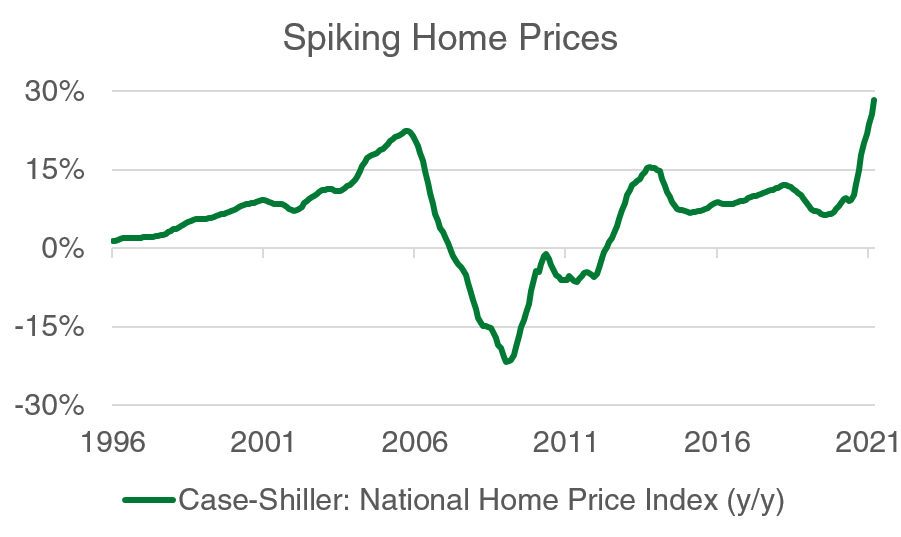

The pressure was building for years, and the global pandemic struck the match. The US housing market is on fire. Residential homes are going for 10, 20, and even 30 percent or more over list price. There are stories of open houses so full there’s no room to move, and anecdotes of bidding wars that include not just a few offers, but dozens of them.

America hasn’t seen a housing market like this in decades. Just last week, the National Association of Realtors estimated that construction of new housing has left the US about 5.5 million homes short of long-term historical levels, going on to call for a ‘once-in-a-generation’ policy response to alleviate the shortfall1. Clearly, there is an enormous supply shortage that is now beginning to materially drive up prices, as seen in the chart below, as well as boost demand for different types of housing across the spectrum.

Source: Case-Shiller (01/1996 – 03/2021).

In our view, underbuilding and demographic trends are driving the imbalance, with housing obsolescence and low interest rates providing an assist. The primary forces are long-term trends and inherent to the nature of the housing market itself, which lead us to believe this imbalance may persist for quite a while. To understand why, we believe it makes sense to first understand how we got here today, starting with the last time housing was such a dominant story: The Global Financial Crisis.

A Decade of Underbuilding

It’s hard to characterize such a seminal moment in US financial history into a single sentence, but if we were to try, it would go something like this: Financial innovation enabled mass speculation on US real estate, powering an enormous overbuild of housing supply that dramatically outstripped demand until the bubble popped, with catastrophic consequences.

