Manning & Napier’s Investment Policy Group discusses, analyzes, and dissects major macroeconomic variables including the economy, global financial markets, and asset allocation to ultimately determine the firm’s views.

From our viewpoint

The past three years have been a remarkable period of change for markets, the economy, and investors. If you went back to March 2020 and said to us, ‘This pandemic will change the world,’ we probably would have believed you. Change was coming, that much was obvious. Predicting how the pandemic would unfold, how our economy would respond, and how financial markets would deal with those ramifications today would have been the truly remarkable prediction.

Stimulus, spending, and government-led economic recovery measures were effective, perhaps too much. Inflation is running hotter and holding up for longer than most investors have seen in their entire careers. That is to say, it’s been four decades plus since we’ve seen an environment anything close to today.

Sharply higher interest rates have damaged bond market performance at exactly the same time as equities entered into a bear market, and the simultaneous pain in equities and fixed income experienced over the past twelve months have quite literally never happened before.

Some of this was predictable—after all, we entered 2022 with a cautious near-term outlook for financial market returns, a view that has proved prescient—but the nature of successful investing is never so easily surmised. Whereas 2020 and 2021 were stellar years for financial markets, and ourselves, last year was less so.

Going forward, we anticipate difficulties in global financial markets. Inflation remains unresolved, liquidity levels are tightening, and the economy is showing signs of deceleration. Much like the views espoused in last year’s piece, our outlook for 2023 remains rather cautious, and we are continuing to invest client portfolios with a degree of defensiveness in mind.

Every storm eventually passes, and as difficult as last year’s results have been for multi-asset class investors, we believe the seeds are being sowed for stronger years ahead. Our analyst teams are finding opportunities for growth, and as the market works through a troughing process, you can expect us to be aggressive when the time is right, adding to the names, industries, and investment themes we like for the long haul.

This is risk management in action. A process designed to promote safety when risks are elevated, and to encourage risk taking only when the conditions are appropriate. Those risk taking conditions will eventually emerge again, and you can be sure we will be there to capitalize when the moment is right.

Learn more about our Outlook

Hear from our team, including Director of Investment Policy Group, Chris Petrosino, on why last year was so difficult, what our market & economic outlook is for 2023, and how we are positioning portfolios in this challenging environment.

Watch the replay nowFacing tough choices

Inflation. It’s back, and it’s creating quite the conundrum for both policymakers and investors.

Entering 2022, it was widely known that inflation was running hot, but few expected the heat to persist for as long as it has. Recall that in January, US monetary policy was still very loose. Interest rates were still pegged to zero!

Obviously, that stance looks like a mistake in hindsight. Beyond finger pointing or relitigating the past, the reality is that the Federal Reserve (Fed) was behind the curve, and they knew it, choosing to play a historic game of interest rate catchup. Belated or not, they have now dramatically raised interest rates, and we believe the substantial bulk of interest rate increases are behind us.

The pace of additional rate hikes will materially slow from here, but that should not be confused with the so-called ‘Fed pivot.’ Trimming the rate of hikes from 0.75% per meeting to 0.50% or 0.25% is natural, especially with today’s rates in the mid-single digits. Monetary policy has significantly tightened and is positioned to slow inflation and the economy, and that’s the key point.

We believe the Fed has been very clear about the need to snuff out inflation. Their credibility is at stake, and they will not in any way appear as anything other than an inflation fighting machine. In our view, the Fed has decided they are willing to sacrifice the economy in order to cool inflation, and there are already emerging signs of sluggishness.

Some indicators, such as the labor market, still suggest economic strength, but there are emerging pockets of weakness. Take housing, where a surge in mortgage rates has dramatically cooled activity. In general, we believe that the majority of forward-looking indicators of economic growth are signaling weakness ahead—the labor market, for example, is a classic lagging indicator that will not look bad until it is too late.

Despite the economic deceleration, it may still take time for inflation to cool. Technicalities in inflation data surveys, such as the long-lagged effect for the integration of higher home prices in reporting, suggests that it could be a while before inflation readings meaningfully come down. High inflation, whatever its cause, will keep pressure on the Fed.

Putting the pieces together, we are of the opinion that inflation will remain an economic headwind for the foreseeable future. We believe the ongoing inflation-fighting policies will further contribute to the ongoing slowdown. Our view is that a recession is the most likely outcome, and if nothing else, the current economic backdrop will certainly be a difficult one for investors.

