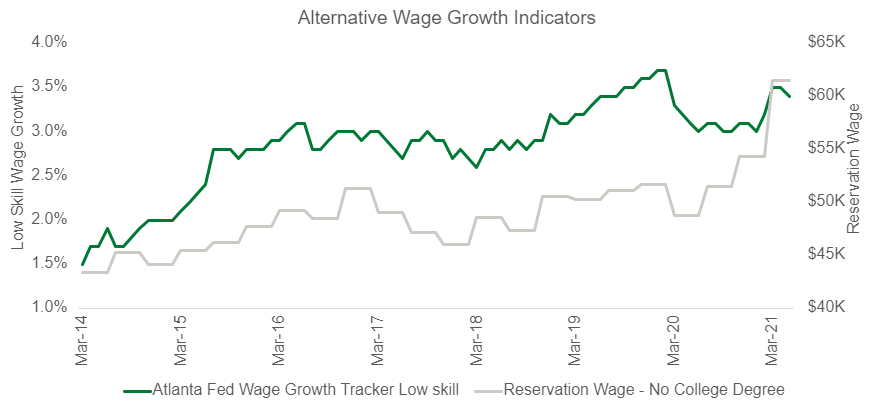

Source: Bloomberg (03/2001 – 04/2021).

With that said, measures of activity focused on workers most negatively impacted by the pandemic—low skill workers specifically—are beginning to point toward higher labor expenses. The chart below shows the year-over-year wage growth for low-skilled jobs nationally based on the Atlanta Fed’s wage data and the reservation wage those without a college degree. The reservation wage data is the average wage that respondents of the New York Fed’s Survey of Consumer Expectations without a college degree say is necessary to attract them to a new job. The reservation wage for this cohort has increased over $10,000 since last March, and realized wage growth for low skilled labor is returning quickly to pre-pandemic levels. It is too early to tell if these trends will spread into the broader labor market, but both warrant close monitoring.

Source: Bloomberg, Federal Reserve (03/2014 – 05/2021)1.

Manning & Napier will continue to track the labor markets for signs that inflation persists longer than anticipated. Wages are a meaningful component of many firms’ costs, particularly for service industries, which make up the lion’s share of the US economy. Rising wages are generally considered good news for consumers, but if growth is too strong, it can represent an inflationary threat to the economy should businesses raise prices to respond to higher labor costs.

Enjoying this information? Sign up to have new insights delivered directly to your inbox.

1Source: Survey of Consumer Expectations, © 2013-2021 Federal Reserve Bank of New York (FRBNY). The SCE data are available without charge at http://www.newyorkfed.org/microeconomics/sce and may be used subject to license terms posted there. FRBNY disclaims any responsibility or legal liability for this analysis and interpretation of Survey of Consumer Expectations data.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. The reader should not assume that investments in the securities identified and discussed were or will be profitable.