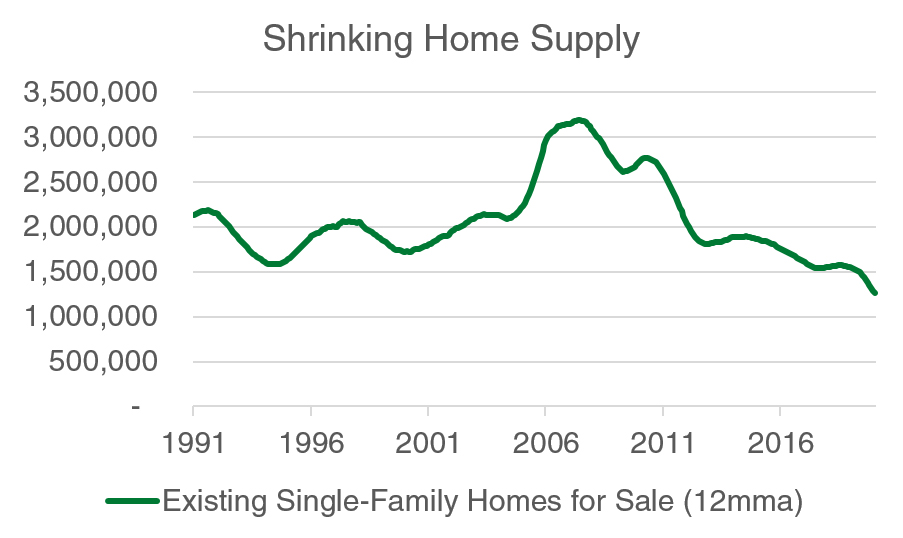

The mechanics about how falling home prices brought the global financial system to its knees are less relevant today. What is relevant is that housing effectively went through a super cycle, peaking in the mid-2000s, and what followed was a massive supply response and substantial consolidation of the home builder industry. New home construction cratered, and what was an oversupply of housing has slowly been whittled away. Per estimates by the National Association of Realtors, the number of existing single-family homes for sale is less than half of what was available fifteen short years ago.

Source: National Association of Realtors (11/1991 – 11/2020). Analysis: Manning & Napier.

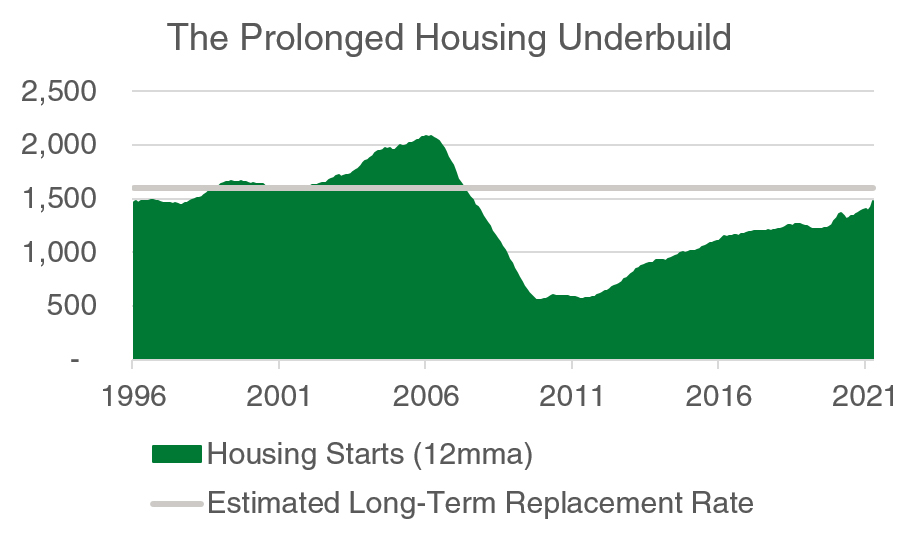

Further, as you can see in the 25-year lookback below, housing starts, a government measure of how many new homes broke ground, fell by nearly three-fourths between 2005 and 2009. Far, far fewer homes were built over the subsequent decade, allowing supply and demand to slowly work its way back into balance, and then some. The supply discipline ended up being overly severe and, as indicated by the long-term replacement rate estimate, too low to meet future needs.

LT replacement rate is an estimate. Source: Federal Reserve. Analysis: Manning & Napier.