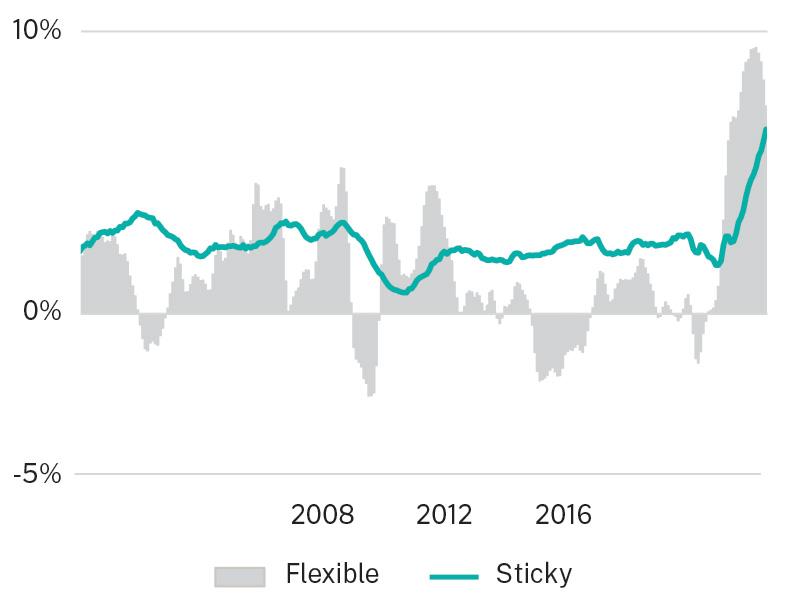

Keeping an Eye on Inflation

Inflation is finally starting to come down, but we are not out of the woods yet. The so-called ‘sticky’ components of inflation–think business and consumer services–are still rising, and rapidly. The services portions of the economy are more susceptible to persistent inflation and once they’ve heated up, they will be more difficult to slow down.

US Consumer Price Index

Source: Federal Reserve Bank of Atlanta. (01/2000 - 09/2022).

Sticky inflation has held steady for many years, but the recent uptick is concerning and may cause overall inflation to stay problematic for longer than expected.

It’s okay to wait

Picking your spots, managing risk, and staying patient is the name of the game.

Part and parcel with the ferocious pace of rate hikes, the past year took its toll on the stock market. The net result is falling valuations, falling prices, and ultimately, a full-blown bear market like what we have today.

Our view is that the stock market selloff this year has been less about deteriorating fundamentals of businesses themselves, and much more about markets, particularly as it relates to higher interest rates. This can be viewed as a gift and a curse.

A gift in that the fundamentals of many sectors of the economy remain healthy; and a concern because our forecast for upcoming economic weakness is not yet being priced into equities.

Should our outlook for slow growth and/or an upcoming recession unfold, then one would expect underlying corporate earnings to deteriorate, a much more fundamental reason for additional market weakness and informing our guarded perspective.

As a result, we have positioned client portfolios for worsening economic conditions by reducing exposure to economic-sensitive areas (i.e., cyclical businesses) and focusing on longer run, secular themes. For example, we are continuing to be very circumspect in areas such as financial services, consumer discretionary, and industrials. In addition, we remain of the view that energy will be a challenged sector as economic growth slows—we would expect energy demand to fall, potentially creating an oversupply situation.

On the other hand, we are constructive on best-in-class enterprises in digital media (e.g., gaming and digital advertising), consumer staples (e.g., food & beverage and wine & spirits), biopharmaceuticals (i.e., biotech), and information technology (e.g., cloud computing, payment processing, and software-as-a-service).

It’s also worth noting that there are many more select, individual opportunities, such as in the government defense contractors, that round out our fundamentally-driven portfolios. Although we are continuing to find a number of attractive opportunities, we are broadly underweight equities in multi-asset portfolios, as well as defensively positioned within those equity sleeves.

With that said, our cautious market & economic outlook will evolve over time, and at some point, we will become more risk-forward in general. Our teams are already preparing for that eventuality, conducting work on more cyclical, ‘recovery’ areas of the economy. We are laying out that groundwork today, for a better time tomorrow.