Generational Demand

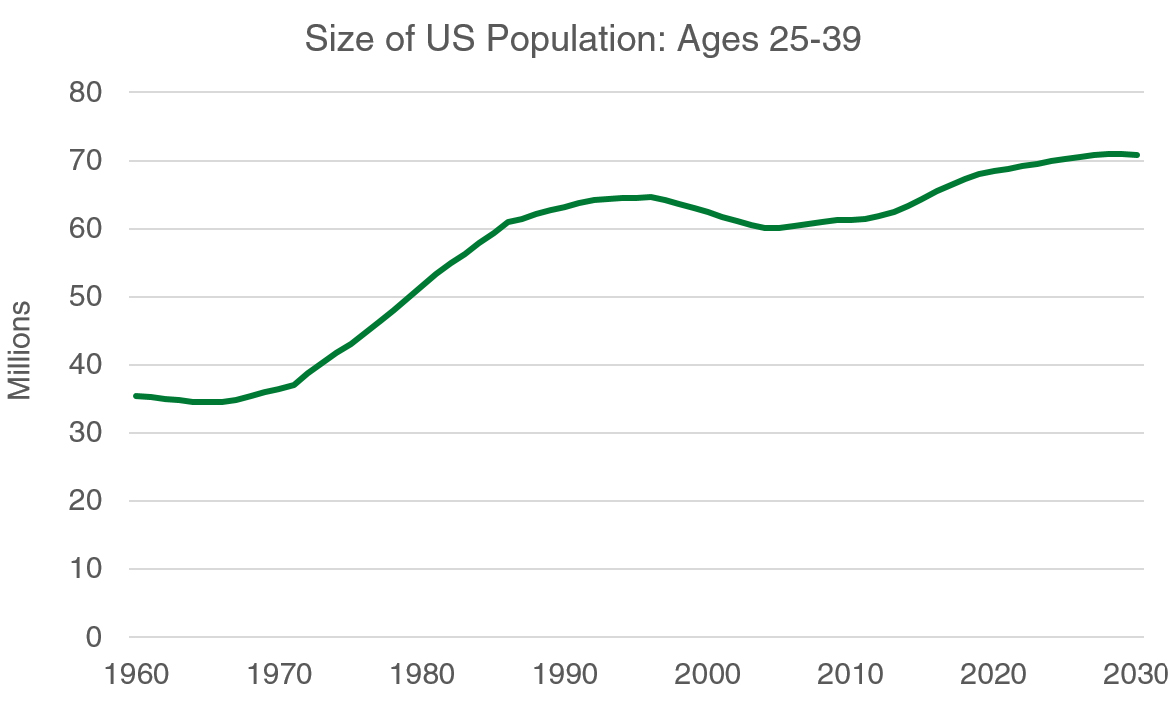

Part of the reason supply growth struggled to return back to sustainable, long-term levels was the anticipated demographic shift did not yet take effect. For the past 15 years, demographics remained a headwind. Most of the Baby Boomer generation already owned homes and was keen on aging in place, and the far outnumbered Gen X did not have the demographic size to quickly soak up the slack.

Additionally, much the Millennial mini-boom was still too young and did not yet have the means to participate in the housing market, and for those that did, they resisted the housing market. A combination of affordability, student debt, and a desire to live near healthier job markets—which often meant living in even more expensive locales—kept Millennial demand lower than their population density would have suggested. See below data from the OECD highlighting the US Millennial mini-boom, whose ages are generally accepted to be between 25 and 40 today.

Source: OECD. Data from 2019 and later are estimates.

These demographic headwinds have since completely flipped. If you assume that the American dream is, and always was, home ownership, then these structural challenges acted not to destroy demand, but to simply delay it. We believe we are only just now barely starting to feel the effects of pent up, Millennial-driven housing demand. It should be noted, however, that people tend to downsize in the 75- to 80-year-old range. The leading edge of the Baby Boomers are now in their mid-70s, suggesting that Boomer-driven selling may increase in the years ahead. We believe this wave of Millennial pent up demand is in the very early innings of being unleashed.

The Obsolescence Wrinkle

While not as significant as the prior two, an additional factor is the mismatch between the specific kinds of homes that are becoming available and the kind of homes that are in demand today. While less easy to quantify directly, we believe this factor is driving particular dislocations within certain segments of real estate and the housing market broadly.

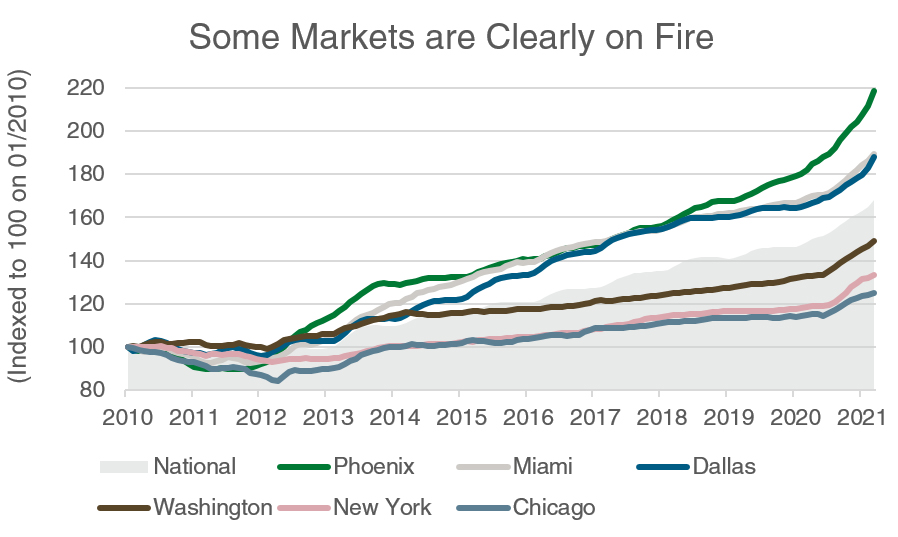

Although some supply continuously becomes available via new construction, the vast majority is resale of existing real estate or relocation from certain rental types/locations to others. What this means is, while new construction is attempting to keep up with supply in hot markets, construction simply can’t move as fast as people can. For example, data from Case-Shiller shows a strong, steady divergence as housing preferences shift from northern/mid-western locales to warmer climates. Select metropolitan areas are shown below.

Source: Case-Shiller (01/2010 – 03/2021).

As a result, price increases are spilling over into a variety of other areas of housing besides owner-occupied properties. In certain regions, apartment leasing spreads—the difference between the new lease rate and the previous lease rate—are at records, and areas such as manufactured housing (i.e., motorhomes) are rising by leaps and bounds. Single family rental properties, an often overlooked, growing segment of the market, are seeing prices rise by record amounts. Many homes were purchased by investors and converted, reducing supply for potential home buyers.

Interest Rates and Inflation

It should also be noted that, along with the unleashing of pent up demand sparked by the reopening of the US economy, are the current levels of interest rates today. While rates have been quite low for some time now, their historic push lower last year appealed to potential buyers. As tends to be the case, the impact of interest rate movements on the market tends to be more about the change in interest rates than the absolute level—and the recent rise in long-rates may have some impact to reduce demand—but regardless, their ultra-low aggregate levels clearly remain supportive of demand.

Moreover, these types of housing price increases are also making a mark on the economy itself, impacting the broader suite of economic data. Recent inflation readings sparked a degree of market volatility and investor consternation over its potential long-term staying power. It should be noted that within the Consumer Price Index (CPI), owner’s equivalent rent (OER) accounts for roughly a quarter of the entire index, a remarkably large figure.

The CPI Index is a bit of an outlier however, and OER’s impact on the competing Personal Consumption Expenditures (PCE) inflation measure is much lower, at approximately 12%. Moreover, owner expenses tend to be much more inflexible as mortgage payments are not indexed to the housing market. The home ownership rate is roughly two-thirds of the US population, and only about one-tenth of the US population moves each year, so the impact of rising home prices from a rental, inflation-standpoint may be less severe that at first glance. For more on our outlook on inflation, see our recent article here.

Lastly, it is also worth mentioning that labor and raw material shortages are not helping the supply shortfall either. It had been a trend for years that fewer Millennials are willing to work in the trades, making it harder for home builders to sufficiently staff up to meet demand. Inflation in the form of rising lumber prices, as well as other material costs, are further challenging the new construction market.

Looking Ahead

We’ve maintained a viewpoint for quite some time now that the US was going to be facing an upcoming housing shortage, and it appears that COVID-19 was the catalyst. Our outlook is for housing prices gains to continue to be robust, even if they are not as extreme as we have seen of late. We believe there are attractive opportunities to be had in a variety of different areas within residential real estate. Sectors, such as single-family rentals, as well as particular geographic locations, including the Sunbelt region among other areas, look attractive to us today.

Although the area looks compelling to us broadly, we continue to advocate for an active approach. Investors should seek to be tactical, using all the tools in their toolbox to properly capitalize on thematic opportunities while minimizing areas of undo risk. For more on how we are implementing these ideas in portfolios today, reach out to speak with one of our consultants.

Enjoying this information? Sign up to have new insights delivered directly to your inbox.

1Source: National Association of Realtors.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. The reader should not assume that investments in the securities identified and discussed were or will be profitable.