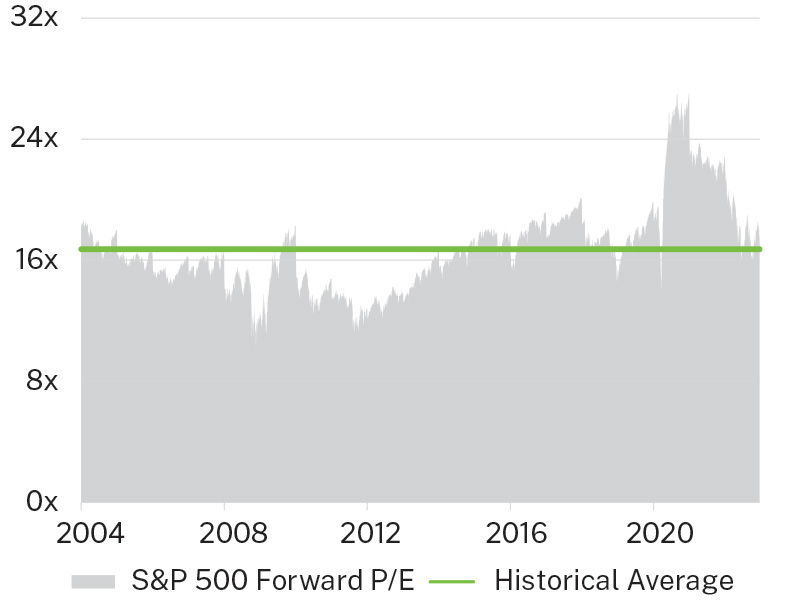

Better, but Still Not Great

Stock market prices fell last year, bringing down market valuations from very high levels, although they have settled at historic averages. Given our cautious outlook, we do not yet view valuations as having become low enough to make excess market risk worth the reward.

US Stock Market Valuations

Source: Bloomberg. (01/2004 - 12/2022).

The price-to-earnings ratio is a valuation metric comparing the price of a stock to the earnings those businesses generate. Last year, much of the selloff was a result of falling valuations, shown above. Should earnings start to fall, we believe the stock market could find itself experiencing additional weakness ahead.

In a better place

Higher rates and juicier yields make bonds look a whole lot better than they used to.

It wasn’t long ago when interest rates were at historic lows, and depressing bond yields makes fixed income investing a rather difficult endeavor.

Surging growth, inflation, rapid rate increases, and quantitative tightening (i.e., the Fed shrinking its balance sheet), have since brought yields way up from the bottom, but the process wasn’t easy.

In fixed income, bond prices move inversely with interest rates, and last year’s sharp rate increases were painful for existing bondholders. As a result, 2022 was the single worst year for bond market performance in the history of the most common US bond market indices – most of which go back about half a century. Perhaps painful isn’t a strong enough phrase. It was more like a bludgeoning.

For an asset class expected to deliver stability and capital preservation, last year’s mid-teens price declines have left many investors wondering whether their bond portfolios have too much risk.

Patience. Just as it’s unwise to sell out of stocks when times get tough, so too is it foolish to abandon time tested fixed income strategies because rates rose more swiftly than anticipated—after all, we have been saying for years (years!) that rates were lying in wait and ready to rise.

A couple things. First, now that yields are higher, bond market investors can anticipate better absolute performance, all else equal. And on a relative basis, they should expect fixed income to look relatively more attractive versus equities.

Second, our outlook for economic deceleration has implications on bond land. In a downturn, the safety of bonds becomes highly desirable, driving bond prices up and bond yields down. This is especially true for the mid- to long-ends of the curve (i.e., 10- or 30-year bonds). In addition, we would also expect credit spreads to widen as investors begin to preference safer bonds versus riskier ones.

Given that yields are higher than they have been in a long time, and considering our economic outlook, we think this is a rather attractive setup for adding more duration, not less. Instead of fleeing into ultra-safe short-term Treasuries, we are positioning portfolios in longer maturities to lock in higher yields, as well as preparing to buy credit should spreads become wide enough to warrant the risk.

Timeless investment truths are all too often thought of only in stock market terms, but they can be just as prescient for bonds as well. Patience and an active approach may very well win out once again.

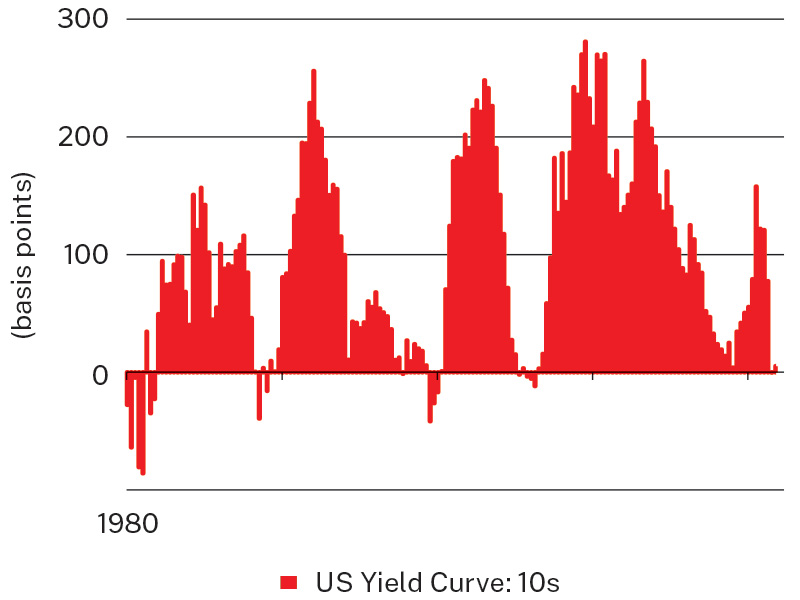

Ominous Signs in Bond Land

The US Treasury issues bonds across various maturities, and normally, long-term bonds earn more interest than short-term. These are not normal times. Today, longer maturity bonds are yielding significantly less than much shorter maturity bonds. This very odd situation is not only unintuitive, but it has historically signaled that an economic downturn is on the way.

US Bond Market Yield Curve

Source: Bloomberg. (09/1980 - 12/2022).

There are a variety of metrics used to analyze the US Treasury yield curve. One of the most common is ‘10s minus 2s,’ which compares the yield of a 10-Year Treasury Note to that of a 2-Year Note. This particular metric–shown above–has correctly signaled recessions in the early-1980s, 1992, 2000, and 2008.

All together now

Each of the pieces—your financial plan, tax strategy, estate plan, and investment strategy—must work together like separate parts of a unified whole.

It’s been said that good investments are like the engine of your car: They provide the power to get you to where you want to go. We agree, but cars need more than power to get you where you want to go.

Good performance is the baseline. It’s a requirement. Sell at the wrong time or make a mistake in your portfolio, and you can do significant, permanent harm to your financial health. But even strong results can be derailed by weak links.

Consider your path to financial success using the following four pieces: 1) investments; 2) financial planning; 3) tax planning; and 4) estate planning. If your portfolio is the engine, then the other areas provide the transmission, steering, and wheels to keep your car straight and on the road.

Take financial planning. The nitty gritty of your investment portfolio, including security buys and sells and other changes amid a fast-moving market and economic outlook, are still just that: the nitty gritty details. Having a skilled financial professional with years of holistic financial planning expertise can help you keep an eye on the bigger picture.

Are you still on track to retire? Will you be able to afford that condo in Florida? Building out and maintaining a comprehensive financial plan gives your investments direction, helping you stay on the road for whatever twists and turns come your way.

Meanwhile, tax management can be thought of as an overlay, enhancing your investment performance by optimizing your financial plan. This is about more than just a few weeks in April.

Tax planning should be ongoing, utilizing strategies such as tax loss harvesting, charitable donations, and Roth conversions to fine-tune your tax situation throughout the year, as well as the long term. Coupled with periodic strategic adjustments and ongoing monitoring of an evolving regulatory landscape, tax management both adds value and protects wealth in a variety of ways.

And lastly, estate planning may not be an exciting topic, but it’s necessary to defend what you’ve earned. Probate complexities, periodic changes to trust & estate laws, and the high stakes nature of estate planning make this as essential need. Don’t skimp. Work with a specialist who can ensure your assets are in full alignment with your wishes. Even the best financial plans can be blown up by an estate planning oversight. Like tires on your car, they might not be the most exciting part, but you need to trust that they’re going to work.

Each piece of a comprehensive plan plays a key role. Alignment matters, make sure all the pieces of your financial health are working together.

None of Us is as Smart as All of Us

Deploying a team of experts, collaborating together, leads to better outcomes across the board.

Learn more about our Outlook

Hear from our team, including Director of Investment Policy Group, Chris Petrosino, on why last year was so difficult, what our market & economic outlook is for 2023, and how we are positioning portfolios in this challenging environment.

Watch the replay nowUnless otherwise noted, analysis provided by Manning & Napier. Past performance does not guarantee future results.

Please consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.

All investments contain risk and may lose value. This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The NASDAQ Composite Index is a broad-based capitalization-weighted index of domestic and international based common type stocks listed in all three NASDAQ tiers: Global Select, Global Market and Capital Market. The NASDAQ Composite includes over 3,000 companies. The Index returns do not reflect any fees or expenses. Index returns provided by Bloomberg.

The S&P 500 Index is an unmanaged, capitalization-weighted measure comprised of 500 leading U.S. companies to gauge U.S. large cap equities. Index returns provided by Bloomberg. Index data referenced herein is the property of S&P Dow Jones Indices LLC, a division of S&P Global Inc., its affiliates (“S&P”) and/or its third party suppliers and has been licensed for use by Manning & Napier. S&P and its third party suppliers accept no liability in connection with its use. Data provided is not a representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none of these parties shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.

The data presented is for informational purposes only. It is not to be considered a specific stock recommendation.